Today, where screens have become the dominant feature of our lives The appeal of tangible printed materials hasn't faded away. For educational purposes for creative projects, simply adding personal touches to your area, How Much Is The Senior Property Tax Exemption In Cook County are now a vital source. This article will take a dive into the world of "How Much Is The Senior Property Tax Exemption In Cook County," exploring what they are, where they are, and how they can add value to various aspects of your daily life.

Get Latest How Much Is The Senior Property Tax Exemption In Cook County Below

How Much Is The Senior Property Tax Exemption In Cook County

How Much Is The Senior Property Tax Exemption In Cook County -

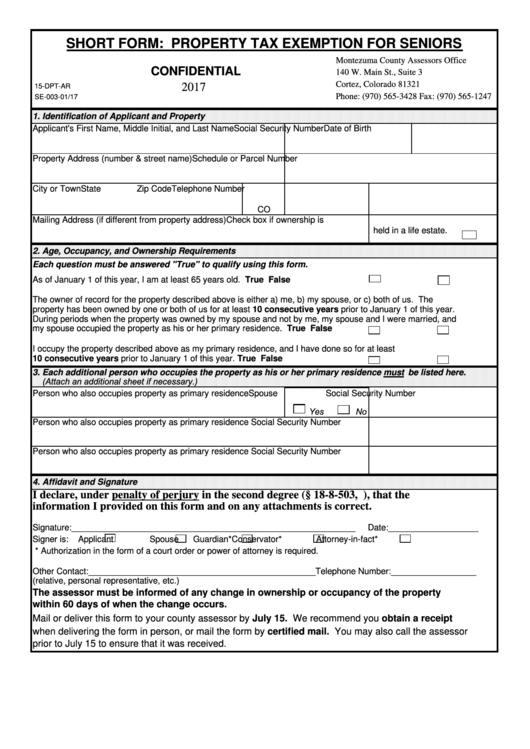

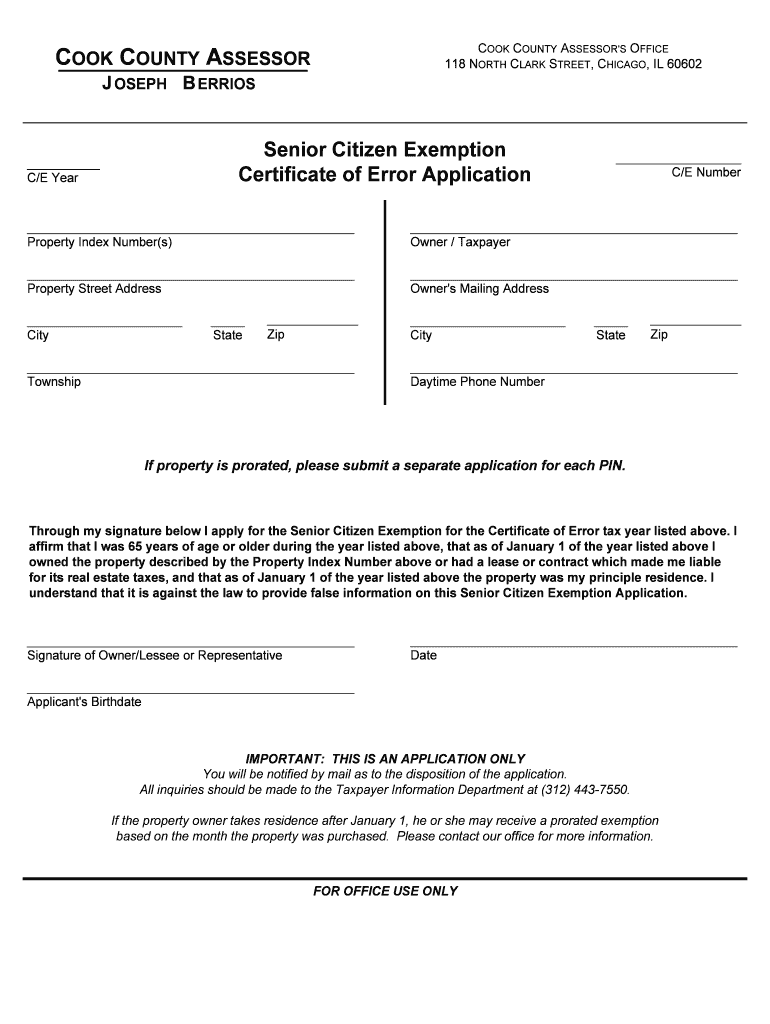

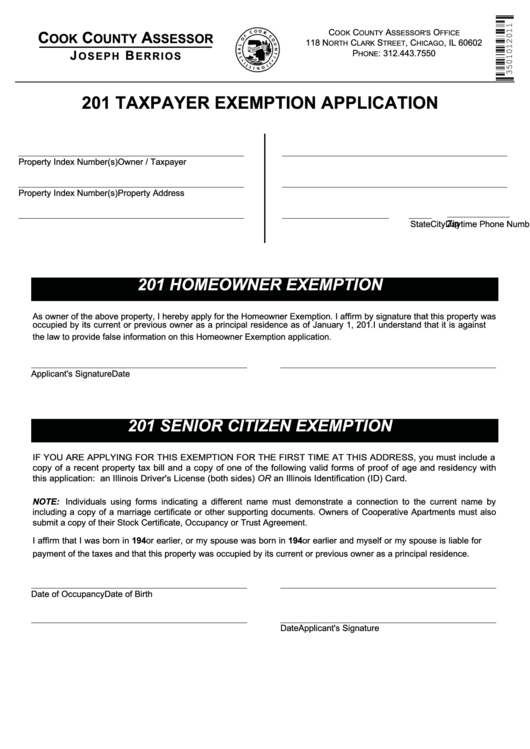

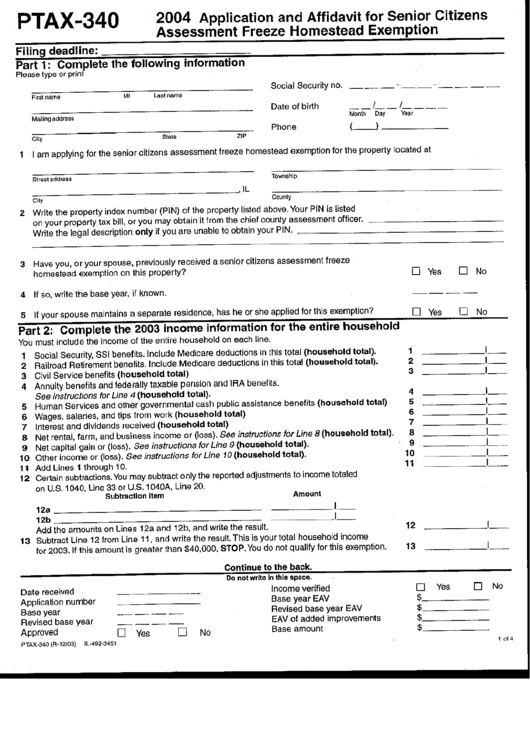

Property tax savings for a Homeowner Exemption are calculated by multiplying the Homeowner Exemption amount of 10 000 by your local tax rate Property tax savings for a Senior

The Senior Citizen Homestead Exemption reduces the EAV of your home by 8 000 To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the

How Much Is The Senior Property Tax Exemption In Cook County encompass a wide array of printable materials that are accessible online for free cost. They are available in numerous types, such as worksheets coloring pages, templates and much more. The attraction of printables that are free is in their versatility and accessibility.

More of How Much Is The Senior Property Tax Exemption In Cook County

Jefferson County Property Tax Exemption Form ExemptForm

Jefferson County Property Tax Exemption Form ExemptForm

The Senior Citizen Exemption provides tax relief by reducing the equalized assessed value EAV of an eligible residence by 8 000 The amount your tax bill is reduced depends on your

Property tax exemptions are provided for owners with the following situations Homeowner Exemption Senior Citizen Exemption Senior Freeze Exemption Longtime Homeowner

How Much Is The Senior Property Tax Exemption In Cook County have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize designs to suit your personal needs, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational value: These How Much Is The Senior Property Tax Exemption In Cook County offer a wide range of educational content for learners from all ages, making the perfect instrument for parents and teachers.

-

Simple: The instant accessibility to a myriad of designs as well as templates will save you time and effort.

Where to Find more How Much Is The Senior Property Tax Exemption In Cook County

Special Senior Property Tax Exemption For Jefferson County Residents

Special Senior Property Tax Exemption For Jefferson County Residents

A Senior Exemption is calculated by multiplying the Senior Exemption savings amount 8 000 by your local tax rate Your local tax rate is determined each year by the Cook County Clerk and

The Senior Exemption for taxpayers residents 65 years or older regardless of income increases from 5 000 to 8 000 in EAV It is important to note that the exemption

If we've already piqued your interest in How Much Is The Senior Property Tax Exemption In Cook County, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with How Much Is The Senior Property Tax Exemption In Cook County for all uses.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a wide selection of subjects, ranging from DIY projects to party planning.

Maximizing How Much Is The Senior Property Tax Exemption In Cook County

Here are some ideas that you can make use use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home also in the classes.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How Much Is The Senior Property Tax Exemption In Cook County are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make them an invaluable addition to your professional and personal life. Explore the vast collection of How Much Is The Senior Property Tax Exemption In Cook County and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes, they are! You can download and print the resources for free.

-

Are there any free printouts for commercial usage?

- It's determined by the specific rules of usage. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns with How Much Is The Senior Property Tax Exemption In Cook County?

- Some printables may come with restrictions concerning their use. Be sure to review the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home with your printer or visit the local print shops for the highest quality prints.

-

What program will I need to access How Much Is The Senior Property Tax Exemption In Cook County?

- The majority of printed documents are in PDF format, which can be opened with free software like Adobe Reader.

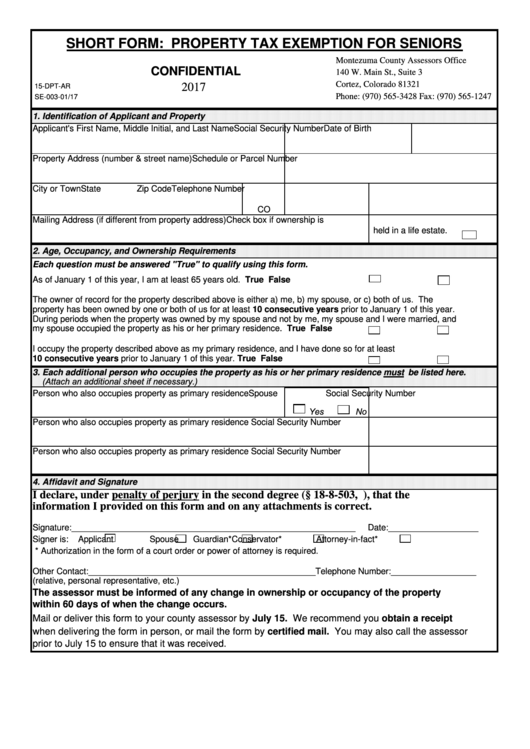

2020 Colorado Senior Property Tax Exemption Funded

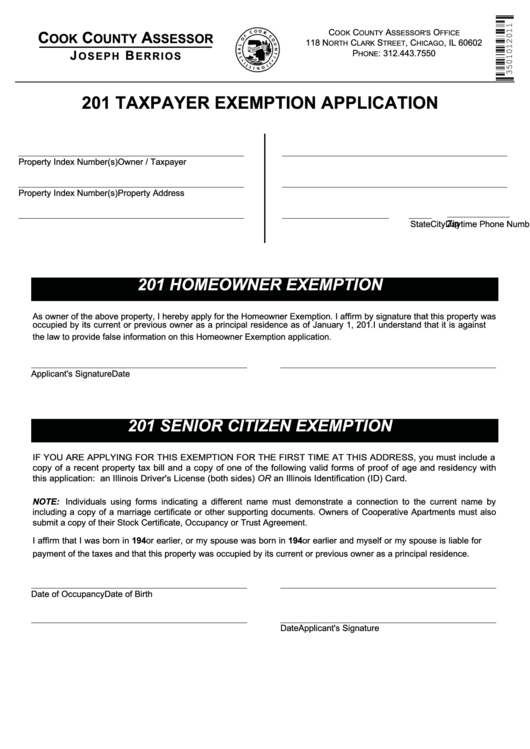

Cook County Homeowners Exemption Form 2017 Best Of Tax Exemption Form

Check more sample of How Much Is The Senior Property Tax Exemption In Cook County below

Senior Property Tax Exemption Available Weld County

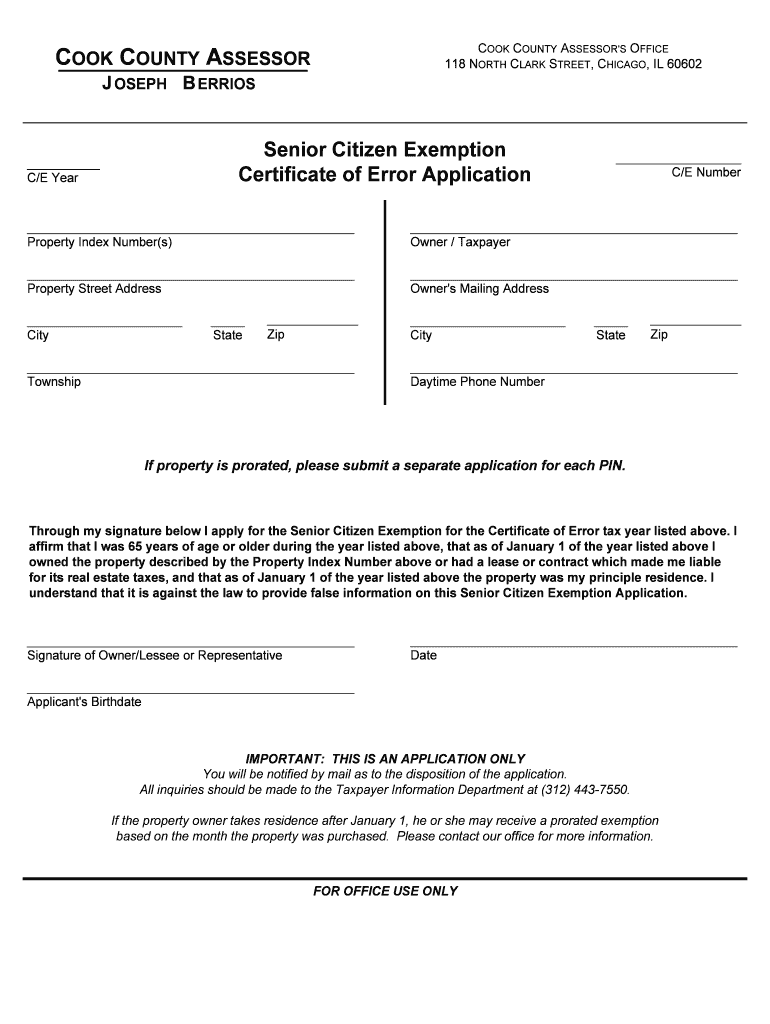

Cook County Senior Citizen Exemption Form ExemptForm

Property Tax Appeals And Exemptions Ticor Title

Cook County Senior Exemption Form For 2020 Fill Online Printable

2023 Senior Citizen Exemption Application Form Cook County ExemptForm

Homestead Vs Non Homestead Taxes Minnesota Blueingreendesigns

https://www.cookcountytreasurer.com/seniorcitizen...

The Senior Citizen Homestead Exemption reduces the EAV of your home by 8 000 To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the

https://www.cookcountyassessor.com…

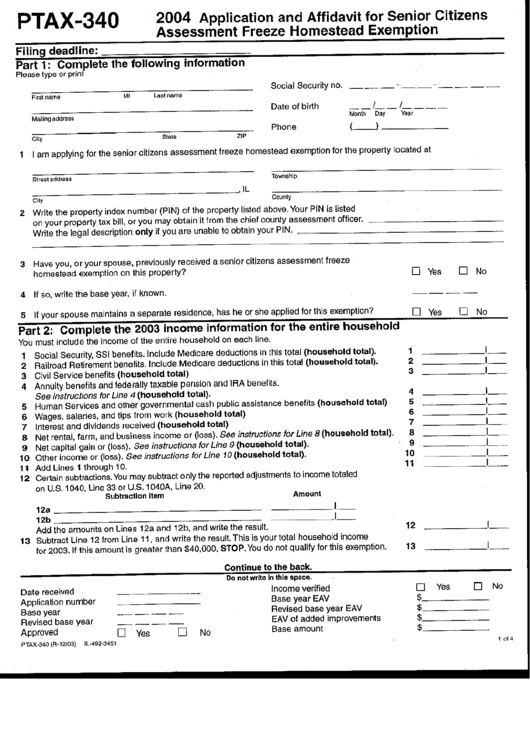

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of 65 000 or less in the 2022 calendar year A Senior Freeze Exemption provides property tax savings by

The Senior Citizen Homestead Exemption reduces the EAV of your home by 8 000 To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of 65 000 or less in the 2022 calendar year A Senior Freeze Exemption provides property tax savings by

Cook County Senior Exemption Form For 2020 Fill Online Printable

Cook County Senior Citizen Exemption Form ExemptForm

2023 Senior Citizen Exemption Application Form Cook County ExemptForm

Homestead Vs Non Homestead Taxes Minnesota Blueingreendesigns

Jefferson County Special Senior Property Tax Exemption For Jefferson

Fillable Online Assessor Mesacounty PDF Senior Property Tax Exemption

Fillable Online Assessor Mesacounty PDF Senior Property Tax Exemption

Cook County Assessor s Office Investigates Possible Exemption Abuse