In a world where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding the personal touch to your home, printables for free have become a valuable source. Through this post, we'll dive into the sphere of "How Much Income Is Tax Free In Germany," exploring what they are, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest How Much Income Is Tax Free In Germany Below

How Much Income Is Tax Free In Germany

How Much Income Is Tax Free In Germany -

Income tax in Germany If you earn money from employment or self employment you ll need to pay income tax The first 10 347 is your tax free allowance so you ll only pay tax on earnings above this amount German income tax rates are progressive starting at 14 and rising to 45 on the highest earnings

Germany has progressive tax rates ranging as follows 2024 tax year Geometrically progressive rates start at 14 and rise to 42 The figures are adjusted on a regular basis Surcharges on income tax

How Much Income Is Tax Free In Germany offer a wide selection of printable and downloadable items that are available online at no cost. They are available in a variety of types, like worksheets, templates, coloring pages, and more. The beauty of How Much Income Is Tax Free In Germany is their flexibility and accessibility.

More of How Much Income Is Tax Free In Germany

Income Tax On Gift Money How Much Money Is Tax Free In Gift Section

Income Tax On Gift Money How Much Money Is Tax Free In Gift Section

The top income tax rate in Germany is 42 and applies in 2023 to incomes ranging from 62 810 to 277 826 Those earning more than 277 826 are taxed at the highest tax rate of 45 also known as the wealthy tax Approximately 4 million Germans currently pay the top tax rate

Taxable income of less than 10 908 is tax free for a single person 21 816 for a married couple Incomes from 10 909 28 816 up to 62 809 125 618 are taxes at a rate of 14 to 42 incomes from 68 810

How Much Income Is Tax Free In Germany have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: You can tailor the design to meet your needs such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: The free educational worksheets offer a wide range of educational content for learners from all ages, making them an invaluable source for educators and parents.

-

Simple: You have instant access a plethora of designs and templates will save you time and effort.

Where to Find more How Much Income Is Tax Free In Germany

Germany s Ministry Of Finance Clarifies Crypto Taxation Crypto

Germany s Ministry Of Finance Clarifies Crypto Taxation Crypto

Payroll taxes and levies in Germany Income tax Einkommensteuer Lohnsteuer on wages in Germany ranges from 14 to 45 However tax is only paid on the amount that exceeds the non taxable minimum of 9 744 per year for a single person or 18 816 per year for a married couple

Let s start with the basics what is the income tax in Germany based on When it comes to German tax income includes Employment earnings Money from trade and business Rental income Money made from investments All sorts of other sources of income like annuities and royalties

After we've peaked your curiosity about How Much Income Is Tax Free In Germany we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of How Much Income Is Tax Free In Germany to suit a variety of reasons.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad variety of topics, ranging from DIY projects to planning a party.

Maximizing How Much Income Is Tax Free In Germany

Here are some unique ways of making the most use of How Much Income Is Tax Free In Germany:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home also in the classes.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

How Much Income Is Tax Free In Germany are an abundance of useful and creative resources which cater to a wide range of needs and hobbies. Their accessibility and versatility make them an essential part of your professional and personal life. Explore the world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can download and print the resources for free.

-

Can I use the free printouts for commercial usage?

- It's based on the terms of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Are there any copyright violations with How Much Income Is Tax Free In Germany?

- Certain printables might have limitations on usage. Be sure to review the conditions and terms of use provided by the designer.

-

How do I print How Much Income Is Tax Free In Germany?

- Print them at home with either a printer at home or in any local print store for higher quality prints.

-

What program must I use to open printables that are free?

- The majority of printables are as PDF files, which can be opened using free programs like Adobe Reader.

Can Married Couples File Taxes As Single VERIFY Wcnc

1602 Tax Free In Germany Tax Free Profit And Tax Exemptions In

Check more sample of How Much Income Is Tax Free In Germany below

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

How Much Income Is Tax Free In BC Genesa CPA Corp

Ca Tax Brackets Chart Jokeragri

Bitcoin Ethereum Will Be Tax Free In Germany After One Year Of Possession

How Much Foreign Income Is Tax free In U K Expat US Tax

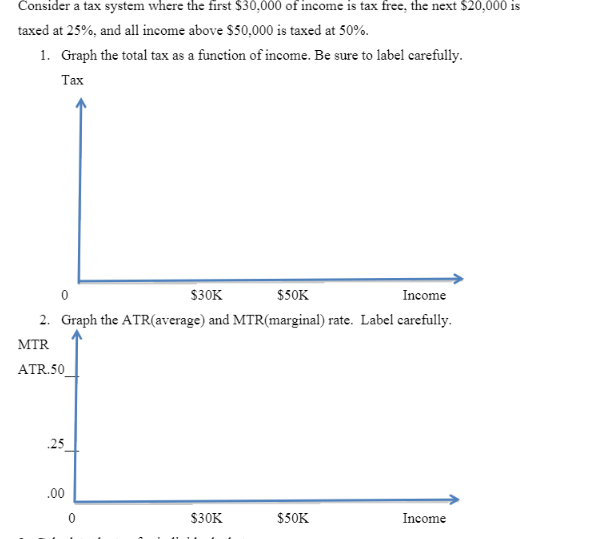

Solved Consider A Tax System Where The First 30 000 Of Chegg

https://taxsummaries.pwc.com/germany/individual/...

Germany has progressive tax rates ranging as follows 2024 tax year Geometrically progressive rates start at 14 and rise to 42 The figures are adjusted on a regular basis Surcharges on income tax

https://www.expatica.com/de/finance/taxes/income...

Income tax rates in Germany Income tax in Germany is progressive Rates start at 14 and incrementally rise to 42 A top rate of 45 is also present for those with very high earnings The German government reviews income tax bands every year The bands for 2022 and 2023 are the following German income tax rates for 2022

Germany has progressive tax rates ranging as follows 2024 tax year Geometrically progressive rates start at 14 and rise to 42 The figures are adjusted on a regular basis Surcharges on income tax

Income tax rates in Germany Income tax in Germany is progressive Rates start at 14 and incrementally rise to 42 A top rate of 45 is also present for those with very high earnings The German government reviews income tax bands every year The bands for 2022 and 2023 are the following German income tax rates for 2022

Bitcoin Ethereum Will Be Tax Free In Germany After One Year Of Possession

How Much Income Is Tax Free In BC Genesa CPA Corp

How Much Foreign Income Is Tax free In U K Expat US Tax

Solved Consider A Tax System Where The First 30 000 Of Chegg

How Much Money Do You Have To Make To Not Pay Taxes

2020 Key Tax Numbers For Individuals Eclectic Associates Inc

2020 Key Tax Numbers For Individuals Eclectic Associates Inc

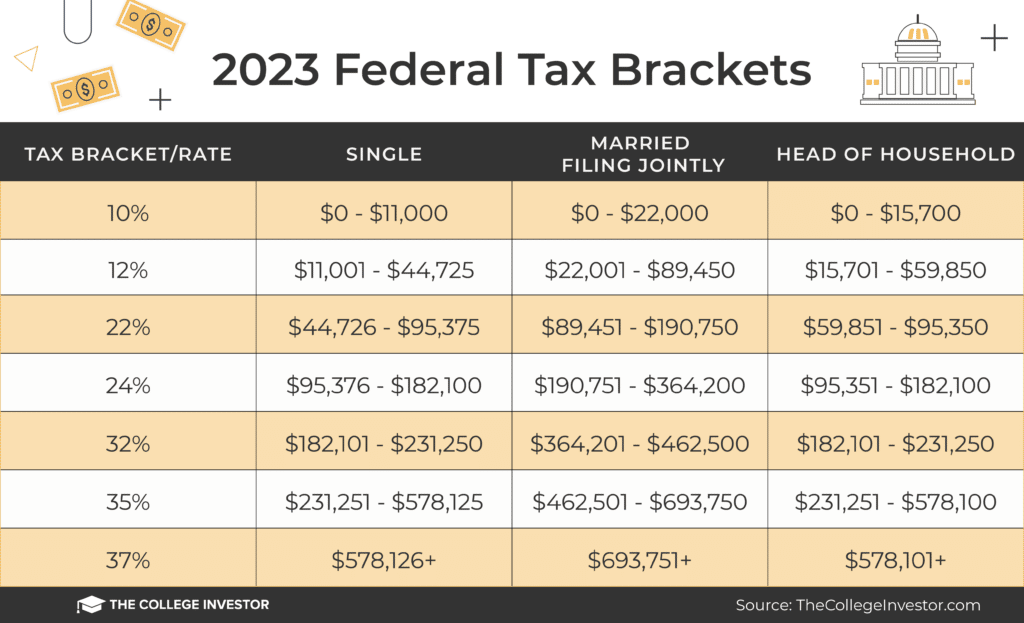

Tax Resource And Help Center The College Investor