In this day and age when screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Whether it's for educational purposes project ideas, artistic or simply adding an individual touch to your space, Income Tax Benefit For Home Loan Under Construction are now a useful source. Here, we'll dive deeper into "Income Tax Benefit For Home Loan Under Construction," exploring their purpose, where you can find them, and how they can improve various aspects of your daily life.

Get Latest Income Tax Benefit For Home Loan Under Construction Below

Income Tax Benefit For Home Loan Under Construction

Income Tax Benefit For Home Loan Under Construction -

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment

As per the Income Tax Act of 1961 Section 24B homeowners are qualified for a tax deduction of up to 2 lakh per financial year on the interest paid for a home

Printables for free cover a broad selection of printable and downloadable documents that can be downloaded online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and more. The attraction of printables that are free is their flexibility and accessibility.

More of Income Tax Benefit For Home Loan Under Construction

Home Loan Tax Benefits As Per Union Budget 2020

Home Loan Tax Benefits As Per Union Budget 2020

Is The Under Construction Property Tax Advantage Applicable To The Principal Amount of My Paid Home Loan Answer On the principle amount of your paid

You can get the under construction property tax benefit of Rs 1 5 Lakh per financial year on your paid home loan principal amount However you can claim this

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor printables to fit your particular needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Education Value Printables for education that are free can be used by students of all ages. This makes these printables a powerful tool for parents and teachers.

-

Affordability: You have instant access numerous designs and templates saves time and effort.

Where to Find more Income Tax Benefit For Home Loan Under Construction

Maui Loan

Maui Loan

Avail Income Tax Benefits on Home Loan under section 24 b 80C for up to Rs 2 00 000 Know home loan tax benefits for FY 2022 23 for second home loan joint home loan

The Income tax Act allows one to claim the pre construction interest from the date of borrowing of the loan till the 31st of March before the end of the financial

In the event that we've stirred your interest in Income Tax Benefit For Home Loan Under Construction Let's look into where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Income Tax Benefit For Home Loan Under Construction designed for a variety objectives.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a broad spectrum of interests, everything from DIY projects to planning a party.

Maximizing Income Tax Benefit For Home Loan Under Construction

Here are some innovative ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to build your knowledge at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Benefit For Home Loan Under Construction are an abundance of innovative and useful resources designed to meet a range of needs and needs and. Their accessibility and flexibility make these printables a useful addition to your professional and personal life. Explore the vast array of Income Tax Benefit For Home Loan Under Construction and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can print and download these resources at no cost.

-

Can I make use of free printing templates for commercial purposes?

- It's contingent upon the specific rules of usage. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables could be restricted on their use. Be sure to check the terms and regulations provided by the author.

-

How do I print printables for free?

- Print them at home with a printer or visit an area print shop for top quality prints.

-

What software will I need to access printables at no cost?

- The majority of printed documents are in PDF format. These is open with no cost programs like Adobe Reader.

Budget 2019 Key Highlights HousingBag

Know How You Can Get Tax Benefits On Home Loan

Check more sample of Income Tax Benefit For Home Loan Under Construction below

Tax Benefit For Electric Vehicle Purchase Loan

Income Tax Benefit On Home Construction Loan HomeFirst

Can A Taxpayer Claim Income Tax Benefit On Both Home Loan And HRA

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Algo trading Why It Is A Boon For Traders Strategies To Follow And

First WAVE Gets Home Loan Under GI Bill Of Rights April 1945 Ann

https://tax2win.in › guide › under-construction-property-tax-benefit

As per the Income Tax Act of 1961 Section 24B homeowners are qualified for a tax deduction of up to 2 lakh per financial year on the interest paid for a home

https://homefirstindia.com › blog › article › tax...

The Income Tax law utilizes the concept of Net Annual Value NAV for house property to calculate the corresponding tax burden on homeowners This article examines the

As per the Income Tax Act of 1961 Section 24B homeowners are qualified for a tax deduction of up to 2 lakh per financial year on the interest paid for a home

The Income Tax law utilizes the concept of Net Annual Value NAV for house property to calculate the corresponding tax burden on homeowners This article examines the

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Income Tax Benefit On Home Construction Loan HomeFirst

Algo trading Why It Is A Boon For Traders Strategies To Follow And

First WAVE Gets Home Loan Under GI Bill Of Rights April 1945 Ann

Kickballdesign Income Tax Home Buyer

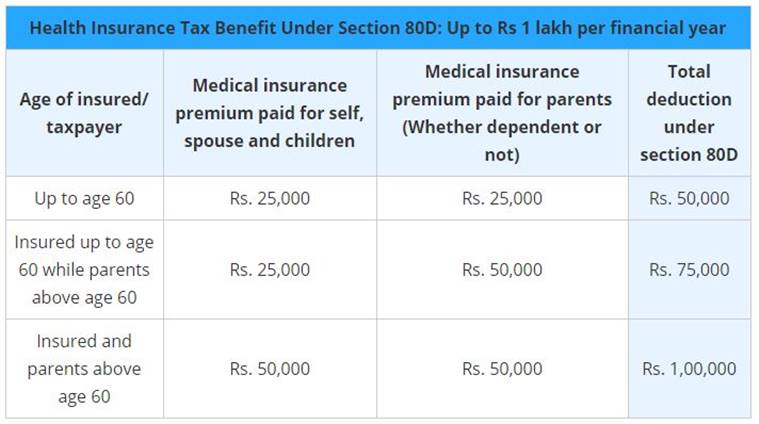

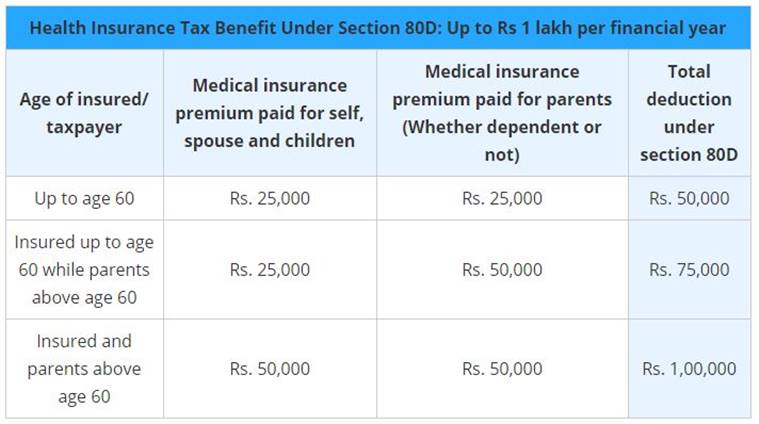

Income Tax Benefit Up To Rs 1 Lakh In Health Insurance Plans How Much

Income Tax Benefit Up To Rs 1 Lakh In Health Insurance Plans How Much

Resolved Home Loan Request For Non Liability Certificate From SBI