Today, in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. Whatever the reason, whether for education or creative projects, or simply adding an extra personal touch to your home, printables for free are now a useful resource. This article will dive to the depths of "How Is Personal Property Tax Calculated In West Virginia," exploring what they are, how they can be found, and how they can improve various aspects of your daily life.

Get Latest How Is Personal Property Tax Calculated In West Virginia Below

How Is Personal Property Tax Calculated In West Virginia

How Is Personal Property Tax Calculated In West Virginia -

West Virginia House Bill 2526 approved during the 2023 regular session of the West Virginia Legislature immediately reduces the income tax in tax year 2023 by an average of 21 25 percent The legislation also provides for a number of

In the context of West Virginia tax law personal property is defined broadly by WV Code 11 5 3 as anything of value that can be owned from movable tangibles to intangible assets like bonds and receivables

How Is Personal Property Tax Calculated In West Virginia provide a diverse selection of printable and downloadable materials online, at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and much more. The appeal of printables for free is their flexibility and accessibility.

More of How Is Personal Property Tax Calculated In West Virginia

How Is Property Tax Calculated In Utah YouTube

How Is Property Tax Calculated In Utah YouTube

Personal business property are subject to the property tax in West Virginia Real property includes land structures and certain equipment attached to structures Personal property includes furnishings inventory machinery equipment fixtures

Property valued by the county assessor includes residential real estate commercial business property and personal property such as motor vehicles The Tax Commissioner determines the value of natural resource real property and the value of industrial real and personal property

How Is Personal Property Tax Calculated In West Virginia have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization: It is possible to tailor the design to meet your needs in designing invitations or arranging your schedule or even decorating your house.

-

Educational Use: Downloads of educational content for free provide for students of all ages, which makes them an essential tool for parents and educators.

-

Simple: immediate access a myriad of designs as well as templates saves time and effort.

Where to Find more How Is Personal Property Tax Calculated In West Virginia

How Is Property Tax Calculated In The City Of Edmonton YouTube

How Is Property Tax Calculated In The City Of Edmonton YouTube

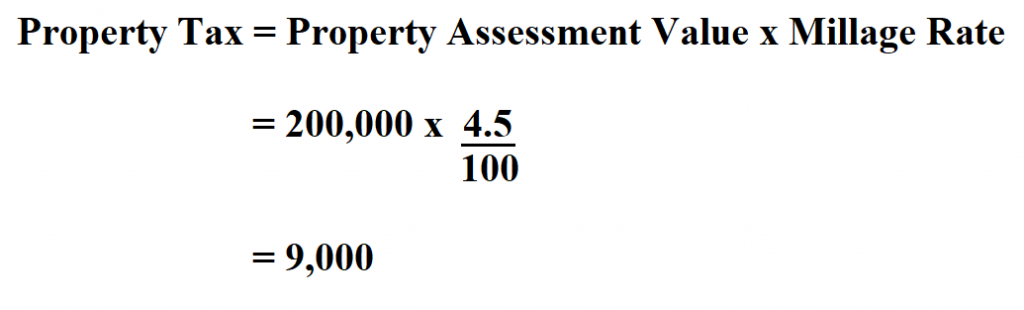

In West Virginia property taxes are collected annually by county assessors from real estate owners located within the state The amount of tax due is calculated using the mils rate or one hundredth of a dollar This is multiplied by the

Our West Virginia Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in West Virginia and across the entire United States

We've now piqued your curiosity about How Is Personal Property Tax Calculated In West Virginia, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with How Is Personal Property Tax Calculated In West Virginia for all goals.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning materials.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing How Is Personal Property Tax Calculated In West Virginia

Here are some creative ways to make the most use of How Is Personal Property Tax Calculated In West Virginia:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How Is Personal Property Tax Calculated In West Virginia are a treasure trove of useful and creative resources that meet a variety of needs and passions. Their accessibility and versatility make them a great addition to both professional and personal life. Explore the vast collection of How Is Personal Property Tax Calculated In West Virginia today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can print and download these tools for free.

-

Can I download free templates for commercial use?

- It's based on the rules of usage. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables might have limitations on usage. Be sure to check the terms and conditions offered by the creator.

-

How can I print How Is Personal Property Tax Calculated In West Virginia?

- Print them at home with a printer or visit a local print shop for higher quality prints.

-

What software do I need to run How Is Personal Property Tax Calculated In West Virginia?

- Many printables are offered in PDF format, which can be opened using free software, such as Adobe Reader.

How To Calculate Property Tax

How Is Commercial Property Tax Calculated

Check more sample of How Is Personal Property Tax Calculated In West Virginia below

How To Calculate Property Taxes

How s Property Tax Calculated n Florida 2023

SMDC Property Tax Calculation Charges How To Pay Online

How To Calculate Property Tax 10 Steps with Pictures Wiki How To

How Are Property Taxes Calculated In Cherokee County Ga About Indian

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

https://www.mortgagerater.com › wv-personal-property-tax

In the context of West Virginia tax law personal property is defined broadly by WV Code 11 5 3 as anything of value that can be owned from movable tangibles to intangible assets like bonds and receivables

https://tax.wv.gov › Business › PropertyTax › Pages › ...

All real and tangible personal property with limited exceptions is subject to property tax As of July 1 each year the ownership use and value of property are determined for the next calendar tax year

In the context of West Virginia tax law personal property is defined broadly by WV Code 11 5 3 as anything of value that can be owned from movable tangibles to intangible assets like bonds and receivables

All real and tangible personal property with limited exceptions is subject to property tax As of July 1 each year the ownership use and value of property are determined for the next calendar tax year

How To Calculate Property Tax 10 Steps with Pictures Wiki How To

How s Property Tax Calculated n Florida 2023

How Are Property Taxes Calculated In Cherokee County Ga About Indian

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

Hecht Group Do I Have To Pay Personal Property Tax On My Office

/filters:quality(80)/2021-08-01-How-to-Calculate-Property-Tax-equation-1.png)

How To Calculate Property Tax Ownerly

/filters:quality(80)/2021-08-01-How-to-Calculate-Property-Tax-equation-1.png)

How To Calculate Property Tax Ownerly

Personal Property Tax SDG Accountants