In this day and age in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Whether it's for educational purposes and creative work, or simply adding a personal touch to your home, printables for free have become a valuable resource. The following article is a dive in the world of "How To Claim Deduction Under Section 80dd," exploring what they are, where they are available, and how they can enhance various aspects of your life.

Get Latest How To Claim Deduction Under Section 80dd Below

How To Claim Deduction Under Section 80dd

How To Claim Deduction Under Section 80dd -

How Much Can You Claim under Section 80DD Individuals meeting the required eligibility criteria can claim these deductions Rs 75 000 where the dependent s disability ranges between 40 80

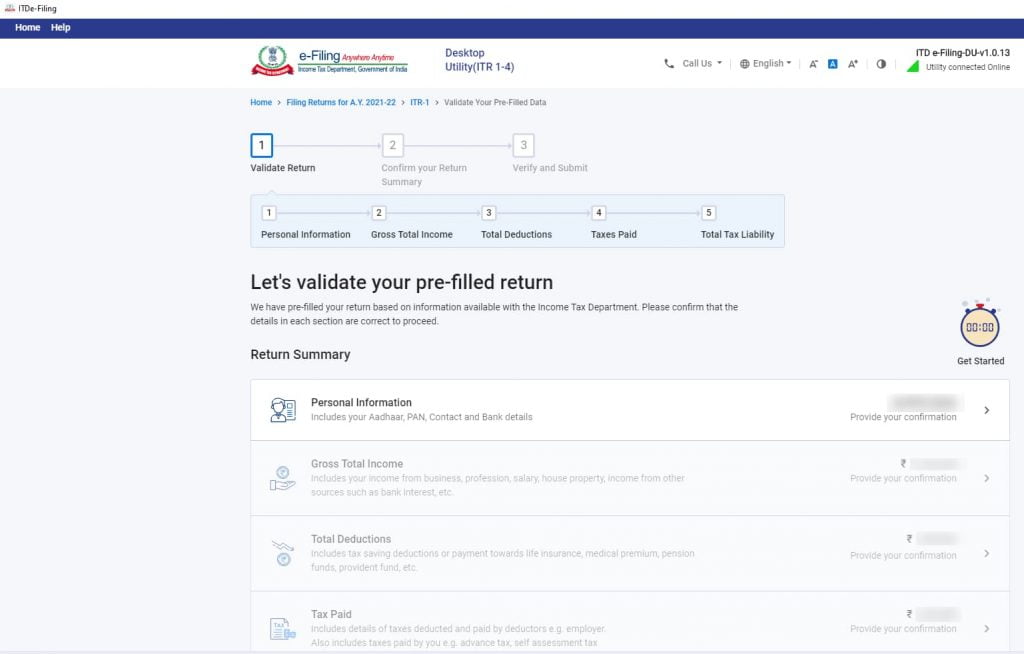

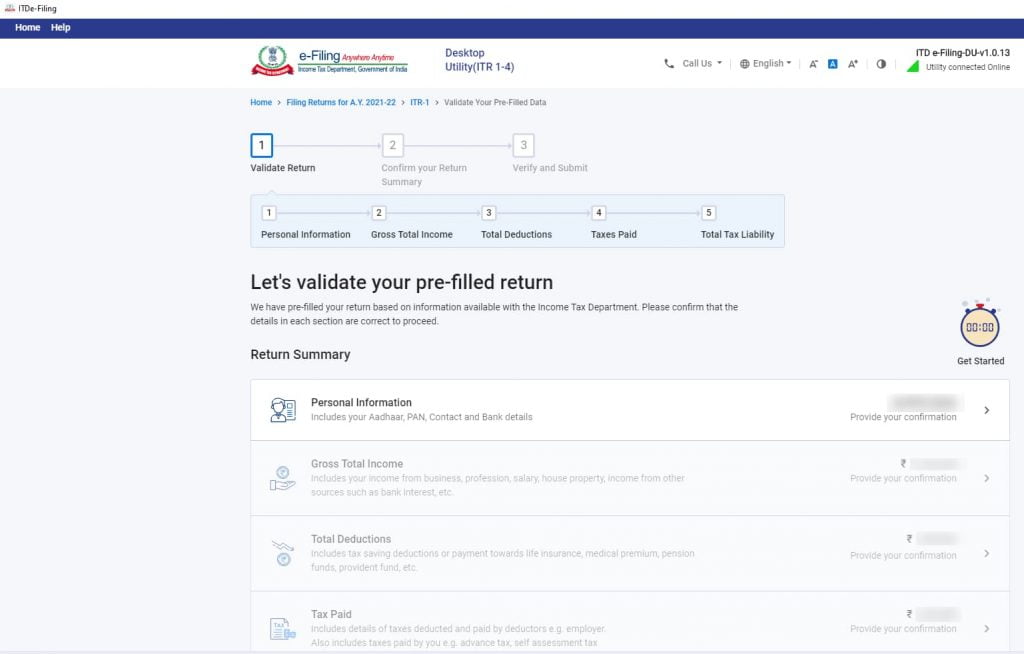

To claim a deduction under section 80DD you should submit Form 10 IA and the income tax return filed for the respective assessment year No deduction can be claimed under section 80DD if the certificate of disability

How To Claim Deduction Under Section 80dd encompass a wide range of printable, free material that is available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages and much more. The attraction of printables that are free is in their versatility and accessibility.

More of How To Claim Deduction Under Section 80dd

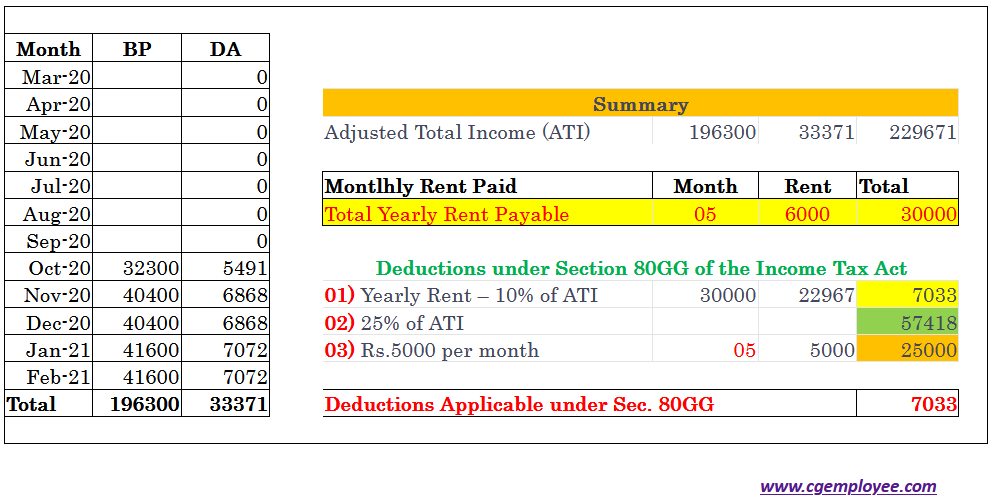

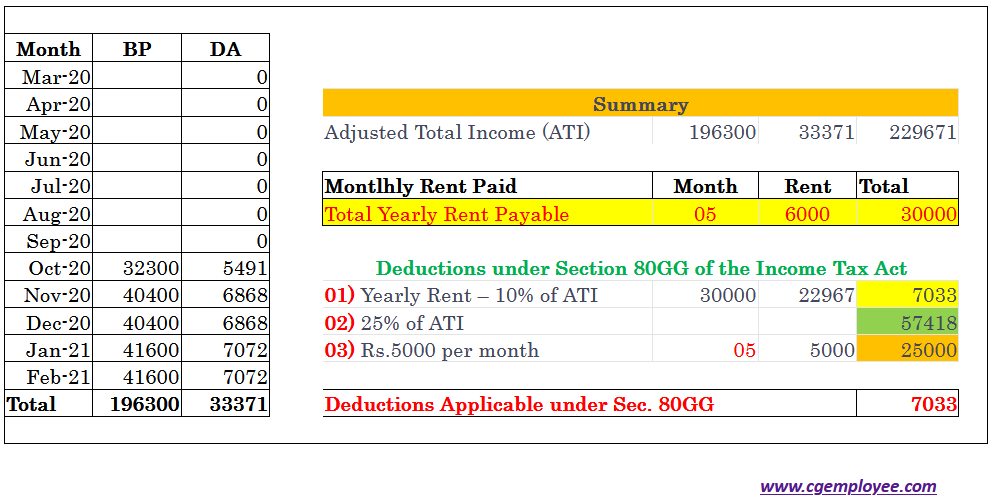

How To Claim Deduction Under Section 80GG Of Income Tax Act For Rent

How To Claim Deduction Under Section 80GG Of Income Tax Act For Rent

To claim the deduction it is mandatory to obtain a certificate The certificate can be obtained from various specialists depending on the type of disease such as a neurologist

To claim a deduction under Section 80DD the individual are required to have a copy of Form 10 IA issued by a medical authority Although this form doesn t required to be

Print-friendly freebies have gained tremendous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: We can customize printed materials to meet your requirements in designing invitations to organize your schedule or even decorating your house.

-

Education Value The free educational worksheets are designed to appeal to students of all ages. This makes them an essential tool for teachers and parents.

-

The convenience of Fast access many designs and templates helps save time and effort.

Where to Find more How To Claim Deduction Under Section 80dd

Section 80DD 2021 Guide On Section 80DD Deductions How To Claim Them

Section 80DD 2021 Guide On Section 80DD Deductions How To Claim Them

Under Section 80DD of the Income Tax Act taxpayers are entitled to a deduction for the expenses incurred on the medical treatment rehabilitation training or deposit in specified schemes for the maintenance of a dependent

A person may claim deductions under Section 80DD if they have a disability dependent such as parents a spouse siblings or children or if they are a HUF with a disabled family member

Now that we've ignited your curiosity about How To Claim Deduction Under Section 80dd Let's look into where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of How To Claim Deduction Under Section 80dd suitable for many needs.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing How To Claim Deduction Under Section 80dd

Here are some fresh ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home for the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

How To Claim Deduction Under Section 80dd are an abundance of practical and imaginative resources that satisfy a wide range of requirements and pursuits. Their accessibility and flexibility make them an invaluable addition to both personal and professional life. Explore the many options of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes, they are! You can download and print these free resources for no cost.

-

Are there any free templates for commercial use?

- It's determined by the specific rules of usage. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations on use. Check these terms and conditions as set out by the author.

-

How can I print How To Claim Deduction Under Section 80dd?

- You can print them at home with your printer or visit a print shop in your area for premium prints.

-

What software is required to open How To Claim Deduction Under Section 80dd?

- The majority are printed with PDF formats, which can be opened with free software such as Adobe Reader.

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Claim Deduction Under Section 80DD Learn By Quicko

Check more sample of How To Claim Deduction Under Section 80dd below

How To Claim Deduction In 80C incometax taxdeductions 80c

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Deduction Under Section 80DD 80DDB And 80U

Section 80U Tax Deductions For Disabled Individuals Tax2win

Medical Expenditure Claim U s 80D 80DD 80DDB In Income Tax Return

How To Claim Deduction Under Section 80C Without Making Any Investment

https://cleartax.in

To claim a deduction under section 80DD you should submit Form 10 IA and the income tax return filed for the respective assessment year No deduction can be claimed under section 80DD if the certificate of disability

https://taxguru.in › income-tax

As per section 80DD the assessee is eligible to claim a deduction of INR 75 000 from his gross total income However in case the dependant is a person with severe disability the assessee is eligible to claim a deduction of

To claim a deduction under section 80DD you should submit Form 10 IA and the income tax return filed for the respective assessment year No deduction can be claimed under section 80DD if the certificate of disability

As per section 80DD the assessee is eligible to claim a deduction of INR 75 000 from his gross total income However in case the dependant is a person with severe disability the assessee is eligible to claim a deduction of

Section 80U Tax Deductions For Disabled Individuals Tax2win

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Medical Expenditure Claim U s 80D 80DD 80DDB In Income Tax Return

How To Claim Deduction Under Section 80C Without Making Any Investment

Tax Deduction Under Sec 80DD Eligibility Amount Covered Documents

Section 80TTA How You Can Claim Tax Deduction

Section 80TTA How You Can Claim Tax Deduction

Section 80D Deduction For Medical Insurance Health Checkups 2019