In this digital age, when screens dominate our lives The appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons and creative work, or just adding an extra personal touch to your home, printables for free are now a vital source. We'll take a dive in the world of "How Much Can A Senior Earn Tax Free In Australia," exploring the different types of printables, where you can find them, and ways they can help you improve many aspects of your life.

Get Latest How Much Can A Senior Earn Tax Free In Australia Below

How Much Can A Senior Earn Tax Free In Australia

How Much Can A Senior Earn Tax Free In Australia -

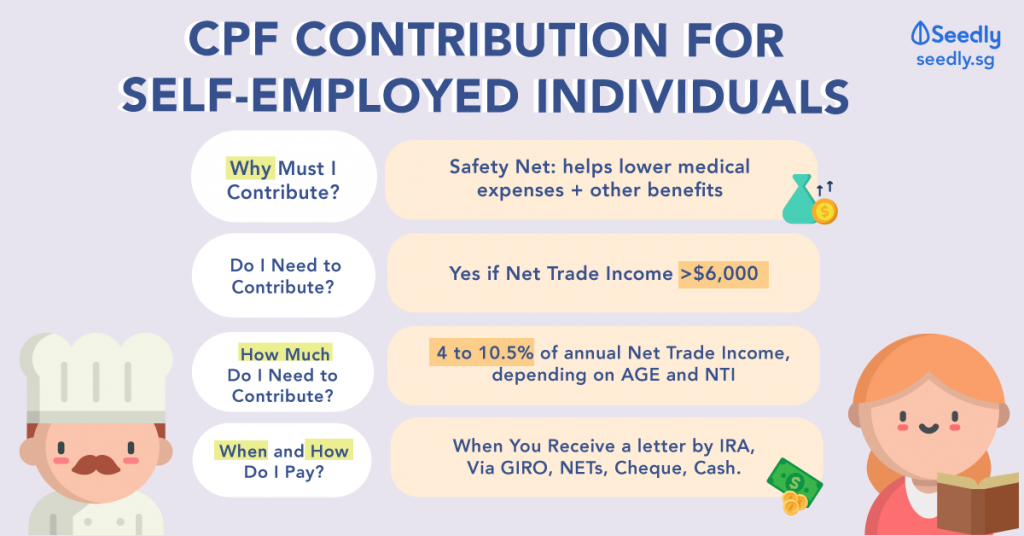

You can claim or vary the seniors and pensioners tax offset SAPTO through your Withholding declaration if you meet both conditions relating to eligibility for Australian Government pensions or allowances income If you have a spouse you also need to work out whether they were eligible

How your super or non super income stream is taxed How much tax you pay on retirement income depends on your age and the type of income stream For most people an income stream from superannuation will be tax free from age 60

How Much Can A Senior Earn Tax Free In Australia provide a diverse collection of printable material that is available online at no cost. They come in many forms, including worksheets, coloring pages, templates and more. The great thing about How Much Can A Senior Earn Tax Free In Australia lies in their versatility and accessibility.

More of How Much Can A Senior Earn Tax Free In Australia

How To Open A Gold IRA Carefulu

How To Open A Gold IRA Carefulu

How Much Can a Senior or Pensioner Earn Tax Free in Australia The SAPTO can affect pensioners and seniors with taxable income up to Single with 50 119 83 580 combined for couples 47 599 per couple if separated due to illness How Does SAPTO Work If you are a senior citizen residing in Australia you can earn more income and pay less

The good news is that any income you receive from super funds is tax free for recipients over 60 so this won t be included in the rebate income threshold for determining SAPTO And there s more good news Using the Seniors and Pensioners Tax Offset does not disqualify you from using other offsets

The How Much Can A Senior Earn Tax Free In Australia have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free can be used by students of all ages, which makes them an essential tool for parents and educators.

-

Accessibility: instant access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more How Much Can A Senior Earn Tax Free In Australia

Can A Senior Citizen Or Children Utilize CBD Mamashealinghands

Can A Senior Citizen Or Children Utilize CBD Mamashealinghands

How Much Can I Earn in Retirement Before Paying Tax The amount you can earn in retirement before paying tax is around 35 000 for a single person and 31 500 for each member of a couple This assumes that you are eligible for the low income tax offset and seniors and pensioners tax offset

The Senior Australians and Pensioners Tax Offset SAPTO won t shower you in riches But depending on your age relationship status and income it could provide a handy tax offset of up to 2 230 for singles and up to 3 204 for couples

Now that we've ignited your interest in How Much Can A Senior Earn Tax Free In Australia Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of How Much Can A Senior Earn Tax Free In Australia for various applications.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs are a vast range of topics, all the way from DIY projects to party planning.

Maximizing How Much Can A Senior Earn Tax Free In Australia

Here are some inventive ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Much Can A Senior Earn Tax Free In Australia are an abundance with useful and creative ideas that can meet the needs of a variety of people and passions. Their accessibility and flexibility make them an essential part of any professional or personal life. Explore the vast array of How Much Can A Senior Earn Tax Free In Australia right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes, they are! You can download and print these materials for free.

-

Do I have the right to use free printables in commercial projects?

- It's contingent upon the specific rules of usage. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions on use. You should read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit any local print store for high-quality prints.

-

What software will I need to access printables for free?

- Most printables come in the format of PDF, which can be opened using free software, such as Adobe Reader.

Health Savings Accounts Desoto ISD Employee Benefits Center

Folk2Folk ISAs 2022 Prices Reviews Our Life Plan

Check more sample of How Much Can A Senior Earn Tax Free In Australia below

How Much Can I Earn Before Registering As Self employed

How Much Money Can You Give As A Gift Tax Free In Australia

A Red Background With The Words Psa How Much Interest Could You Earn

What Happens If You Don t Pay Your Taxes A Complete Guide All

How Much Can You Earn And Still Get Tax Credits Who Can Claim And How

How Much Can A Senior Citizen Get In Social Security Benefits Taxes

https://moneysmart.gov.au › retirement-income › ...

How your super or non super income stream is taxed How much tax you pay on retirement income depends on your age and the type of income stream For most people an income stream from superannuation will be tax free from age 60

https://www.ato.gov.au › individuals-and-families › ...

How to determine your eligibility for the seniors and pensioners tax offset when you lodge your return using myTax

How your super or non super income stream is taxed How much tax you pay on retirement income depends on your age and the type of income stream For most people an income stream from superannuation will be tax free from age 60

How to determine your eligibility for the seniors and pensioners tax offset when you lodge your return using myTax

What Happens If You Don t Pay Your Taxes A Complete Guide All

How Much Money Can You Give As A Gift Tax Free In Australia

How Much Can You Earn And Still Get Tax Credits Who Can Claim And How

How Much Can A Senior Citizen Get In Social Security Benefits Taxes

How To Earn More Than 40k Tax Free Optimum

Earn Up To 2000 Tax Free Each Year When Every Penny Counts

Earn Up To 2000 Tax Free Each Year When Every Penny Counts

How To Earn Up To 10 000s Extra In 2021 Without Paying Federal Tax