In this day and age where screens have become the dominant feature of our lives yet the appeal of tangible printed materials isn't diminishing. If it's to aid in education as well as creative projects or simply adding personal touches to your home, printables for free have become an invaluable source. For this piece, we'll take a dive through the vast world of "Import Tax Refund Canada," exploring the different types of printables, where to find them, and how they can add value to various aspects of your lives.

Get Latest Import Tax Refund Canada Below

Import Tax Refund Canada

Import Tax Refund Canada -

The good news is when you return your goods that have been imported into Canada you are able to apply for a refund of the Canadian duties and taxes paid on the original purchase You can apply with Canada Border Services Agency CBSA and their Casual Refund Program

If you import or export goods or services you may have to collect or pay the GST HST How this tax is applied depends on the specific goods or service whether you are a resident or non resident of Canada the province you

Printables for free cover a broad assortment of printable, downloadable materials available online at no cost. These printables come in different designs, including worksheets coloring pages, templates and much more. The appealingness of Import Tax Refund Canada is in their versatility and accessibility.

More of Import Tax Refund Canada

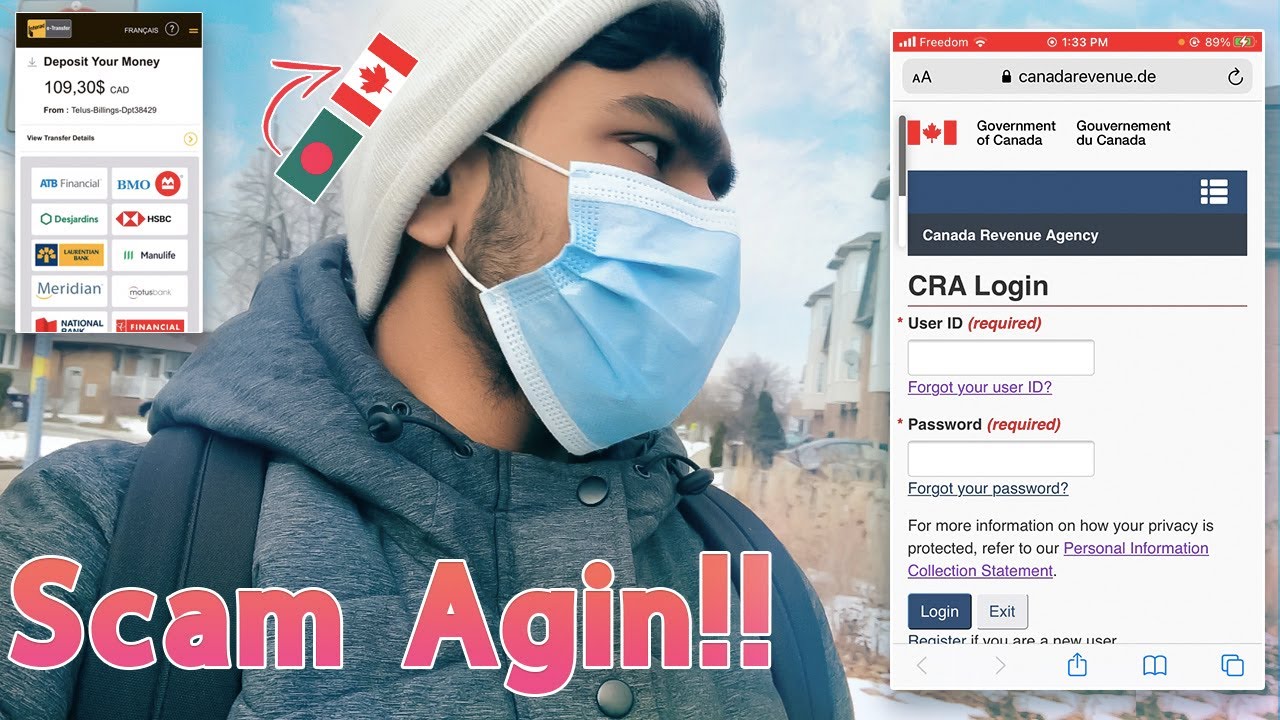

Canada Revenue Agency Free Tax Refund YouTube

Canada Revenue Agency Free Tax Refund YouTube

When you return an item to a foreign supplier whether by mail or by hand you re entitled to a refund on the duties GST HST and provincial taxes that you paid to get the item into Canada The process can be a little confusing but we ll break it down for you Keep reading to find out how to claim duty back

Canadian importers of steel and aluminum products and electric vehicles EVs from China may benefit from new relief on recently announced surtaxes Finance has provided details on how Canadian businesses can request remission of surtaxes on these goods which will only apply in very limited circumstances and for a specific transition period

Import Tax Refund Canada have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization This allows you to modify print-ready templates to your specific requirements, whether it's designing invitations to organize your schedule or even decorating your home.

-

Educational Worth: Printing educational materials for no cost provide for students of all ages, making them an essential tool for parents and educators.

-

Convenience: The instant accessibility to numerous designs and templates cuts down on time and efforts.

Where to Find more Import Tax Refund Canada

Tax Refund Don ts And Dos NORTHERN RIVER Financial

Tax Refund Don ts And Dos NORTHERN RIVER Financial

Information for individuals on tax refunds refund interest how to check your tax refund status understand your refund and transfer your refund

The CBSA with their Drawback Program will provide a refund of customs duties paid for imported goods The program is intended to help offset the cost of importing goods that are later exported to another country

We've now piqued your interest in Import Tax Refund Canada Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Import Tax Refund Canada for different objectives.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging from DIY projects to party planning.

Maximizing Import Tax Refund Canada

Here are some inventive ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Import Tax Refund Canada are an abundance of fun and practical tools that can meet the needs of a variety of people and interest. Their accessibility and flexibility make them an invaluable addition to both personal and professional life. Explore the many options of Import Tax Refund Canada today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes, they are! You can download and print the resources for free.

-

Can I make use of free printables in commercial projects?

- It's contingent upon the specific usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with Import Tax Refund Canada?

- Some printables may contain restrictions on their use. Be sure to check the terms and conditions provided by the designer.

-

How do I print Import Tax Refund Canada?

- You can print them at home using either a printer at home or in a local print shop for high-quality prints.

-

What software do I need to run printables at no cost?

- The majority of PDF documents are provided in the format of PDF, which can be opened using free software like Adobe Reader.

Here s How To Claim Your Carbon Tax Refund From The Canadian Government

Pin On Real Estate Info Sandra Rakowska

Check more sample of Import Tax Refund Canada below

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

How To Get The Best Tax Refund Canada Blackspark Blackspark

How Long Does It Take To Get Your Tax Refund In Canada BCJ Group

Canadian Work Placement Tax Refund For International Students In Canada

Fee GIC Refund After Refusal Of Canada Study Visa Fee GIC Refund

Instant Tax Refund Online Tax Preparation Service Canada

https://www.canada.ca › en › revenue-agency › services › ...

If you import or export goods or services you may have to collect or pay the GST HST How this tax is applied depends on the specific goods or service whether you are a resident or non resident of Canada the province you

https://www.cbsa-asfc.gc.ca › publications › dm-md

Under prescribed conditions the Customs Act allows for a person who paid duties on imported goods to apply for and for the Minister to issue a refund of all or part of the duties and taxes collected on non commercial casual importations

If you import or export goods or services you may have to collect or pay the GST HST How this tax is applied depends on the specific goods or service whether you are a resident or non resident of Canada the province you

Under prescribed conditions the Customs Act allows for a person who paid duties on imported goods to apply for and for the Minister to issue a refund of all or part of the duties and taxes collected on non commercial casual importations

Canadian Work Placement Tax Refund For International Students In Canada

How To Get The Best Tax Refund Canada Blackspark Blackspark

Fee GIC Refund After Refusal Of Canada Study Visa Fee GIC Refund

Instant Tax Refund Online Tax Preparation Service Canada

Tax Refund Options In Canada WorkingHolidayinCanada

Everything You Need To Know About Getting Your Instant Tax Refund

Everything You Need To Know About Getting Your Instant Tax Refund

When Can I Expect My Tax Refund BCJ Group