In this age of electronic devices, where screens have become the dominant feature of our lives and the appeal of physical printed items hasn't gone away. In the case of educational materials, creative projects, or just adding personal touches to your area, How To Claim Deduction U S 80ccd 2 are now a vital resource. With this guide, you'll dive to the depths of "How To Claim Deduction U S 80ccd 2," exploring what they are, how to find them and how they can enhance various aspects of your life.

Get Latest How To Claim Deduction U S 80ccd 2 Below

How To Claim Deduction U S 80ccd 2

How To Claim Deduction U S 80ccd 2 -

If you choose to invest in the avenue under Section 80CCD you can claim a total deduction of INR 2 lakhs in a financial year Section 80CCD is further divided into

Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below Section 80CCD is

How To Claim Deduction U S 80ccd 2 provide a diverse array of printable content that can be downloaded from the internet at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and many more. The appealingness of How To Claim Deduction U S 80ccd 2 lies in their versatility and accessibility.

More of How To Claim Deduction U S 80ccd 2

Deduction U S 80C 80CCC 80CCD Detailed Analysis CA CS CMA MAY

Deduction U S 80C 80CCC 80CCD Detailed Analysis CA CS CMA MAY

A Yes an individual can claim a deduction under both Section 80CCD 1B and Section 80CCD 2 of the Income Tax Act However the total deduction cannot

Section 80 CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for Central Government made by

How To Claim Deduction U S 80ccd 2 have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization They can make designs to suit your personal needs for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free cater to learners of all ages, making them a valuable device for teachers and parents.

-

An easy way to access HTML0: You have instant access a myriad of designs as well as templates helps save time and effort.

Where to Find more How To Claim Deduction U S 80ccd 2

Deductions U s 80C To 80U Part 4 In Tamil Deduction U s 80CCC And

Deductions U s 80C To 80U Part 4 In Tamil Deduction U s 80CCC And

Section 80 CCD 2 allows employees to claim a deduction of up to 10 of their wages This includes basic salary and salary supplements Otherwise it is equal to the employer s contribution to

If your employer is contributing to your NPS account then as a salaried employee you are eligible to claim a deduction for the contribution made from gross income This deduction is claimed under

We've now piqued your interest in How To Claim Deduction U S 80ccd 2 Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of How To Claim Deduction U S 80ccd 2 suitable for many purposes.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad range of topics, everything from DIY projects to planning a party.

Maximizing How To Claim Deduction U S 80ccd 2

Here are some new ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home and in class.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

How To Claim Deduction U S 80ccd 2 are a treasure trove of useful and creative resources designed to meet a range of needs and desires. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the plethora of How To Claim Deduction U S 80ccd 2 now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can print and download these tools for free.

-

Can I download free printing templates for commercial purposes?

- It's all dependent on the usage guidelines. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Are there any copyright problems with How To Claim Deduction U S 80ccd 2?

- Some printables may contain restrictions regarding their use. Always read the terms and regulations provided by the creator.

-

How do I print How To Claim Deduction U S 80ccd 2?

- You can print them at home with either a printer at home or in an area print shop for higher quality prints.

-

What program do I require to open printables that are free?

- The majority are printed in the format of PDF, which can be opened using free programs like Adobe Reader.

How To Claim Deduction U s 80TTA In ITR 1 For AY 2022 23 II Show 80 TTA

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

Check more sample of How To Claim Deduction U S 80ccd 2 below

Income Tax Deduction U S 80CCD 1B YouTube

Section 80EEA Eligibility And Deduction Amount

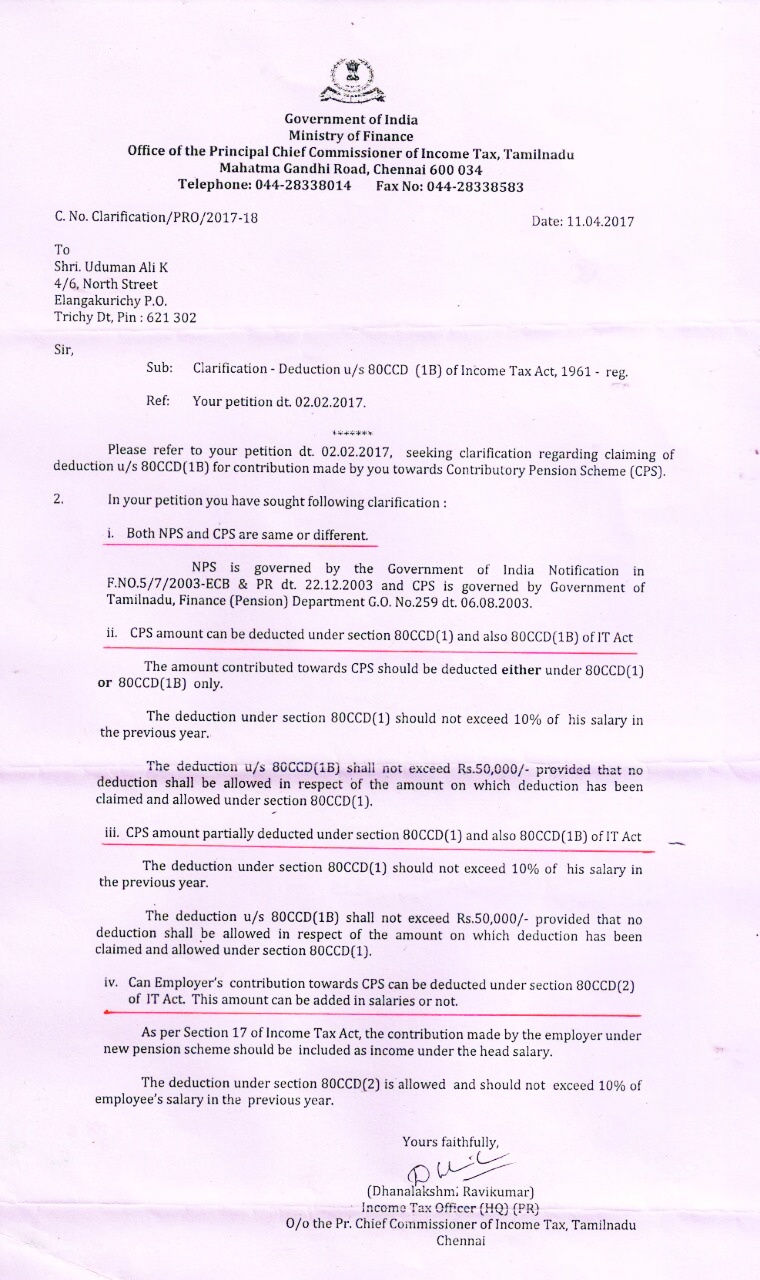

IT Clarification

Deduction Under Income Tax 80CCC And 80CCD

Deduction Under Section 80CCD 2 For Employer s Contribution To

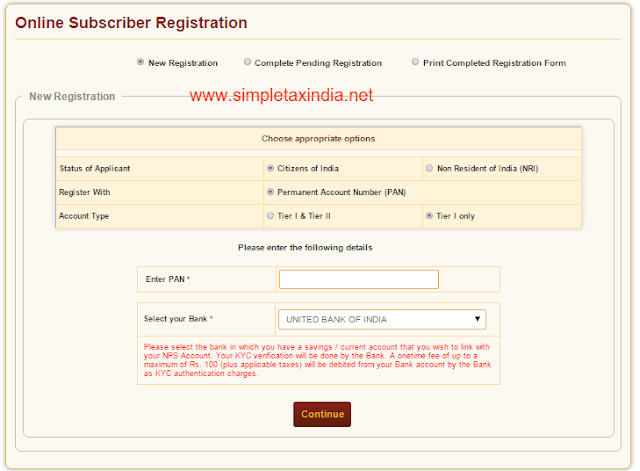

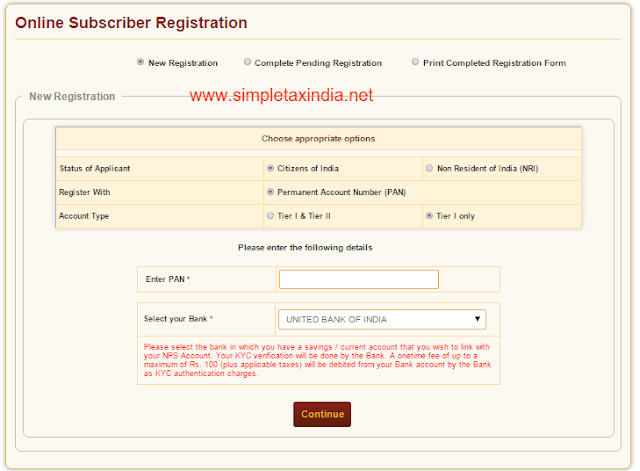

How To Open Online NPS Account To Claim Additional Deduction Of 50000

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below Section 80CCD is

https://groww.in/p/tax/section-80ccd

Under Section 80CCD deductions can be claimed by both salaried as well as self employed people While on the one hand it is obligatory for government employees on

Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below Section 80CCD is

Under Section 80CCD deductions can be claimed by both salaried as well as self employed people While on the one hand it is obligatory for government employees on

Deduction Under Income Tax 80CCC And 80CCD

Section 80EEA Eligibility And Deduction Amount

Deduction Under Section 80CCD 2 For Employer s Contribution To

How To Open Online NPS Account To Claim Additional Deduction Of 50000

Deduction Under Section 80C 80CCC 80CCD 80D For AY 2019 20

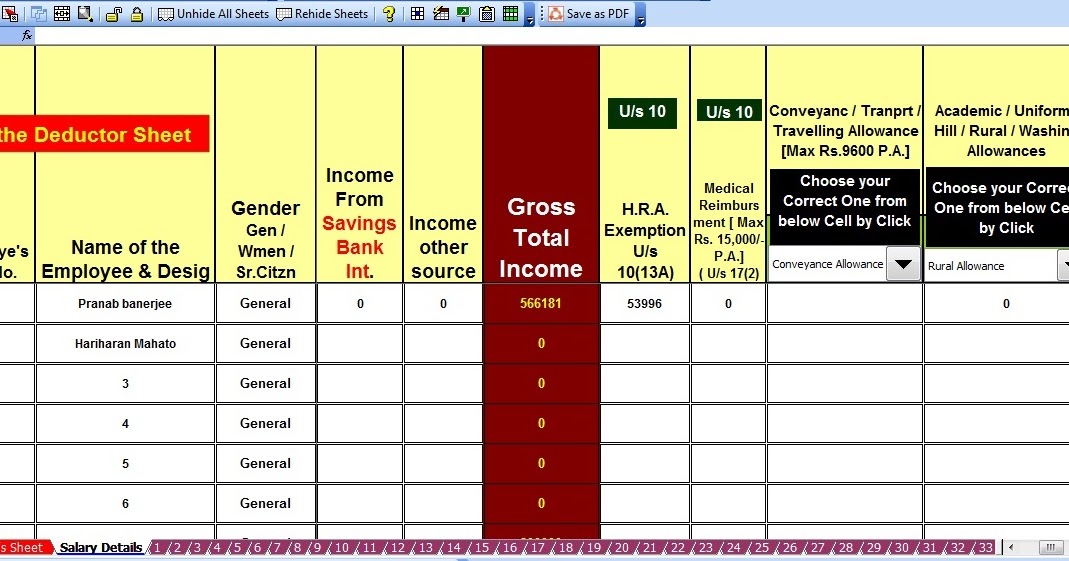

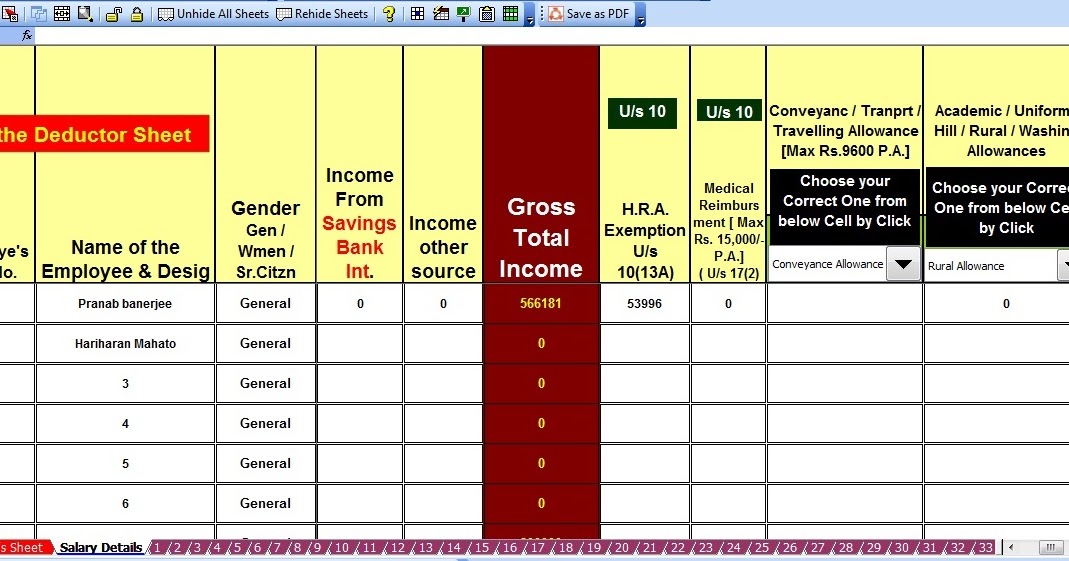

Deduction U s 80CCD 2 In Respect Of Contribution To New Pension Fund

Deduction U s 80CCD 2 In Respect Of Contribution To New Pension Fund

How To Claim Deduction For Pension U s 80CCD Learn By Quicko