In this day and age when screens dominate our lives however, the attraction of tangible printed objects hasn't waned. Whether it's for educational purposes as well as creative projects or simply to add an individual touch to the space, How To Claim Deduction Under Section 80ddb have become an invaluable source. We'll dive deeper into "How To Claim Deduction Under Section 80ddb," exploring the different types of printables, where to find them and what they can do to improve different aspects of your lives.

Get Latest How To Claim Deduction Under Section 80ddb Below

How To Claim Deduction Under Section 80ddb

How To Claim Deduction Under Section 80ddb -

Section 80DD The deduction can be claimed for the expenditure incurred on the medical treatment including nursing training and rehabilitation of a person with disability The deduction is claimed from total income of the claimant before levy of tax thereby reducing the total tax payable

Section 80DDB For certain specific diseases IT Department offers tax deductions to individuals HUFs under Section 80DDB based on expenses incurred by him Learn how to claim form format documents required filing procedure

How To Claim Deduction Under Section 80ddb cover a large collection of printable materials online, at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and much more. The benefit of How To Claim Deduction Under Section 80ddb lies in their versatility as well as accessibility.

More of How To Claim Deduction Under Section 80ddb

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

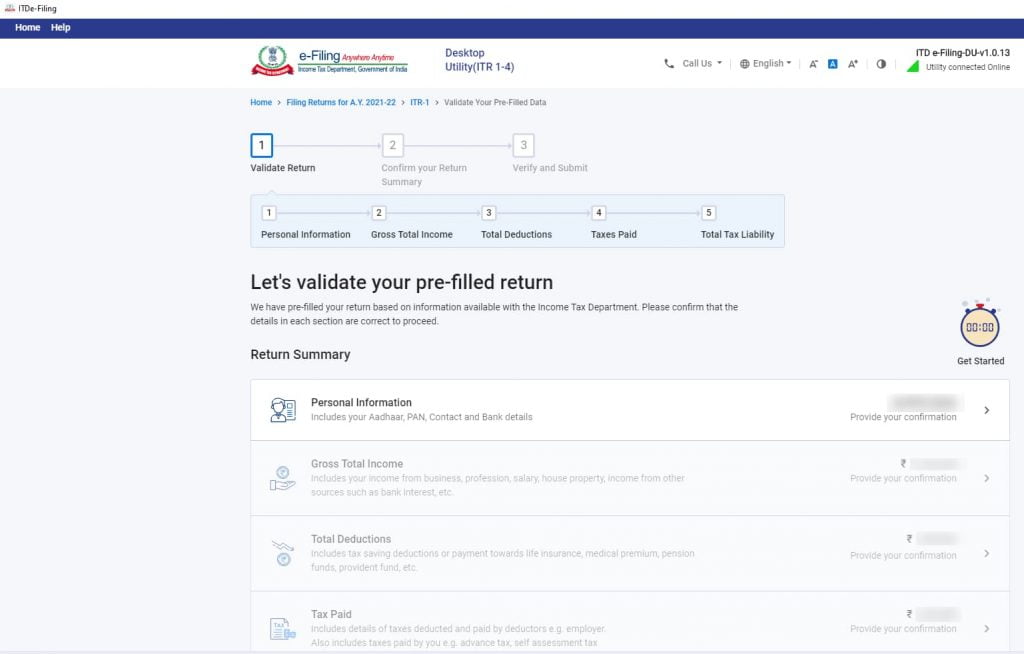

Documents Required to Claim Deductions under section 80DDB Apart from the medical certificate provided by the medical professional you need to submit some additional documents too For instance A prescription stating that the patient needs to get treatment for the specified disease under Section 80DDB of the Income Tax Act

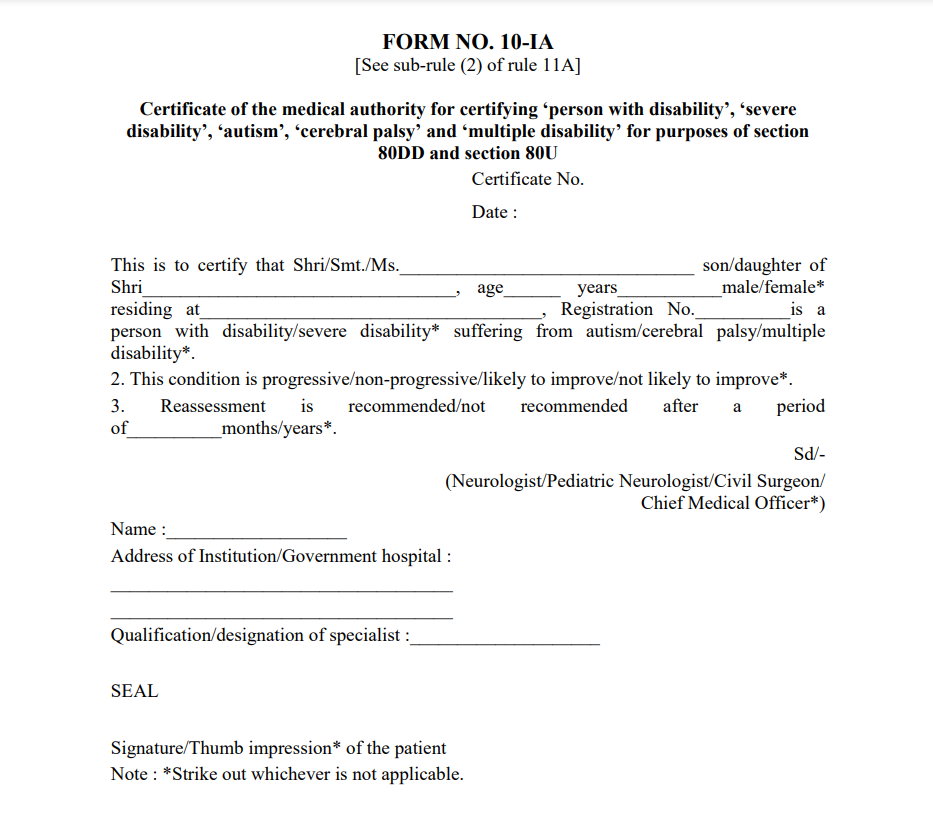

Who can claim a deduction under Section 80DDB of income tax What is the amount of deduction u s 80DDB What is the list of specified diseases under Section 80DDB What documents are required How to claim deduction u s 80DDB What is the Prescription Format for claiming 80DDB deduction Conclusion

How To Claim Deduction Under Section 80ddb have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization They can make print-ready templates to your specific requirements for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational Value: Printing educational materials for no cost cater to learners from all ages, making them an essential tool for teachers and parents.

-

The convenience of Quick access to an array of designs and templates saves time and effort.

Where to Find more How To Claim Deduction Under Section 80ddb

How To Claim Deduction Of Up To Rs 1 Lakh On Medical Expenses Under

How To Claim Deduction Of Up To Rs 1 Lakh On Medical Expenses Under

Who can claim a tax deduction under section 80DDB The following taxpayers can claim 80DDB deductions for expenses incurred towards the treatment of specified ailments Resident individuals for self children spouse siblings and parents

Yes section 80DDB allows to claim the deduction for inpatient as well as for outpatient expenses Last Updated on 4 weeks by Jayni Bhavsar Section 80DDB allows a deduction for expenses on medical treatment of specified ailment diseases such as AIDS cancer dementia etc

We've now piqued your curiosity about How To Claim Deduction Under Section 80ddb and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection and How To Claim Deduction Under Section 80ddb for a variety motives.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to party planning.

Maximizing How To Claim Deduction Under Section 80ddb

Here are some innovative ways of making the most of How To Claim Deduction Under Section 80ddb:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance your learning at home and in class.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How To Claim Deduction Under Section 80ddb are a treasure trove of practical and imaginative resources which cater to a wide range of needs and pursuits. Their access and versatility makes them a fantastic addition to the professional and personal lives of both. Explore the endless world of How To Claim Deduction Under Section 80ddb right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these materials for free.

-

Can I make use of free printables for commercial uses?

- It's based on specific terms of use. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may come with restrictions in use. Be sure to check the terms of service and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home using your printer or visit any local print store for better quality prints.

-

What program do I need to run printables at no cost?

- Most printables come with PDF formats, which is open with no cost software, such as Adobe Reader.

Claim Deduction Under Section 80DD Learn By Quicko

Section 80U Tax Deductions For Disabled Individuals Tax2win

Check more sample of How To Claim Deduction Under Section 80ddb below

Section 80DDB Diseases Covered Certificate Deductions Masters India

How To Claim Deduction In 80C incometax taxdeductions 80c

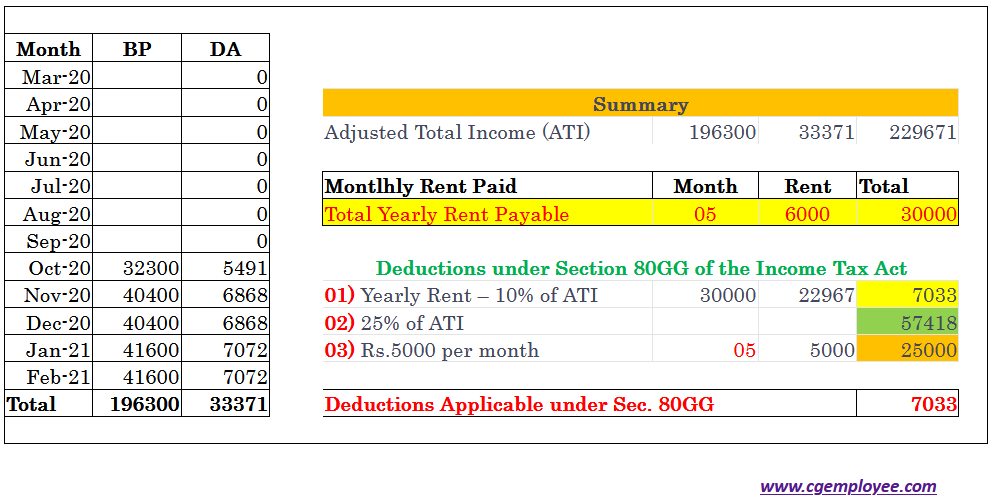

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

All About Section 80DDB Deduction For Treatment Of Specified Disease

How To Claim Deduction Under Section 80C Without Making Any Investment

54F Requirements To Claim Exemptions Under Section 54F Of Income Tax Act

https://tax2win.in/guide/section-80ddb

Section 80DDB For certain specific diseases IT Department offers tax deductions to individuals HUFs under Section 80DDB based on expenses incurred by him Learn how to claim form format documents required filing procedure

https://www.acko.com/income-tax/how-to-get...

Individual taxpayers who have incurred medical expenses for specific diseases or conditions may claim deductions under Income Tax Act Section 80DDB The taxpayer or a dependent such as a spouse kid or parent can be eligible The maximum allowable deduction is Rs 40 000 Rs 1 lakh for senior citizens or exact expenses

Section 80DDB For certain specific diseases IT Department offers tax deductions to individuals HUFs under Section 80DDB based on expenses incurred by him Learn how to claim form format documents required filing procedure

Individual taxpayers who have incurred medical expenses for specific diseases or conditions may claim deductions under Income Tax Act Section 80DDB The taxpayer or a dependent such as a spouse kid or parent can be eligible The maximum allowable deduction is Rs 40 000 Rs 1 lakh for senior citizens or exact expenses

All About Section 80DDB Deduction For Treatment Of Specified Disease

How To Claim Deduction In 80C incometax taxdeductions 80c

How To Claim Deduction Under Section 80C Without Making Any Investment

54F Requirements To Claim Exemptions Under Section 54F Of Income Tax Act

Section 80TTA How You Can Claim Tax Deduction

Deduction Under Section 80DDB L Certificate For Deduction L Amount Of

Deduction Under Section 80DDB L Certificate For Deduction L Amount Of

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog