In the digital age, in which screens are the norm however, the attraction of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add an extra personal touch to your home, printables for free have become an invaluable resource. We'll take a dive into the world of "How Much Can I Claim For Fuel Self Employed," exploring their purpose, where to find them, and how they can improve various aspects of your life.

Get Latest How Much Can I Claim For Fuel Self Employed Below

How Much Can I Claim For Fuel Self Employed

How Much Can I Claim For Fuel Self Employed -

This quick article will tell you everything you need to know about self employed car expenses for sole traders from MOT insurance petrol maintenance and repair costs

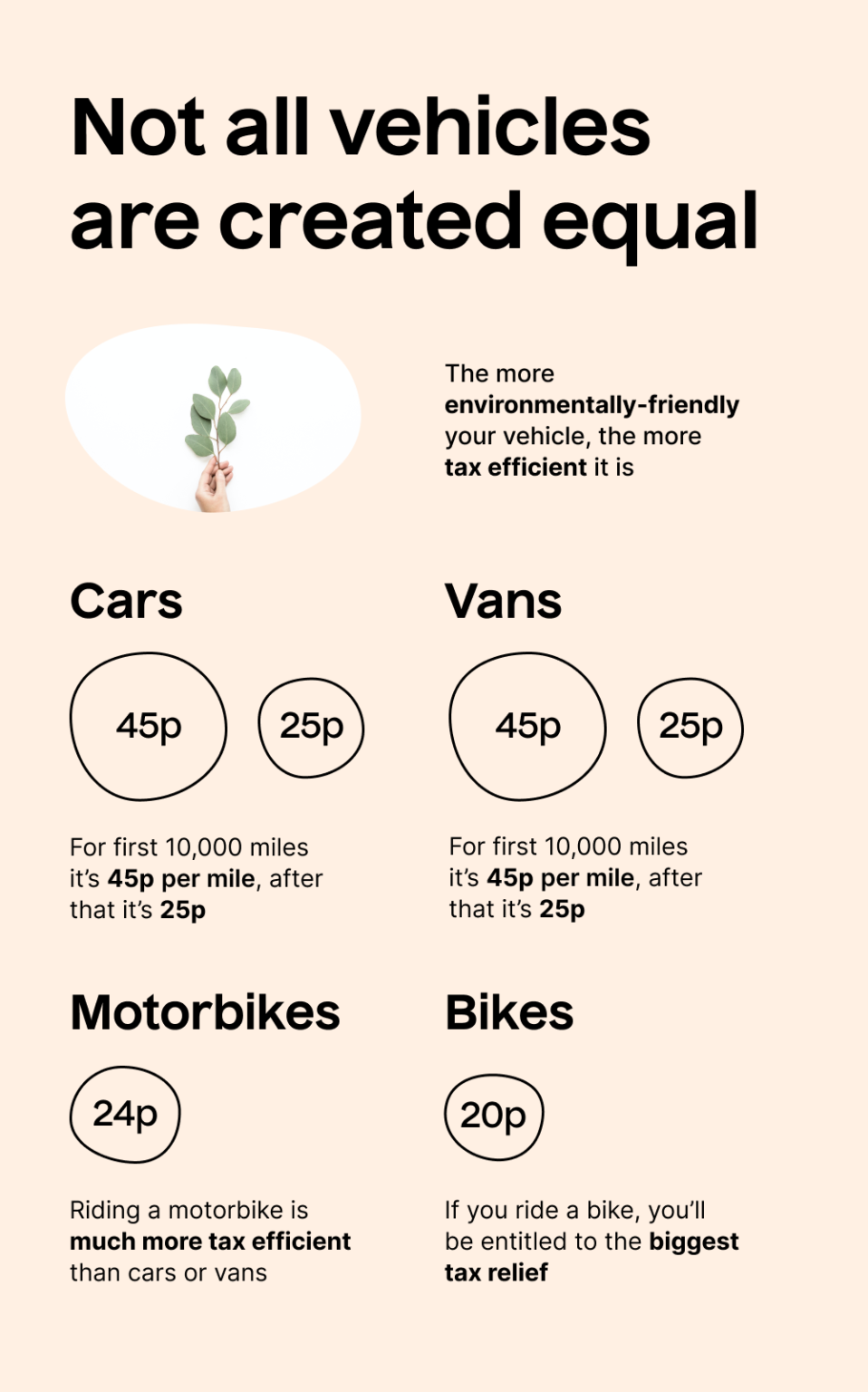

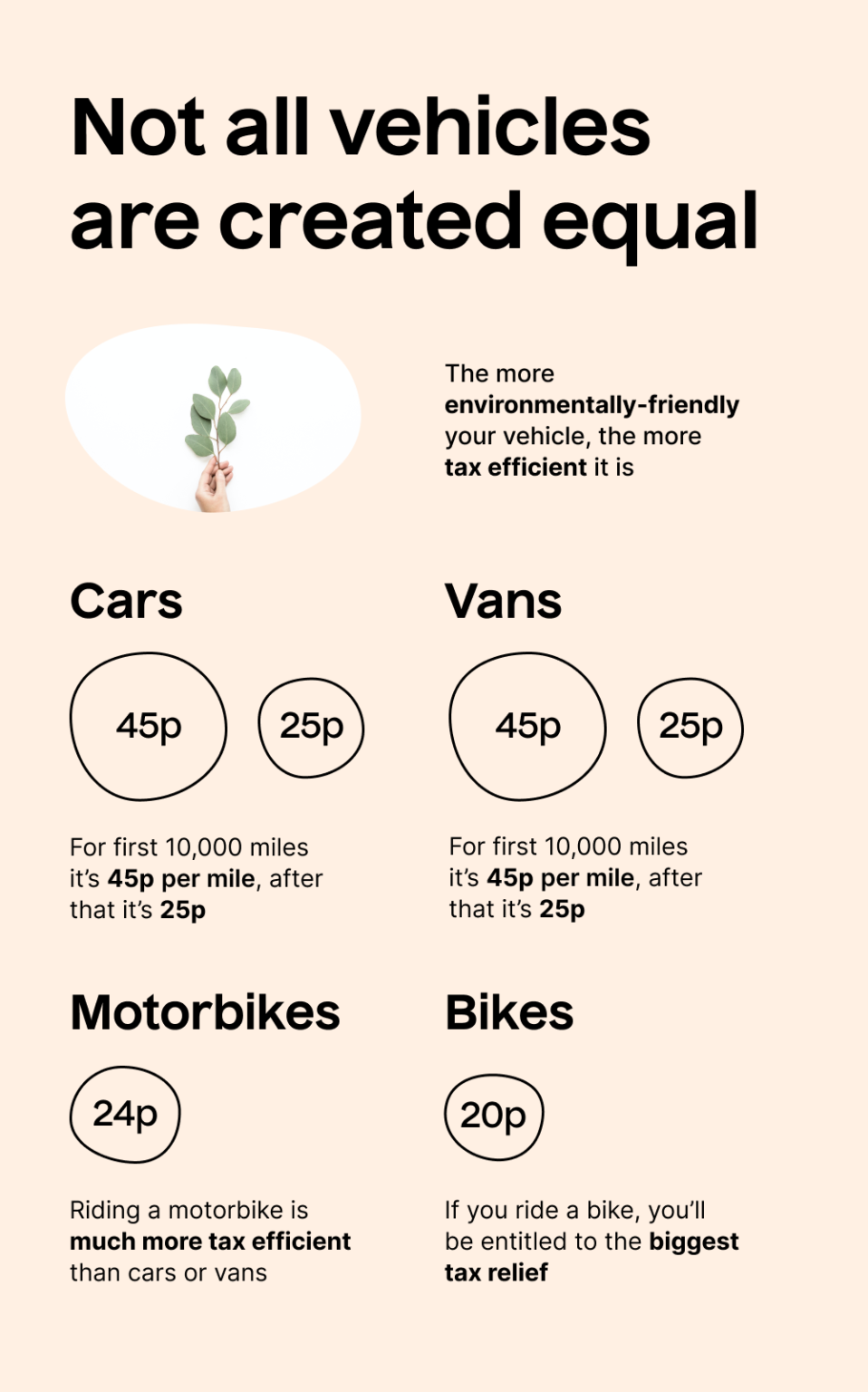

If you re self employed and drive a car or a van you can claim a mileage allowance of 45p per business mile for the first 10 000 miles and 25p per business mile after that You can also opt to instead claim your actual car

How Much Can I Claim For Fuel Self Employed cover a large range of downloadable, printable items that are available online at no cost. These resources come in many forms, like worksheets templates, coloring pages and much more. The benefit of How Much Can I Claim For Fuel Self Employed is their versatility and accessibility.

More of How Much Can I Claim For Fuel Self Employed

Housing Disrepair Solicitors Loxley Sheffield How Much Can I Claim

Housing Disrepair Solicitors Loxley Sheffield How Much Can I Claim

There are two ways of working out motor expenses if you re self employed a fixed rate for each mile travelled on business using HMRC simplified expenses actual expenses using detailed records of business and private mileage the

How much mileage you can claim The mileage allowance relief claim is based on HMRC s approved mileage rates The 2024 HMRC rates are 45p for cars and vans for the

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor printing templates to your own specific requirements in designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Education-related printables at no charge are designed to appeal to students from all ages, making them a vital tool for parents and educators.

-

The convenience of The instant accessibility to various designs and templates will save you time and effort.

Where to Find more How Much Can I Claim For Fuel Self Employed

Housing Disrepair Solicitors Newquay Cornwall How Much Can I Claim

Housing Disrepair Solicitors Newquay Cornwall How Much Can I Claim

Can you still claim if you owned the car before becoming self employed Yes you can always claim the HMRC approved mileage rate no matter when you bought the car The

The amount you can claim is worked out based on the total amount of business miles you travel as a proportion of your total mileage For example if 40 of the miles you travel in a year relate to business you can

Now that we've piqued your interest in printables for free Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of How Much Can I Claim For Fuel Self Employed to suit a variety of applications.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs covered cover a wide spectrum of interests, everything from DIY projects to party planning.

Maximizing How Much Can I Claim For Fuel Self Employed

Here are some unique ways to make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

How Much Can I Claim For Fuel Self Employed are a treasure trove of useful and creative resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them a valuable addition to both personal and professional life. Explore the vast array of How Much Can I Claim For Fuel Self Employed right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can download and print these files for free.

-

Can I download free printing templates for commercial purposes?

- It's dependent on the particular terms of use. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations concerning their use. Be sure to check the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with printing equipment or visit any local print store for the highest quality prints.

-

What software do I need to open How Much Can I Claim For Fuel Self Employed?

- The majority of printables are in PDF format. They is open with no cost programs like Adobe Reader.

Housing Disrepair Solicitors Longley Sheffield How Much Can I Claim

Can I Claim This YouTube

Check more sample of How Much Can I Claim For Fuel Self Employed below

Housing Disrepair Solicitors Morley Leeds How Much Can I Claim For

Can I Claim For Fuel As Well As Mileage

Self Employed Expenses What You Can And Cannot Claim Self Business

How Much Can I Claim Per Mile Get The Answers Here TaxScouts

How Much Can I Claim Per Mile Get The Answers Here TaxScouts

What Can I Claim When Self employed In Canada Genesa CPA Corp

https://www.driversnote.co.uk/hmrc-mile…

If you re self employed and drive a car or a van you can claim a mileage allowance of 45p per business mile for the first 10 000 miles and 25p per business mile after that You can also opt to instead claim your actual car

https://www.gosimpletax.com/blog/car-al…

How Much Can You Claim for Mileage You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey

If you re self employed and drive a car or a van you can claim a mileage allowance of 45p per business mile for the first 10 000 miles and 25p per business mile after that You can also opt to instead claim your actual car

How Much Can You Claim for Mileage You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey

How Much Can I Claim Per Mile Get The Answers Here TaxScouts

Can I Claim For Fuel As Well As Mileage

How Much Can I Claim Per Mile Get The Answers Here TaxScouts

What Can I Claim When Self employed In Canada Genesa CPA Corp

How To Claim Self Employed Expenses Small Business Tax Deductions

How Much Can I Claim For Being Ill On Holiday Typical Awards

How Much Can I Claim For Being Ill On Holiday Typical Awards

How Much Can I Claim Against UIF Stangen