In the age of digital, where screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses in creative or artistic projects, or just adding some personal flair to your space, Huf 80c Benefits can be an excellent source. Through this post, we'll dive to the depths of "Huf 80c Benefits," exploring what they are, how you can find them, and how they can improve various aspects of your daily life.

Get Latest Huf 80c Benefits Below

Huf 80c Benefits

Huf 80c Benefits -

Income Tax Benefits are available to Individual HUFs for AY 2024 25 Claim reliefs rebates of up to Rs 2 5 lakhs Senior Super Senior Citizens can get up to Rs 3 lakhs 5 lakhs respectively

The HUF can pay life insurance premium on the life of its members and clam the tax benefits under section 80C So in case your limit of Section 80 C of Rs 1 50 lakhs gets exhausted you can pay the life insurance premium on the life of any member of HUF and claim it here

Huf 80c Benefits offer a wide selection of printable and downloadable items that are available online at no cost. These materials come in a variety of forms, including worksheets, templates, coloring pages, and more. The attraction of printables that are free is in their versatility and accessibility.

More of Huf 80c Benefits

HUF Tax Planning HUF 80C

HUF Tax Planning HUF 80C

HUF is a separate legal entity from its members The tax benefits of HUF include exemption of up to 2 5 Lakhs and deductions u s 80

The income tax slab for HUF is same as that of an individual with an exemption limit of Rs 2 5 lakh and qualifies for all the tax benefits under Section 80C 80D 80G and so on It also enjoys exemptions under Section 54 and 54F with respect to capital gains Creating an HUF

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: They can make printed materials to meet your requirements for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Value: Printables for education that are free offer a wide range of educational content for learners from all ages, making the perfect device for teachers and parents.

-

The convenience of The instant accessibility to many designs and templates will save you time and effort.

Where to Find more Huf 80c Benefits

Section 80C 80CCC 80CCD Income Tax Deduction For Individual And HUF

Section 80C 80CCC 80CCD Income Tax Deduction For Individual And HUF

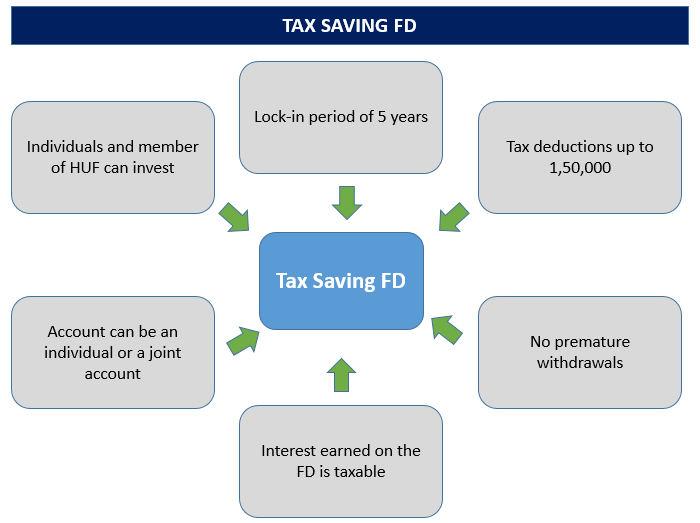

Section 80C of the Income Tax Act allows an individual and a Hindu Undivided Family HUF to claim a deduction of Rs 1 50 lakh on certain eligible expenditures and investments One of the items is the premium paid for a

HUF can claim deductions under Section 80C towards the investments or expenses such as life insurance premiums for members tuition fees for children s education and contributions to provident funds and likewise The limit of Section 80C for maximum deduction of INR 1 50 000 is also applicable

In the event that we've stirred your interest in Huf 80c Benefits Let's look into where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Huf 80c Benefits for all goals.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs covered cover a wide range of topics, including DIY projects to party planning.

Maximizing Huf 80c Benefits

Here are some ideas of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Huf 80c Benefits are an abundance of useful and creative resources that satisfy a wide range of requirements and hobbies. Their availability and versatility make them a valuable addition to both professional and personal life. Explore the endless world of Huf 80c Benefits today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can download and print these materials for free.

-

Do I have the right to use free printables to make commercial products?

- It's dependent on the particular conditions of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may contain restrictions regarding usage. You should read the conditions and terms of use provided by the author.

-

How do I print Huf 80c Benefits?

- You can print them at home with any printer or head to any local print store for superior prints.

-

What software do I need in order to open printables that are free?

- The majority are printed in PDF format. They can be opened with free software such as Adobe Reader.

Deductions Under Chapter VIA

Tax Saving Investment Income Tax Deduction U s 80C For Individual And

Check more sample of Huf 80c Benefits below

List Of Deductions Under Section 80C Finserv MARKETS

Tax Savings Tips For Investors Beyond 80C Benefits YouTube

Myth No 5 Section 80C Benefits Are Available Only On Investments Or

Fortune India Business News Strategy Finance And Corporate Insight

Get Section 80C Benefits By Investing In ELSS ELSS Sahi Hai YouTube

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://taxguru.in/income-tax/tax-benefits-huf.html

The HUF can pay life insurance premium on the life of its members and clam the tax benefits under section 80C So in case your limit of Section 80 C of Rs 1 50 lakhs gets exhausted you can pay the life insurance premium on the life of any member of HUF and claim it here

https://www.incometax.gov.in/iec/foportal/help/individual/return...

The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI or Artificial Juridical Person

The HUF can pay life insurance premium on the life of its members and clam the tax benefits under section 80C So in case your limit of Section 80 C of Rs 1 50 lakhs gets exhausted you can pay the life insurance premium on the life of any member of HUF and claim it here

The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI or Artificial Juridical Person

Fortune India Business News Strategy Finance And Corporate Insight

Tax Savings Tips For Investors Beyond 80C Benefits YouTube

Get Section 80C Benefits By Investing In ELSS ELSS Sahi Hai YouTube

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Remittance Of Assets By Non Resident KL Aggarwal Associates

Analysing Tax Deductions In India And Exemptions On Life Insurance

Analysing Tax Deductions In India And Exemptions On Life Insurance

Investment Plans Save Money Online Policyworld