In the digital age, with screens dominating our lives however, the attraction of tangible printed objects isn't diminished. Be it for educational use in creative or artistic projects, or just adding personal touches to your space, How Much Tax Credit For Health Insurance are a great source. We'll take a dive to the depths of "How Much Tax Credit For Health Insurance," exploring the different types of printables, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest How Much Tax Credit For Health Insurance Below

How Much Tax Credit For Health Insurance

How Much Tax Credit For Health Insurance -

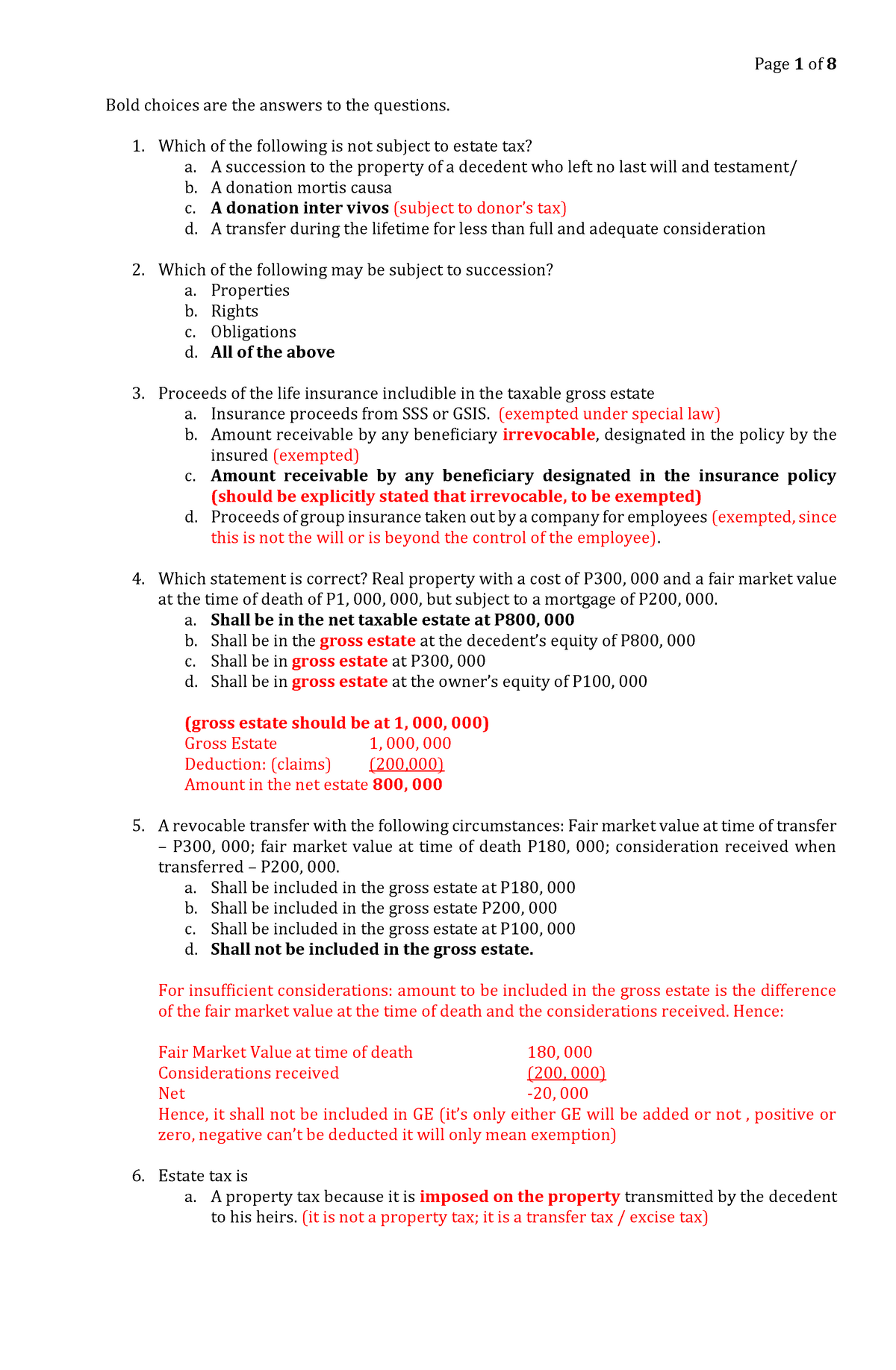

Taxpayers who purchase health insurance through a Health Insurance Marketplace for themselves or others in their tax family see the Instructions for Form 8962 may be eligible for the premium tax credit This tax credit helps make purchasing health insurance coverage more affordable for people with low to moderate incomes

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

How Much Tax Credit For Health Insurance provide a diverse range of downloadable, printable materials available online at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and much more. The beauty of How Much Tax Credit For Health Insurance is in their versatility and accessibility.

More of How Much Tax Credit For Health Insurance

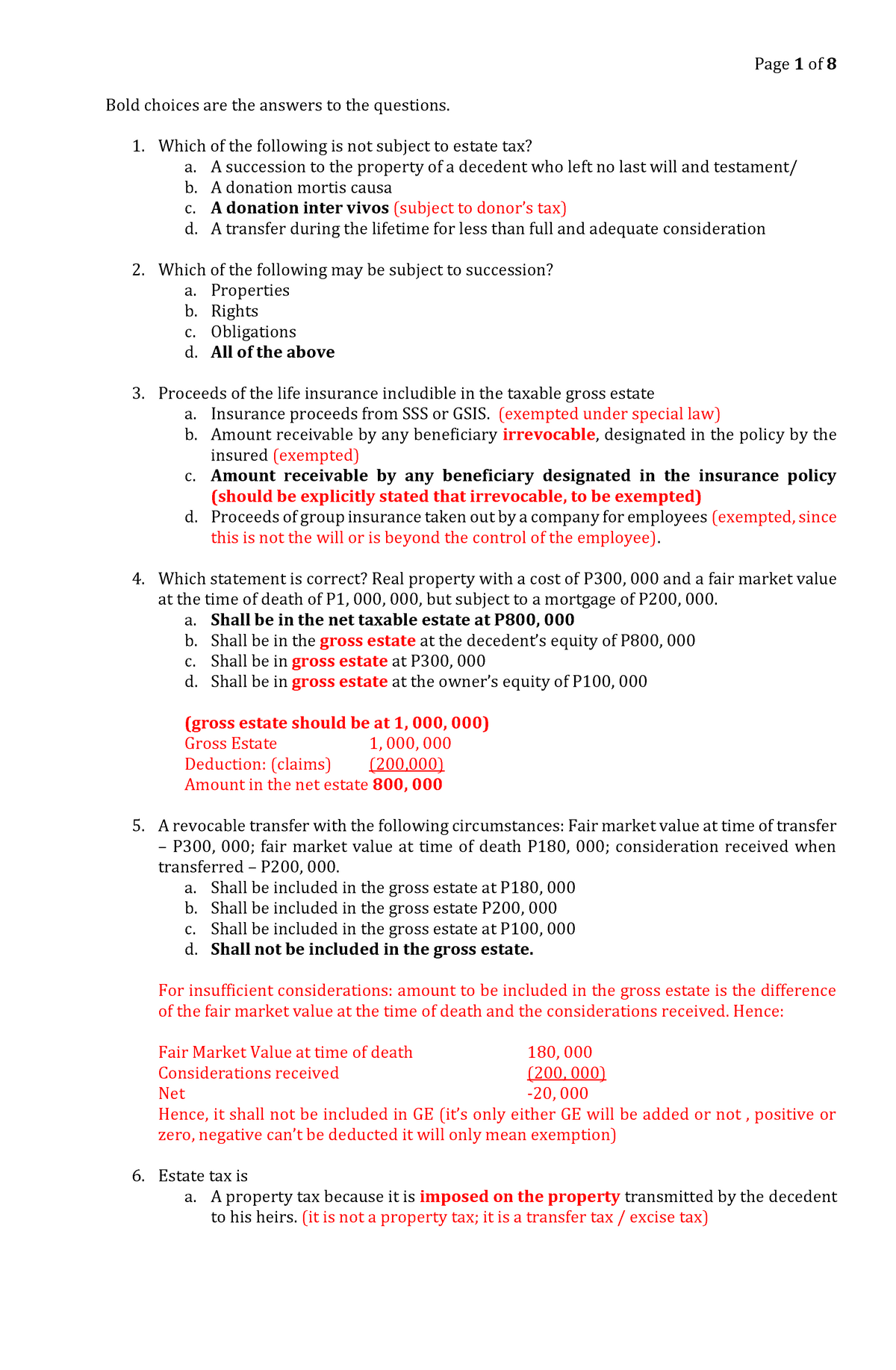

Estate TAX POST QUIZ Answer KEY Bold Choices Are The Answers To The

Estate TAX POST QUIZ Answer KEY Bold Choices Are The Answers To The

Premium tax credit than you qualified for in 2023 You ll have to report the excess amount on your 2023 tax return by filing Form 8962 Premium Tax Credit PDF 110 KB Get a refund or lower the amount of taxes you owe if you used less of the premium tax credit you qualified for or got an increase in the premium tax credit when you reconciled

The monthly premium for a silver plan purchased on the Florida health insurance exchange was 1380 Gibson calculated that a family living at the poverty threshold in that year would receive a

How Much Tax Credit For Health Insurance have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: You can tailor the templates to meet your individual needs, whether it's designing invitations to organize your schedule or even decorating your home.

-

Educational Value: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes the perfect source for educators and parents.

-

Simple: Quick access to an array of designs and templates reduces time and effort.

Where to Find more How Much Tax Credit For Health Insurance

Understanding The Tax Credit For Health Insurance Premiums Benefits

Understanding The Tax Credit For Health Insurance Premiums Benefits

Who is Eligible for a Health Care Credit Before 2021 the PTC was available to people with household incomes from 100 to 400 of the poverty level who bought health coverage through an

The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit

After we've peaked your interest in How Much Tax Credit For Health Insurance We'll take a look around to see where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of How Much Tax Credit For Health Insurance for various goals.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs are a vast spectrum of interests, from DIY projects to party planning.

Maximizing How Much Tax Credit For Health Insurance

Here are some new ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

How Much Tax Credit For Health Insurance are an abundance of practical and imaginative resources that meet a variety of needs and pursuits. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the wide world of How Much Tax Credit For Health Insurance and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes you can! You can download and print these resources at no cost.

-

Do I have the right to use free printing templates for commercial purposes?

- It's contingent upon the specific conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright violations with How Much Tax Credit For Health Insurance?

- Certain printables might have limitations regarding usage. You should read the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home using an printer, or go to a local print shop to purchase high-quality prints.

-

What software will I need to access printables at no cost?

- The majority of printables are in the PDF format, and is open with no cost software, such as Adobe Reader.

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

FAQs Health Insurance Premium Tax Credits

Check more sample of How Much Tax Credit For Health Insurance below

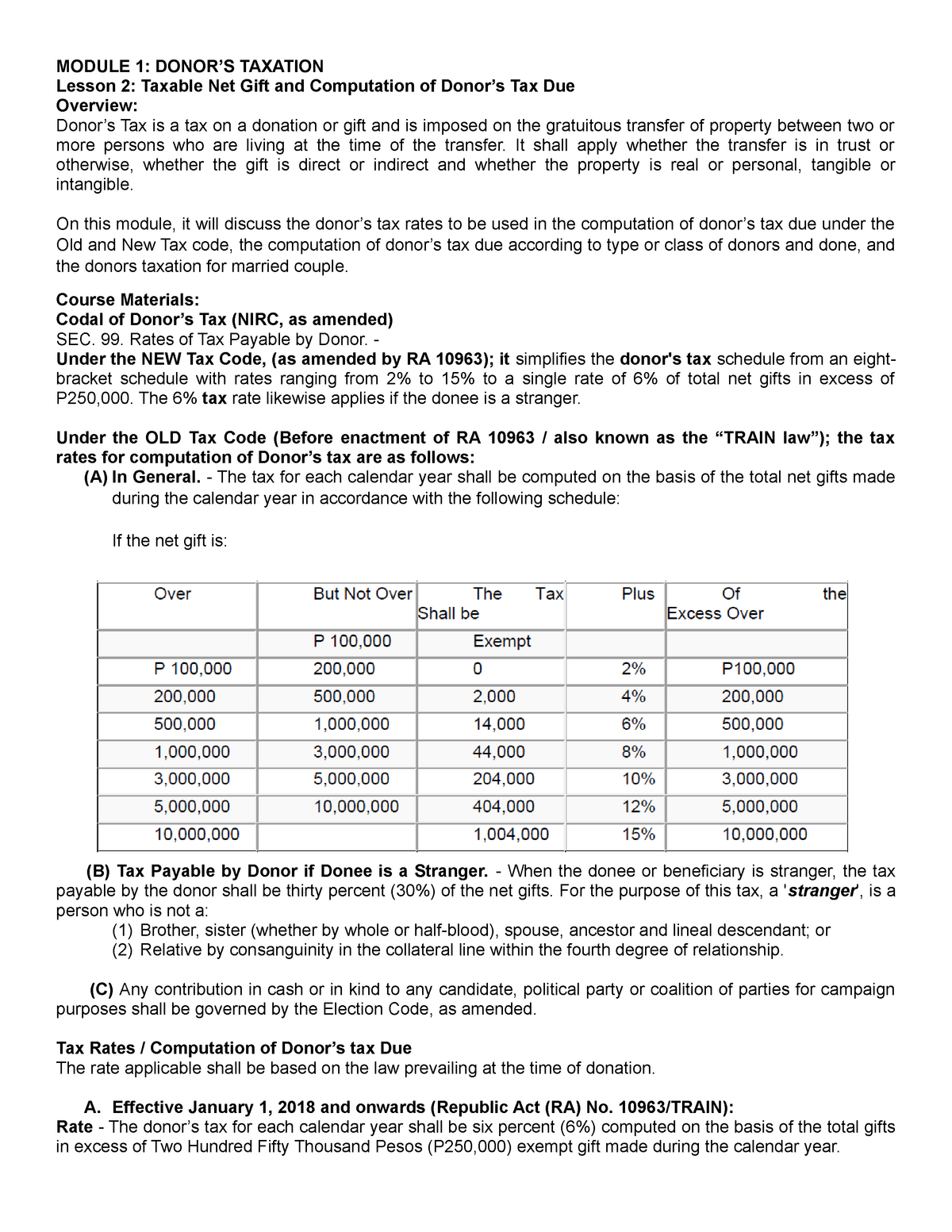

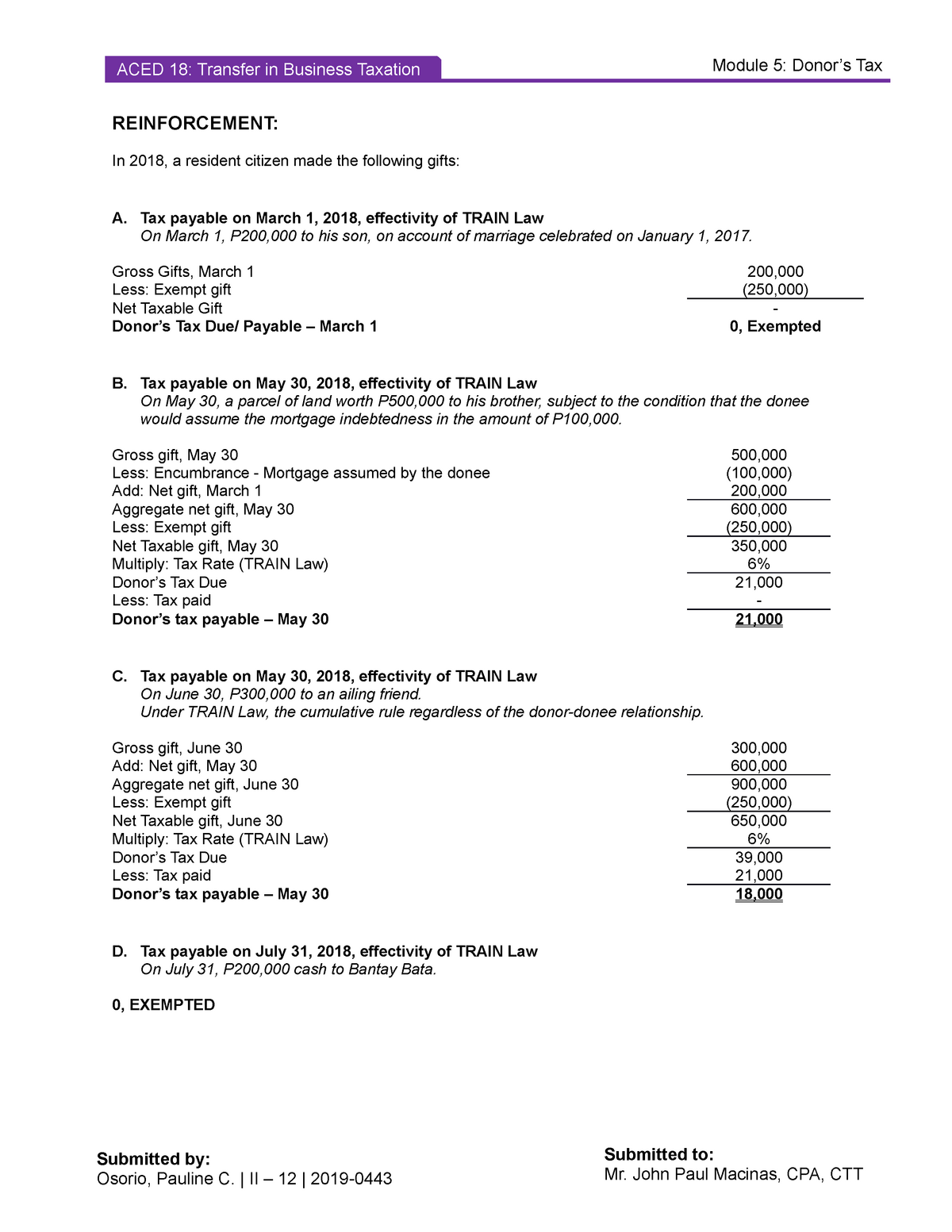

Module 1 Lesson 2 Taxable Net Gift And Computation Of Donor s Tax

Premium Tax Credit Calculator For Health Insurance Tax Refund YouTube

Tax Credit For Health Insurance 2022 2022 DRT

Understanding The Tax Credit For Health Insurance Premiums Benefits

Tax Credits Save You More Than Deductions Here Are The Best Ones

How To Apply For Health Care Tax Credit PicsHealth

https://www.irs.gov/affordable-care-act/...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

https://www.valuepenguin.com/health-insurance-tax-credit

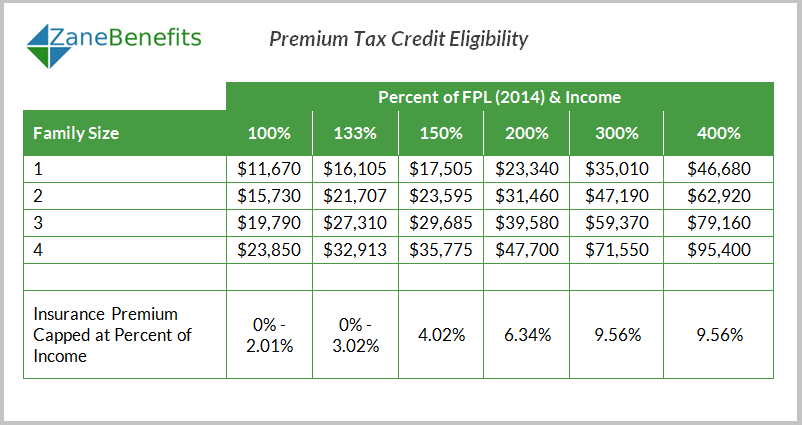

The 2024 income limits for the health insurance subsidy are 58 320 for a single person and 120 000 for a family of four That s four times the federal poverty level FPL and the most you can earn and still qualify for premium tax credits unless you pay more than 8 5 of your income for health insurance

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

The 2024 income limits for the health insurance subsidy are 58 320 for a single person and 120 000 for a family of four That s four times the federal poverty level FPL and the most you can earn and still qualify for premium tax credits unless you pay more than 8 5 of your income for health insurance

Understanding The Tax Credit For Health Insurance Premiums Benefits

Premium Tax Credit Calculator For Health Insurance Tax Refund YouTube

Tax Credits Save You More Than Deductions Here Are The Best Ones

How To Apply For Health Care Tax Credit PicsHealth

2019 0443 Osorio Pauline II 12 ACED 18 Reinforcement 5 REINFORCEMENT

Why Do You Lose Child Tax Credit At Age 17 Expat US Tax

Why Do You Lose Child Tax Credit At Age 17 Expat US Tax

Premium Tax Credit Charts 2015