In this day and age when screens dominate our lives however, the attraction of tangible printed material hasn't diminished. In the case of educational materials or creative projects, or simply adding a personal touch to your area, How To Claim Tax Credit For Energy Efficient Appliances have proven to be a valuable resource. Here, we'll take a dive into the world "How To Claim Tax Credit For Energy Efficient Appliances," exploring what they are, where they are, and the ways that they can benefit different aspects of your daily life.

Get Latest How To Claim Tax Credit For Energy Efficient Appliances Below

How To Claim Tax Credit For Energy Efficient Appliances

How To Claim Tax Credit For Energy Efficient Appliances -

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product and services

How do you claim energy efficient tax credits on your tax return To claim the credits you ll need IRS Form 5695 Work out the credit amount on that form then enter it on your Form 1040

The How To Claim Tax Credit For Energy Efficient Appliances are a huge array of printable content that can be downloaded from the internet at no cost. They are available in numerous forms, including worksheets, templates, coloring pages and much more. The beauty of How To Claim Tax Credit For Energy Efficient Appliances is their flexibility and accessibility.

More of How To Claim Tax Credit For Energy Efficient Appliances

Time To Get Tax Credit For Energy efficient Update Tax Credits How

Time To Get Tax Credit For Energy efficient Update Tax Credits How

You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who improve their primary residence will find the most opportunities to claim a credit for qualifying expenses

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization They can make the templates to meet your individual needs whether you're designing invitations and schedules, or decorating your home.

-

Educational Impact: Education-related printables at no charge provide for students of all ages. This makes these printables a powerful aid for parents as well as educators.

-

Easy to use: Fast access a myriad of designs as well as templates can save you time and energy.

Where to Find more How To Claim Tax Credit For Energy Efficient Appliances

Ways To Claim Tax Credit For Going Green Integrated Tax Services

Ways To Claim Tax Credit For Going Green Integrated Tax Services

You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many state and local governments and utility companies offer incentives or rebates for energy or water saving home improvements

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts

We've now piqued your interest in How To Claim Tax Credit For Energy Efficient Appliances Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of How To Claim Tax Credit For Energy Efficient Appliances for various applications.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing How To Claim Tax Credit For Energy Efficient Appliances

Here are some innovative ways create the maximum value use of How To Claim Tax Credit For Energy Efficient Appliances:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How To Claim Tax Credit For Energy Efficient Appliances are an abundance with useful and creative ideas designed to meet a range of needs and needs and. Their accessibility and versatility make them a great addition to any professional or personal life. Explore the vast array that is How To Claim Tax Credit For Energy Efficient Appliances today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can print and download these documents for free.

-

Can I utilize free printables in commercial projects?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright issues when you download How To Claim Tax Credit For Energy Efficient Appliances?

- Certain printables might have limitations in their usage. Always read the terms of service and conditions provided by the creator.

-

How do I print How To Claim Tax Credit For Energy Efficient Appliances?

- You can print them at home with any printer or head to any local print store for superior prints.

-

What software will I need to access How To Claim Tax Credit For Energy Efficient Appliances?

- Most printables come in PDF format, which can be opened using free programs like Adobe Reader.

How To Claim The Solar Tax Credit YouTube

Blog Totara Hospice

Check more sample of How To Claim Tax Credit For Energy Efficient Appliances below

Is There A Tax Credit For Energy Efficient Appliances

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How To Claim Tax Credit For Income Earned Outside India incometax

Is There A Tax Credit For Energy Efficient Appliances

Is There A Tax Credit For Energy Efficient Appliances

UK Government Rape Clause For Claiming Child Benefit Inhuman And

https://turbotax.intuit.com › tax-tips › going-green › ...

How do you claim energy efficient tax credits on your tax return To claim the credits you ll need IRS Form 5695 Work out the credit amount on that form then enter it on your Form 1040

https://www.energystar.gov › about › federal-tax-credits

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

How do you claim energy efficient tax credits on your tax return To claim the credits you ll need IRS Form 5695 Work out the credit amount on that form then enter it on your Form 1040

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Is There A Tax Credit For Energy Efficient Appliances

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Is There A Tax Credit For Energy Efficient Appliances

UK Government Rape Clause For Claiming Child Benefit Inhuman And

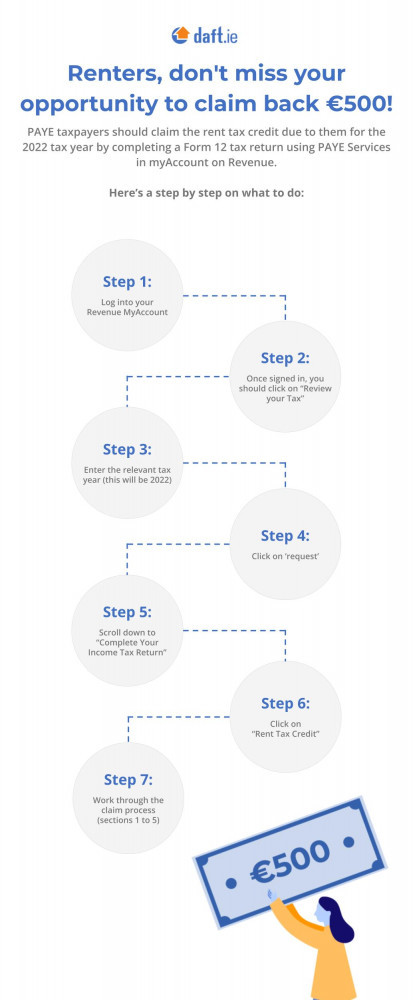

Learn How To Claim The New Rental Tax Credit With This Handy Guide From

How To Claim Tax Benefits On Home Loans Sec 80C 24B Navi Hindi

How To Claim Tax Benefits On Home Loans Sec 80C 24B Navi Hindi

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC