In the digital age, where screens rule our lives and the appeal of physical printed objects hasn't waned. If it's to aid in education and creative work, or simply adding the personal touch to your space, How To Claim Maryland Student Loan Debt Relief Tax Credit have become an invaluable source. With this guide, you'll take a dive into the sphere of "How To Claim Maryland Student Loan Debt Relief Tax Credit," exploring what they are, how to get them, as well as how they can enhance various aspects of your life.

Get Latest How To Claim Maryland Student Loan Debt Relief Tax Credit Below

How To Claim Maryland Student Loan Debt Relief Tax Credit

How To Claim Maryland Student Loan Debt Relief Tax Credit -

Maryland taxpayers who have incurred at least 20 000 in undergraduate and or graduate student loan debt and have at least 5 000 in outstanding student loan debt are

This Student Loan Debt Relief Tax Credit Application is for full year Maryland residents and part year Maryland residents who wish to claim the Student Loan Debt Relief

How To Claim Maryland Student Loan Debt Relief Tax Credit provide a diverse range of printable, free materials available online at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages and more. One of the advantages of How To Claim Maryland Student Loan Debt Relief Tax Credit lies in their versatility and accessibility.

More of How To Claim Maryland Student Loan Debt Relief Tax Credit

Application Process Opens For Student Loan Debt Relief Tax Credit

Application Process Opens For Student Loan Debt Relief Tax Credit

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part year Residents This application and the related instructions are for Maryland

A qualified individual wishing to claim the Maryland Student Loan Debt Relief Tax Credit must submit an annual application to the Maryland Higher Education Commission MHEC 5 If

How To Claim Maryland Student Loan Debt Relief Tax Credit have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Modifications: There is the possibility of tailoring printables to fit your particular needs, whether it's designing invitations planning your schedule or even decorating your house.

-

Educational value: Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them an essential instrument for parents and teachers.

-

Simple: You have instant access many designs and templates is time-saving and saves effort.

Where to Find more How To Claim Maryland Student Loan Debt Relief Tax Credit

Student Loan Forgiveness Won t Come Cheap For Borrowers In Certain

Student Loan Forgiveness Won t Come Cheap For Borrowers In Certain

To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20 000 in undergraduate and or

Complete the Maryland Student Loan Debt Relief Tax Credit Application as instructed below SUPPORTING DOCUMENTATION The following documents are required to be included with

We hope we've stimulated your curiosity about How To Claim Maryland Student Loan Debt Relief Tax Credit Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in How To Claim Maryland Student Loan Debt Relief Tax Credit for different reasons.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide array of topics, ranging that range from DIY projects to party planning.

Maximizing How To Claim Maryland Student Loan Debt Relief Tax Credit

Here are some new ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

How To Claim Maryland Student Loan Debt Relief Tax Credit are a treasure trove of fun and practical tools that can meet the needs of a variety of people and desires. Their access and versatility makes them an essential part of both personal and professional life. Explore the vast array of How To Claim Maryland Student Loan Debt Relief Tax Credit now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are How To Claim Maryland Student Loan Debt Relief Tax Credit really gratis?

- Yes you can! You can print and download the resources for free.

-

Can I make use of free printables for commercial use?

- It is contingent on the specific conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables could have limitations on use. Make sure to read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home using a printer or visit any local print store for better quality prints.

-

What program is required to open printables that are free?

- A majority of printed materials are in PDF format. They can be opened using free software like Adobe Reader.

Marylanders Have Less Than One Month To Apply For Student Loan Debt

Applications Close Thursday For Maryland Student Loan Debt Relief Tax

Check more sample of How To Claim Maryland Student Loan Debt Relief Tax Credit below

MHEC Student Loan Debt Relief Tax Credit Program For 2022 Apply By

Applications Close Thursday For Maryland Student Loan Debt Relief Tax

Biden s Student Loan Forgiveness Program Remains Blocked Here Are

Maryland Offers Student Loan Debt Relief I95 Business

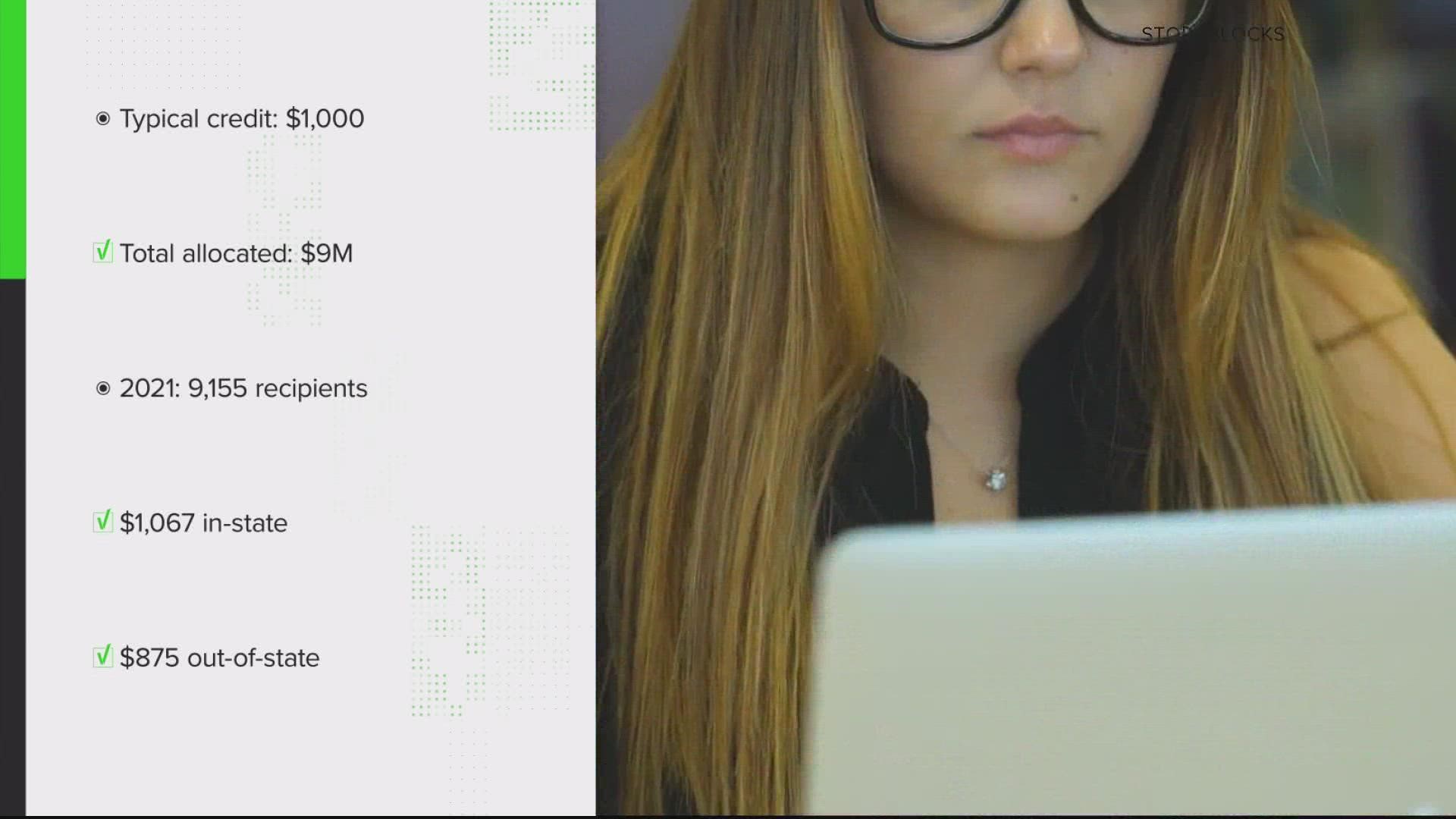

9M In More Tax Credits Available For Maryland Student Loan Debt

How Do Student Loans Appear On Your Credit Report CreditRepair

https://onestop.md.gov › forms

This Student Loan Debt Relief Tax Credit Application is for full year Maryland residents and part year Maryland residents who wish to claim the Student Loan Debt Relief

https://mhec.maryland.gov › Pages › Maryland_s-Student...

The Maryland Higher Education Commission s Student Loan Debt Relief Tax Credit SLDRTC program provides 18 million in tax credits to Maryland residents filing their 2024 tax returns

This Student Loan Debt Relief Tax Credit Application is for full year Maryland residents and part year Maryland residents who wish to claim the Student Loan Debt Relief

The Maryland Higher Education Commission s Student Loan Debt Relief Tax Credit SLDRTC program provides 18 million in tax credits to Maryland residents filing their 2024 tax returns

Maryland Offers Student Loan Debt Relief I95 Business

Applications Close Thursday For Maryland Student Loan Debt Relief Tax

9M In More Tax Credits Available For Maryland Student Loan Debt

How Do Student Loans Appear On Your Credit Report CreditRepair

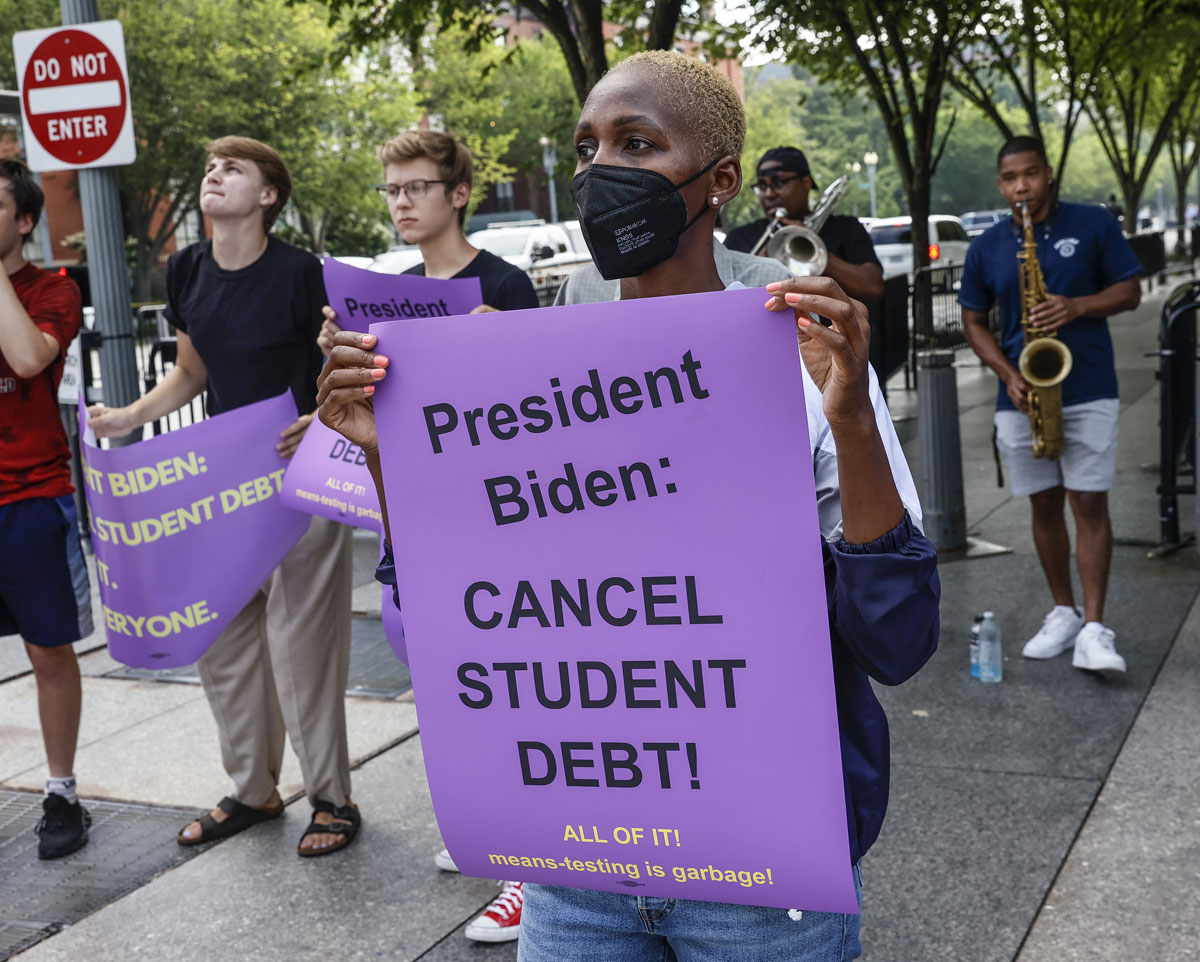

The Student Debt Crisis Has More Artists Calling For A Cancellation Of

Deadline Approaching For Maryland Student Loan Debt Relief Tax Credit

Deadline Approaching For Maryland Student Loan Debt Relief Tax Credit

More Student Loan Relief Available For Maryland Taxpayers Wusa9