In a world in which screens are the norm, the charm of tangible printed objects hasn't waned. Whatever the reason, whether for education, creative projects, or simply adding a personal touch to your home, printables for free are now a vital source. In this article, we'll take a dive in the world of "Income Limits For Residential Energy Credit," exploring their purpose, where to get them, as well as how they can enrich various aspects of your daily life.

Get Latest Income Limits For Residential Energy Credit Below

Income Limits For Residential Energy Credit

Income Limits For Residential Energy Credit -

Annual overall limitation The credit allowed for any tax year cannot exceed 1 200 Annual limitation for qualified energy property The credit allowed for any tax year with respect to any item of qualified energy property cannot exceed 600

There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

Printables for free cover a broad selection of printable and downloadable resources available online for download at no cost. These resources come in various designs, including worksheets templates, coloring pages, and many more. The beauty of Income Limits For Residential Energy Credit is their flexibility and accessibility.

More of Income Limits For Residential Energy Credit

Residential Energy Credit Application 2023 ElectricRate

Residential Energy Credit Application 2023 ElectricRate

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to

A total combined credit limit of 500 200 limit for windows for all tax years after 2005 The maximum credit for residential energy property costs is 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water boiler and 300 for any item of ener gy eficient building property

Income Limits For Residential Energy Credit have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: There is the possibility of tailoring printed materials to meet your requirements when it comes to designing invitations making your schedule, or even decorating your house.

-

Educational Value: The free educational worksheets are designed to appeal to students of all ages, which makes them a valuable source for educators and parents.

-

Simple: Instant access to numerous designs and templates can save you time and energy.

Where to Find more Income Limits For Residential Energy Credit

What You Need To Know About Energy Efficient Property Credits

What You Need To Know About Energy Efficient Property Credits

300 150 N A Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 Subject to cap of 1 200 year

There is no longer a 500 lifetime credit limit instead for qualified property placed in service on or after January 1 2023 and before January 1 2033 you can now claim up to 1 200 annually until 2033 when you make eligible improvements The limits are as follows 250 per exterior door and 500 total 600 for exterior windows and skylights

In the event that we've stirred your interest in Income Limits For Residential Energy Credit, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Income Limits For Residential Energy Credit to suit a variety of reasons.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a wide range of topics, from DIY projects to planning a party.

Maximizing Income Limits For Residential Energy Credit

Here are some ideas of making the most of Income Limits For Residential Energy Credit:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets to enhance learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Limits For Residential Energy Credit are an abundance of practical and innovative resources that can meet the needs of a variety of people and hobbies. Their accessibility and flexibility make them a valuable addition to your professional and personal life. Explore the many options of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes they are! You can download and print these items for free.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific terms of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright issues with printables that are free?

- Certain printables may be subject to restrictions on usage. Be sure to review the conditions and terms of use provided by the creator.

-

How do I print Income Limits For Residential Energy Credit?

- Print them at home using a printer or visit a local print shop to purchase more high-quality prints.

-

What software do I require to view Income Limits For Residential Energy Credit?

- The majority of PDF documents are provided as PDF files, which can be opened using free software such as Adobe Reader.

Michigan Medicare Income Limits 2021 INCOMUNTA

Do Air Conditioners Qualify For Residential Energy Credit

Check more sample of Income Limits For Residential Energy Credit below

2023 Residential Clean Energy Credit Guide ReVision Energy

Commercial Solar In Georgia Commercial Solar Installation

Coming Soon New Residential Energy Credit On The Mark Tax Service

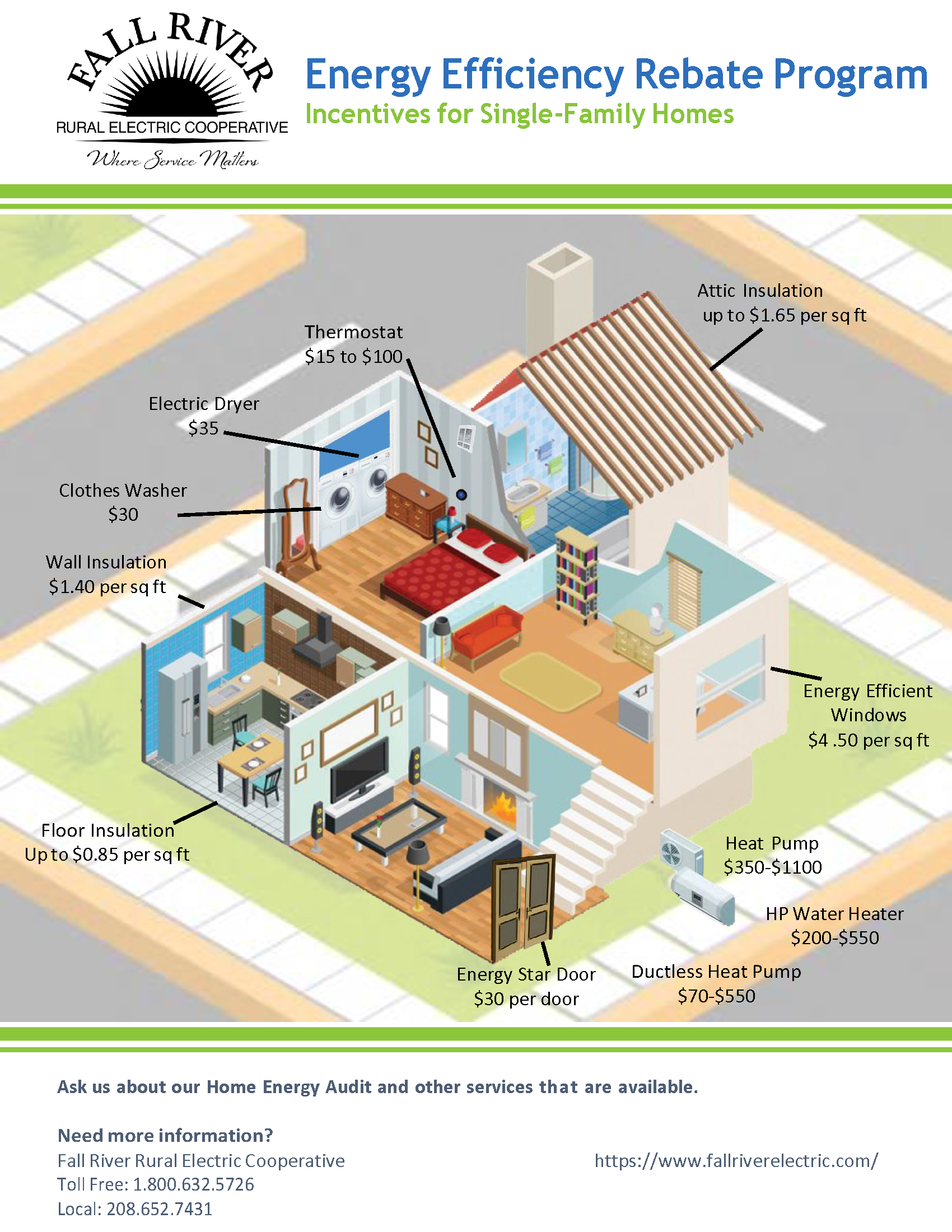

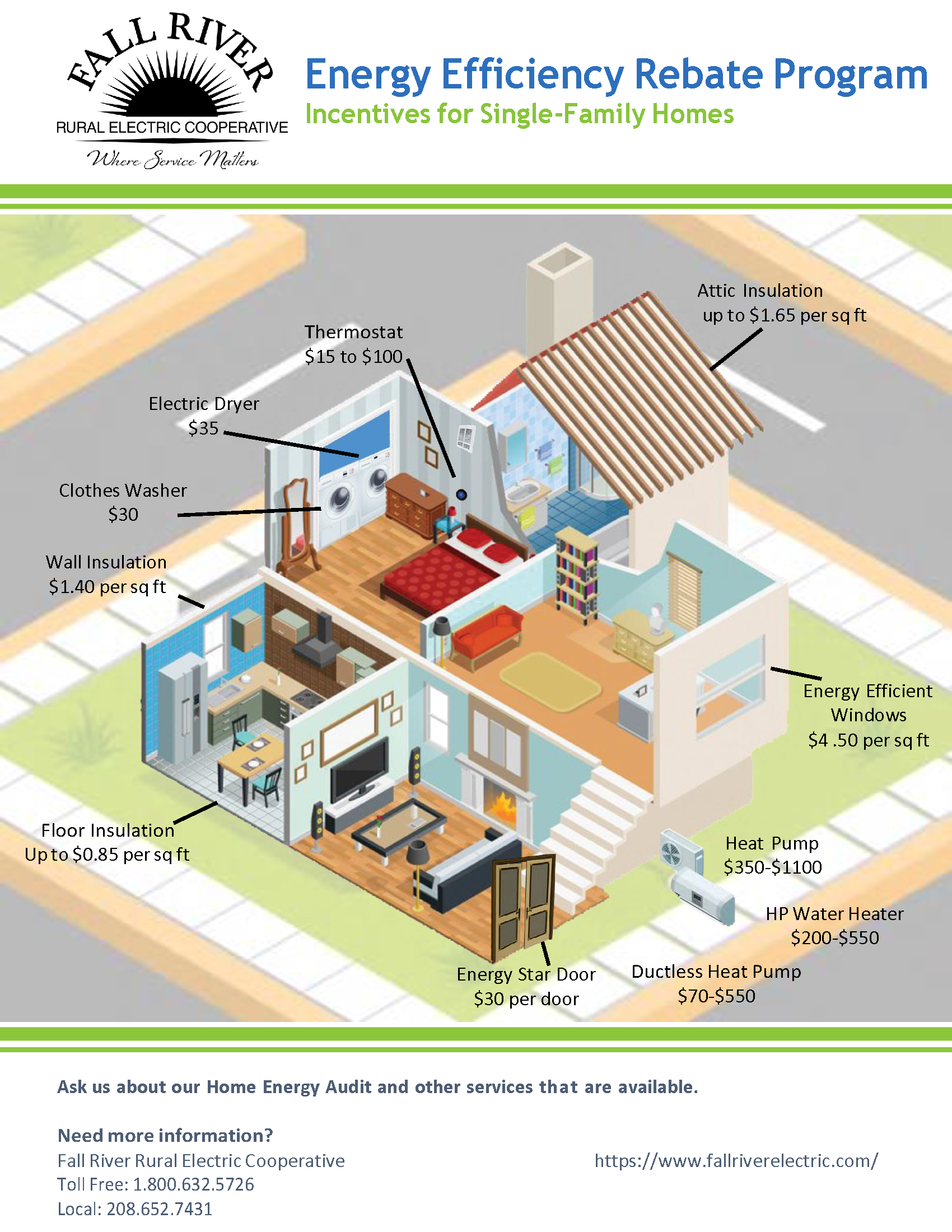

Home Improvement Rebates Fall River Rural Electric Cooperative

California Medi Cal Income Limits 2022 California Medi Cal Help 2022

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

https://www.irs.gov/credits-deductions/frequently...

There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

https://rsmus.com/insights/tax-alerts/2023/IRS...

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30 now applies to property placed in service after Dec 31 2021 and before Jan 1 2033

There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made

In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30 now applies to property placed in service after Dec 31 2021 and before Jan 1 2033

Home Improvement Rebates Fall River Rural Electric Cooperative

Commercial Solar In Georgia Commercial Solar Installation

California Medi Cal Income Limits 2022 California Medi Cal Help 2022

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

Residential Energy Credit Application 2023 ElectricRate

Residential Energy Efficient Property Credit Limit Worksheet

Residential Energy Efficient Property Credit Limit Worksheet

Alabama Food Stamps Application And Requirements Unemployment Gov