In the age of digital, in which screens are the norm The appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an element of personalization to your home, printables for free are now an essential resource. This article will take a dive deeper into "How Can I Show Arrears Of Salary In Itr," exploring their purpose, where to find them and the ways that they can benefit different aspects of your daily life.

Get Latest How Can I Show Arrears Of Salary In Itr Below

How Can I Show Arrears Of Salary In Itr

How Can I Show Arrears Of Salary In Itr -

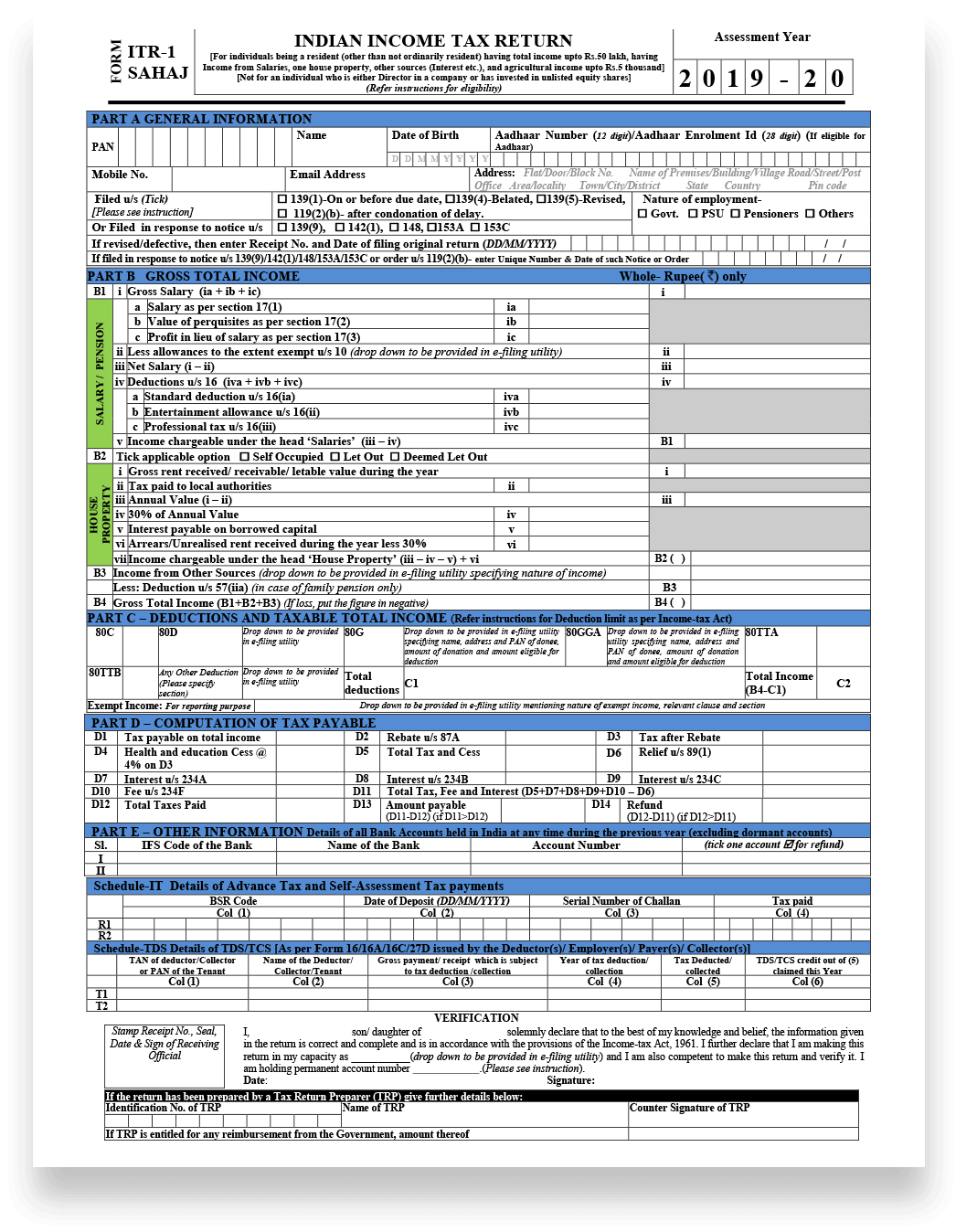

Section 89 of the Income Tax Act 1961 provides relief to taxpayers who receive arrears of salary or profits in lieu of salary in a particular financial year This relief is designed to reduce the tax burden on individuals who might face higher tax liability due to the receipt of arrears

1 What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E The Form must be filed before filing the Return of Income 2 Do I need to download and submit Form 10E

How Can I Show Arrears Of Salary In Itr offer a wide selection of printable and downloadable resources available online for download at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and many more. The beauty of How Can I Show Arrears Of Salary In Itr is their versatility and accessibility.

More of How Can I Show Arrears Of Salary In Itr

Relief Under Section 89 1 On Arrears Of Salary FY 2020 21 Excel

Relief Under Section 89 1 On Arrears Of Salary FY 2020 21 Excel

Arrears of salary is treated as salary income in the ITR They are taxable in the year of receipt However the taxpayer may be worried about paying taxes at a higher rate because of a higher tax bracket in the year of receipt or due to a change in the applicable slab rate

MyOnlineCA 530K subscribers 779 86K views 2 years ago Live Income Tax Return Filing Checkout this Video to know about Arrear Salary Income Tax Calculation How to Fill Form 10e in New

How Can I Show Arrears Of Salary In Itr have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization We can customize print-ready templates to your specific requirements when it comes to designing invitations planning your schedule or decorating your home.

-

Education Value Printing educational materials for no cost provide for students of all ages, which makes them a useful tool for teachers and parents.

-

The convenience of Fast access numerous designs and templates is time-saving and saves effort.

Where to Find more How Can I Show Arrears Of Salary In Itr

ITR Filing How To Claim Income Tax Relief On Advance Other Salary

ITR Filing How To Claim Income Tax Relief On Advance Other Salary

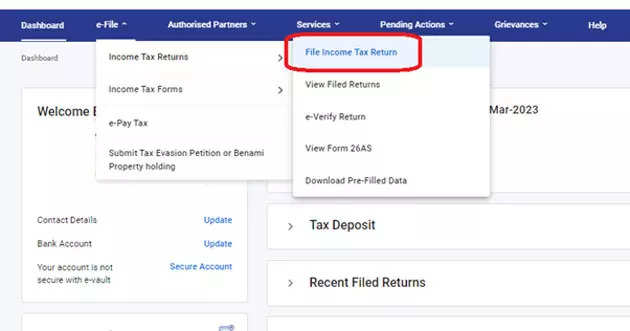

Step 1 Log in to the e Filing portal with user ID and password Step 2 On Dashboard click e File Income tax forms File Income Tax Forms Step 3 On the File Income Tax Forms page select Form 10E Step 4 Choose the Assessment Year A Y and click Continue Step 5 On the Instructions page click Let s Get Started

Arrears of salary Family pension in arrears Advance salary Gratuity Commuted pension Compensation on termination of employment How to File Form 10E Form 10E can be filed online Here are the following steps to file Form 10E online Step 1 Log in to the e Filing portal with your User ID and password

If we've already piqued your interest in How Can I Show Arrears Of Salary In Itr Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of motives.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs covered cover a wide variety of topics, starting from DIY projects to party planning.

Maximizing How Can I Show Arrears Of Salary In Itr

Here are some unique ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home also in the classes.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

How Can I Show Arrears Of Salary In Itr are a treasure trove of practical and imaginative resources for a variety of needs and interest. Their access and versatility makes them a wonderful addition to both professional and personal life. Explore the vast array that is How Can I Show Arrears Of Salary In Itr today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can print and download these tools for free.

-

Can I use free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables could be restricted in use. Be sure to check the conditions and terms of use provided by the author.

-

How do I print printables for free?

- Print them at home using printing equipment or visit any local print store for superior prints.

-

What software do I need to open printables that are free?

- Many printables are offered with PDF formats, which is open with no cost software, such as Adobe Reader.

File Form 10E And Tax Relief U s 89 For Arrear Salary In ITR Filing

EXCEL Of Salary Arrears Calculator xlsx WPS Free Templates

Check more sample of How Can I Show Arrears Of Salary In Itr below

Tax Exemption From Salary Arrears Filing Form 10E In The New Tax

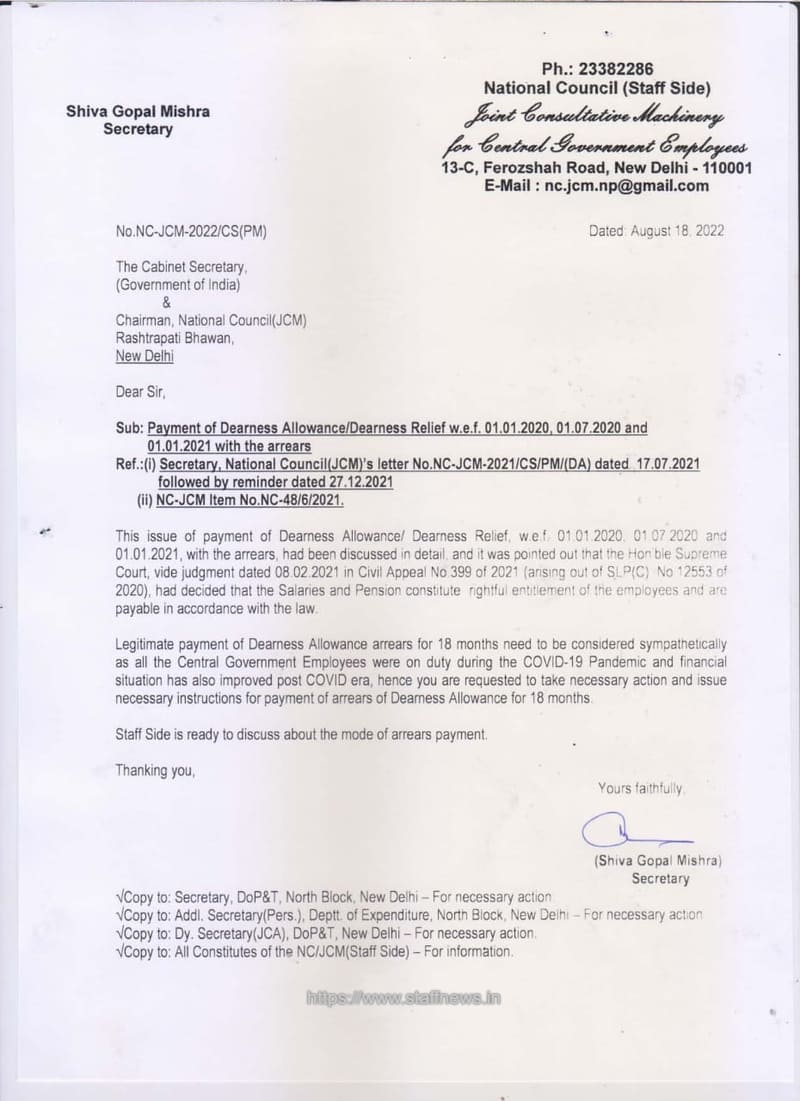

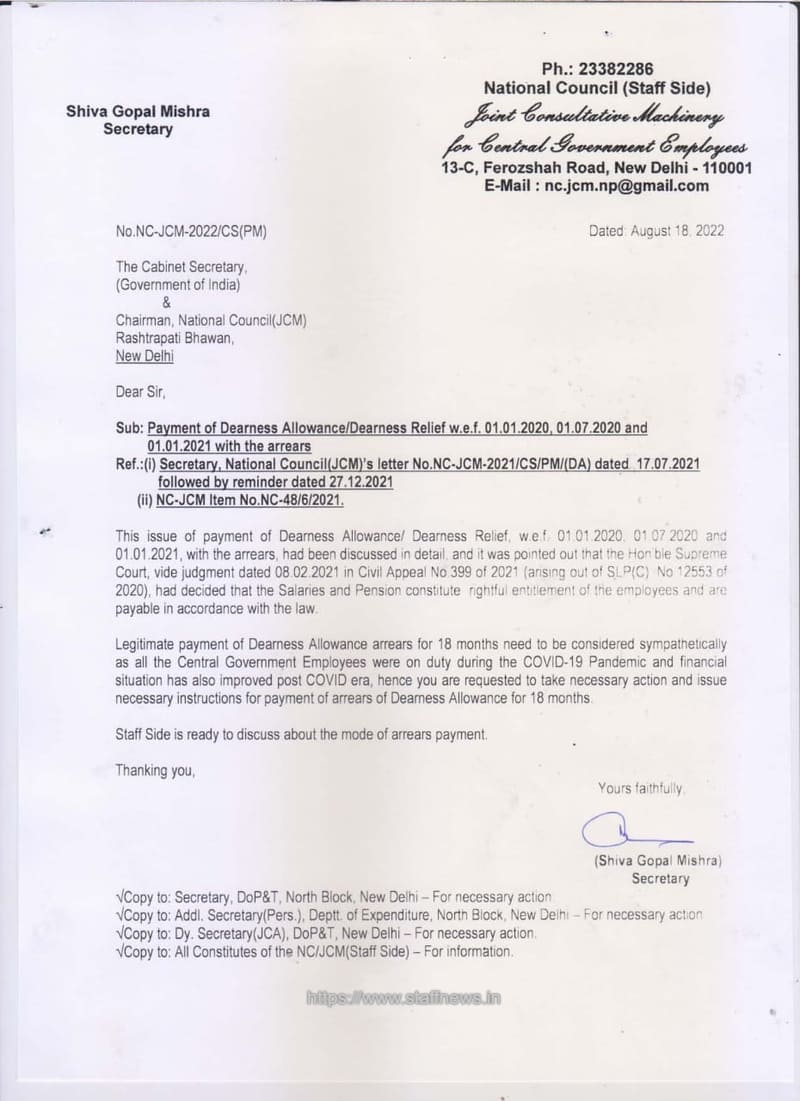

Payment Of Dearness Allowance Dearness Relief W e f 01 01 2020 01 07

How To File ITR 1 For FY 2022 23 With Salary Income From House

Arrears Of Salary Relief U s 89 EZTax

Military Pay Grade Calculator Enge Salary

Relief U s 89 How To Claim Tax Relief On Salary Arrears Under Section 89

https://www.incometax.gov.in/iec/foportal/help/...

1 What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E The Form must be filed before filing the Return of Income 2 Do I need to download and submit Form 10E

https://www.livemint.com/money/personal-finance/...

If someone someone is eligible for income tax relief on received salary arrears then her or she can claim it in current year s ITR by simply submitting Form 10E

1 What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E The Form must be filed before filing the Return of Income 2 Do I need to download and submit Form 10E

If someone someone is eligible for income tax relief on received salary arrears then her or she can claim it in current year s ITR by simply submitting Form 10E

Arrears Of Salary Relief U s 89 EZTax

Payment Of Dearness Allowance Dearness Relief W e f 01 01 2020 01 07

Military Pay Grade Calculator Enge Salary

Relief U s 89 How To Claim Tax Relief On Salary Arrears Under Section 89

Income Tax Itr E Filing Tabitomo

7th Pay Arrear Excel Sheet Rajasthan

7th Pay Arrear Excel Sheet Rajasthan

Salary Revision In Jobs And Recovery Of Arrears