In the age of digital, where screens have become the dominant feature of our lives, the charm of tangible printed products hasn't decreased. In the case of educational materials as well as creative projects or simply adding personal touches to your space, Hra Deduction In Itr can be an excellent source. We'll take a dive in the world of "Hra Deduction In Itr," exploring what they are, how to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest Hra Deduction In Itr Below

Hra Deduction In Itr

Hra Deduction In Itr -

Contents What is HRA House Rent Allowance Eligibility Criteria to Claim Tax Deductions On HRA How much HRA exemption is available under the income tax act How to Calculate HRA Exemption Documents Required to Claim HRA Tax Exemption How to Claim HRA Exemption at the Time of Filing ITR

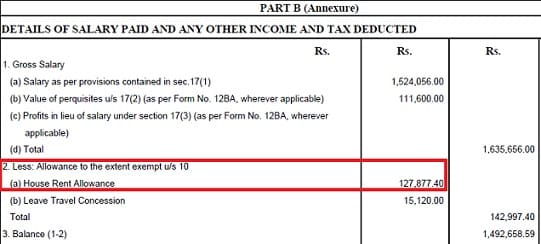

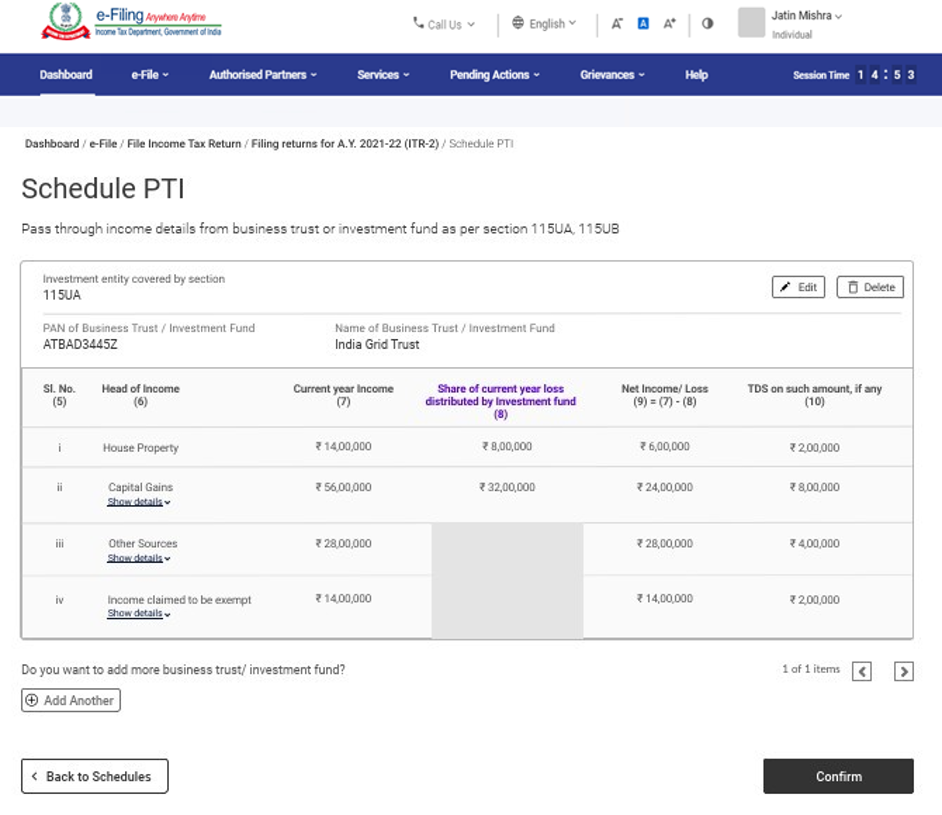

While filing your return you will have to deduct the tax exempt HRA amount from the Gross salary Salary as per provision under section 17 Make sure to provide the correct details including the correct tax exempt amount of HRA in your ITR otherwise the income tax department may ask you to submit documents for proof of the HRA

Hra Deduction In Itr include a broad assortment of printable materials online, at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Hra Deduction In Itr

How To Show HRA Not Accounted By The Employer In ITR

How To Show HRA Not Accounted By The Employer In ITR

What is House Rent Allowance HRA House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in rental premises can claim exemption of House Rent Allowance u s 10 13A

Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees

Hra Deduction In Itr have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization: They can make printed materials to meet your requirements in designing invitations, organizing your schedule, or even decorating your house.

-

Education Value Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them a useful aid for parents as well as educators.

-

Simple: You have instant access a variety of designs and templates cuts down on time and efforts.

Where to Find more Hra Deduction In Itr

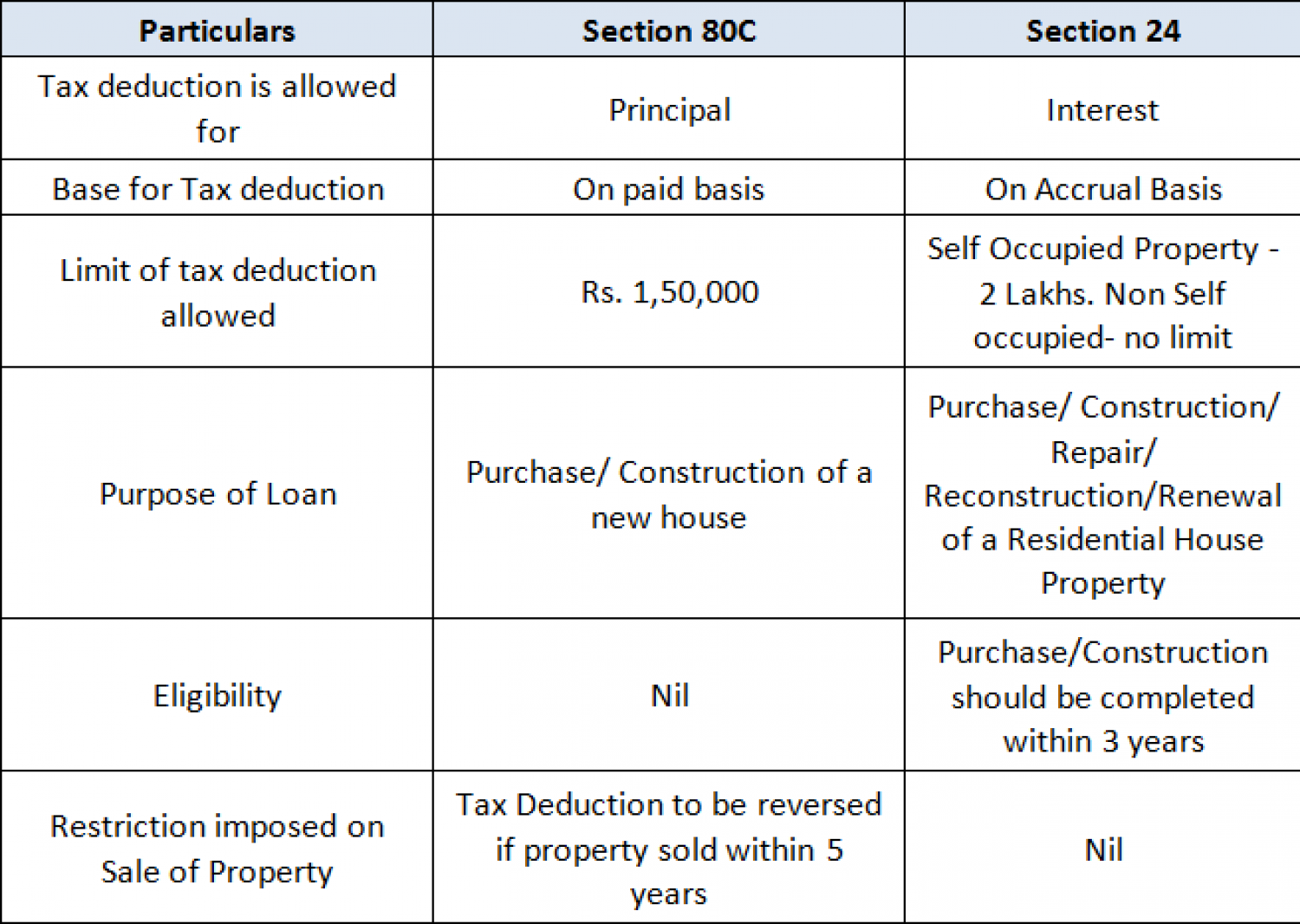

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Discover the eligibility criteria necessary documents and key considerations to ensure a smooth and successful HRA claim in your ITR Maximize your tax benefits with this valuable resource on claiming HRA in your income tax return

If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2024 If you receive HRA you can use this calculator

Now that we've piqued your interest in printables for free and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Hra Deduction In Itr suitable for many needs.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad selection of subjects, all the way from DIY projects to planning a party.

Maximizing Hra Deduction In Itr

Here are some inventive ways how you could make the most of Hra Deduction In Itr:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Hra Deduction In Itr are an abundance with useful and creative ideas that cater to various needs and interests. Their access and versatility makes them an invaluable addition to each day life. Explore the wide world of Hra Deduction In Itr and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can print and download the resources for free.

-

Can I download free printouts for commercial usage?

- It depends on the specific terms of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with Hra Deduction In Itr?

- Certain printables may be subject to restrictions in use. Be sure to review the terms and conditions offered by the author.

-

How can I print Hra Deduction In Itr?

- You can print them at home with your printer or visit a local print shop to purchase higher quality prints.

-

What program is required to open Hra Deduction In Itr?

- Most PDF-based printables are available in PDF format. These can be opened using free software like Adobe Reader.

ITR Filing How To Claim HRA Exemption India Today

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Check more sample of Hra Deduction In Itr below

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

HRA Calculation Income Tax 2023 HRA Exemption For Salaried Employee

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Income Tax Savings HRA

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

Itr What Is Deduction In

https://blog.saginfotech.com/claim-hra-filing-income-tax-return

While filing your return you will have to deduct the tax exempt HRA amount from the Gross salary Salary as per provision under section 17 Make sure to provide the correct details including the correct tax exempt amount of HRA in your ITR otherwise the income tax department may ask you to submit documents for proof of the HRA

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

While filing your return you will have to deduct the tax exempt HRA amount from the Gross salary Salary as per provision under section 17 Make sure to provide the correct details including the correct tax exempt amount of HRA in your ITR otherwise the income tax department may ask you to submit documents for proof of the HRA

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Income Tax Savings HRA

HRA Calculation Income Tax 2023 HRA Exemption For Salaried Employee

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

Itr What Is Deduction In

2 Income Tax Department

Mediclaim For Independent Parents Can You Claim Deduction In ITR

Mediclaim For Independent Parents Can You Claim Deduction In ITR

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving