In this age of technology, where screens dominate our lives yet the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses in creative or artistic projects, or simply to add an element of personalization to your space, How Much Tax Rebate Under 87a are now a useful source. The following article is a dive deeper into "How Much Tax Rebate Under 87a," exploring the different types of printables, where they can be found, and the ways that they can benefit different aspects of your lives.

Get Latest How Much Tax Rebate Under 87a Below

How Much Tax Rebate Under 87a

How Much Tax Rebate Under 87a -

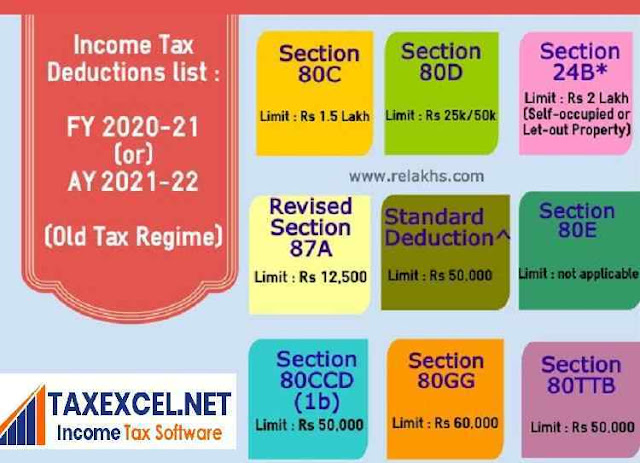

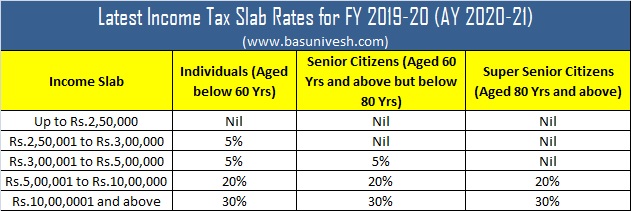

The maximum rebate under Section 87A for AY 2022 23 is Rs 12 500 Eligibility and limitations Here are some important points to remember while availing the rebate under Section 87A The rebate is applicable to individuals who are residents only This discount can be availed by old people aged sixty to eighty

Currently this limit stands at Rs 3 00 000 under new regime for FY 2023 2024 However if your total income is upto Rs 7 00 000 under the new tax regime then you are entitled to get the benefit of tax rebate u s 87A of Rs 25 000 or 100 of tax amount whichever is lower

How Much Tax Rebate Under 87a provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in numerous designs, including worksheets templates, coloring pages and much more. The benefit of How Much Tax Rebate Under 87a is in their variety and accessibility.

More of How Much Tax Rebate Under 87a

What Is Income Tax Rebate Under Section 87A HDFC Life

What Is Income Tax Rebate Under Section 87A HDFC Life

A income tax rebate under section 87 of Rs 25 000 is available u s 87A for the NEW tax regime for individuals whose taxable income is Rs 7 lakh or less in a year A rebate of Rs 12 500 is available u s 87A for those under the OLD tax regime for individuals whose taxable income is Rs 5 lakh or less in a year

The maximum tax rebate amount is 12 500 To claim the rebate you need to file income tax returns You can check your income tax refund status through different online portals Here is an example for better understanding As per the Income Tax Act 1961 if you have gross taxable income below 5 lakhs per year you can claim a tax

The How Much Tax Rebate Under 87a have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: This allows you to modify printables to your specific needs when it comes to designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Impact: Free educational printables can be used by students of all ages. This makes these printables a powerful instrument for parents and teachers.

-

Simple: Fast access many designs and templates reduces time and effort.

Where to Find more How Much Tax Rebate Under 87a

Rebate U s 87A

Rebate U s 87A

You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been amended from time to time In the beginning the maximum limit of tax rebate under Section 87A of the Income Tax Act was 2 000 In the Union Budget 2016 it was raised

Individuals can claim the rebate if the total income after Chapter VIA reductions is up to Rs 5 lakh in a financial year What is the eligibility criteria for claiming a tax rebate under Section 87A and how to claim it Keep reading to get the details here What is Section 87A

If we've already piqued your curiosity about How Much Tax Rebate Under 87a We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of How Much Tax Rebate Under 87a for various applications.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning tools.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs are a vast array of topics, ranging that range from DIY projects to planning a party.

Maximizing How Much Tax Rebate Under 87a

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How Much Tax Rebate Under 87a are a treasure trove with useful and creative ideas designed to meet a range of needs and interests. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the vast array of How Much Tax Rebate Under 87a and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can print and download these materials for free.

-

Can I use the free printables to make commercial products?

- It's based on specific conditions of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to check the terms and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home using your printer or visit an area print shop for more high-quality prints.

-

What software do I require to open printables that are free?

- The majority are printed in PDF format. They is open with no cost software such as Adobe Reader.

Is Sec 87A Tax Rebate Accessible Under New Tax Regime With Automated

How Much Income Tax Upto 5 Lakhs what Is Rebate Income Tax sec 87A

Check more sample of How Much Tax Rebate Under 87a below

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Income Tax Rebate Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

Breathtaking Income Tax Calculation Statement Two Types Of Financial

https://tax2win.in/guide/section-87a

Currently this limit stands at Rs 3 00 000 under new regime for FY 2023 2024 However if your total income is upto Rs 7 00 000 under the new tax regime then you are entitled to get the benefit of tax rebate u s 87A of Rs 25 000 or 100 of tax amount whichever is lower

https://m.economictimes.com/wealth/tax/who-is...

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

Currently this limit stands at Rs 3 00 000 under new regime for FY 2023 2024 However if your total income is upto Rs 7 00 000 under the new tax regime then you are entitled to get the benefit of tax rebate u s 87A of Rs 25 000 or 100 of tax amount whichever is lower

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual opting for the new tax regime in FY 2023 24 will pay zero taxes if their taxable income does not exceed Rs 7 lakh

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

Income Tax Rebate Under Section 87A

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Revised Tax Rebate Under Sec 87A After Budget 2019