In this age of electronic devices, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses in creative or artistic projects, or just adding the personal touch to your area, How To Get Tax Exemption On Fd Interest have become a valuable resource. We'll take a dive deeper into "How To Get Tax Exemption On Fd Interest," exploring what they are, how they can be found, and how they can enhance various aspects of your daily life.

Get Latest How To Get Tax Exemption On Fd Interest Below

How To Get Tax Exemption On Fd Interest

How To Get Tax Exemption On Fd Interest -

Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in period of 5 years Interest earned is taxable The rate of interest ranges from 5 5 7 75 Benefits of Tax Saving Fixed Deposits

Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks

How To Get Tax Exemption On Fd Interest cover a large assortment of printable materials that are accessible online for free cost. They come in many forms, including worksheets, templates, coloring pages and many more. The appealingness of How To Get Tax Exemption On Fd Interest is in their versatility and accessibility.

More of How To Get Tax Exemption On Fd Interest

How To Get Tax Exempt On Amazon For Dropshipping Amazon Tax Exemption

How To Get Tax Exempt On Amazon For Dropshipping Amazon Tax Exemption

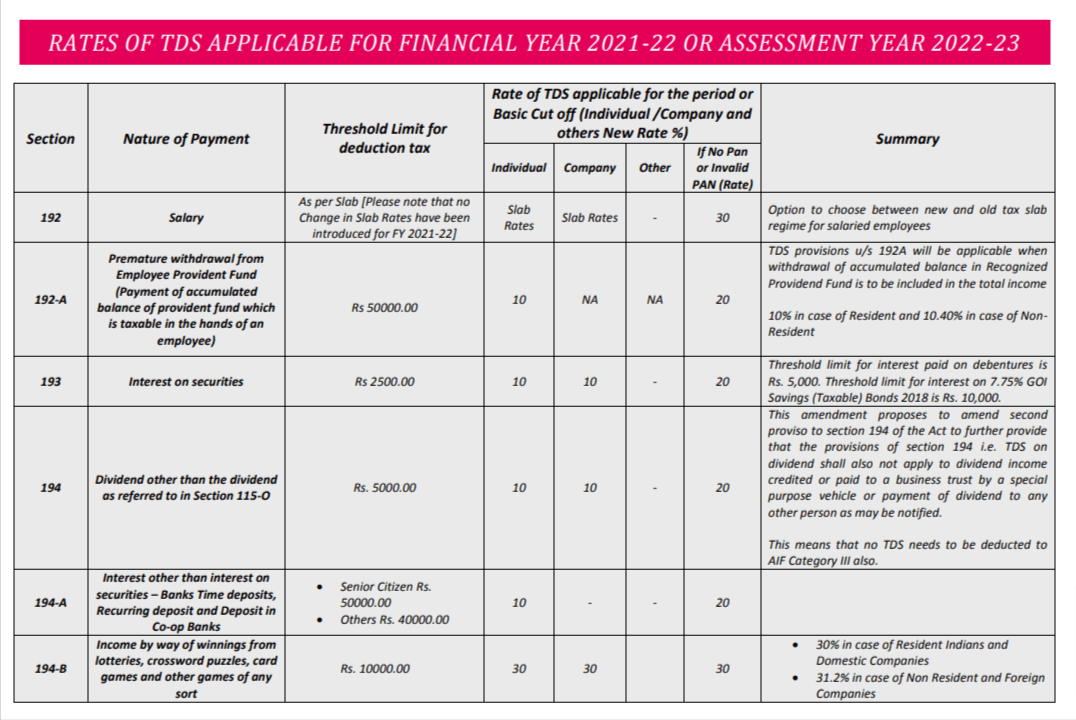

Like your regular income the interest earned from Fixed Deposits FDs is subject to tax deductions This deducted tax is known as Tax Deducted at Source TDS Whether the fixed deposit is with a bank post office or NBFC TDS is deducted in accordance with income tax regulations

Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can reinvest the sum for another term Loan against FDs are available

How To Get Tax Exemption On Fd Interest have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Individualization We can customize designs to suit your personal needs such as designing invitations or arranging your schedule or even decorating your house.

-

Educational Impact: Free educational printables offer a wide range of educational content for learners from all ages, making them an essential tool for teachers and parents.

-

An easy way to access HTML0: You have instant access a myriad of designs as well as templates can save you time and energy.

Where to Find more How To Get Tax Exemption On Fd Interest

Tax On Fixed Deposit Interest Rates

Tax On Fixed Deposit Interest Rates

Interest from an FD is fully taxable if your interest earnings exceed 40 000 in a financial year Under Section 80TTB of the aforementioned act the tax exemption limit on FD interest for senior citizens is 50 000 A 10 Tax Deducted at Source TDS applies to your annual interest earnings

If you are a senior citizen i e aged 60 years or above you can claim a deduction on the fixed deposit interest under Section 80TTB of the Income Tax Act 1961 For this the annual interest income from

If we've already piqued your interest in How To Get Tax Exemption On Fd Interest Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of How To Get Tax Exemption On Fd Interest for various motives.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs are a vast array of topics, ranging everything from DIY projects to planning a party.

Maximizing How To Get Tax Exemption On Fd Interest

Here are some new ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

How To Get Tax Exemption On Fd Interest are a treasure trove of useful and creative resources designed to meet a range of needs and desires. Their accessibility and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the plethora of How To Get Tax Exemption On Fd Interest right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can print and download these items for free.

-

Can I make use of free printables for commercial uses?

- It's based on specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with How To Get Tax Exemption On Fd Interest?

- Certain printables may be subject to restrictions in their usage. Make sure you read the terms of service and conditions provided by the creator.

-

How can I print How To Get Tax Exemption On Fd Interest?

- Print them at home with any printer or head to an area print shop for superior prints.

-

What program is required to open printables free of charge?

- The majority of printables are as PDF files, which can be opened with free software such as Adobe Reader.

HOW TO SAVE TDS ON FD INTEREST I TDS On FD Interest I TDS ON FD

People Aged 75 May Not Have To Pay 10 TDS On FD Interest Mint

Check more sample of How To Get Tax Exemption On Fd Interest below

Tax TDS On FD Interest Digiforum Space

TDS Rate On FD Interest

Income Tax Rates For Fy 2022 23 Pdf Download Pay Period Calendars 2023

TDS On FD Interest When How To Pay Income Tax On FDs

Example Of Taxable Supplies Jspag

Check List Of Top 10 Banks Giving Interest Up To 7 5 On FD In Short

https://www.paisabazaar.com/fixed-deposit/tax...

Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks

https://www.livemint.com/money/ask-mint-money/how...

To claim the tax refund already deducted by the bank it is necessary to file her income tax return ITR Please note that your mother can not file her ITR because she does not have a

Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks

To claim the tax refund already deducted by the bank it is necessary to file her income tax return ITR Please note that your mother can not file her ITR because she does not have a

TDS On FD Interest When How To Pay Income Tax On FDs

TDS Rate On FD Interest

Example Of Taxable Supplies Jspag

Check List Of Top 10 Banks Giving Interest Up To 7 5 On FD In Short

Income Tax Exemption Big News Senior Citizens Can Avoid Paying 10

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Income Tax On Interest On Savings Bank FD Account In India Fintrakk