In the digital age, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses and creative work, or just adding the personal touch to your area, Income Tax Benefit On Housing Loan Interest And Principal are now a vital resource. This article will take a dive in the world of "Income Tax Benefit On Housing Loan Interest And Principal," exploring their purpose, where they are available, and how they can enrich various aspects of your lives.

Get Latest Income Tax Benefit On Housing Loan Interest And Principal Below

Income Tax Benefit On Housing Loan Interest And Principal

Income Tax Benefit On Housing Loan Interest And Principal -

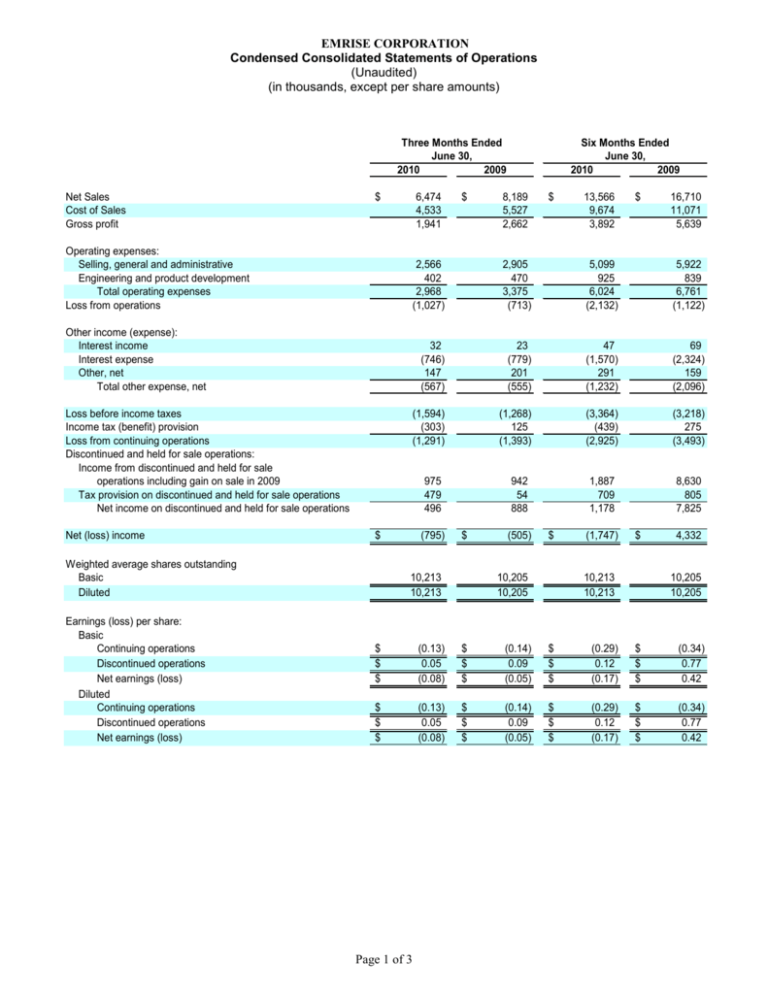

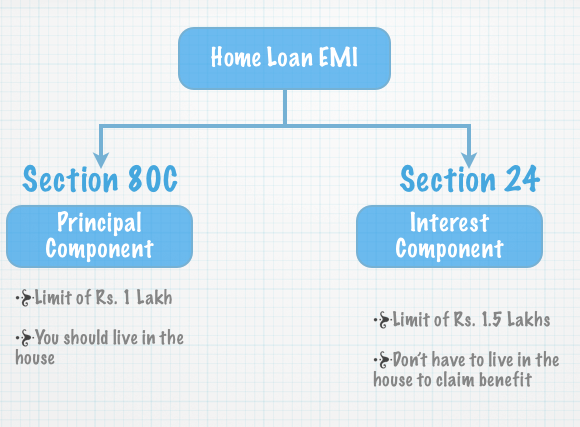

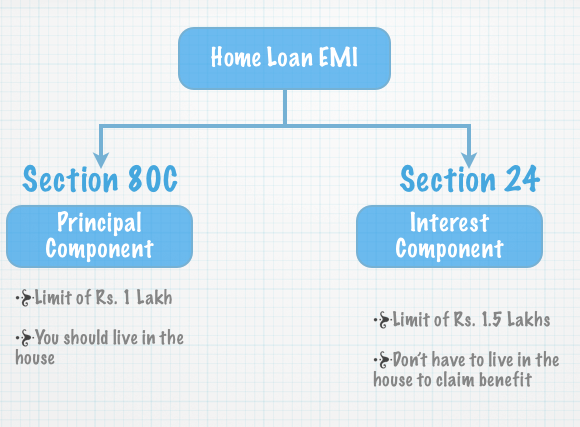

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property

Updated 03 01 2024 06 37 32 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment

Income Tax Benefit On Housing Loan Interest And Principal cover a large array of printable documents that can be downloaded online at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The value of Income Tax Benefit On Housing Loan Interest And Principal is their flexibility and accessibility.

More of Income Tax Benefit On Housing Loan Interest And Principal

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs

There is no threshold limit for claiming principal repayment of home loans hence any principal payment amount up to Rs 1 5 lakh irrespective of whether it is pre

Income Tax Benefit On Housing Loan Interest And Principal have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor designs to suit your personal needs when it comes to designing invitations making your schedule, or even decorating your house.

-

Educational Use: Educational printables that can be downloaded for free cater to learners of all ages, which makes them an essential tool for parents and educators.

-

The convenience of Quick access to an array of designs and templates reduces time and effort.

Where to Find more Income Tax Benefit On Housing Loan Interest And Principal

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

House Rent Allowance HRA is a component received by salaried taxpayers to bear the rental payment of the hired premises It is allowed as an exemption from

For a self occupied property Each co owner who is also a co applicant in the loan can claim a maximum deduction Rs 2 00 000 for interest on the home loan in their Income

In the event that we've stirred your interest in printables for free Let's see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of applications.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning tools.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Income Tax Benefit On Housing Loan Interest And Principal

Here are some new ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Income Tax Benefit On Housing Loan Interest And Principal are a treasure trove filled with creative and practical information that can meet the needs of a variety of people and preferences. Their accessibility and versatility make they a beneficial addition to the professional and personal lives of both. Explore the plethora of Income Tax Benefit On Housing Loan Interest And Principal and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes they are! You can print and download these resources at no cost.

-

Can I use the free printables to make commercial products?

- It's based on the rules of usage. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may come with restrictions regarding their use. Be sure to read the terms and condition of use as provided by the author.

-

How can I print Income Tax Benefit On Housing Loan Interest And Principal?

- You can print them at home using either a printer at home or in a local print shop to purchase the highest quality prints.

-

What program do I need to run Income Tax Benefit On Housing Loan Interest And Principal?

- The majority are printed with PDF formats, which can be opened with free software such as Adobe Reader.

To Tables

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Check more sample of Income Tax Benefit On Housing Loan Interest And Principal below

How To Fill Housing Loan Interest And Principal In Income Tax Return

How To Calculate Interest On Housing Loan For Income Tax Haiper

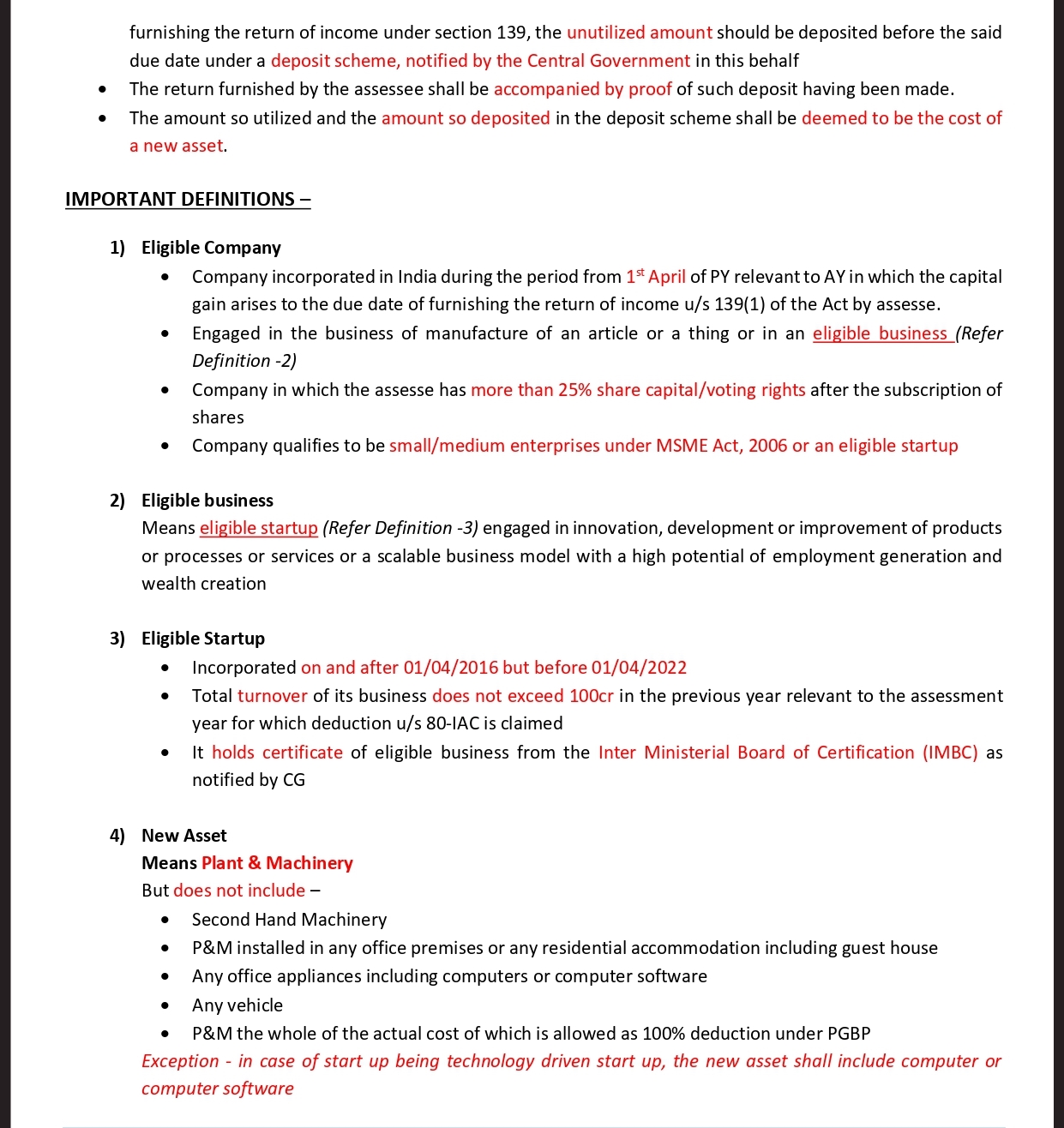

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Income Tax Benefits On Home Loan Loanfasttrack

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Updated 03 01 2024 06 37 32 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment

https://taxguru.in/income-tax/tax-benefit-ho…

Section 80EEA Income Tax Benefit on Interest on Home Loan First Time Buyers FY 2019 20 onwards Section 80C Tax benefit on Principal amount on Home Loan The maximum tax deduction

Updated 03 01 2024 06 37 32 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment

Section 80EEA Income Tax Benefit on Interest on Home Loan First Time Buyers FY 2019 20 onwards Section 80C Tax benefit on Principal amount on Home Loan The maximum tax deduction

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

How To Calculate Interest On Housing Loan For Income Tax Haiper

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Income Tax Benefits On Home Loan Loanfasttrack

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

Income Tax Benefits On Housing Loan In India