In this age of technology, in which screens are the norm it's no wonder that the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes such as creative projects or simply adding an individual touch to the area, How Many Years Can You Claim Residential Energy Credit are now an essential source. With this guide, you'll dive deeper into "How Many Years Can You Claim Residential Energy Credit," exploring their purpose, where they can be found, and ways they can help you improve many aspects of your life.

Get Latest How Many Years Can You Claim Residential Energy Credit Below

How Many Years Can You Claim Residential Energy Credit

How Many Years Can You Claim Residential Energy Credit -

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

Currently the residential energy credit can be carried forward for up to five years This means that if you are unable to fully utilize the credit in the year it is claimed

How Many Years Can You Claim Residential Energy Credit encompass a wide assortment of printable, downloadable content that can be downloaded from the internet at no cost. These resources come in various designs, including worksheets templates, coloring pages and many more. The value of How Many Years Can You Claim Residential Energy Credit is their versatility and accessibility.

More of How Many Years Can You Claim Residential Energy Credit

How Long Can You Finance A Boat Easy Quick Guide

How Long Can You Finance A Boat Easy Quick Guide

Residential Energy Efficient Property Credit now the Residential Clean Energy Credit 1 Nonbusiness Energy Property Credit Energy Efficient Home Improvement Credit With the Inflation Reduction Act of 2022 the

Nerdy takeaways If you made a qualifying home improvement in 2023 you may be able to recoup up to 30 of the cost through the energy efficient home

How Many Years Can You Claim Residential Energy Credit have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: The Customization feature lets you tailor designs to suit your personal needs whether it's making invitations making your schedule, or even decorating your house.

-

Educational Worth: Education-related printables at no charge can be used by students of all ages, making them an invaluable resource for educators and parents.

-

It's easy: immediate access many designs and templates, which saves time as well as effort.

Where to Find more How Many Years Can You Claim Residential Energy Credit

TW Residential Energy Credit

TW Residential Energy Credit

Residential Energy Tax Credits Several energy related tax credits are available for 2023 including two major energy tax credits for homeowners the Energy

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement

We've now piqued your curiosity about How Many Years Can You Claim Residential Energy Credit, let's explore where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of How Many Years Can You Claim Residential Energy Credit designed for a variety goals.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs are a vast range of topics, that range from DIY projects to party planning.

Maximizing How Many Years Can You Claim Residential Energy Credit

Here are some unique ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

How Many Years Can You Claim Residential Energy Credit are a treasure trove of creative and practical resources that can meet the needs of a variety of people and needs and. Their access and versatility makes these printables a useful addition to both personal and professional life. Explore the vast world of How Many Years Can You Claim Residential Energy Credit now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Many Years Can You Claim Residential Energy Credit truly free?

- Yes, they are! You can print and download these tools for free.

-

Can I use the free templates for commercial use?

- It's based on specific terms of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in How Many Years Can You Claim Residential Energy Credit?

- Certain printables might have limitations regarding their use. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home using any printer or head to an in-store print shop to get more high-quality prints.

-

What software will I need to access printables for free?

- The majority of printed documents are in PDF format. These can be opened with free software, such as Adobe Reader.

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Residential Energy Credit Application 2023 ElectricRate

Check more sample of How Many Years Can You Claim Residential Energy Credit below

What You Need To Know About Energy Efficient Property Credits

How Many Years Can A Squirrel Live Find Out Here Squirrel Arena

Residential Energy Efficient Property Credit Qualification Form 5695

2023 Residential Clean Energy Credit Guide ReVision Energy

Top 6 How Far Back Can The Irs Collect Taxes In 2022 G u y

/mature-couple-calculating-home-finances-506033706-5bd22c53c9e77c00585cc074.jpg)

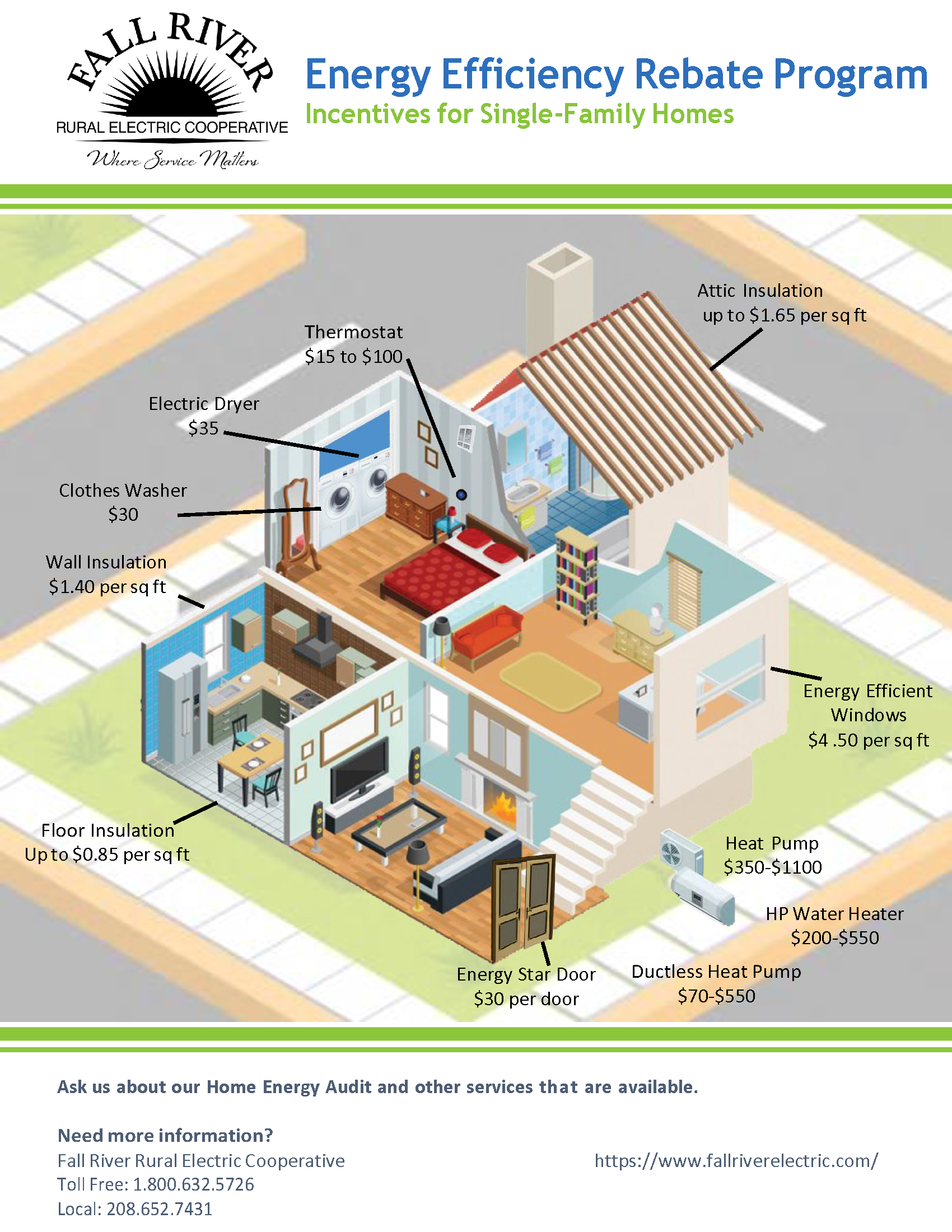

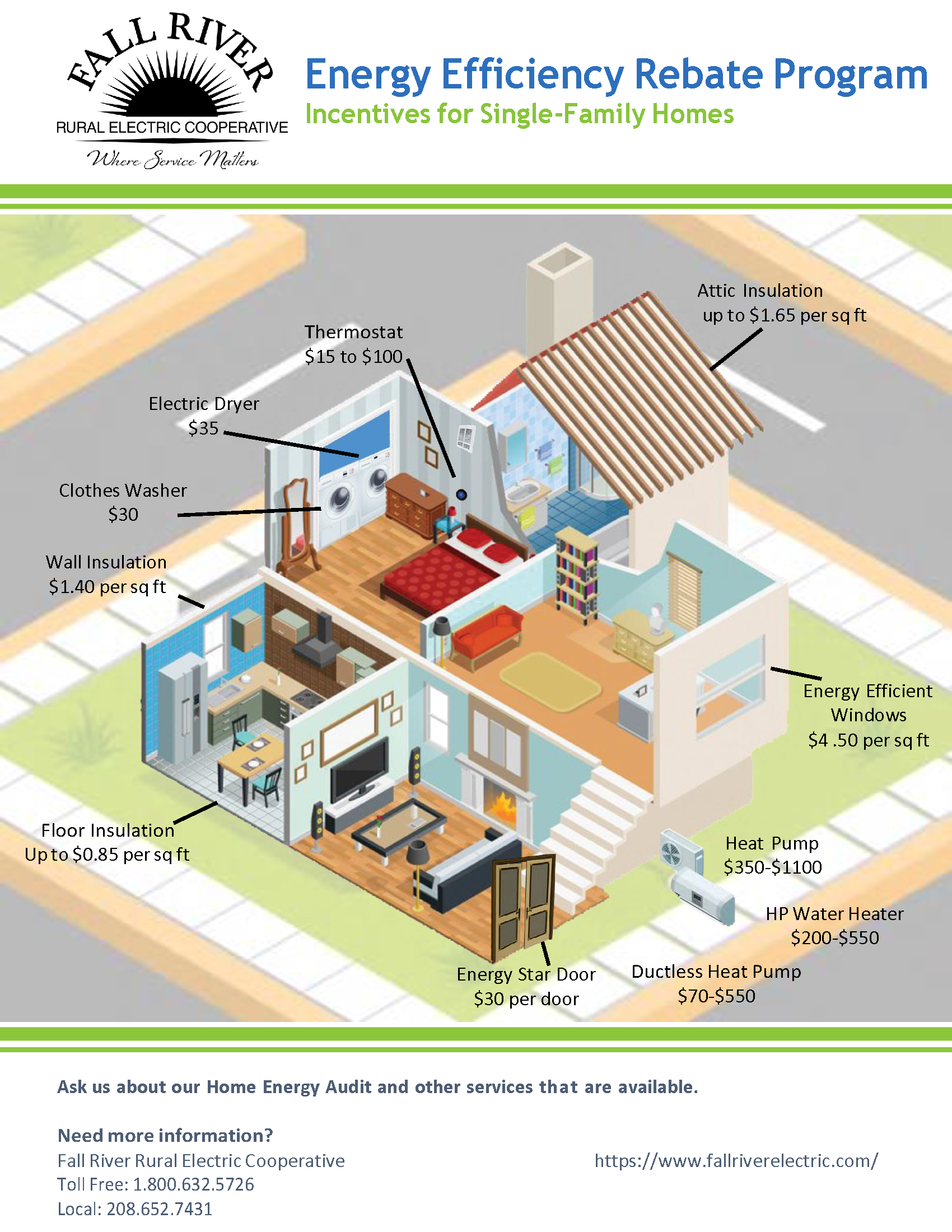

Home Improvement Rebates Fall River Rural Electric Cooperative

https://livewell.com/finance/how-many-years-can...

Currently the residential energy credit can be carried forward for up to five years This means that if you are unable to fully utilize the credit in the year it is claimed

https://rsmus.com/insights/tax-alerts/2023/IRS...

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30

Currently the residential energy credit can be carried forward for up to five years This means that if you are unable to fully utilize the credit in the year it is claimed

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30

2023 Residential Clean Energy Credit Guide ReVision Energy

How Many Years Can A Squirrel Live Find Out Here Squirrel Arena

/mature-couple-calculating-home-finances-506033706-5bd22c53c9e77c00585cc074.jpg)

Top 6 How Far Back Can The Irs Collect Taxes In 2022 G u y

Home Improvement Rebates Fall River Rural Electric Cooperative

How Many Years Can You Do For Vehicular Homicide

How Many Years Can You Do For Vehicular Homicide

How Many Years Can You Do For Vehicular Homicide

Coming Soon New Residential Energy Credit On The Mark Tax Service