In the age of digital, where screens rule our lives however, the attraction of tangible, printed materials hasn't diminished. If it's to aid in education, creative projects, or just adding an extra personal touch to your space, How Is The Earned Income Tax Credit Calculated have become an invaluable source. With this guide, you'll dive through the vast world of "How Is The Earned Income Tax Credit Calculated," exploring the different types of printables, where they are available, and ways they can help you improve many aspects of your life.

Get Latest How Is The Earned Income Tax Credit Calculated Below

How Is The Earned Income Tax Credit Calculated

How Is The Earned Income Tax Credit Calculated -

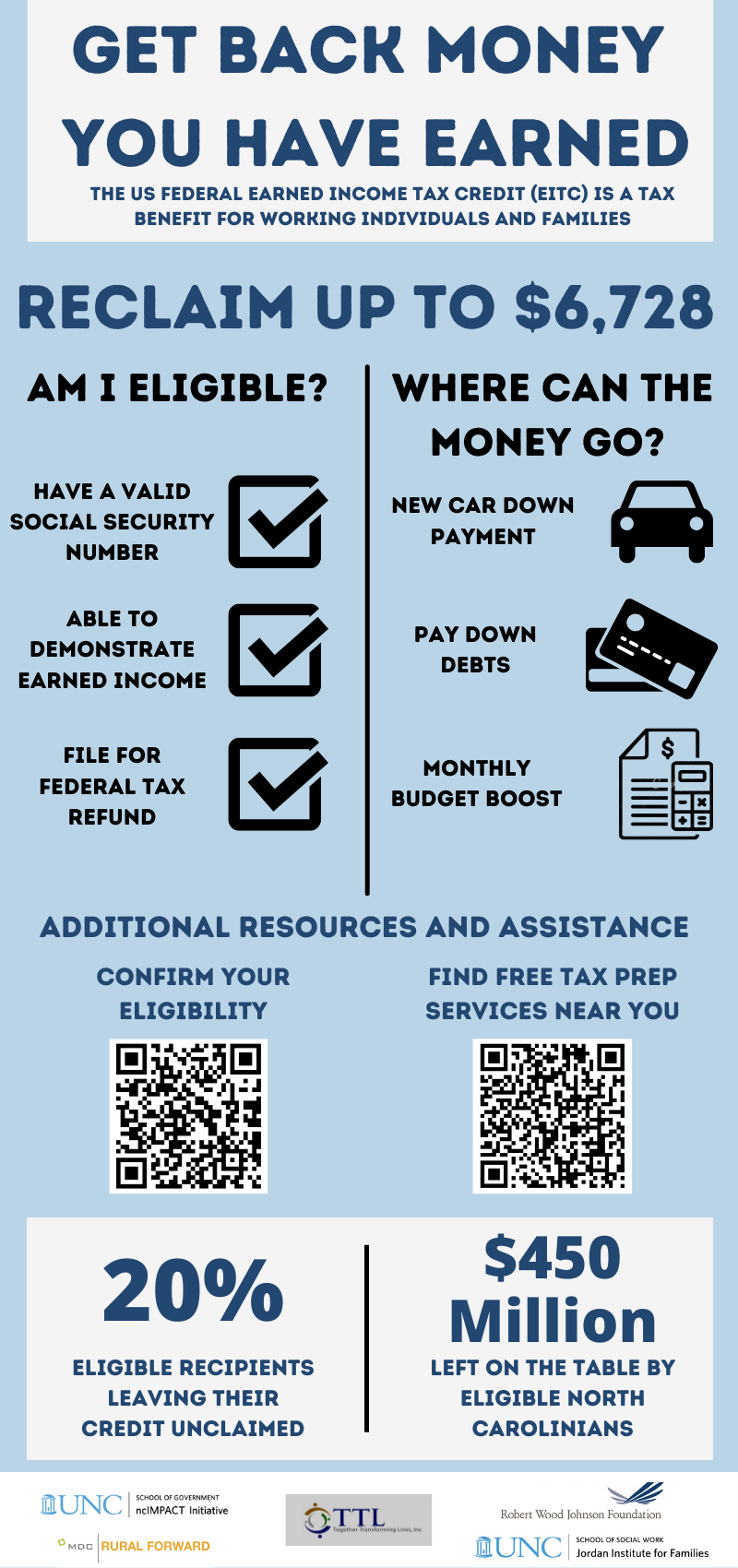

Use the EITC Assistant to see if you re eligible for this valuable credit calculate how much money you may get and find answers to questions The Earned Income Tax

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the

The How Is The Earned Income Tax Credit Calculated are a huge range of downloadable, printable items that are available online at no cost. They are available in numerous types, like worksheets, templates, coloring pages, and much more. The beauty of How Is The Earned Income Tax Credit Calculated is their flexibility and accessibility.

More of How Is The Earned Income Tax Credit Calculated

Can A Single Person Get The Earned Income Credit Leia Aqui What Is

Can A Single Person Get The Earned Income Credit Leia Aqui What Is

The earned income tax credit EIC or EITC is for low and moderate income workers See qualifications and credit amounts for 2024 2025

Bankrate provides a FREE earned income tax credit calculator and other EIC income tax calculators to help consumers determine the amount of income tax due or owed to the IRS

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Impact: Printing educational materials for no cost can be used by students of all ages, making them a valuable resource for educators and parents.

-

Easy to use: Quick access to a myriad of designs as well as templates will save you time and effort.

Where to Find more How Is The Earned Income Tax Credit Calculated

Earned Income Tax Credit EITC Erfahren Sie Wie Sie Sich

Earned Income Tax Credit EITC Erfahren Sie Wie Sie Sich

The EIC calculator otherwise known as the EITC Assistant is a tool supplied by the IRS that allows you to find out If you are eligible for EITC If you meet the tests for claiming qualifying child ren Estimate the amount of your credit

The Earned Income Credit or EIC is automatically calculated by the program and many factors contribute to how it is calculated Please read the article below or click here to see the

After we've peaked your curiosity about How Is The Earned Income Tax Credit Calculated Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and How Is The Earned Income Tax Credit Calculated for a variety purposes.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad spectrum of interests, that includes DIY projects to party planning.

Maximizing How Is The Earned Income Tax Credit Calculated

Here are some innovative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets for teaching at-home or in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

How Is The Earned Income Tax Credit Calculated are an abundance with useful and creative ideas designed to meet a range of needs and interest. Their access and versatility makes them a wonderful addition to every aspect of your life, both professional and personal. Explore the many options of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes you can! You can print and download these resources at no cost.

-

Are there any free printouts for commercial usage?

- It's all dependent on the rules of usage. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with How Is The Earned Income Tax Credit Calculated?

- Some printables may have restrictions in their usage. Be sure to check the terms and regulations provided by the creator.

-

How do I print printables for free?

- Print them at home with any printer or head to any local print store for top quality prints.

-

What program is required to open printables free of charge?

- The majority of printables are in the format of PDF, which can be opened with free software like Adobe Reader.

How To Qualify For The Earned Income Tax Credit M M Tax

Earned Income Tax Credit For Households With One Child 2023 Center

Check more sample of How Is The Earned Income Tax Credit Calculated below

Understanding The Earned Income Tax Credit Wells Financial Group LLC

Comments On What Is The Earned Income Tax Credit EITC And Do I

FAQ WA Tax Credit

T22 0250 Tax Benefit Of The Earned Income Tax Credit EITC Baseline

Do I Qualify For The Earned Income Tax Credit The Motley Fool

A Birdcage Filled With Money Sitting Next To The Words What Is The

https://www.irs.gov/credits-deductions/individuals...

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the

https://www.irs.gov/publications/p596

The EIC is a tax credit for certain people who work and have earned income under 63 398 A tax credit usually means more money in your pocket It reduces the amount of tax you owe The EIC may also give you a refund

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the

The EIC is a tax credit for certain people who work and have earned income under 63 398 A tax credit usually means more money in your pocket It reduces the amount of tax you owe The EIC may also give you a refund

T22 0250 Tax Benefit Of The Earned Income Tax Credit EITC Baseline

Comments On What Is The Earned Income Tax Credit EITC And Do I

Do I Qualify For The Earned Income Tax Credit The Motley Fool

A Birdcage Filled With Money Sitting Next To The Words What Is The

What Is The Earned Income Tax Credit And Do You Qualify For It YouTube

Illinois Earned Income Tax Credit Do You Qualify Pasquesi Sheppard

Illinois Earned Income Tax Credit Do You Qualify Pasquesi Sheppard

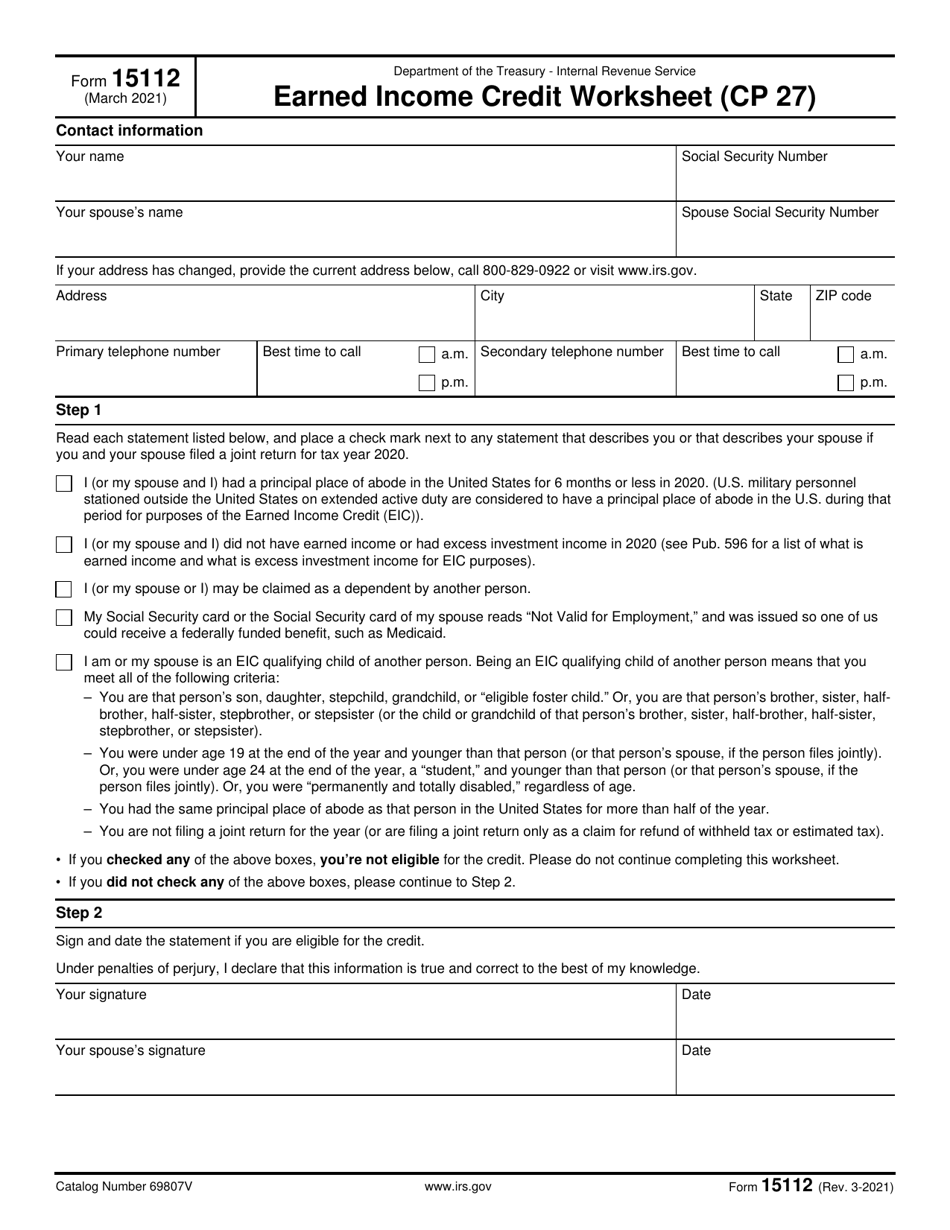

IRS Form 15112 Fill Out Sign Online And Download Fillable PDF