In the digital age, where screens rule our lives it's no wonder that the appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons such as creative projects or just adding an element of personalization to your area, How Much Is California Tax On Purchases are a great resource. The following article is a take a dive through the vast world of "How Much Is California Tax On Purchases," exploring what they are, how to find them, and how they can improve various aspects of your daily life.

Get Latest How Much Is California Tax On Purchases Below

.png)

How Much Is California Tax On Purchases

How Much Is California Tax On Purchases -

The California sales tax rate is 7 5 as of 2024 with some cities and counties adding a local sales tax on top of the CA state sales tax Exemptions to the California sales tax will vary by state

California sales tax is 6 state sales tax plus 0 25 county sales tax plus municipality and special taxes that range between 0 and 2 and 0 3 25 respectively As of October 2022 the average combined sales tax rate is 8 82

How Much Is California Tax On Purchases offer a wide collection of printable items that are available online at no cost. They come in many types, like worksheets, coloring pages, templates and more. One of the advantages of How Much Is California Tax On Purchases is in their versatility and accessibility.

More of How Much Is California Tax On Purchases

State Gas Tax Rates State Gas Tax Rankings Luglio 2021 Tax

State Gas Tax Rates State Gas Tax Rankings Luglio 2021 Tax

In California the statewide sales tax is 7 25 However the final price of any taxable purchase could be higher due to district taxes which can be anywhere from 10 to 1 00 It s also

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage Look up the current sales and use tax rate by address Please note unincorporated cities and communities are not listed below

How Much Is California Tax On Purchases have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: This allows you to modify designs to suit your personal needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes them an essential instrument for parents and teachers.

-

Affordability: Fast access an array of designs and templates reduces time and effort.

Where to Find more How Much Is California Tax On Purchases

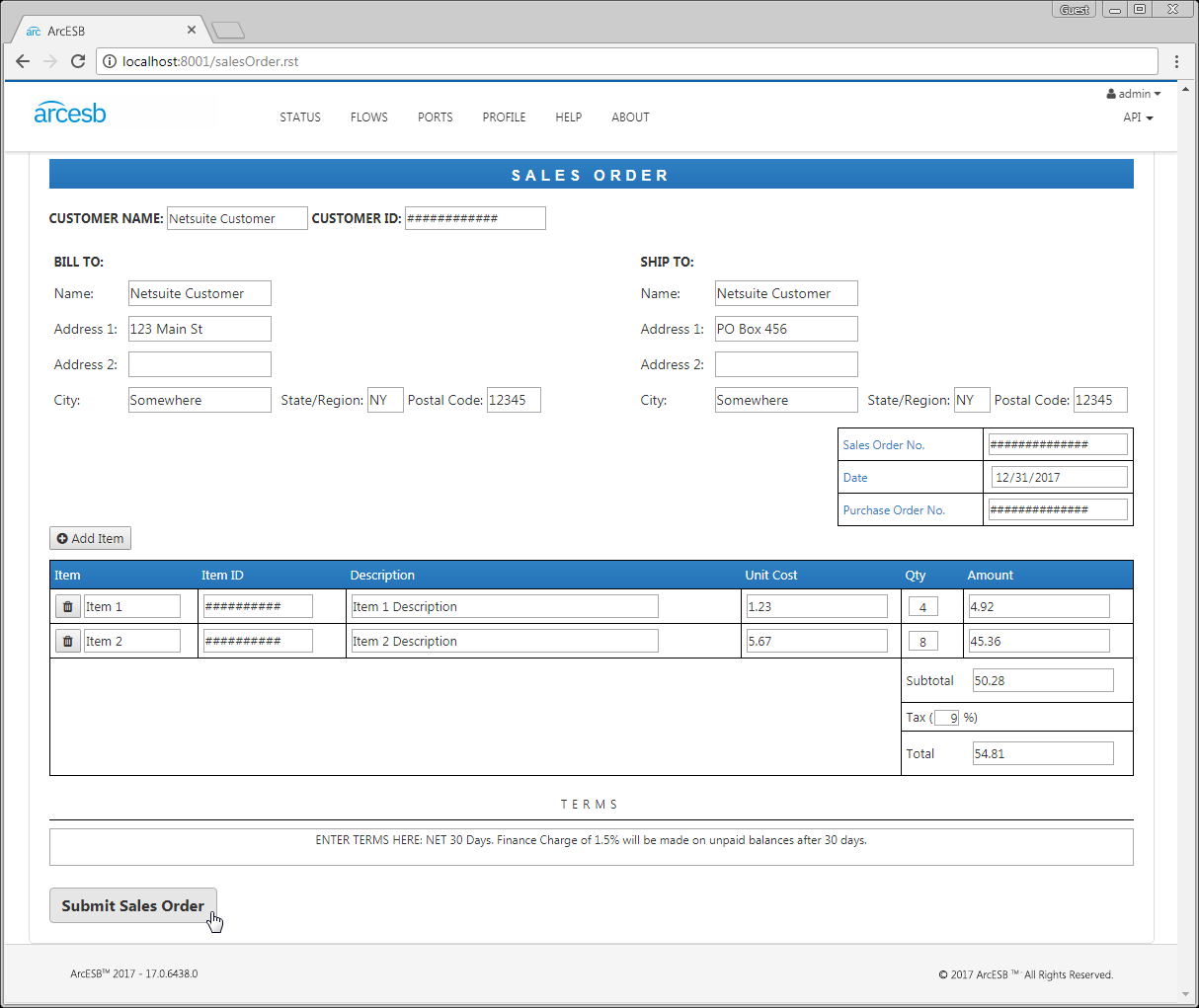

Insert A Sales Order Into NetSuite Based On HTML Form Data

Insert A Sales Order Into NetSuite Based On HTML Form Data

California sales tax is a minimum of 7 25 But you might be over 10 depending on where you re shopping Here s what you need to know

California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3 5 There are a total of 470 local tax jurisdictions across the state collecting an average local tax of 2 685 Click here for a larger sales tax map or here for a sales tax table

After we've peaked your interest in How Much Is California Tax On Purchases we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of How Much Is California Tax On Purchases for various goals.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs covered cover a wide range of topics, everything from DIY projects to party planning.

Maximizing How Much Is California Tax On Purchases

Here are some ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

How Much Is California Tax On Purchases are an abundance of innovative and useful resources that can meet the needs of a variety of people and interests. Their accessibility and flexibility make them a fantastic addition to both professional and personal lives. Explore the many options of How Much Is California Tax On Purchases today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes you can! You can print and download these tools for free.

-

Does it allow me to use free printables for commercial purposes?

- It's determined by the specific usage guidelines. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may contain restrictions on use. Be sure to check the terms and conditions provided by the author.

-

How can I print How Much Is California Tax On Purchases?

- You can print them at home using any printer or head to an area print shop for more high-quality prints.

-

What program is required to open printables free of charge?

- Many printables are offered in PDF format. These is open with no cost software like Adobe Reader.

Is California Tax Extension Automatic YouTube

Tax On Purchases

Check more sample of How Much Is California Tax On Purchases below

2021 Nc Standard Deduction Standard Deduction 2021

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Federal Income Tax Brackets 2021 Vs 2022 Orangerilo

10 2023 California Tax Brackets References 2023 BGH

How To Calculate Dividend Withholding Tax Haiper

California Restaurant Puts Minimum Wage Line On Receipt ATTN Repo

.png?w=186)

https://www.omnicalculator.com › finance › california-sales-tax

California sales tax is 6 state sales tax plus 0 25 county sales tax plus municipality and special taxes that range between 0 and 2 and 0 3 25 respectively As of October 2022 the average combined sales tax rate is 8 82

https://wise.com › us › business › sales-tax › california

How much is sales tax in California The base state sales tax rate in California is 6 The mandatory local rate is 1 25 which makes the total minimum combined sales tax rate 7 25

California sales tax is 6 state sales tax plus 0 25 county sales tax plus municipality and special taxes that range between 0 and 2 and 0 3 25 respectively As of October 2022 the average combined sales tax rate is 8 82

How much is sales tax in California The base state sales tax rate in California is 6 The mandatory local rate is 1 25 which makes the total minimum combined sales tax rate 7 25

10 2023 California Tax Brackets References 2023 BGH

Sales Tax By State Here s How Much You re Really Paying Sales Tax

How To Calculate Dividend Withholding Tax Haiper

California Restaurant Puts Minimum Wage Line On Receipt ATTN Repo

1880 50 Silver Certificate Note Fr 329 PMG Very Fine 25 Net

Texas Seller s Permit TX Tax Permit Resale Certificate Fast Filings

Texas Seller s Permit TX Tax Permit Resale Certificate Fast Filings

FBR Warns Buyers To Ask For Registration Number If Seller Charges Sales