In this day and age in which screens are the norm yet the appeal of tangible, printed materials hasn't diminished. No matter whether it's for educational uses such as creative projects or simply to add personal touches to your area, How Much Tax Benefit On Home Loan are now a vital source. In this article, we'll take a dive into the world "How Much Tax Benefit On Home Loan," exploring the benefits of them, where they are available, and how they can add value to various aspects of your daily life.

Get Latest How Much Tax Benefit On Home Loan Below

How Much Tax Benefit On Home Loan

How Much Tax Benefit On Home Loan -

Home Loan Home Loan Tax Benefits Income Tax Benefit on Home Loan FY 2023 24 According to the guidelines of the Income Tax Act of 1961 obtaining a home loan can offer chances for tax savings Provisions in the most recent financial budget improved these advantages even more

27 500 INR Tax before Home Loan 32 500 INR Tax after Home Loan 5 000 INR Apply Now Home Loan Tax Benefit Whether you are a salaried or a self employed individual you are eligible to invest in a housing property as well as for the income tax deductions as stated under Section 80C

Printables for free include a vast selection of printable and downloadable materials available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and much more. The attraction of printables that are free is their flexibility and accessibility.

More of How Much Tax Benefit On Home Loan

Home Loan Tax Benefit Home Loan Income Tax Benefit Income Tax

Home Loan Tax Benefit Home Loan Income Tax Benefit Income Tax

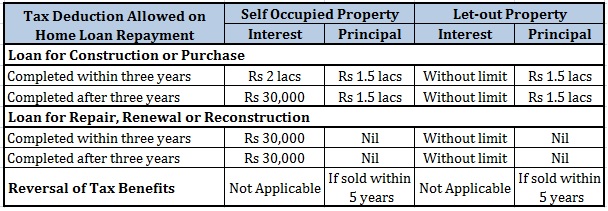

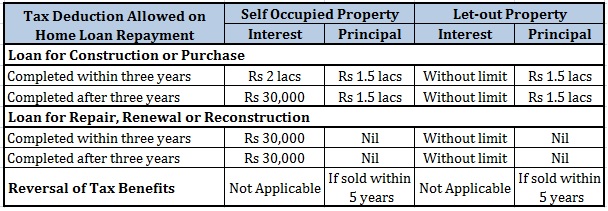

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator Calculate Your Potential Income Tax Savings Available Through Home Ownership Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes

How Much Tax Benefit On Home Loan have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: This allows you to modify printables to fit your particular needs in designing invitations making your schedule, or even decorating your house.

-

Educational value: The free educational worksheets are designed to appeal to students of all ages, which makes these printables a powerful tool for teachers and parents.

-

It's easy: Quick access to numerous designs and templates can save you time and energy.

Where to Find more How Much Tax Benefit On Home Loan

How To Claim Tax Benefits On Home Loan Bleu Finance

How To Claim Tax Benefits On Home Loan Bleu Finance

This is within the overall limit of Rs 1 50 000 of Section 80C Therefore as a family you will be able to take a larger tax benefit against the interest paid on the home loan when the property is jointly owned and your

Interest expense Homeowners can deduct interest expenses on up to 750 000 of mortgage debt from their income taxes though when they itemize these deductions they forgo the standard deduction of 12 550 for individuals or married couples filing individually 18 800 for head of household 25 100 for married filing jointly

We've now piqued your curiosity about How Much Tax Benefit On Home Loan we'll explore the places you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with How Much Tax Benefit On Home Loan for all reasons.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide range of interests, that includes DIY projects to party planning.

Maximizing How Much Tax Benefit On Home Loan

Here are some creative ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How Much Tax Benefit On Home Loan are an abundance of practical and imaginative resources that meet a variety of needs and hobbies. Their accessibility and versatility make them a valuable addition to any professional or personal life. Explore the plethora of How Much Tax Benefit On Home Loan right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Much Tax Benefit On Home Loan really completely free?

- Yes you can! You can print and download these materials for free.

-

Can I utilize free printouts for commercial usage?

- It's based on specific usage guidelines. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with How Much Tax Benefit On Home Loan?

- Some printables may come with restrictions concerning their use. You should read the terms and condition of use as provided by the designer.

-

How do I print How Much Tax Benefit On Home Loan?

- Print them at home using the printer, or go to an area print shop for top quality prints.

-

What software do I require to view printables for free?

- The majority are printed in the format PDF. This can be opened using free programs like Adobe Reader.

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Check more sample of How Much Tax Benefit On Home Loan below

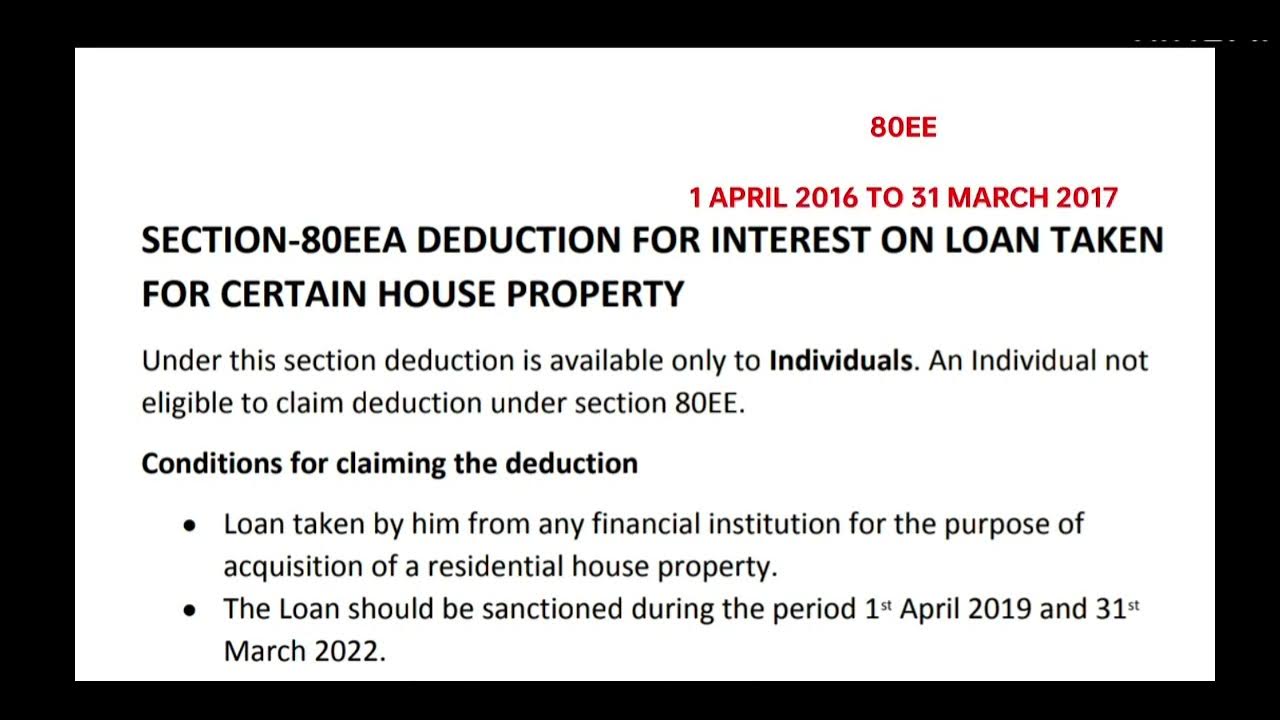

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

Home Loan Tax Benefits As Per Union Budget 2020

Homebuyers Can t Avail Tax Benefit On Home Loan From April 1 The Live

20151209 Tax Benefits On A Home Loan Personal Finance Plan

Tax Benefit On Home Loan And HRA Both

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

https://www.kotak.com/en/personal-banking/loans/...

27 500 INR Tax before Home Loan 32 500 INR Tax after Home Loan 5 000 INR Apply Now Home Loan Tax Benefit Whether you are a salaried or a self employed individual you are eligible to invest in a housing property as well as for the income tax deductions as stated under Section 80C

https://cleartax.in/s/home-loan-tax-benefits

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

27 500 INR Tax before Home Loan 32 500 INR Tax after Home Loan 5 000 INR Apply Now Home Loan Tax Benefit Whether you are a salaried or a self employed individual you are eligible to invest in a housing property as well as for the income tax deductions as stated under Section 80C

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

20151209 Tax Benefits On A Home Loan Personal Finance Plan

Home Loan Tax Benefits As Per Union Budget 2020

Tax Benefit On Home Loan And HRA Both

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

How To Claim Tax Benefit On Home Loan For Under Construction Property

Indiabulls Home Loans Tax Benefit On Home Loan Top Up

Indiabulls Home Loans Tax Benefit On Home Loan Top Up

What Are The Tax Benefit On Home Loan FY 2020 2021