In a world with screens dominating our lives but the value of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons for creative projects, just adding personal touches to your area, How Many Times Can You Claim Energy Tax Credit are now a vital resource. This article will take a dive in the world of "How Many Times Can You Claim Energy Tax Credit," exploring the benefits of them, where you can find them, and how they can enrich various aspects of your daily life.

Get Latest How Many Times Can You Claim Energy Tax Credit Below

How Many Times Can You Claim Energy Tax Credit

How Many Times Can You Claim Energy Tax Credit -

Energy Tax Credit An energy tax credit is given to homeowners who make their homes more energy efficient by installing energy efficient improvements There are both federal energy tax incentives

You can be entitled to a tax credit if electricity expenses are high in your permanent home The credit is a temporary measure in response to increased prices Only the expenses for January February March and April 2023 will qualify How much is the credit If the total 4 month cost exceeds 2 000 you are entitled to the tax credit

How Many Times Can You Claim Energy Tax Credit provide a diverse assortment of printable materials that are accessible online for free cost. These printables come in different forms, including worksheets, templates, coloring pages, and more. The appeal of printables for free is their flexibility and accessibility.

More of How Many Times Can You Claim Energy Tax Credit

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

Energy Tax Credit 2011 Not What It Used To Be Darwin s Money

You can claim the annual credit every year that you install eligible property until the credit begins to phase out in 2033 Credit Limits for Fuel Cell Property Fuel cell property is limited to 500 for each half kilowatt of capacity

Dec 15 2023 11 42 AM EST Contents What is a tax credit What are the 2 home energy tax credits Can you claim both Residential Clean Energy Credit vs Energy Efficient

How Many Times Can You Claim Energy Tax Credit have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization You can tailor printables to your specific needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your home.

-

Educational Value: Downloads of educational content for free cater to learners of all ages, which makes them a useful tool for parents and educators.

-

Accessibility: Quick access to an array of designs and templates is time-saving and saves effort.

Where to Find more How Many Times Can You Claim Energy Tax Credit

What Tax Deductions Can You Claim Without Receipts Bench Accounting

What Tax Deductions Can You Claim Without Receipts Bench Accounting

In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020 2022 and 22 for systems installed in 2023 4 The tax credit expires starting in 2024 unless Congress renews it There is no maximum amount that can be claimed

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades SEE TAX

In the event that we've stirred your curiosity about How Many Times Can You Claim Energy Tax Credit Let's find out where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of How Many Times Can You Claim Energy Tax Credit designed for a variety uses.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning tools.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide range of topics, from DIY projects to party planning.

Maximizing How Many Times Can You Claim Energy Tax Credit

Here are some innovative ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Many Times Can You Claim Energy Tax Credit are an abundance with useful and creative ideas for a variety of needs and interest. Their availability and versatility make them a great addition to each day life. Explore the vast array of How Many Times Can You Claim Energy Tax Credit today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can print and download these materials for free.

-

Can I make use of free printables for commercial purposes?

- It's based on specific conditions of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with How Many Times Can You Claim Energy Tax Credit?

- Some printables may come with restrictions concerning their use. Be sure to read the conditions and terms of use provided by the creator.

-

How do I print How Many Times Can You Claim Energy Tax Credit?

- Print them at home using either a printer or go to a print shop in your area for premium prints.

-

What program must I use to open printables for free?

- The majority of printed documents are as PDF files, which can be opened with free programs like Adobe Reader.

Solar Energy Tax Credit Andrews Tax Accounting

How Many Times Can I Reheat Breastmilk

Check more sample of How Many Times Can You Claim Energy Tax Credit below

How Many Times Can You Recycle Different Waste Materials Better

How Many Times Can You Get Married In Texas

Can You Claim Washer And Dryer On Taxes JacAnswers

Ryan Gosling absolute Perfection How Many Times Can You Pin This

How Many Kids Can You Claim On Taxes Hanfincal

How Many Times Can You Get Reinfected With COVID Here s What Experts

https://www.vero.fi/.../tax-credit-for-electricity

You can be entitled to a tax credit if electricity expenses are high in your permanent home The credit is a temporary measure in response to increased prices Only the expenses for January February March and April 2023 will qualify How much is the credit If the total 4 month cost exceeds 2 000 you are entitled to the tax credit

https://www.irs.gov/credits-deductions/frequently...

A3 No There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made Q4 May a taxpayer carry forward unused credits to another

You can be entitled to a tax credit if electricity expenses are high in your permanent home The credit is a temporary measure in response to increased prices Only the expenses for January February March and April 2023 will qualify How much is the credit If the total 4 month cost exceeds 2 000 you are entitled to the tax credit

A3 No There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made Q4 May a taxpayer carry forward unused credits to another

Ryan Gosling absolute Perfection How Many Times Can You Pin This

How Many Times Can You Get Married In Texas

How Many Kids Can You Claim On Taxes Hanfincal

How Many Times Can You Get Reinfected With COVID Here s What Experts

Energy Tax Credit Lowes ReliaBilt Media Site

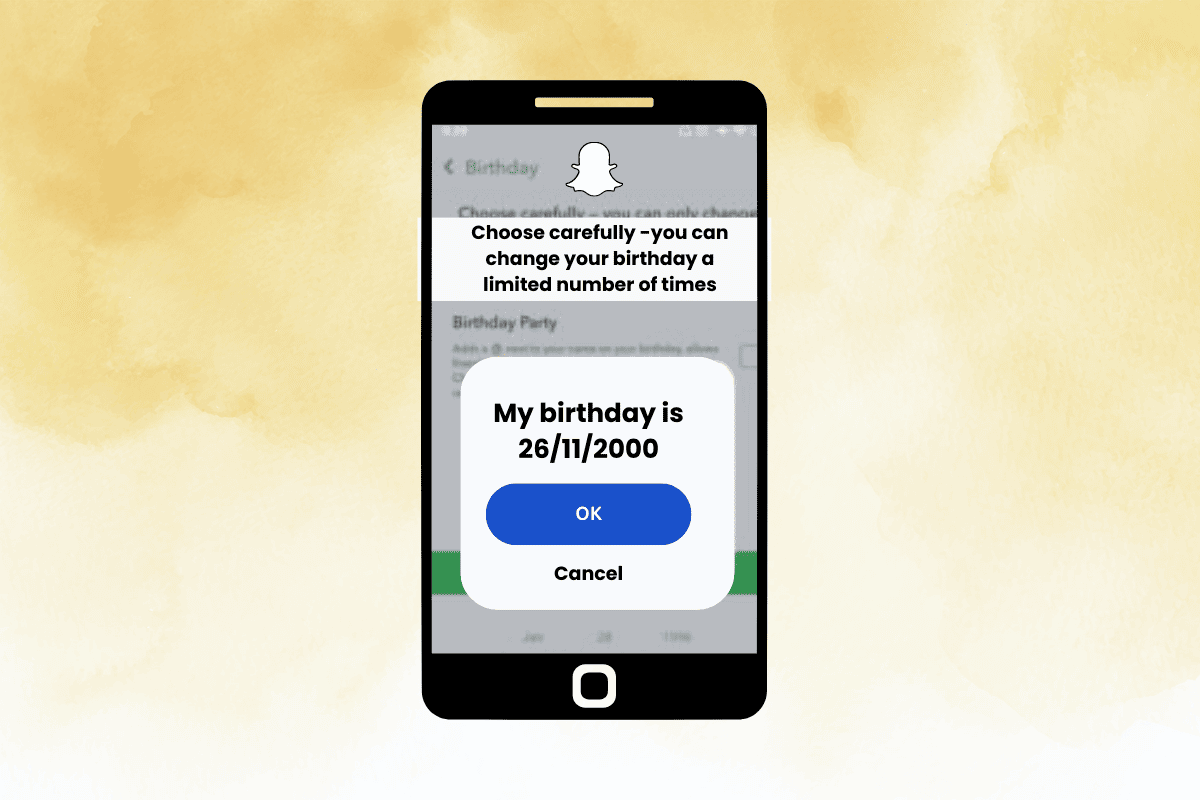

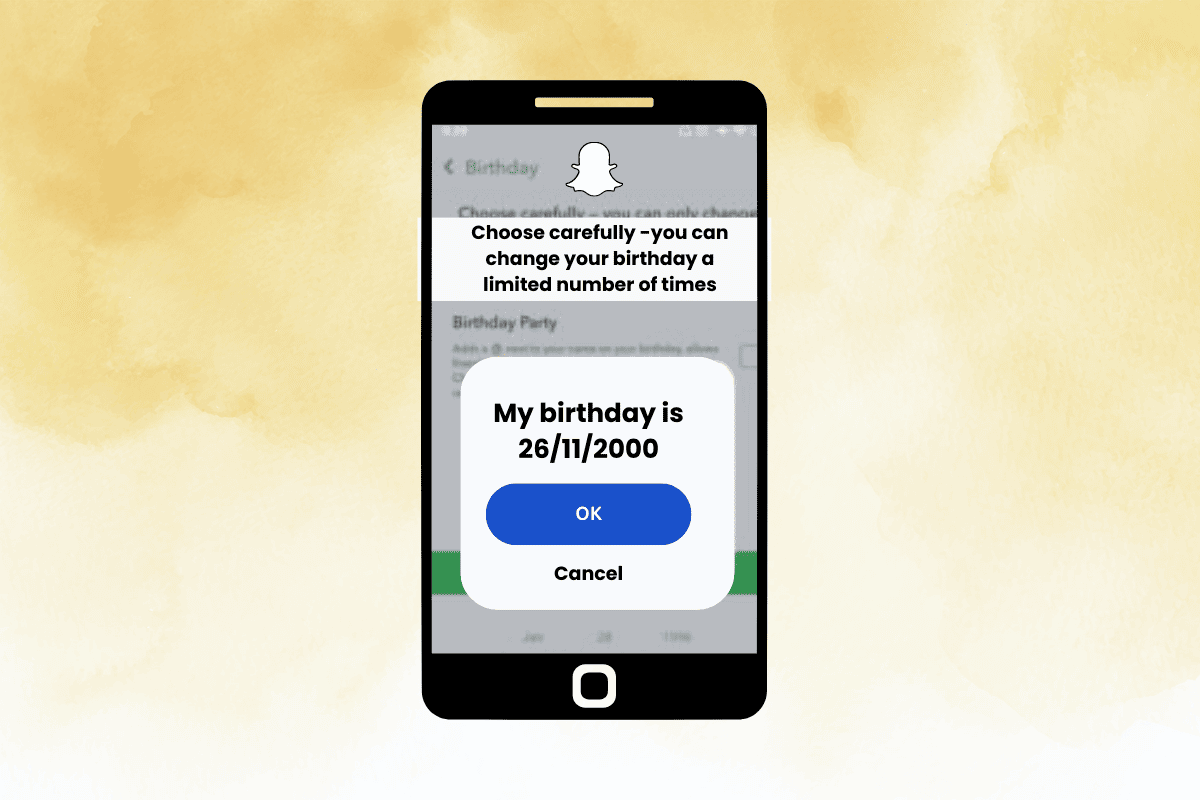

How Many Times Can You Change Your Birthday On Snapchat TechCult

How Many Times Can You Change Your Birthday On Snapchat TechCult

How Many Times Can You File An Insurance Claim For Auto Hail Damage