In this age of technology, where screens rule our lives but the value of tangible printed products hasn't decreased. If it's to aid in education for creative projects, simply to add a personal touch to your area, How Much Tax Credit For Home Improvements have become an invaluable source. We'll take a dive to the depths of "How Much Tax Credit For Home Improvements," exploring what they are, where to locate them, and how they can add value to various aspects of your lives.

Get Latest How Much Tax Credit For Home Improvements Below

How Much Tax Credit For Home Improvements

How Much Tax Credit For Home Improvements -

Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to

The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit insulation materials or systems and air sealing materials

How Much Tax Credit For Home Improvements cover a large assortment of printable, downloadable items that are available online at no cost. They are available in numerous kinds, including worksheets templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of How Much Tax Credit For Home Improvements

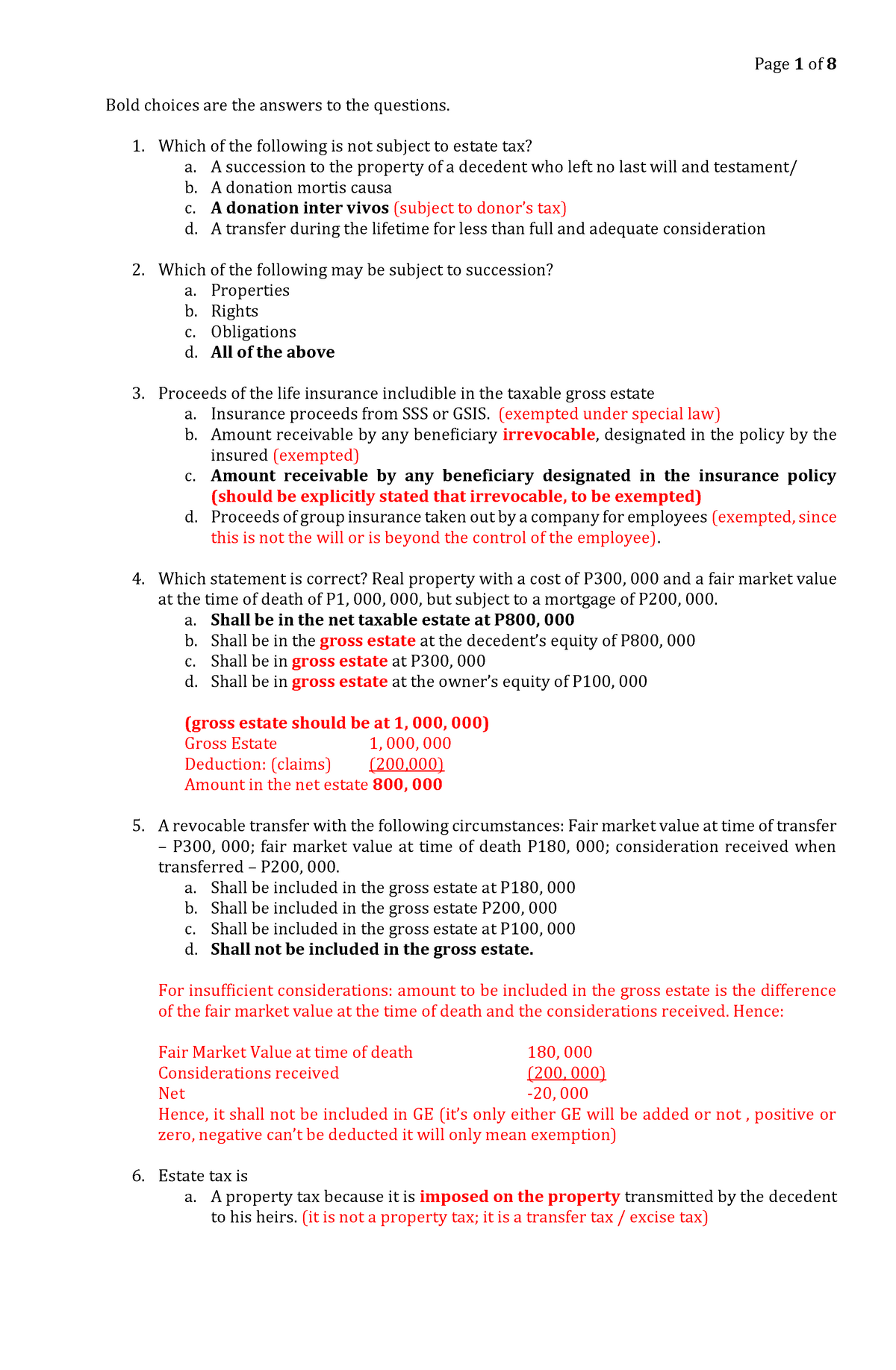

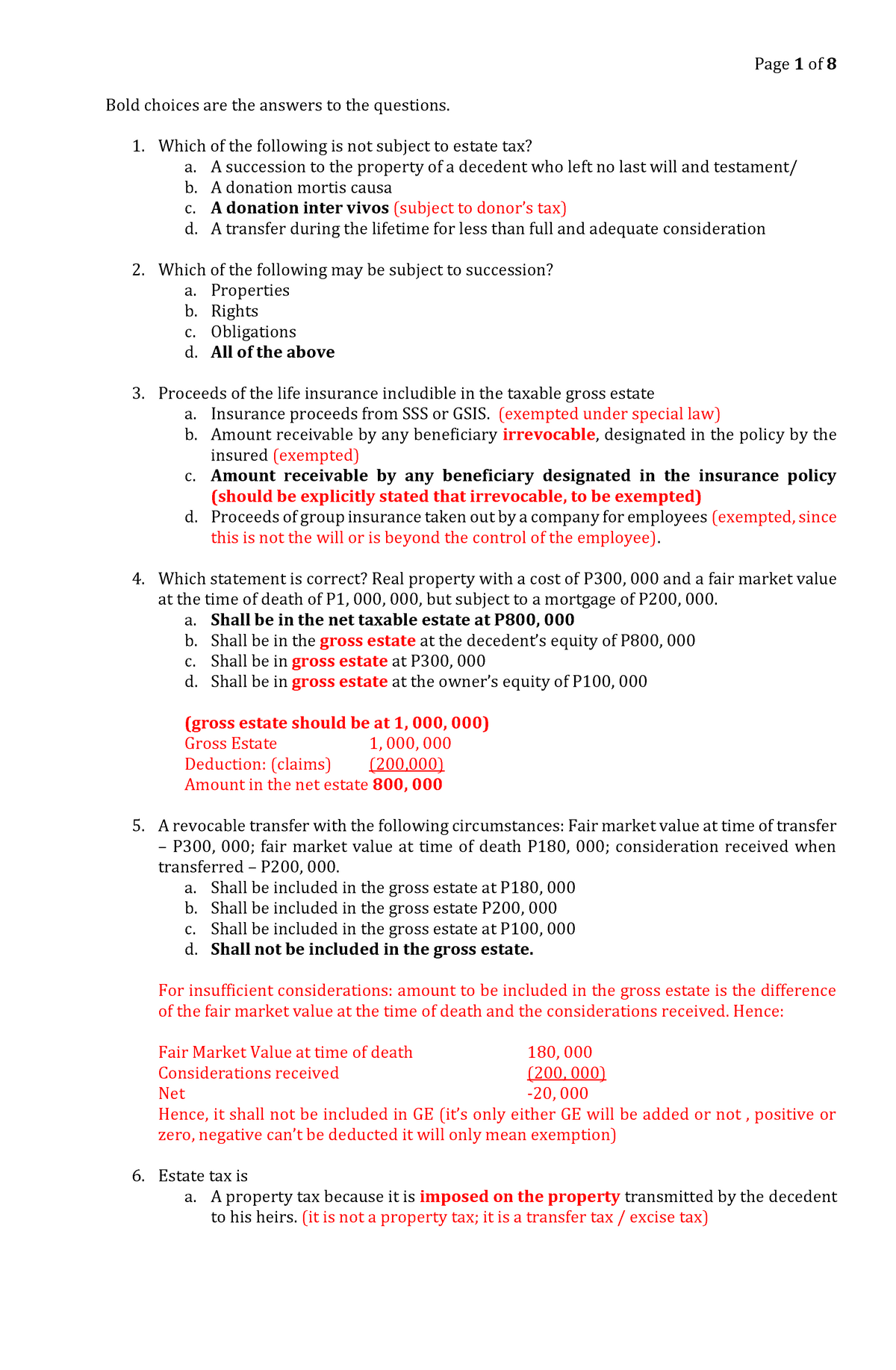

Estate TAX POST QUIZ Answer KEY Bold Choices Are The Answers To The

Estate TAX POST QUIZ Answer KEY Bold Choices Are The Answers To The

Home improvements and taxes When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

How Much Tax Credit For Home Improvements have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Modifications: They can make the templates to meet your individual needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Benefits: Printing educational materials for no cost cater to learners from all ages, making them a vital instrument for parents and teachers.

-

An easy way to access HTML0: Quick access to numerous designs and templates saves time and effort.

Where to Find more How Much Tax Credit For Home Improvements

How Much Tax Credit Do You Get For Buying A Tesla

How Much Tax Credit Do You Get For Buying A Tesla

The cost of increasing the insulation and reducing air leaks in a home may be eligible for a federal tax credit when the improvements meet the 2021 International Energy Conservation Code IECC The 2021 IECC provides

A key element in that push is offering up to 14 000 in rebates and tax credits for people to make their homes more energy efficient Those benefits can be used to lower the cost of home

Since we've got your interest in How Much Tax Credit For Home Improvements Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of How Much Tax Credit For Home Improvements for various purposes.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast variety of topics, from DIY projects to party planning.

Maximizing How Much Tax Credit For Home Improvements

Here are some creative ways create the maximum value of How Much Tax Credit For Home Improvements:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Much Tax Credit For Home Improvements are a treasure trove filled with creative and practical information catering to different needs and pursuits. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the vast world of How Much Tax Credit For Home Improvements now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can print and download these items for free.

-

Does it allow me to use free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may come with restrictions in use. Be sure to check the terms and regulations provided by the creator.

-

How can I print How Much Tax Credit For Home Improvements?

- Print them at home with an printer, or go to a print shop in your area for more high-quality prints.

-

What software do I need to run How Much Tax Credit For Home Improvements?

- The majority of PDF documents are provided as PDF files, which is open with no cost software like Adobe Reader.

What Is The Tax Credit For Home Improvements TAXP

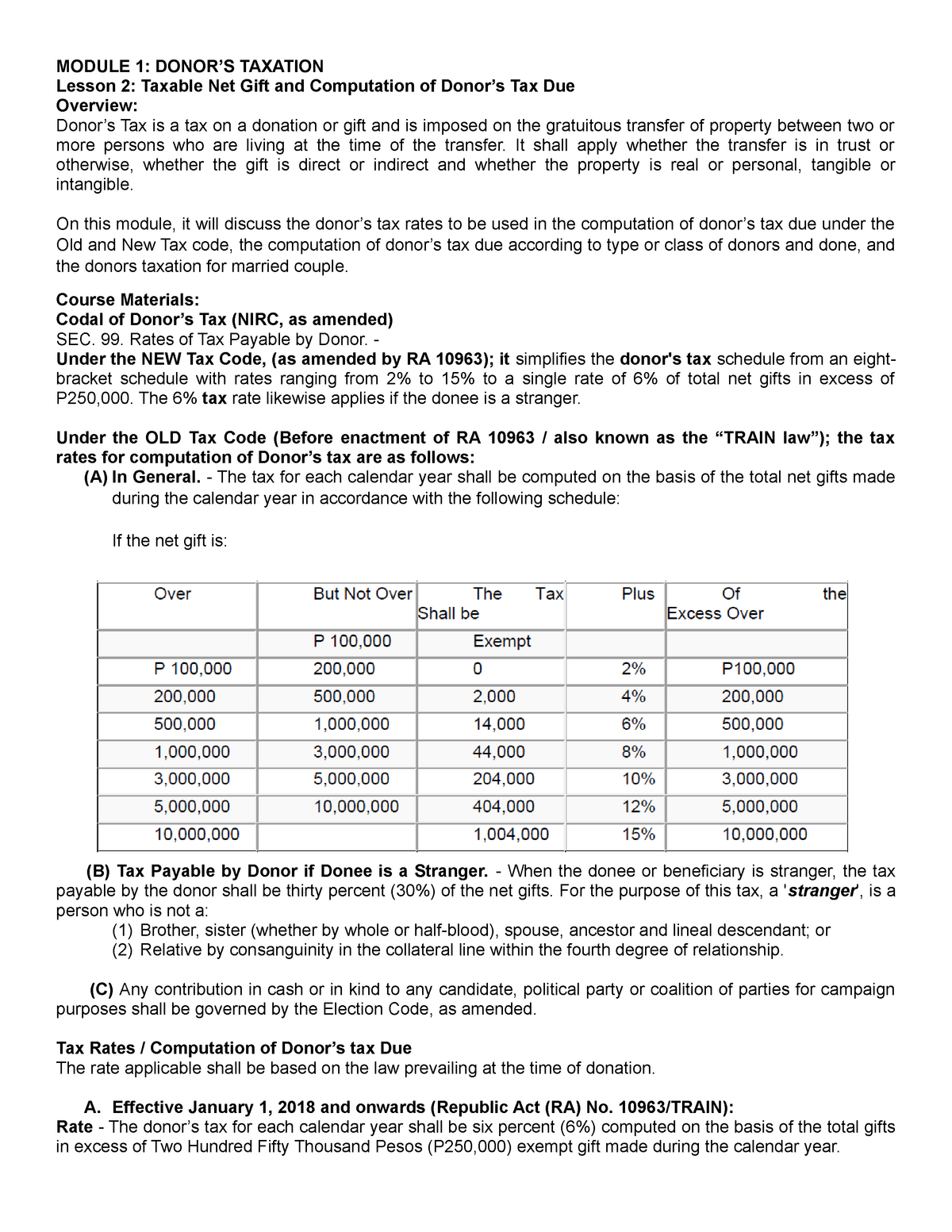

Module 1 Lesson 2 Taxable Net Gift And Computation Of Donor s Tax

Check more sample of How Much Tax Credit For Home Improvements below

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

FAQs Tax Forming Lives OK EIGO

How To Get A Solar Tax Credit For A Home Office Zero Down Solar

Sponsored MoneyWise Tip How You Can Use Equity Loans And Lines Of

Infonavit Introduces Mejoravit Repara Credit For Home Improvements In

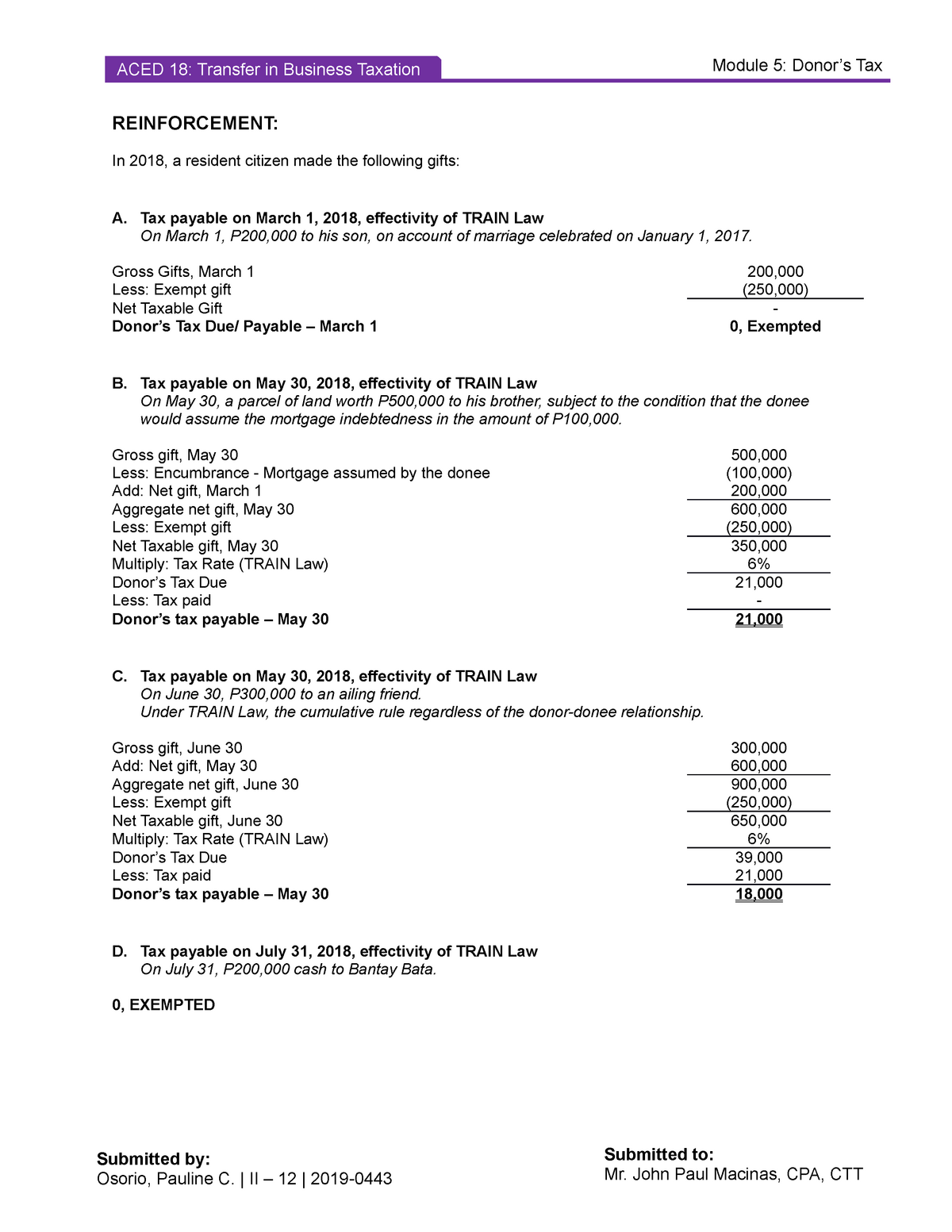

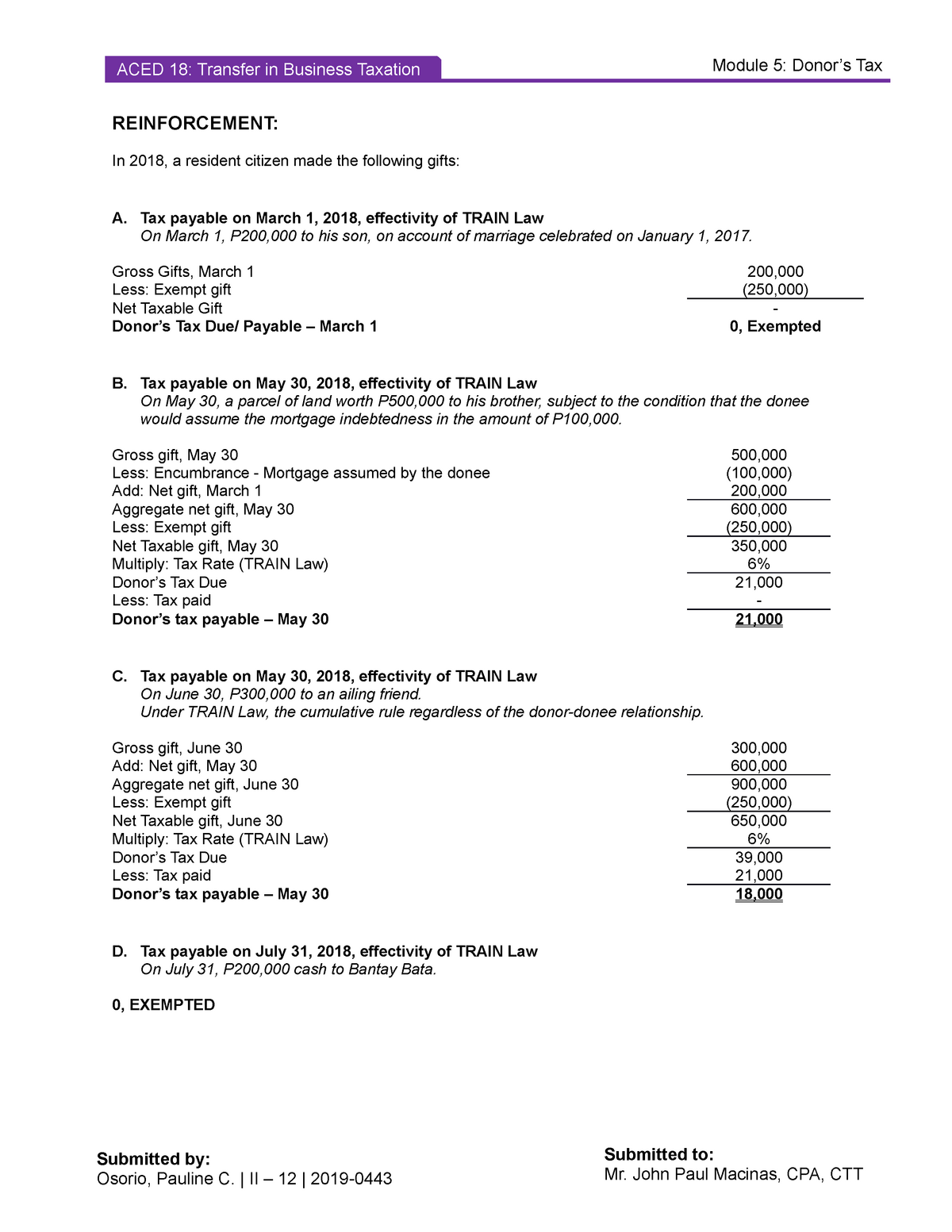

2019 0443 Osorio Pauline II 12 ACED 18 Reinforcement 5 REINFORCEMENT

https://www.irs.gov › credits-deductions › frequently...

The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit insulation materials or systems and air sealing materials

https://www.nerdwallet.com › article › t…

The energy efficient home improvement credit for 2023 is 30 of eligible expenses up to a maximum of 3 200 You can only claim expenses made in 2023 on your 2024 return Which projects

The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit insulation materials or systems and air sealing materials

The energy efficient home improvement credit for 2023 is 30 of eligible expenses up to a maximum of 3 200 You can only claim expenses made in 2023 on your 2024 return Which projects

Sponsored MoneyWise Tip How You Can Use Equity Loans And Lines Of

FAQs Tax Forming Lives OK EIGO

Infonavit Introduces Mejoravit Repara Credit For Home Improvements In

2019 0443 Osorio Pauline II 12 ACED 18 Reinforcement 5 REINFORCEMENT

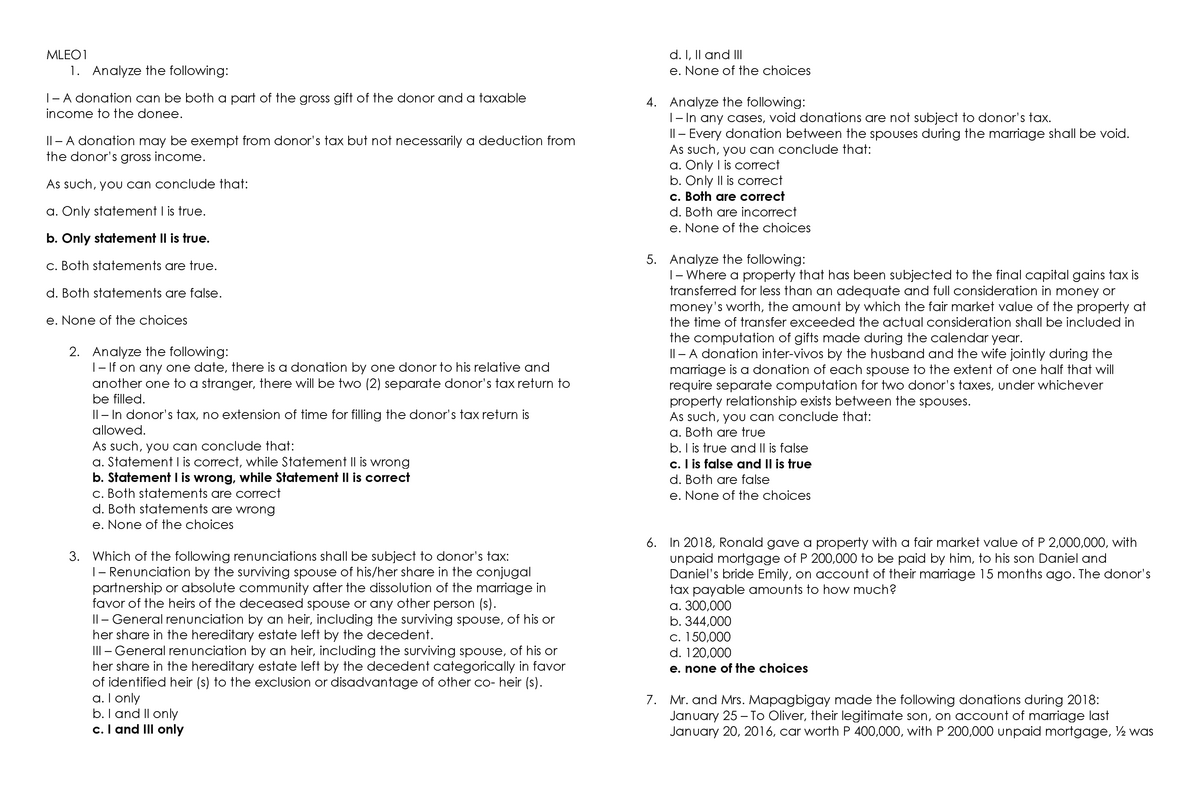

Exam 2020 Questions And Answers MLEO Analyze The Following I A

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

What Is The Tax Credit For Home Improvements TAXP