In this age of technology, where screens rule our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons such as creative projects or simply adding a personal touch to your area, Income Tax Benefit On House Rent Paid are now an essential source. For this piece, we'll dive into the world "Income Tax Benefit On House Rent Paid," exploring their purpose, where you can find them, and how they can add value to various aspects of your daily life.

Get Latest Income Tax Benefit On House Rent Paid Below

Income Tax Benefit On House Rent Paid

Income Tax Benefit On House Rent Paid -

HRA Tax Deduction Under Section 80GG To claim a deduction under Section 80GG of the Income Tax Act individuals need to consider the following and select the lowest amount among them Individuals can claim a deduction of Rs 5 000 per month towards rent paid Calculate 25 of the adjusted total income

Form 10BA is a declaration that has to be filed by an individual who wants to claim a deduction under section 80GG for rent paid on rental property It is a declaration that you are not claiming the benefit of a self occupied property on the house in any other location or the same location as you are employed

Printables for free cover a broad variety of printable, downloadable items that are available online at no cost. These printables come in different designs, including worksheets coloring pages, templates and more. The appealingness of Income Tax Benefit On House Rent Paid lies in their versatility and accessibility.

More of Income Tax Benefit On House Rent Paid

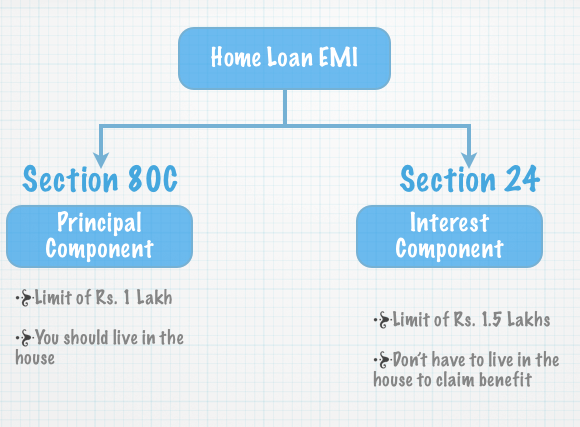

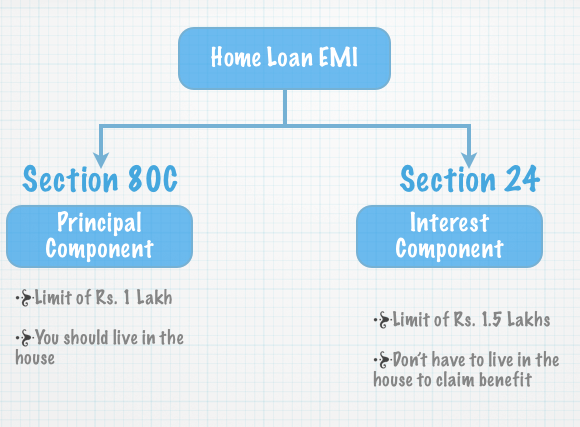

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

In Income Tax HRA is defined as a house rent allowance It is the amount paid by the employer to the employees to help them meet living costs in rented accommodation Most employers of both private and public sector organizations pay HRA as one of the sub components of salary to their employees

For most employees House Rent Allowance HRA is a part of their salary structure Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961

Income Tax Benefit On House Rent Paid have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: It is possible to tailor printing templates to your own specific requirements when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Educational Value Education-related printables at no charge are designed to appeal to students of all ages, making them an invaluable device for teachers and parents.

-

An easy way to access HTML0: immediate access the vast array of design and templates, which saves time as well as effort.

Where to Find more Income Tax Benefit On House Rent Paid

Lease Car Calculator Uk CALCULATORSA

Lease Car Calculator Uk CALCULATORSA

Under Section 80GG the least of the following amounts is available for tax exemption i Rent paid in excess of 10 of total income ii 25 of the total income iii Rs 5 000 per month Total

Rent paid minus 10 of salary 20 000 x 12 10 30 000 3 000 x 12 months 2 04 000 In this case the minimum value among these three calculations is the HRA of 1 50 000 Therefore the entire HRA received from the employer which is 1 50 000 is exempt from income tax under Section 10 13A

We've now piqued your interest in Income Tax Benefit On House Rent Paid We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Income Tax Benefit On House Rent Paid for different reasons.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to party planning.

Maximizing Income Tax Benefit On House Rent Paid

Here are some innovative ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Income Tax Benefit On House Rent Paid are a treasure trove with useful and creative ideas that meet a variety of needs and pursuits. Their accessibility and flexibility make them an essential part of your professional and personal life. Explore the vast world that is Income Tax Benefit On House Rent Paid today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes they are! You can download and print these files for free.

-

Can I utilize free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may have restrictions on use. Be sure to check these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home using your printer or visit an area print shop for high-quality prints.

-

What program do I require to view printables at no cost?

- A majority of printed materials are as PDF files, which is open with no cost software such as Adobe Reader.

80GG Tax Benefit For Rent Paid

Income Tax Benefits On Housing Loan In India

Check more sample of Income Tax Benefit On House Rent Paid below

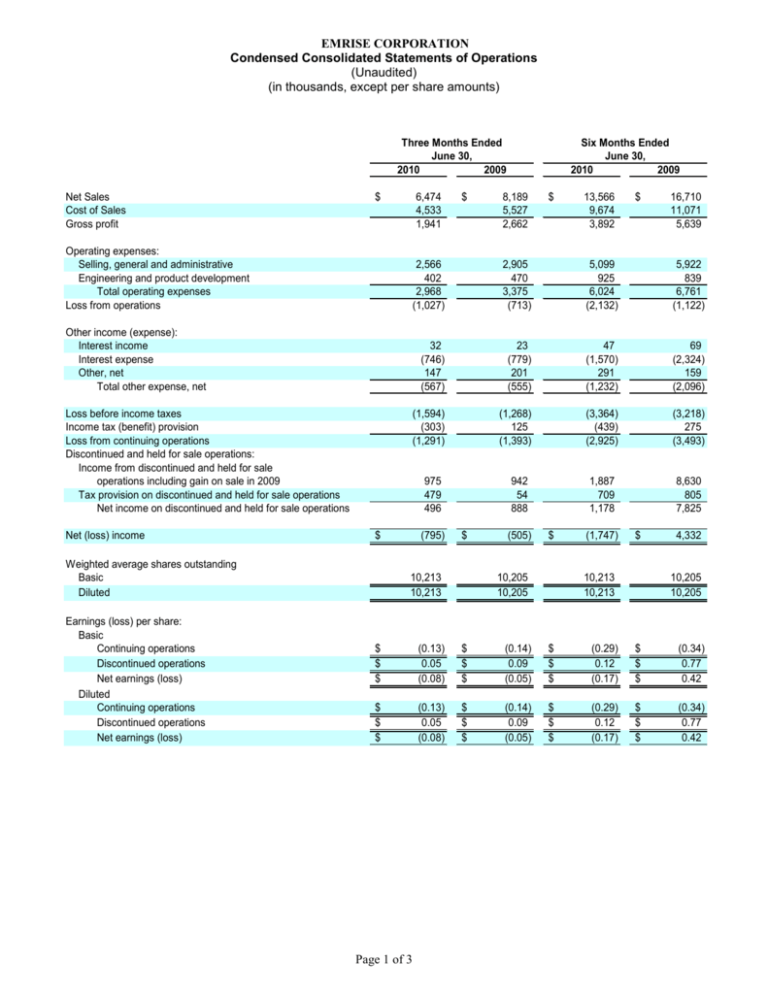

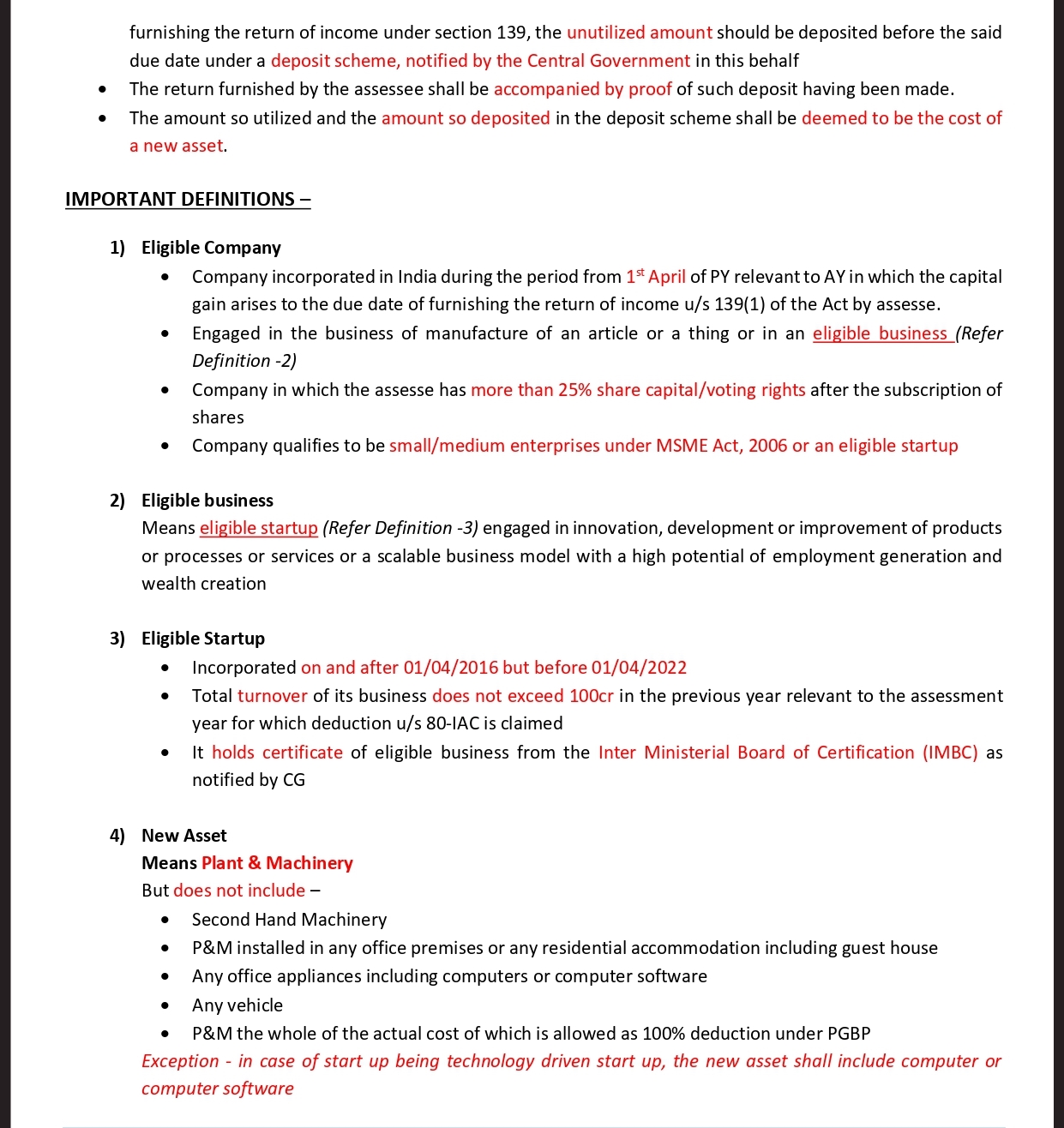

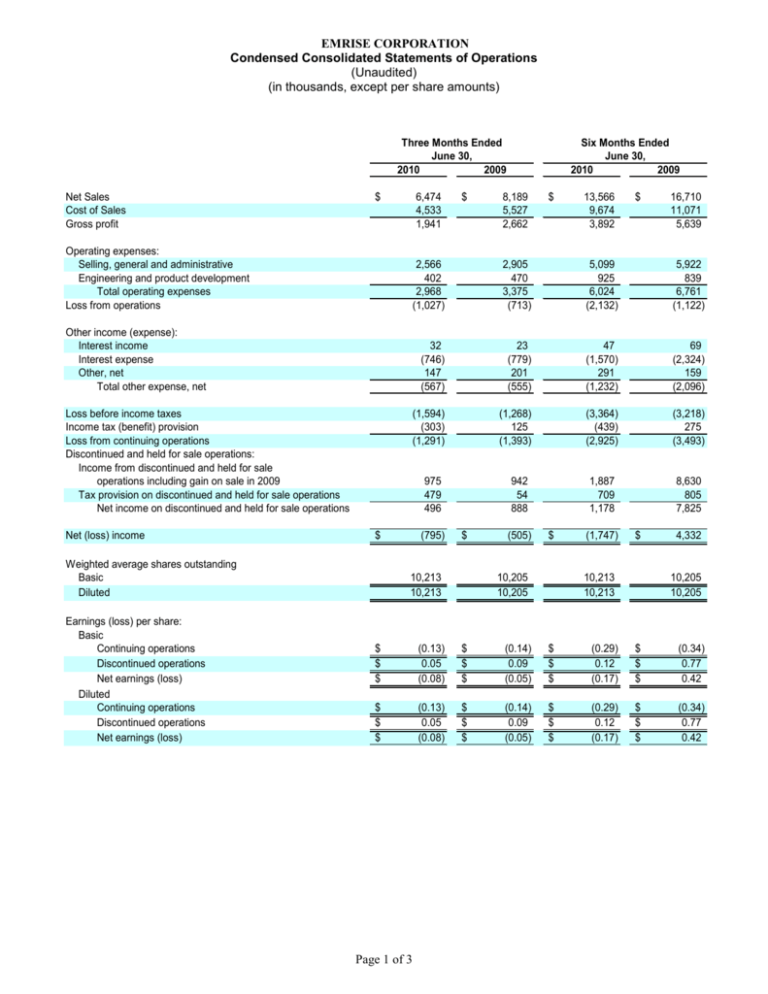

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

What Are The Tax Benefits On Top Up Loan HomeFirst

Tax Benefit On Electric Vehicles Inside Narrative

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

Form 10BA is a declaration that has to be filed by an individual who wants to claim a deduction under section 80GG for rent paid on rental property It is a declaration that you are not claiming the benefit of a self occupied property on the house in any other location or the same location as you are employed

https://www.vero.fi/en/individuals/property/rental_income

See the instructions for reporting foreign sourced income Page last updated 12 4 2023 Income received through rental contracts is taxable As an income type rental income falls into the category of capital income also known as investment income

Form 10BA is a declaration that has to be filed by an individual who wants to claim a deduction under section 80GG for rent paid on rental property It is a declaration that you are not claiming the benefit of a self occupied property on the house in any other location or the same location as you are employed

See the instructions for reporting foreign sourced income Page last updated 12 4 2023 Income received through rental contracts is taxable As an income type rental income falls into the category of capital income also known as investment income

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

What Are The Tax Benefits On Top Up Loan HomeFirst

Tax Benefit On Electric Vehicles Inside Narrative

Mere Securing A House On Rent In USA Is Not Conclusive Fact That

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog