In this age of technology, where screens rule our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. For educational purposes and creative work, or simply to add some personal flair to your area, How Much Of Redundancy Payment Is Tax Free In Australia have proven to be a valuable source. The following article is a dive in the world of "How Much Of Redundancy Payment Is Tax Free In Australia," exploring their purpose, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest How Much Of Redundancy Payment Is Tax Free In Australia Below

How Much Of Redundancy Payment Is Tax Free In Australia

How Much Of Redundancy Payment Is Tax Free In Australia -

Does redundancy pay get taxed No redundancy pay does not usually get taxed As long as the payment is classified by the ATO as a genuine redundancy and below the tax free limit then the sum will be tax free The tax free threshold changes every year It is the base amount plus a sum for each year of work the employee has completed

Find out about genuine redundancy early retirement scheme payments and reporting the tax free amounts Tax free component of ETPs Learn about when an employment termination payment may be eligible for a tax free component Applying the ETP caps ETPs are concessionally taxed up to a certain limit or cap

How Much Of Redundancy Payment Is Tax Free In Australia offer a wide range of printable, free materials that are accessible online for free cost. These resources come in various types, such as worksheets coloring pages, templates and more. The attraction of printables that are free is in their versatility and accessibility.

More of How Much Of Redundancy Payment Is Tax Free In Australia

REDUNDANCY UK Tax Planning With Your Redundancy Payment YouTube

REDUNDANCY UK Tax Planning With Your Redundancy Payment YouTube

Genuine redundancy payments are taxed at special rates and part of the redundancy payment can be paid tax free The tax free limit consists of two elements a base amount and an annual amount for each full year of service and both are indexed annually For 2023 24 year the base amount is 11 985 and the annual service amount is 5 994

So if your total genuine redundancy payment is less than this you won t pay any tax on the payment at all If you are below the preservation age you pay tax at 30 Medicare Levy on any excess amount above the tax free component up to 210 000

How Much Of Redundancy Payment Is Tax Free In Australia have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor the design to meet your needs in designing invitations to organize your schedule or even decorating your home.

-

Educational Worth: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a vital source for educators and parents.

-

Accessibility: Quick access to many designs and templates is time-saving and saves effort.

Where to Find more How Much Of Redundancy Payment Is Tax Free In Australia

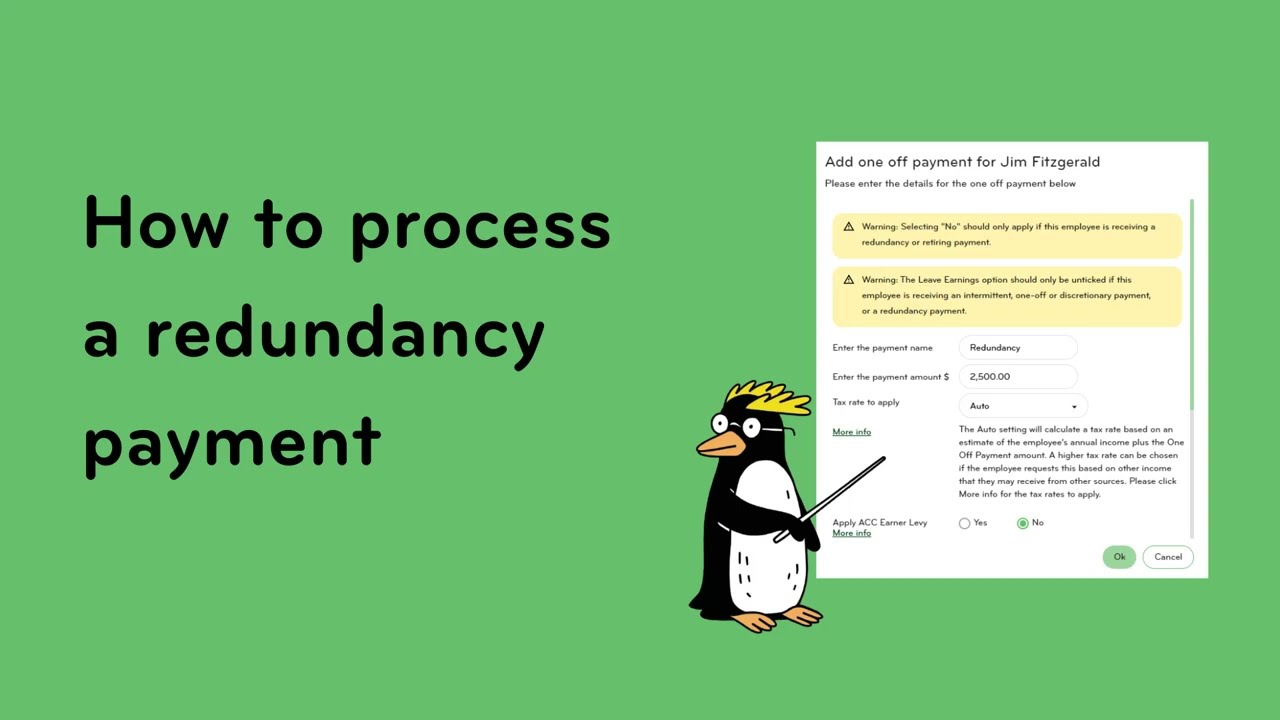

How To Process A Redundancy Payment In Smartly YouTube

How To Process A Redundancy Payment In Smartly YouTube

The tax free component for genuine redundancies for the 2022 23FY is Base Limit 11 591 Service amount 5 797 You can read more about the Tax free part of genuine redundancy and early retirement scheme payments on our website

When an employee s job is made redundant their employer may need to pay them redundancy pay also known as severance pay On this page Redundancy pay When redundancy pay doesn t apply Reducing redundancy pay Tools and resources Related information Redundancy pay The amount of redundancy pay the employee gets is based on their

Now that we've ignited your curiosity about How Much Of Redundancy Payment Is Tax Free In Australia We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of reasons.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching tools.

- Ideal for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad selection of subjects, that includes DIY projects to planning a party.

Maximizing How Much Of Redundancy Payment Is Tax Free In Australia

Here are some ways in order to maximize the use of How Much Of Redundancy Payment Is Tax Free In Australia:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

How Much Of Redundancy Payment Is Tax Free In Australia are an abundance of useful and creative resources for a variety of needs and hobbies. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the vast array of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes you can! You can download and print these files for free.

-

Can I download free printables for commercial use?

- It is contingent on the specific usage guidelines. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables might have limitations in their usage. Always read these terms and conditions as set out by the author.

-

How do I print How Much Of Redundancy Payment Is Tax Free In Australia?

- Print them at home using your printer or visit a print shop in your area for superior prints.

-

What software do I need in order to open printables free of charge?

- The majority of printed documents are in the PDF format, and is open with no cost programs like Adobe Reader.

Redundancy Calculator How Much Are Employees Entitled To Factorial

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

Check more sample of How Much Of Redundancy Payment Is Tax Free In Australia below

How Much Tax Will I Pay On My Redundancy Payment Calculator

Are You Entitled To A Redundancy Payment If Your Employer Closes Down

Is My Redundancy Payment Tax Free

What Tax Do I Pay On Redundancy Payments Accounting Firms

Redundancy

How To Calculate A Redundancy Payment In Lieu Of Notice MAD HR

https://www.ato.gov.au/businesses-and...

Find out about genuine redundancy early retirement scheme payments and reporting the tax free amounts Tax free component of ETPs Learn about when an employment termination payment may be eligible for a tax free component Applying the ETP caps ETPs are concessionally taxed up to a certain limit or cap

https://www.ato.gov.au/.../redundancy-and-early-retirement

Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employee s years of service The tax free amount isn t part of the employee s ETP It s reported as a lump sum in the employee s income statement or PAYG payment summary individual non business

Find out about genuine redundancy early retirement scheme payments and reporting the tax free amounts Tax free component of ETPs Learn about when an employment termination payment may be eligible for a tax free component Applying the ETP caps ETPs are concessionally taxed up to a certain limit or cap

Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employee s years of service The tax free amount isn t part of the employee s ETP It s reported as a lump sum in the employee s income statement or PAYG payment summary individual non business

What Tax Do I Pay On Redundancy Payments Accounting Firms

Are You Entitled To A Redundancy Payment If Your Employer Closes Down

Redundancy

How To Calculate A Redundancy Payment In Lieu Of Notice MAD HR

Mango Black Spots On Mango Leaves

How To Write A Redundancy Appeal Letter

How To Write A Redundancy Appeal Letter

I Have A Client Who Is A Director Of A Limited Company Which He Intends