In a world where screens have become the dominant feature of our lives The appeal of tangible printed objects isn't diminished. In the case of educational materials in creative or artistic projects, or simply to add an individual touch to the space, How Do I Get My Vat Refund are now a vital source. Here, we'll dive deeper into "How Do I Get My Vat Refund," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest How Do I Get My Vat Refund Below

How Do I Get My Vat Refund

How Do I Get My Vat Refund -

Table of Contents Hey there Have you ever heard about those amazing tax refunds you can get by shopping in Europe It s a fantastic way to save money but if you have no idea how to get them don t worry I ve got you covered In this guide I ll walk you through the entire process of getting a VAT refund while shopping in Europe

How to claim your VAT refund You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on your claim to the authorities in the other country The VAT refund procedure is harmonised at EU level

How Do I Get My Vat Refund offer a wide range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of designs, including worksheets templates, coloring pages, and many more. One of the advantages of How Do I Get My Vat Refund lies in their versatility as well as accessibility.

More of How Do I Get My Vat Refund

How Can I Get My VAT Refund Back UK How Can I Do Tax Free In UK

How Can I Get My VAT Refund Back UK How Can I Do Tax Free In UK

Check out the VAT rates of the different European countries here The Basics of VAT refunds Why can you get a VAT Tax Refund For non EU residents this system offers tax free shopping meaning the VAT paid can be claimed back When you shop in Spain the price tag includes VAT but as a visitor you re eligible for a refund on

At the Merchant The details on how to get a refund vary per country but generally you ll need to do the following Have the merchant completely fill out the refund document they ll need your passport or a photo of it to complete the form Hang on to the paperwork and original sales receipt until you file it see later

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: We can customize printed materials to meet your requirements be it designing invitations to organize your schedule or decorating your home.

-

Educational Value: Printing educational materials for no cost cater to learners of all ages. This makes the perfect source for educators and parents.

-

Accessibility: Quick access to numerous designs and templates will save you time and effort.

Where to Find more How Do I Get My Vat Refund

How To Estimate Your Tax Refund From SARS Greater Good SA

How To Estimate Your Tax Refund From SARS Greater Good SA

In Ireland the standard VAT rate is 23 This is the rate you will see most often when shopping while you are travelling to the country You should also look at two other rates the reduced rate and the second reduced rate that are used for some items And certain goods and services are eligible for zero rated VAT

Many items qualify for a VAT refund but it s important to note that only new goods not used can be claimed Each transaction also has to be over a certain threshold and this threshold varies by country For instance you have to spend over 100 per transaction in France to qualify for a VAT refund

Since we've got your curiosity about How Do I Get My Vat Refund, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of uses.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs are a vast array of topics, ranging all the way from DIY projects to planning a party.

Maximizing How Do I Get My Vat Refund

Here are some new ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

How Do I Get My Vat Refund are an abundance of fun and practical tools which cater to a wide range of needs and interest. Their accessibility and versatility make them a great addition to both professional and personal life. Explore the vast world of How Do I Get My Vat Refund today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can print and download these materials for free.

-

Are there any free printables for commercial use?

- It's based on specific terms of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables might have limitations in their usage. Be sure to check the terms and regulations provided by the creator.

-

How can I print How Do I Get My Vat Refund?

- Print them at home using either a printer or go to a local print shop to purchase superior prints.

-

What software do I need in order to open printables free of charge?

- Most PDF-based printables are available in PDF format. These can be opened with free software such as Adobe Reader.

VAT Return Template

VAT Refund Help R travel

Check more sample of How Do I Get My Vat Refund below

VAT Refund Help R travel

VAT Refund Help R travel

VAT Refund Help R travel

VAT Refund Help R travel

VAT REFUND USER GUIDE

How Do I Get My Parents To Like My Crush What Starbucks Drink Do I

https://europa.eu/youreurope/business/taxation/vat/vat-refunds

How to claim your VAT refund You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on your claim to the authorities in the other country The VAT refund procedure is harmonised at EU level

https://taxation-customs.ec.europa.eu/vat-refunds_en

This deduction is made by means of a refund from the EU country where they paid the VAT How to get a VAT refund Claimants must send an application to the national tax authorities in the EU country where they incurred the VAT see VAT refunds country guide Procedure to follow

How to claim your VAT refund You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on your claim to the authorities in the other country The VAT refund procedure is harmonised at EU level

This deduction is made by means of a refund from the EU country where they paid the VAT How to get a VAT refund Claimants must send an application to the national tax authorities in the EU country where they incurred the VAT see VAT refunds country guide Procedure to follow

VAT Refund Help R travel

VAT Refund Help R travel

VAT REFUND USER GUIDE

How Do I Get My Parents To Like My Crush What Starbucks Drink Do I

VAT Refund Help R travel

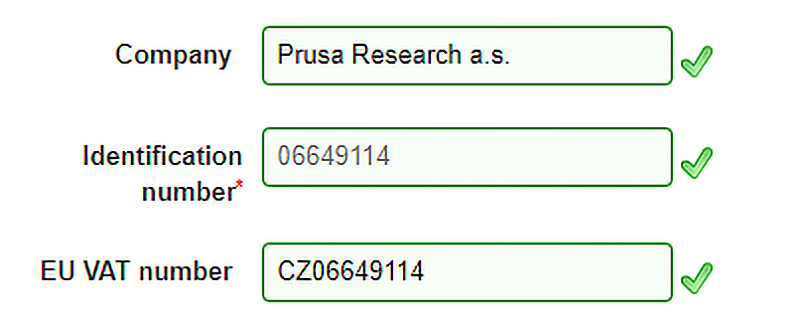

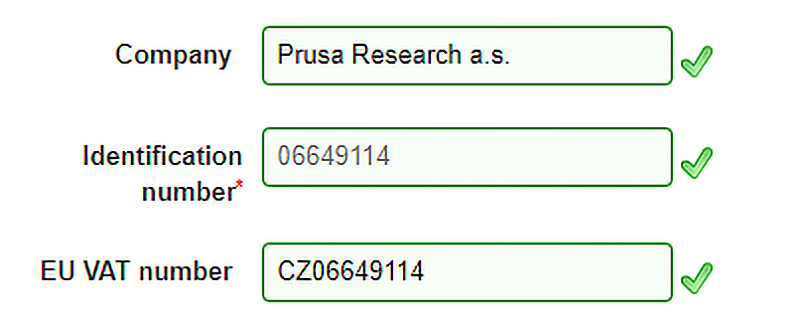

Prusa Knowledge Base VAT Value Added Tax Customs Fees

Prusa Knowledge Base VAT Value Added Tax Customs Fees

VAT Refund Help R travel