In this day and age where screens have become the dominant feature of our lives however, the attraction of tangible printed materials isn't diminishing. Whether it's for educational purposes or creative projects, or simply adding a personal touch to your space, How Do I Claim My Cis Refund From Hmrc are a great resource. We'll dive into the world of "How Do I Claim My Cis Refund From Hmrc," exploring what they are, where they can be found, and how they can improve various aspects of your life.

Get Latest How Do I Claim My Cis Refund From Hmrc Below

How Do I Claim My Cis Refund From Hmrc

How Do I Claim My Cis Refund From Hmrc -

If you do not run a workplace payroll HMRC doesn t provide you CIS repayments during the year Instead for any unrelieved CIS tax deductions that remain at the tax year end 5th April you can claim a

Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year

How Do I Claim My Cis Refund From Hmrc encompass a wide array of printable documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and much more. The appeal of printables for free lies in their versatility and accessibility.

More of How Do I Claim My Cis Refund From Hmrc

Hecht Group Does Pennymac Pay Property Taxes

Hecht Group Does Pennymac Pay Property Taxes

To claim a CIS tax refund you must meet the following criteria Be a subcontractor registered under the CIS scheme Have deductions made from your payments by

Once you re sure you re eligible for a CIS tax refund follow these steps to claim it Complete your Self Assessment tax return Head to HMRC s online platform to

How Do I Claim My Cis Refund From Hmrc have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization: You can tailor printables to your specific needs be it designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Downloads of educational content for free can be used by students of all ages. This makes them an invaluable device for teachers and parents.

-

Affordability: The instant accessibility to the vast array of design and templates can save you time and energy.

Where to Find more How Do I Claim My Cis Refund From Hmrc

Construction Industry Scheme How To Claim A CIS Tax Refund

Construction Industry Scheme How To Claim A CIS Tax Refund

After the end of the tax year 5 April you can complete and file your tax return Get in touch with a professional accountant Collect all your payslips for the year

This can be done online through the HMRC website or by submitting a paper tax return Ensure you provide accurate and detailed information regarding your

After we've peaked your interest in How Do I Claim My Cis Refund From Hmrc Let's take a look at where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of How Do I Claim My Cis Refund From Hmrc to suit a variety of motives.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a wide variety of topics, ranging from DIY projects to planning a party.

Maximizing How Do I Claim My Cis Refund From Hmrc

Here are some inventive ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How Do I Claim My Cis Refund From Hmrc are an abundance of creative and practical resources for a variety of needs and needs and. Their availability and versatility make them an invaluable addition to both professional and personal lives. Explore the plethora of How Do I Claim My Cis Refund From Hmrc right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I download free printables in commercial projects?

- It's all dependent on the conditions of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables could be restricted on usage. Make sure you read the terms and conditions offered by the creator.

-

How can I print How Do I Claim My Cis Refund From Hmrc?

- You can print them at home with a printer or visit a print shop in your area for more high-quality prints.

-

What program do I need to open How Do I Claim My Cis Refund From Hmrc?

- Many printables are offered as PDF files, which can be opened using free software such as Adobe Reader.

HMRC Announce Changes To Process For Claiming CIS Credit For Companies

CIS Tax Refund In London The CIS Tax Rebate Is A Refund Of Tax To

Check more sample of How Do I Claim My Cis Refund From Hmrc below

Online Income Tax Cis Tax Rebate Hmrc Tax Refund And Return Calculator

How Do I Gain A Stamp Duty Refund From HMRC SDLT Refunds

How Do I Claim A CIS Refund What To Claim Back

HOW I CLAIMED MY TAX REFUND FROM HMRC YouTube

How Long Does It Take To Get A Tax Refund From HMRC UK Salary Tax

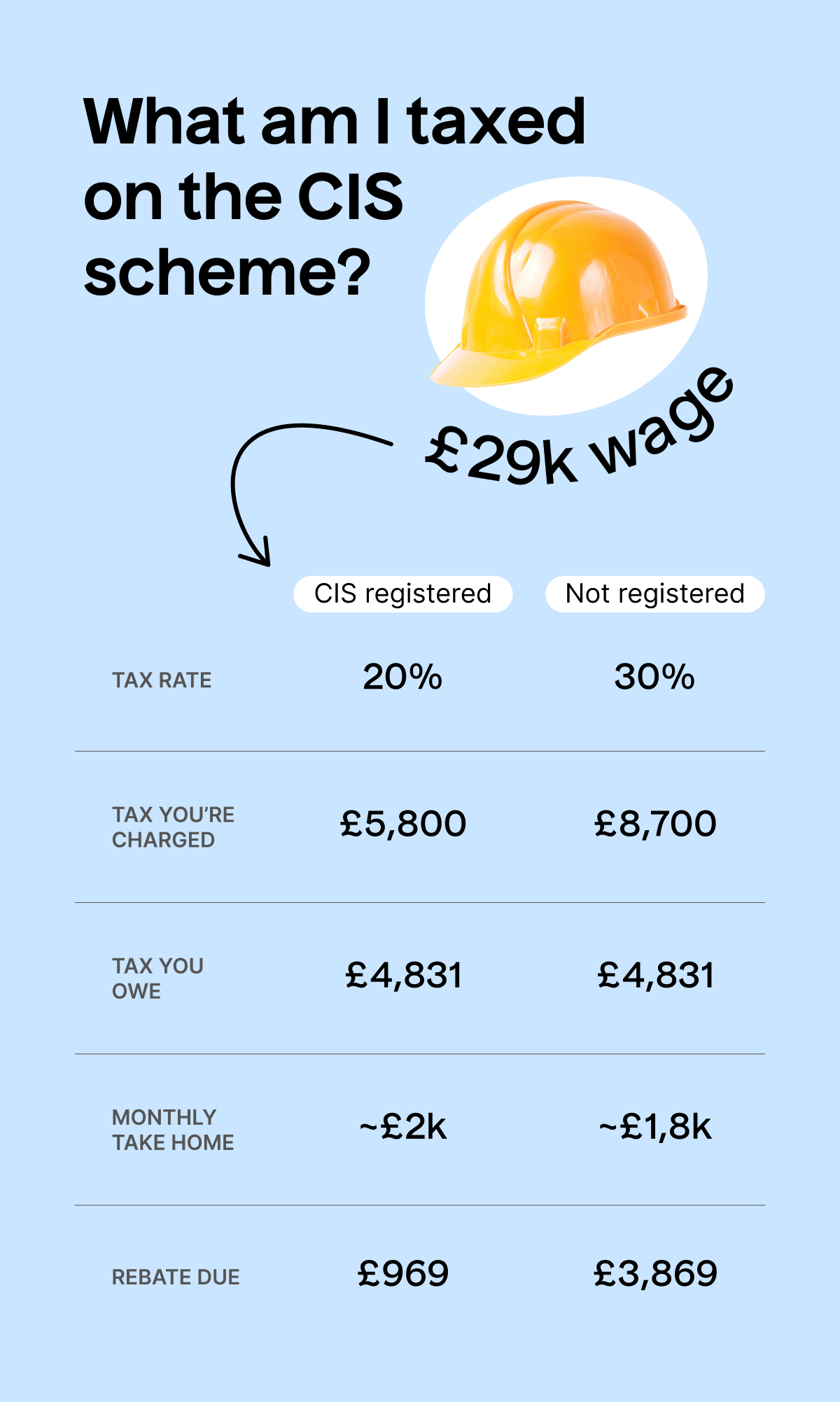

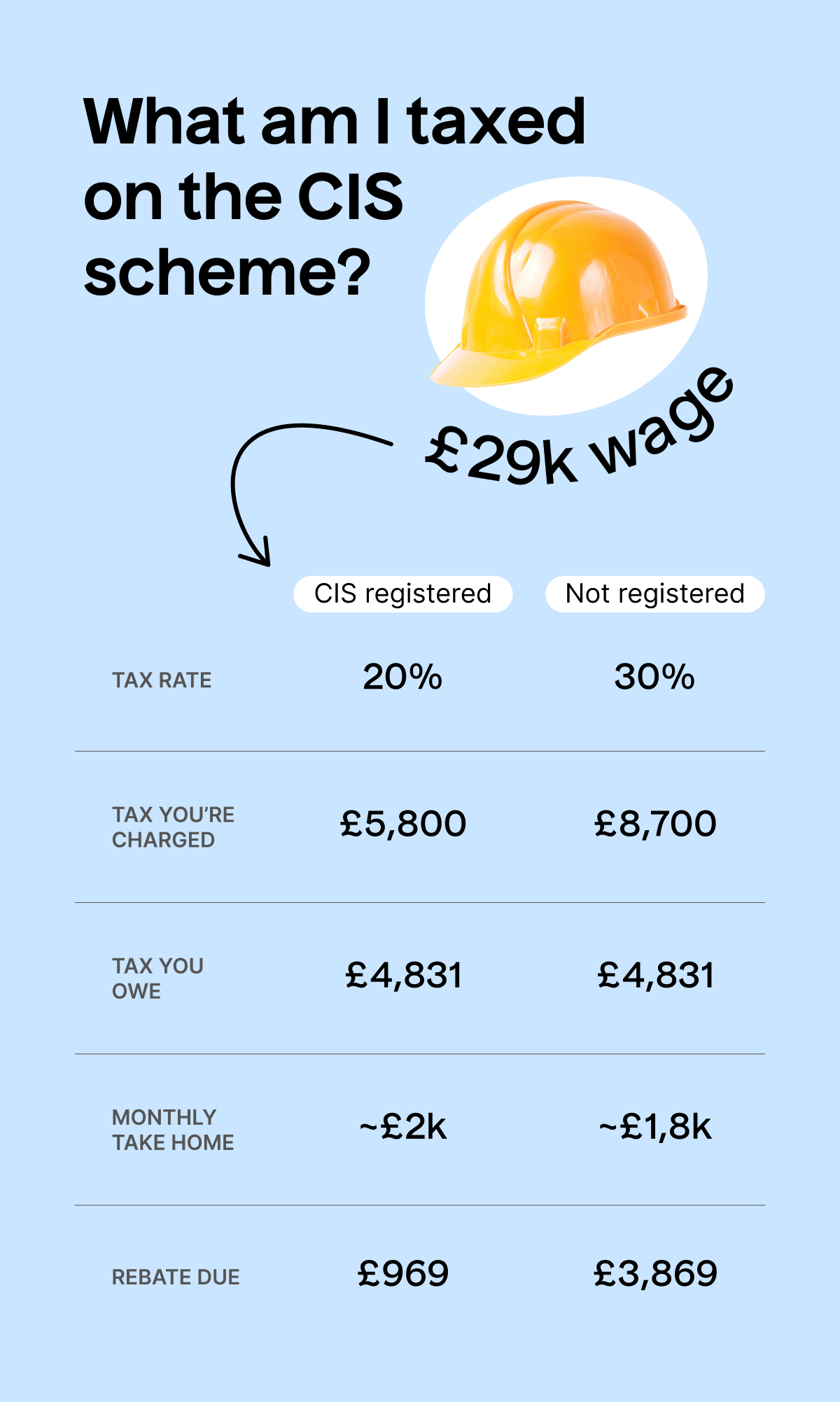

Why Am I Paying 30 Tax TaxScouts

https://www.gov.uk/government/publications/...

Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year

https://www.gov.uk/what-you-must-do-as-a-cis...

If you pay CIS deductions you must claim these back through your company s monthly payroll scheme Do not try to claim back through your Corporation Tax return you may

Use the Construction Industry Scheme CIS form CIS40 if you re an individual to claim repayment of subcontractor deductions during the current tax year

If you pay CIS deductions you must claim these back through your company s monthly payroll scheme Do not try to claim back through your Corporation Tax return you may

HOW I CLAIMED MY TAX REFUND FROM HMRC YouTube

How Do I Gain A Stamp Duty Refund From HMRC SDLT Refunds

How Long Does It Take To Get A Tax Refund From HMRC UK Salary Tax

Why Am I Paying 30 Tax TaxScouts

CIS Tax Refund Start Your Claim With Danbro Today

HMRC PPI Refund Of Tax Claim My Tax Back

HMRC PPI Refund Of Tax Claim My Tax Back

How To Claim A CIS Tax Refund McKellar Accountancy