In this digital age, where screens rule our lives however, the attraction of tangible printed objects hasn't waned. Be it for educational use such as creative projects or simply adding some personal flair to your space, Illinois State Tax Deductions are now a useful resource. For this piece, we'll dive deeper into "Illinois State Tax Deductions," exploring what they are, where they are, and how they can enrich various aspects of your daily life.

Get Latest Illinois State Tax Deductions Below

Illinois State Tax Deductions

Illinois State Tax Deductions -

The due date for filing your 2023 Form IL 1040 and paying any tax you owe is April 15 2024 Income Tax Rate The Illinois income tax rate is 4 95 percent 0495 Exemption Allowance Per Public Act 103 0009 the personal exemption amount for

SmartAsset s Illinois paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

Illinois State Tax Deductions offer a wide array of printable materials available online at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and much more. The beauty of Illinois State Tax Deductions is in their versatility and accessibility.

More of Illinois State Tax Deductions

Illinois Governor Signs Bill Allowing Marijuana Businesses To Take

Illinois Governor Signs Bill Allowing Marijuana Businesses To Take

Find out how much you ll pay in Illinois state income taxes given your annual income Customize using your filing status deductions exemptions and more Menu burger

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your

Illinois State Tax Deductions have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: You can tailor designs to suit your personal needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Worth: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making these printables a powerful tool for teachers and parents.

-

The convenience of Access to a variety of designs and templates cuts down on time and efforts.

Where to Find more Illinois State Tax Deductions

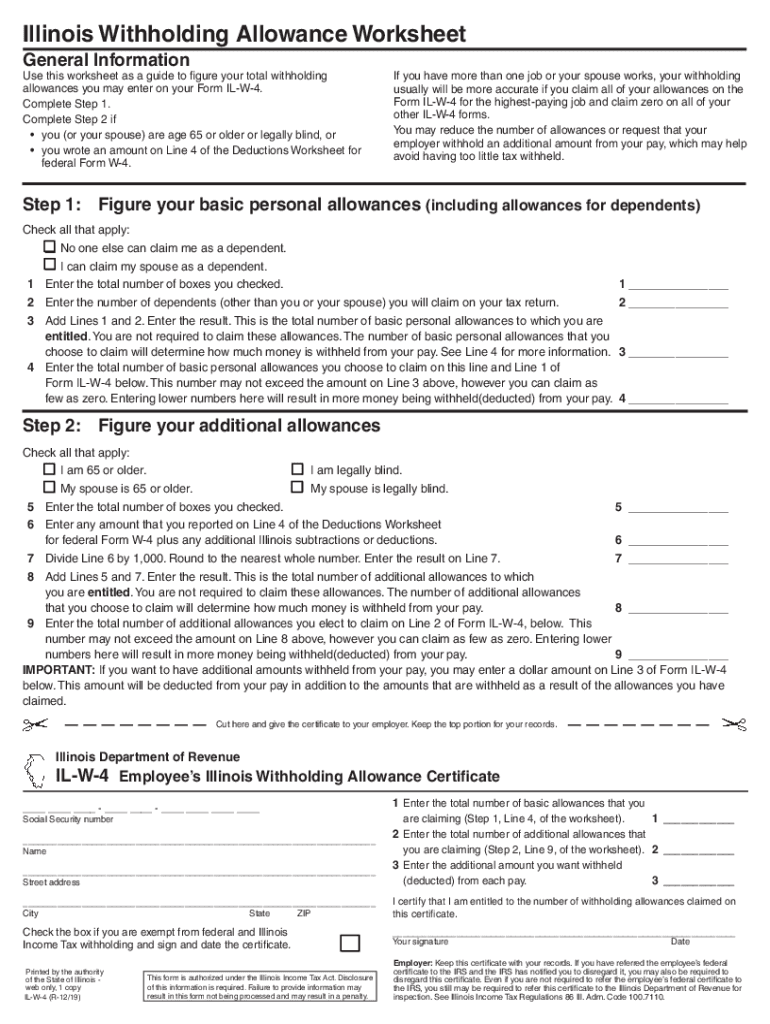

Worksheet A Withholding Allowances 2021 2022 Ford Gettrip24

Worksheet A Withholding Allowances 2021 2022 Ford Gettrip24

A tax credit used by millions of Illinois residents that lawmakers quietly pared back last year is getting more generous in the new state budget approved by the legislature and awaiting Gov J B Pritzker s signature It s

An Illinois resident who worked in Iowa Kentucky Michigan or Wisconsin you must file Form IL 1040 and include as Illinois income any compensation you received from an employer in these states Compensation paid to Illinois residents working in these states is taxed by Illinois

After we've peaked your interest in printables for free and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of motives.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs are a vast array of topics, ranging everything from DIY projects to party planning.

Maximizing Illinois State Tax Deductions

Here are some unique ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home, or even in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Illinois State Tax Deductions are an abundance of innovative and useful resources catering to different needs and pursuits. Their availability and versatility make them a great addition to both professional and personal lives. Explore the world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I use the free printables in commercial projects?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download Illinois State Tax Deductions?

- Certain printables might have limitations on their use. You should read these terms and conditions as set out by the creator.

-

How can I print Illinois State Tax Deductions?

- You can print them at home with either a printer or go to an area print shop for top quality prints.

-

What software do I require to view Illinois State Tax Deductions?

- The majority of PDF documents are provided in the format PDF. This can be opened using free software such as Adobe Reader.

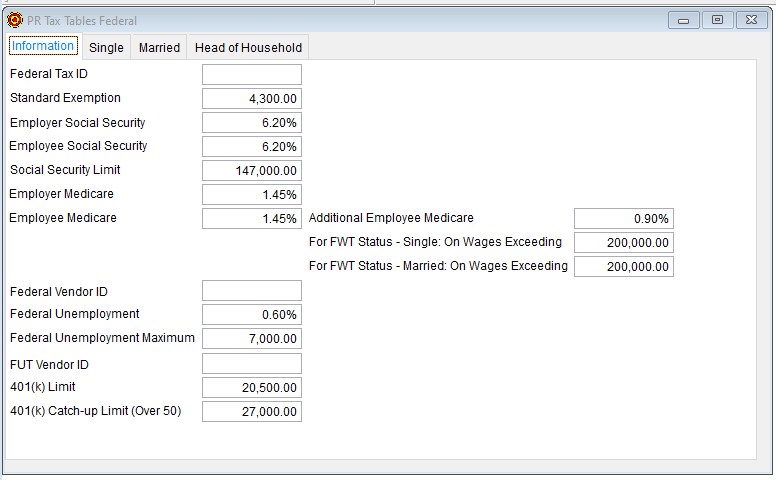

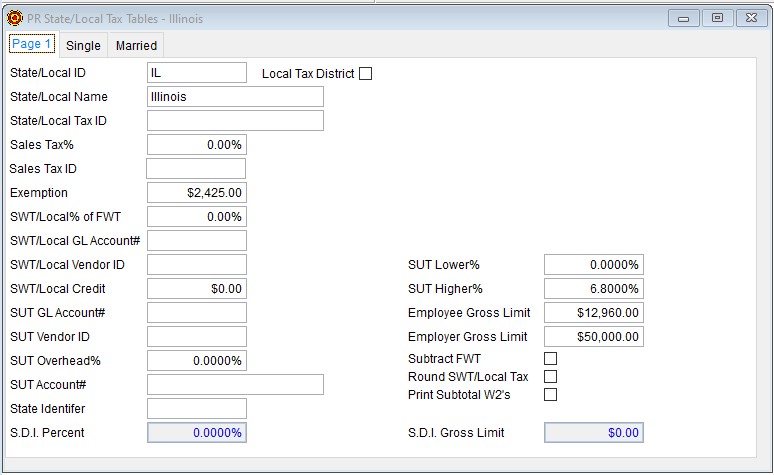

2022 Federal Illinois State Tax Information For Visual ContrAcct

Illinois Withholding Allowance Worksheet Examples Pdf Tripmart

Check more sample of Illinois State Tax Deductions below

Illinois Tax Forms 2022 Printable State IL 1040 Form And IL 1040

Illinois Lawmakers Pass Bill Allowing Marijuana Businesses To Claim Tax

Pin On Business Template

Illinois Lawmakers Approve Bill To Allow Cannabis Businesses To Claim

In High Tax States Such As Illinois There s Plenty At Stake In

:quality(70):focal(888x872:898x882)/cloudfront-us-east-1.images.arcpublishing.com/tronc/RCIE5ZAPZ5CXFGIYBIJTN7ETQY.jpg)

2022 Federal Illinois State Tax Information For Visual ContrAcct

https://smartasset.com/taxes/illinois-paycheck-calculator

SmartAsset s Illinois paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

https://il-us.icalculator.com/income-tax-rates/2024.html

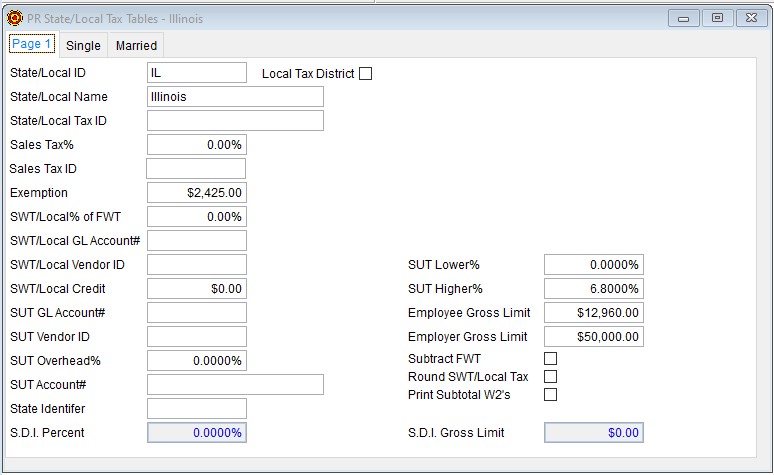

Illinois provides a standard Personal Exemption tax deduction of 2 625 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024 The federal standard deduction for a Single Filer in 2024 is 14 600 00

SmartAsset s Illinois paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

Illinois provides a standard Personal Exemption tax deduction of 2 625 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024 The federal standard deduction for a Single Filer in 2024 is 14 600 00

Illinois Lawmakers Approve Bill To Allow Cannabis Businesses To Claim

Illinois Lawmakers Pass Bill Allowing Marijuana Businesses To Claim Tax

:quality(70):focal(888x872:898x882)/cloudfront-us-east-1.images.arcpublishing.com/tronc/RCIE5ZAPZ5CXFGIYBIJTN7ETQY.jpg)

In High Tax States Such As Illinois There s Plenty At Stake In

2022 Federal Illinois State Tax Information For Visual ContrAcct

Illinois Employee Withholding Allowance Certificate IL W 4 Form DocHub

Illinois Salary After Tax Calculator 2024 ICalculator

Illinois Salary After Tax Calculator 2024 ICalculator

Actor Tax Deductions Worksheet