In this digital age, where screens dominate our lives, the charm of tangible printed objects hasn't waned. Be it for educational use in creative or artistic projects, or simply adding a personal touch to your area, Income Tax Benefit On Home Loan Interest In The Pre Construction Period have become a valuable resource. This article will take a dive to the depths of "Income Tax Benefit On Home Loan Interest In The Pre Construction Period," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Income Tax Benefit On Home Loan Interest In The Pre Construction Period Below

Income Tax Benefit On Home Loan Interest In The Pre Construction Period

Income Tax Benefit On Home Loan Interest In The Pre Construction Period -

Claim the deduction of pre construction interest from the financial year of completion of construction while filing ITR on the Income Tax e Filing portal under the head

Deduction on Interest Paid Towards Home Loan During the Pre Construction Period Say you bought an under construction property and have not moved in yet but you are

Income Tax Benefit On Home Loan Interest In The Pre Construction Period offer a wide range of downloadable, printable material that is available online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and much more. The great thing about Income Tax Benefit On Home Loan Interest In The Pre Construction Period is in their versatility and accessibility.

More of Income Tax Benefit On Home Loan Interest In The Pre Construction Period

Income From House Property Interest On Loan 2021 Calculation Of Pre

Income From House Property Interest On Loan 2021 Calculation Of Pre

If you buy an under construction property and pay the EMIs you can claim interest on your housing loan as deduction after the construction gets completed Income Tax Act allows to claim a deduction of both the pre

In case the loan money is to be used for the construction or purchase of a new property the borrower can claim Rs 2 lakh as deduction on pre construction interest in a year in five equal installments at the start of the

Income Tax Benefit On Home Loan Interest In The Pre Construction Period have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization They can make printed materials to meet your requirements when it comes to designing invitations making your schedule, or even decorating your home.

-

Educational Use: Free educational printables provide for students of all ages, making these printables a powerful source for educators and parents.

-

It's easy: Fast access a myriad of designs as well as templates reduces time and effort.

Where to Find more Income Tax Benefit On Home Loan Interest In The Pre Construction Period

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

In accordance with Section 24 of the Income Tax Act 1961 hereinafter referred to as the IT Act the taxpayer would not be allowed to claim the benefit of interest deduction unless

Deduction on interest paid for home loan during the pre construction period If you ve purchased an under construction property and are paying EMIs without having moved

After we've peaked your curiosity about Income Tax Benefit On Home Loan Interest In The Pre Construction Period, let's explore where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Income Tax Benefit On Home Loan Interest In The Pre Construction Period designed for a variety purposes.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets as well as flashcards and other learning tools.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Income Tax Benefit On Home Loan Interest In The Pre Construction Period

Here are some creative ways how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Benefit On Home Loan Interest In The Pre Construction Period are an abundance of practical and innovative resources that meet a variety of needs and pursuits. Their accessibility and flexibility make them an invaluable addition to any professional or personal life. Explore the many options of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use the free printables for commercial uses?

- It's based on the usage guidelines. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may come with restrictions on use. Be sure to review the terms and regulations provided by the designer.

-

How do I print Income Tax Benefit On Home Loan Interest In The Pre Construction Period?

- You can print them at home with an printer, or go to an area print shop for superior prints.

-

What program is required to open printables free of charge?

- Many printables are offered in PDF format, which is open with no cost software, such as Adobe Reader.

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Check more sample of Income Tax Benefit On Home Loan Interest In The Pre Construction Period below

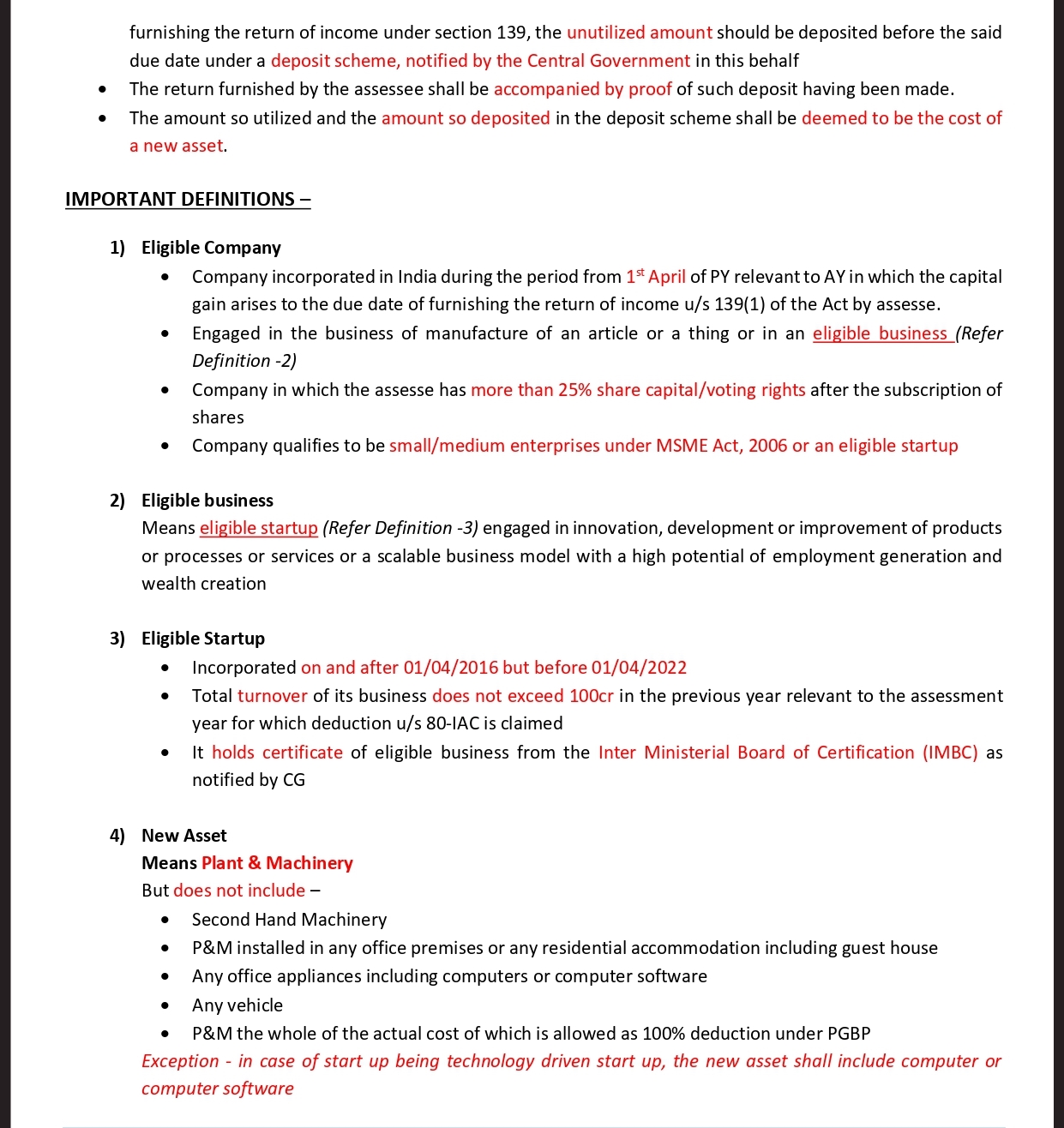

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Income Tax Benefit On Home Construction Loan HomeFirst

What Are The Tax Benefit On Home Loan FY 2020 2021

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

https://cleartax.in/s/home-loan-tax-benefit

Deduction on Interest Paid Towards Home Loan During the Pre Construction Period Say you bought an under construction property and have not moved in yet but you are

https://www.tatacapital.com/blog/loan-fo…

As you know Section 24 of the Income Tax Act allows you tax benefits on interest paid on home loans but only after the construction is complete However home buyers claim benefits on interest paid even in the pre construction

Deduction on Interest Paid Towards Home Loan During the Pre Construction Period Say you bought an under construction property and have not moved in yet but you are

As you know Section 24 of the Income Tax Act allows you tax benefits on interest paid on home loans but only after the construction is complete However home buyers claim benefits on interest paid even in the pre construction

Income Tax Benefit On Home Construction Loan HomeFirst

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

What Are The Tax Benefit On Home Loan FY 2020 2021

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

How To Claim Stamp Duty Exemption On Property 2023

Tax Benefit On Home Loan And HRA Both

Tax Benefit On Home Loan And HRA Both

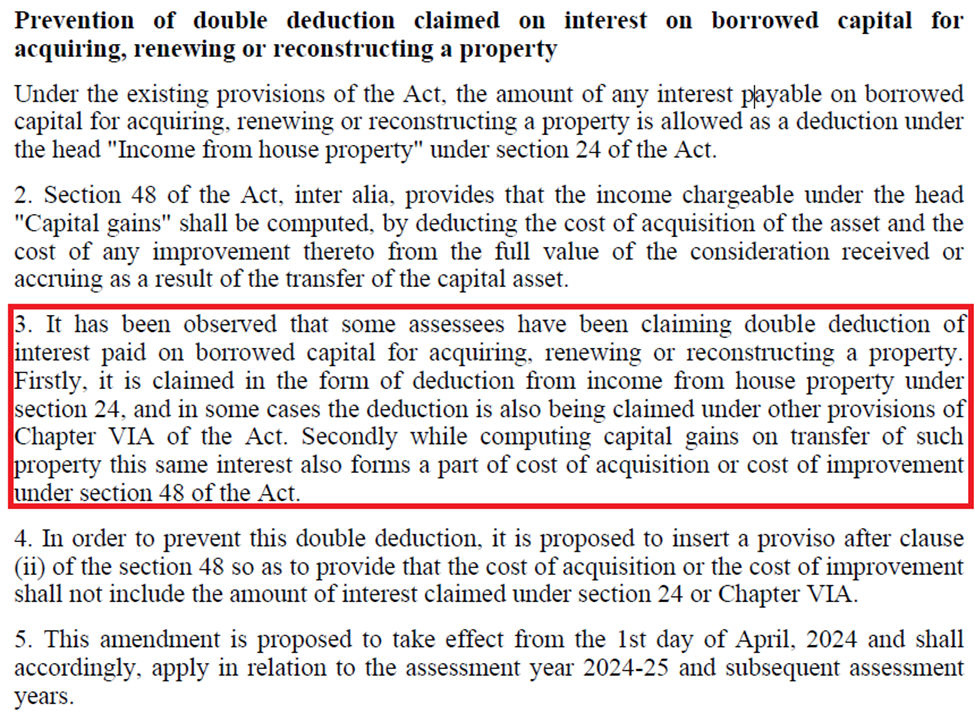

You Cannot Take The Tax Benefit For Home Loan Interest Twice EMI