In this digital age, with screens dominating our lives yet the appeal of tangible printed materials hasn't faded away. If it's to aid in education as well as creative projects or just adding some personal flair to your home, printables for free are now an essential source. We'll take a dive deeper into "How Is The Adoption Tax Credit Calculated," exploring what they are, how to find them, and how they can enrich various aspects of your life.

Get Latest How Is The Adoption Tax Credit Calculated Below

How Is The Adoption Tax Credit Calculated

How Is The Adoption Tax Credit Calculated -

The National Council for Adoption NCFA has provided an updated guide to understanding the adoption tax credit ATC The guide includes sections discussing the following The legislative history of the ATC Eligibility criteria and restrictions How the tax credit works

The adoption tax credit is calculated on a per child basis so qualifying families who adopt multiple children will have the credit applied on a per child basis What is the difference between a tax credit and a tax deduction

Printables for free cover a broad array of printable materials that are accessible online for free cost. These resources come in many forms, including worksheets, coloring pages, templates and much more. The appeal of printables for free is their flexibility and accessibility.

More of How Is The Adoption Tax Credit Calculated

Giving Adoption Tax Credit Where Credit Is Due Foster Care Newsletter

Giving Adoption Tax Credit Where Credit Is Due Foster Care Newsletter

The tax code provides an adoption credit of up to 15 950 for qualified adoption expenses in 2023 The credit is available for each child adopted whether via public foster care domestic private adoption or international adoption

General Information 1 How much is the adoption tax credit For adoptions finalized in 2023 tax returns claimed in 2024 the maximum amount a family can receive as credit is 15 950 per adopted child For adoptions finalized in 2022 tax returns claimed in 2023 the maximum amount a family can receive as credit is 14 890 per adopted

How Is The Adoption Tax Credit Calculated have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: This allows you to modify the design to meet your needs in designing invitations to organize your schedule or even decorating your house.

-

Educational Impact: These How Is The Adoption Tax Credit Calculated are designed to appeal to students of all ages. This makes them a great device for teachers and parents.

-

It's easy: immediate access a plethora of designs and templates helps save time and effort.

Where to Find more How Is The Adoption Tax Credit Calculated

How To Use The Adoption Tax Credit In Domestic Adoption US Adoption

How To Use The Adoption Tax Credit In Domestic Adoption US Adoption

To claim the adoption credit or exclusion complete Form 8839 PDF Qualified Adoption Expenses and attach the form to your Form 1040 PDF U S Individual Income Tax Return or Form 1040NR PDF U S Nonresident Alien Income Tax Return

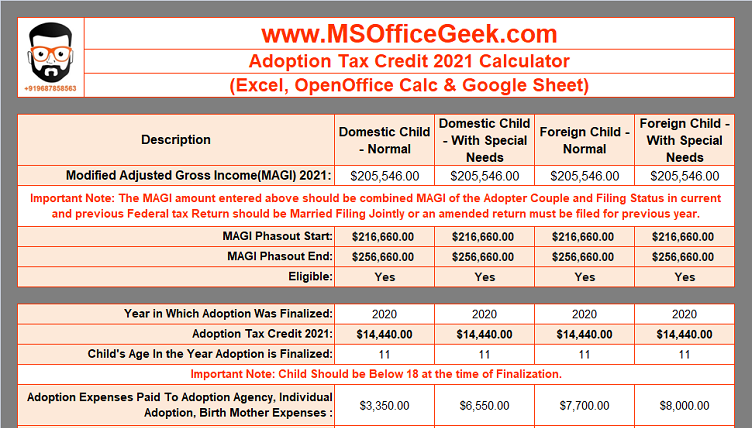

In 2020 the adoption tax credit could be worth up to 14 300 In 2021 its value increases to 14 440 To claim the maximum credit however you need to rack up that much in eligible expenses

Since we've got your interest in How Is The Adoption Tax Credit Calculated Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in How Is The Adoption Tax Credit Calculated for different needs.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs covered cover a wide range of interests, starting from DIY projects to planning a party.

Maximizing How Is The Adoption Tax Credit Calculated

Here are some innovative ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home as well as in the class.

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

How Is The Adoption Tax Credit Calculated are an abundance of creative and practical resources that can meet the needs of a variety of people and pursuits. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the world of How Is The Adoption Tax Credit Calculated today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes you can! You can print and download these items for free.

-

Do I have the right to use free templates for commercial use?

- It's dependent on the particular conditions of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright concerns with How Is The Adoption Tax Credit Calculated?

- Certain printables could be restricted on usage. Make sure to read the terms and conditions provided by the author.

-

How do I print How Is The Adoption Tax Credit Calculated?

- Print them at home using an printer, or go to the local print shop for the highest quality prints.

-

What program do I need to open How Is The Adoption Tax Credit Calculated?

- Many printables are offered in the format of PDF, which can be opened with free software such as Adobe Reader.

9 Things About The Adoption Tax Credit You Should Know AdoptHelp

The Adoption Tax Credit Helps Families With Adoption Related Expenses

Check more sample of How Is The Adoption Tax Credit Calculated below

2021 Adoption Tax Credit Adoption Choices Of Arizona

2022 How Does The Adoption Tax Credit Work Struggle Shuttle

Trump s Proposed Tax Bill Will Keep Parents From Adopting That Sucks

Adoption Tax Credit Survives Overhaul

2021 Adoption Tax Credit

Adoption Tax Credit Archives

https://adoptioncouncil.org/publications/...

The adoption tax credit is calculated on a per child basis so qualifying families who adopt multiple children will have the credit applied on a per child basis What is the difference between a tax credit and a tax deduction

https://www.irs.gov/taxtopics/tc607

Tax benefits for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer provided adoption assistance The credit is nonrefundable which means it s limited to your tax liability for the year

The adoption tax credit is calculated on a per child basis so qualifying families who adopt multiple children will have the credit applied on a per child basis What is the difference between a tax credit and a tax deduction

Tax benefits for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer provided adoption assistance The credit is nonrefundable which means it s limited to your tax liability for the year

Adoption Tax Credit Survives Overhaul

2022 How Does The Adoption Tax Credit Work Struggle Shuttle

2021 Adoption Tax Credit

Adoption Tax Credit Archives

About The Adoption Tax Credit For The 2020 Tax Year About The Adoption

Adoption Tax Credit Adopting

Adoption Tax Credit Adopting

Understanding The Adoption Tax Credit Nightlight Christian Adoptions