In this day and age when screens dominate our lives and the appeal of physical printed items hasn't gone away. For educational purposes in creative or artistic projects, or just adding an individual touch to your space, How Does Supplemental Property Tax Work are now a useful resource. The following article is a dive deep into the realm of "How Does Supplemental Property Tax Work," exploring what they are, how they are available, and how they can enrich various aspects of your daily life.

Get Latest How Does Supplemental Property Tax Work Below

How Does Supplemental Property Tax Work

How Does Supplemental Property Tax Work -

How it Works Examples Resources FAQs The supplemental roll provides a mechanism for placing property subject to Proposition 13 reappraisals due to change in ownership or completed new construction into immediate effect

No unlike your ordinary annual taxes the supplemental tax is a one time tax which dates from the date you take ownership of your property or complete the construction until the end of the tax year on June 30 The obligation for this tax is entirely that of the property owner

How Does Supplemental Property Tax Work include a broad range of printable, free material that is available online at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages, and much more. The appeal of printables for free is their versatility and accessibility.

More of How Does Supplemental Property Tax Work

Adjusted Supplemental Property Tax Bill Los Angeles County Property

Adjusted Supplemental Property Tax Bill Los Angeles County Property

If you purchase a home in California you may be required to pay a supplemental property tax which will become a lien against your property as of the date of ownership change or the date of completion of new construction

How does the proration factor work The supplemental tax becomes effective on the first day of the month following the month in which the change of ownership or completion of new construction actually occurred

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring printables to your specific needs when it comes to designing invitations making your schedule, or even decorating your home.

-

Educational Benefits: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, making them a vital instrument for parents and teachers.

-

Affordability: Quick access to numerous designs and templates, which saves time as well as effort.

Where to Find more How Does Supplemental Property Tax Work

Understanding Supplemental Property Taxes Team Forkel At Cal Counties

Understanding Supplemental Property Taxes Team Forkel At Cal Counties

The supplemental tax bill represents the tax due on the difference between the old and new values adjusted for the number of months left in the fiscal year When is the supplemental tax due The supplemental tax is due upon the mailing of the bill

Here s a simple way to understand supplemental tax bills they are the tax office s way of catching up on taxes owed due to an increase in your property s value from the last regular assessment

In the event that we've stirred your curiosity about How Does Supplemental Property Tax Work we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of motives.

- Explore categories such as home decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free, flashcards, and learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- The blogs are a vast range of interests, everything from DIY projects to party planning.

Maximizing How Does Supplemental Property Tax Work

Here are some ways for you to get the best of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

How Does Supplemental Property Tax Work are an abundance of practical and innovative resources which cater to a wide range of needs and needs and. Their access and versatility makes them a great addition to both professional and personal lives. Explore the plethora of How Does Supplemental Property Tax Work today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these items for free.

-

Can I make use of free printables for commercial purposes?

- It's based on specific terms of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Are there any copyright issues with How Does Supplemental Property Tax Work?

- Certain printables could be restricted in use. Make sure you read the terms and conditions provided by the author.

-

How do I print How Does Supplemental Property Tax Work?

- Print them at home using either a printer at home or in an area print shop for premium prints.

-

What software do I need to open How Does Supplemental Property Tax Work?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software like Adobe Reader.

California Supplemental Property Tax Bill CA Prop Tax Does My

Does Property Tax Included In Mortgage MortgageInfoGuide

Check more sample of How Does Supplemental Property Tax Work below

How Does Property Tax Work Marine Management

Diferencia Entre Property Taxes Y Supplemental Property Taxes YouTube

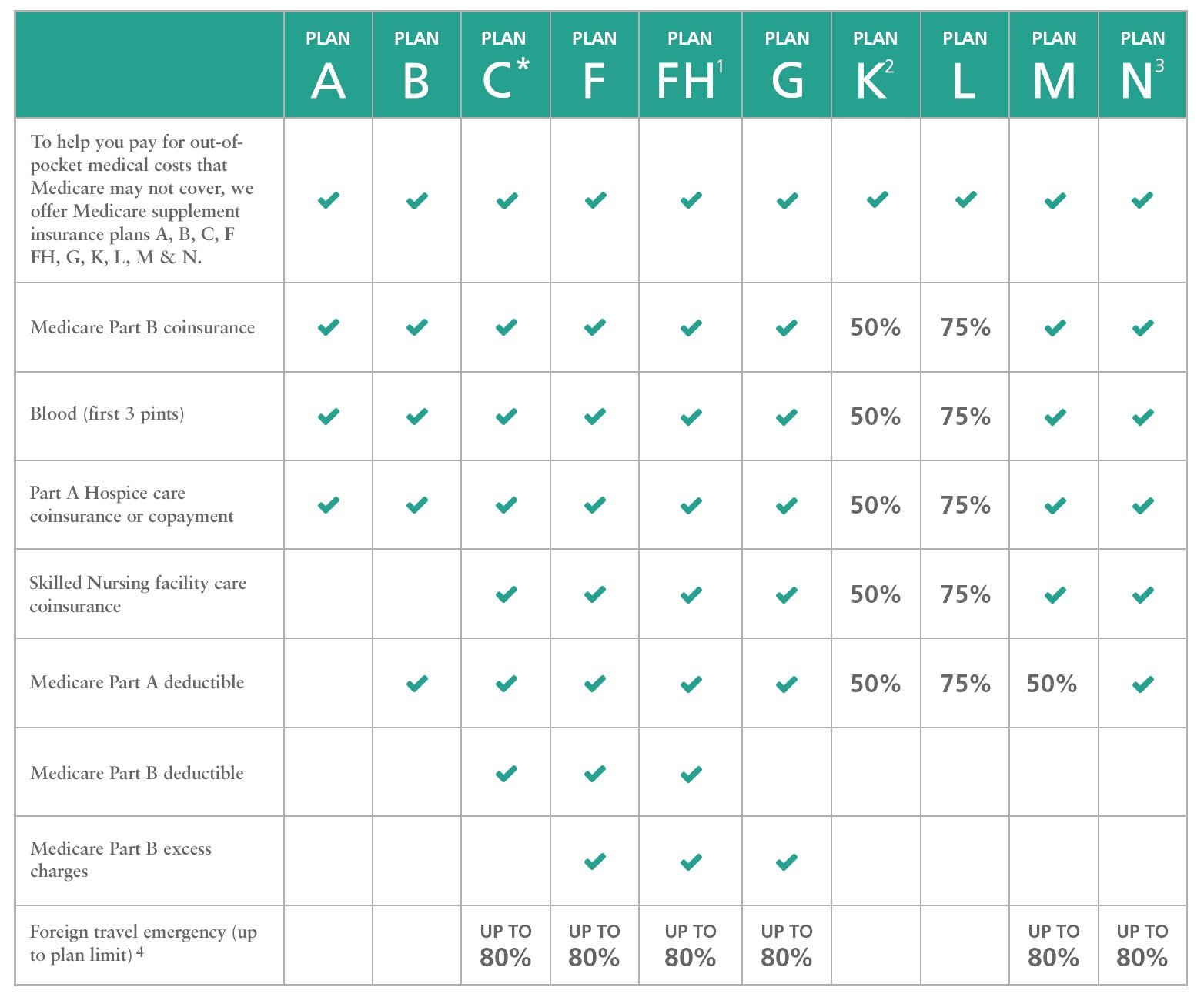

Does Supplemental Insurance Cover Medicare Deductible MedicareTalk

Understanding Property Tax A Comprehensive Guide The Enlightened Mindset

Hecht Group Who Pays Supplemental Property Tax

Some In Simsbury Getting A Pre Holiday Tax Bill Simsbury CT Patch

https://www.clta.org/page/Consumer13

No unlike your ordinary annual taxes the supplemental tax is a one time tax which dates from the date you take ownership of your property or complete the construction until the end of the tax year on June 30 The obligation for this tax is entirely that of the property owner

https://lucas-real-estate.com/understanding...

The Supplemental Real Property Tax Law was signed by the Governor in July of 1983 and is part of an ambitious drive to aid California s schools This property tax revision is expected to produce over 300 million per year in revenue for schools

No unlike your ordinary annual taxes the supplemental tax is a one time tax which dates from the date you take ownership of your property or complete the construction until the end of the tax year on June 30 The obligation for this tax is entirely that of the property owner

The Supplemental Real Property Tax Law was signed by the Governor in July of 1983 and is part of an ambitious drive to aid California s schools This property tax revision is expected to produce over 300 million per year in revenue for schools

Understanding Property Tax A Comprehensive Guide The Enlightened Mindset

Diferencia Entre Property Taxes Y Supplemental Property Taxes YouTube

Hecht Group Who Pays Supplemental Property Tax

Some In Simsbury Getting A Pre Holiday Tax Bill Simsbury CT Patch

SUPPLEMENTAL PROPERTY TAX PROPERTY TAX ESCROW YouTube

California Supplemental Tax Bills Explained Understanding Your

California Supplemental Tax Bills Explained Understanding Your

Supplemental Property Tax Bill