Today, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons or creative projects, or simply to add a personal touch to your space, How Much Tax Can I Claim Back For Professional Fees have proven to be a valuable resource. We'll dive deep into the realm of "How Much Tax Can I Claim Back For Professional Fees," exploring what they are, where to locate them, and how they can enhance various aspects of your lives.

Get Latest How Much Tax Can I Claim Back For Professional Fees Below

How Much Tax Can I Claim Back For Professional Fees

How Much Tax Can I Claim Back For Professional Fees -

You can claim your professional fees for tax relief as part of your self assessment tax return by entering your subscription amount and the years you re claiming in box 19 on the SA102 form With that we consider our

Your organisation can tell you how much tax you re allowed to claim back You can claim for this tax year and the 4 previous tax years If you can claim these expenses you must complete a

How Much Tax Can I Claim Back For Professional Fees cover a large assortment of printable resources available online for download at no cost. These resources come in various forms, including worksheets, templates, coloring pages, and much more. The benefit of How Much Tax Can I Claim Back For Professional Fees is in their variety and accessibility.

More of How Much Tax Can I Claim Back For Professional Fees

How Much Tax Can You Save On House Rent Allowance HRA Exemption

How Much Tax Can You Save On House Rent Allowance HRA Exemption

You can claim tax back on your registration fee because it is a professional fee that is necessary for you to do your job The government does not tax these fees You can claim for

How much can I claim How much you can claim will depend on a number of factors including how much your annual fees cost and your tax situation As a guide members who pay basic rate tax in the UK can claim up to 20 on

How Much Tax Can I Claim Back For Professional Fees have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: This allows you to modify the design to meet your needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational Impact: These How Much Tax Can I Claim Back For Professional Fees offer a wide range of educational content for learners of all ages, which makes them an essential tool for parents and teachers.

-

Affordability: Fast access many designs and templates is time-saving and saves effort.

Where to Find more How Much Tax Can I Claim Back For Professional Fees

Can I Claim Business Lunches As An Expense To Reduce My Tax My

Can I Claim Business Lunches As An Expense To Reduce My Tax My

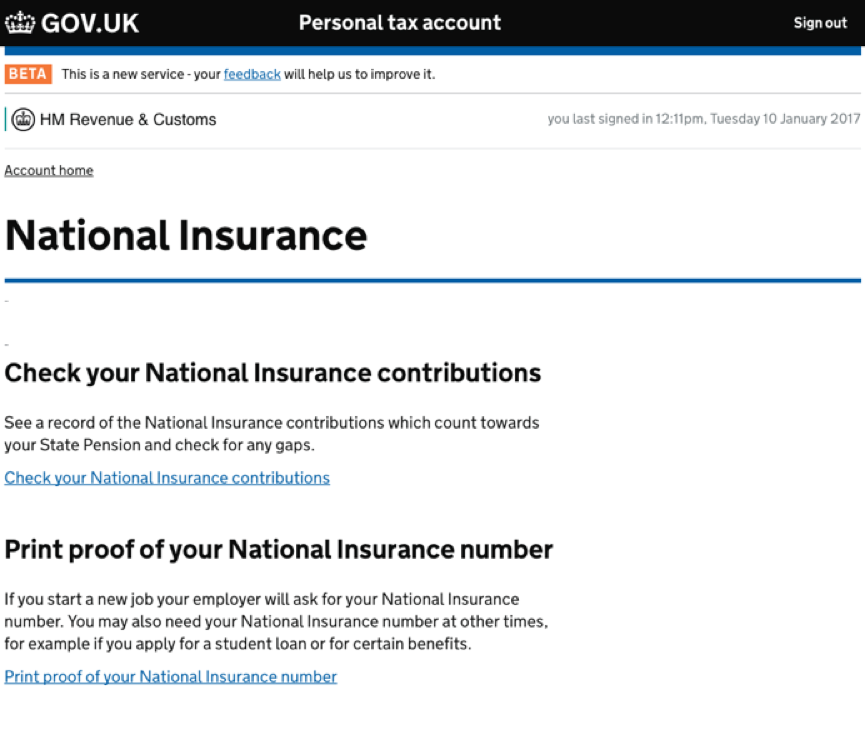

If you haven t already been reimbursed by your employer or if you were reimbursed but already paid tax on the amount you will need to claim tax relief on work related expenses These are called tax deductible expenses

Find out if you re eligible to claim tax relief If you re eligible you ll be able to claim tax relief on your job expenses by post If you complete a Self Assessment tax return you must

In the event that we've stirred your curiosity about How Much Tax Can I Claim Back For Professional Fees Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of How Much Tax Can I Claim Back For Professional Fees designed for a variety purposes.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning tools.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a wide range of topics, ranging from DIY projects to party planning.

Maximizing How Much Tax Can I Claim Back For Professional Fees

Here are some new ways create the maximum value of How Much Tax Can I Claim Back For Professional Fees:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

How Much Tax Can I Claim Back For Professional Fees are a treasure trove of innovative and useful resources that meet a variety of needs and pursuits. Their access and versatility makes these printables a useful addition to both professional and personal lives. Explore the wide world of How Much Tax Can I Claim Back For Professional Fees to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these materials for free.

-

Can I use the free printables for commercial use?

- It's determined by the specific usage guidelines. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Check the terms and conditions offered by the author.

-

How do I print How Much Tax Can I Claim Back For Professional Fees?

- You can print them at home using either a printer or go to the local print shop for more high-quality prints.

-

What program will I need to access printables at no cost?

- Most PDF-based printables are available in the format of PDF, which is open with no cost programs like Adobe Reader.

How Much Tax Can You Expect To Pay With An Electric Car Vantage

American National Insurance Claims Center

Check more sample of How Much Tax Can I Claim Back For Professional Fees below

Electric Cars How Much Tax Can You Expect To Pay SG Contractor

Sole Trading To Limited Company How Much Tax Can You Save Clever

Claiming Tax Back From UK After Leaving TAX TWERK

Tax Back On Medical And Dental Expenses My Tax Rebate

Podcast Episode 2 How Much Tax Can Save By Registering Sdn Bhd

Should I Delay Taking My State Pension How Much Tax Can I Save

https://www.gov.uk/tax-relief-for-employees/...

Your organisation can tell you how much tax you re allowed to claim back You can claim for this tax year and the 4 previous tax years If you can claim these expenses you must complete a

https://www.taxrebateservices.co.uk/tax-guides/...

You can claim a tax rebate for professional fees for many industry bodies backdated for up to four tax years in most cases you should get a new tax code which means a reduction in

Your organisation can tell you how much tax you re allowed to claim back You can claim for this tax year and the 4 previous tax years If you can claim these expenses you must complete a

You can claim a tax rebate for professional fees for many industry bodies backdated for up to four tax years in most cases you should get a new tax code which means a reduction in

Tax Back On Medical And Dental Expenses My Tax Rebate

Sole Trading To Limited Company How Much Tax Can You Save Clever

Podcast Episode 2 How Much Tax Can Save By Registering Sdn Bhd

Should I Delay Taking My State Pension How Much Tax Can I Save

Electric Cars How Much Tax Can You Expect To Pay Aardvark Accounting

How Much Tax Can You ACTUALLY Save Within A Tax Free Savings Account

How Much Tax Can You ACTUALLY Save Within A Tax Free Savings Account

Can I Claim My Roommate As A Dependent Gerber Accounting And Tax