In this age of electronic devices, where screens have become the dominant feature of our lives but the value of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons, creative projects, or simply to add an element of personalization to your space, How Much Tax Exemption Under 80c have become an invaluable source. In this article, we'll take a dive deeper into "How Much Tax Exemption Under 80c," exploring the benefits of them, where to locate them, and how they can add value to various aspects of your life.

Get Latest How Much Tax Exemption Under 80c Below

How Much Tax Exemption Under 80c

How Much Tax Exemption Under 80c -

Here s step by step guidance on how to use the calculator Select the assessment year AY for which you want your taxes to be calculated if you have invested in the year 2020 21 then your AY shall be 2021 22 Select the status to indicate whether you are an individual or HUF

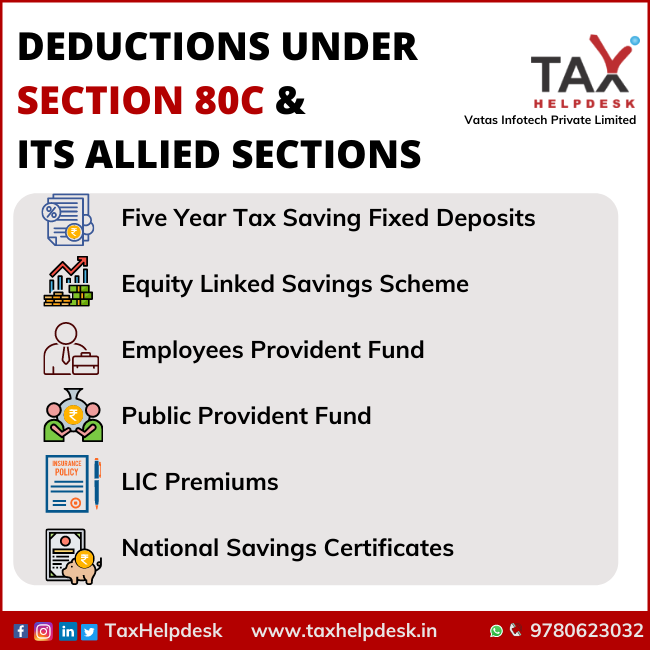

For section 80C The amount of eligible investment or expenditure as specified is fully allowed for deduction subject to the limit of Rs 1 5 lakh The limit of Rs 1 5 lakh deduction of Section 80C includes 80CCC contribution towards pension plan and 80CCD 1 80CCD 1b and 80CCD 2

How Much Tax Exemption Under 80c include a broad selection of printable and downloadable material that is available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and much more. The value of How Much Tax Exemption Under 80c is in their variety and accessibility.

More of How Much Tax Exemption Under 80c

Income Tax Deduction Under 80C Lex N Tax Associates

Income Tax Deduction Under 80C Lex N Tax Associates

Section 80C of the Income Tax Act is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is Rs 1 50 000 However ITR filing is mandatory in order to claim the deduction under section 80C Deduction under section 80C of the income tax act are applicable only for individual

80C 80CCD 1 80CCD 2 Upto 1 50 000 80CCD 1B Upto 50 000 Total Maximum deduction Upto 2 00 000 Important Note The date for making various investment payment for claiming deduction under Chapter VIA B of the IT Act which includes section 80C LIC PPF NSC etc 80D Mediclaim 80G Donations etc has

How Much Tax Exemption Under 80c have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization The Customization feature lets you tailor printing templates to your own specific requirements in designing invitations planning your schedule or even decorating your house.

-

Education Value These How Much Tax Exemption Under 80c offer a wide range of educational content for learners of all ages, making them an invaluable instrument for parents and teachers.

-

Accessibility: Quick access to numerous designs and templates reduces time and effort.

Where to Find more How Much Tax Exemption Under 80c

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

The admissible deduction shall be the least of the following a Rs 5 000 per month b 25 of the adjusted total income or c Rent paid less than 10 of total income Adjusted Total Income total income excluding short term capital gains under section 111A long term capital gains income under section 115A and deductions under

3 Tax benefit of 46 800 is calculated at the highest tax slab rate of 31 2 including Cess excluding surcharge on life insurance premium under Section 80C of 1 50 000 Tax benefits under the policy are subject to conditions under Sections 80C 80D 10 10D 115BAC and other provisions of the Income Tax Act 1961

Since we've got your interest in printables for free Let's see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of How Much Tax Exemption Under 80c suitable for many goals.

- Explore categories like interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning materials.

- Ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs or templates for download.

- These blogs cover a broad selection of subjects, that range from DIY projects to party planning.

Maximizing How Much Tax Exemption Under 80c

Here are some fresh ways to make the most use of How Much Tax Exemption Under 80c:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

How Much Tax Exemption Under 80c are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and interest. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the plethora of How Much Tax Exemption Under 80c today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I download free printing templates for commercial purposes?

- It's based on specific usage guidelines. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on their use. Be sure to read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home with a printer or visit a local print shop for premium prints.

-

What software do I need in order to open printables free of charge?

- The majority of printed documents are in PDF format. They can be opened using free programs like Adobe Reader.

Pay Commission 7th CPC News Income Tax Exemption Limit Under 80C

EP5 80C TAX Tax

Check more sample of How Much Tax Exemption Under 80c below

Top 5 Post Office Tax Saving Schemes Offering Income Tax Deduction

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80C Deduction Under Section 80C In India Paisabazaar

![]()

How To Save Tax Under Section 80c In Income Tax Here s All About It

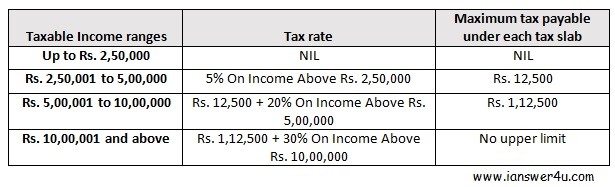

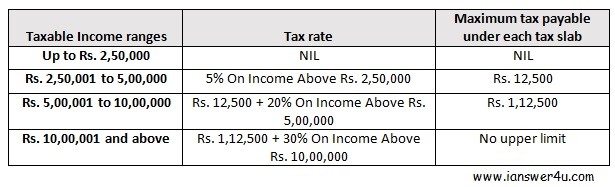

How Much Tax You Can Save Under Section 80c I Answer 4 U

Secure Your Future By Investing Wisely Invest In Public Provident

https://cleartax.in/s/80C-Deductions

For section 80C The amount of eligible investment or expenditure as specified is fully allowed for deduction subject to the limit of Rs 1 5 lakh The limit of Rs 1 5 lakh deduction of Section 80C includes 80CCC contribution towards pension plan and 80CCD 1 80CCD 1b and 80CCD 2

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Maximum Limit Rs 1 50 lakh every financial year Please note that the aggregate deduction amount under Sections 80C 80CCC and 80CCD is restricted to Rs 1 50 000 for a taxpayer Maximum Age No maximum age Tuition fee meaning Only payment made towards the full time education of the child

For section 80C The amount of eligible investment or expenditure as specified is fully allowed for deduction subject to the limit of Rs 1 5 lakh The limit of Rs 1 5 lakh deduction of Section 80C includes 80CCC contribution towards pension plan and 80CCD 1 80CCD 1b and 80CCD 2

Maximum Limit Rs 1 50 lakh every financial year Please note that the aggregate deduction amount under Sections 80C 80CCC and 80CCD is restricted to Rs 1 50 000 for a taxpayer Maximum Age No maximum age Tuition fee meaning Only payment made towards the full time education of the child

How To Save Tax Under Section 80c In Income Tax Here s All About It

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

How Much Tax You Can Save Under Section 80c I Answer 4 U

Secure Your Future By Investing Wisely Invest In Public Provident

Stamp Duty And Registration Charges Deduction U s 80C

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Income Tax Return On Which Investments Can You Get Income Tax