Today, with screens dominating our lives The appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply to add some personal flair to your home, printables for free have become an invaluable source. With this guide, you'll take a dive deep into the realm of "Income Tax Benefits In India," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Benefits In India Below

Income Tax Benefits In India

Income Tax Benefits In India -

What is Income Tax Benefit In India tax benefits are different based on the status of the taxpayer i e individual HUF company etc The tax benefit can be a tax rebate or deduction Tax rebate means a specific amount will be deducted from the tax payable Deduction means deducting an eligible amount from the taxable income

A Total HRA received from your employer b Rent paid less than 10 of basic salary DA c 40 of salary Basic salary DA for non metros and 50 of salary Basic salary DA for metros Read more about how to claim HRA exemption Standard Deduction For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime

Income Tax Benefits In India cover a large collection of printable material that is available online at no cost. These resources come in many forms, like worksheets templates, coloring pages, and more. The attraction of printables that are free is in their variety and accessibility.

More of Income Tax Benefits In India

Maximizing Home Loan Tax Benefits In India 2023

Maximizing Home Loan Tax Benefits In India 2023

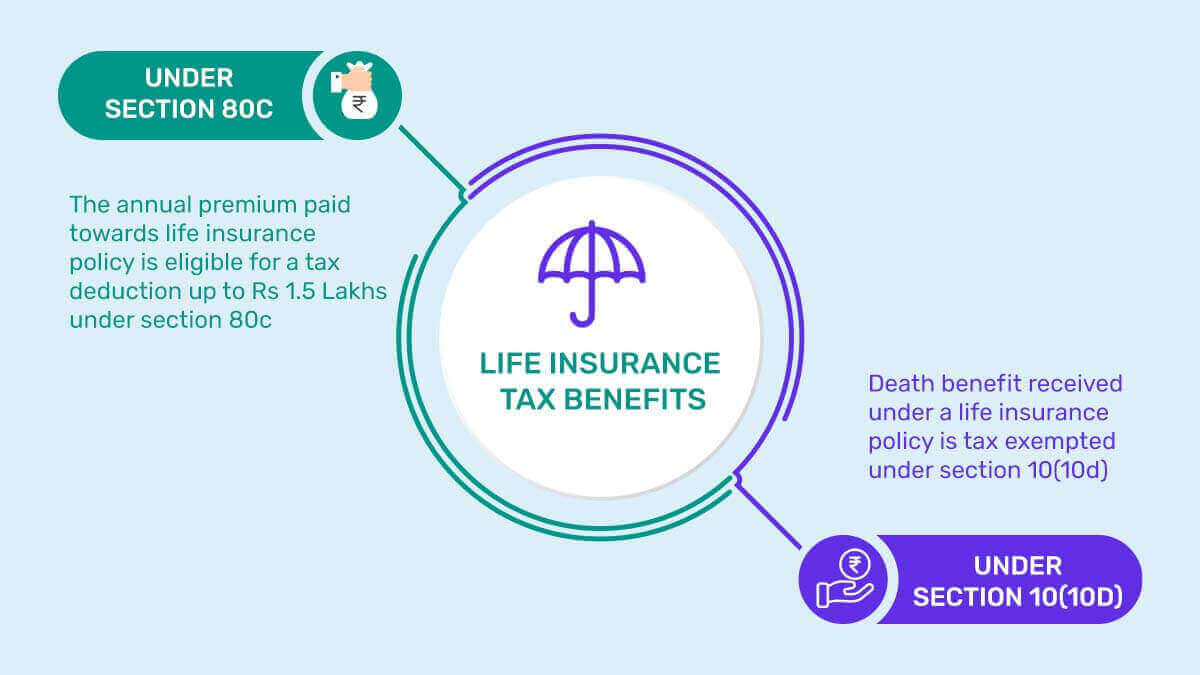

The most popular tax saving options available to individuals and HUFs in India are under Section 80C of the Income Tax Act Section 80C includes various investments and expenses you can claim deductions on up to the limit of Rs 1 5 lakh in a financial year

Section 80G Income Tax Benefits Towards Donations for Social Causes The various donations specified in u s 80G are eligible for deduction up to either 100 or 50 with or without restriction From FY 2017 18 any donations made in cash exceeding Rs 2 000 will not be allowed as a deduction

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Flexible: Your HTML0 customization options allow you to customize printing templates to your own specific requirements for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Educational Worth: These Income Tax Benefits In India cater to learners of all ages. This makes them a valuable instrument for parents and teachers.

-

Affordability: instant access an array of designs and templates reduces time and effort.

Where to Find more Income Tax Benefits In India

Child Plan Tax Benefits In India Child Plans Are The Most Flickr

Child Plan Tax Benefits In India Child Plans Are The Most Flickr

As per the Income Tax Act the entire amount of DA received is taxable and has to be declared at the time of filing income tax returns In October 2019 the DA of central government employees and pensioners was increased to 17 from the earlier 12 of basic salary

Effectively the taxpayer will get an additional income exemption of Rs 5 800 The limit of Rs 40 000 has been increased to Rs 50 000 from FY 2019 20 onwards in the Interim Budget 2019 From FY 2023 2024 this deduction of Rs 50 000 is available and can be claimed under both the old and new tax regimes

In the event that we've stirred your interest in Income Tax Benefits In India Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Income Tax Benefits In India for a variety needs.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to party planning.

Maximizing Income Tax Benefits In India

Here are some inventive ways of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home and in class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Income Tax Benefits In India are a treasure trove of innovative and useful resources that meet a variety of needs and passions. Their accessibility and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the wide world of Income Tax Benefits In India to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes, they are! You can download and print these documents for free.

-

Can I download free templates for commercial use?

- It's determined by the specific conditions of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may have restrictions concerning their use. You should read the terms and condition of use as provided by the author.

-

How can I print Income Tax Benefits In India?

- You can print them at home with either a printer at home or in an area print shop for high-quality prints.

-

What software is required to open printables at no cost?

- The majority of printables are with PDF formats, which is open with no cost programs like Adobe Reader.

5 Important Things You Should Know About Home Loan Tax Benefits In

Startup India Recognition Anbac Advisors Best CA Firm In Delhi

Check more sample of Income Tax Benefits In India below

Life Insurance Tax Benefits In India 2023 PolicyBachat

Know All About Term Insurance Tax Benefits In India Techcrams

How To Save Income Tax On Rent Donation how To Get Income Tax

NPS Tax Benefits How To Avail NPS Income Tax Benefits

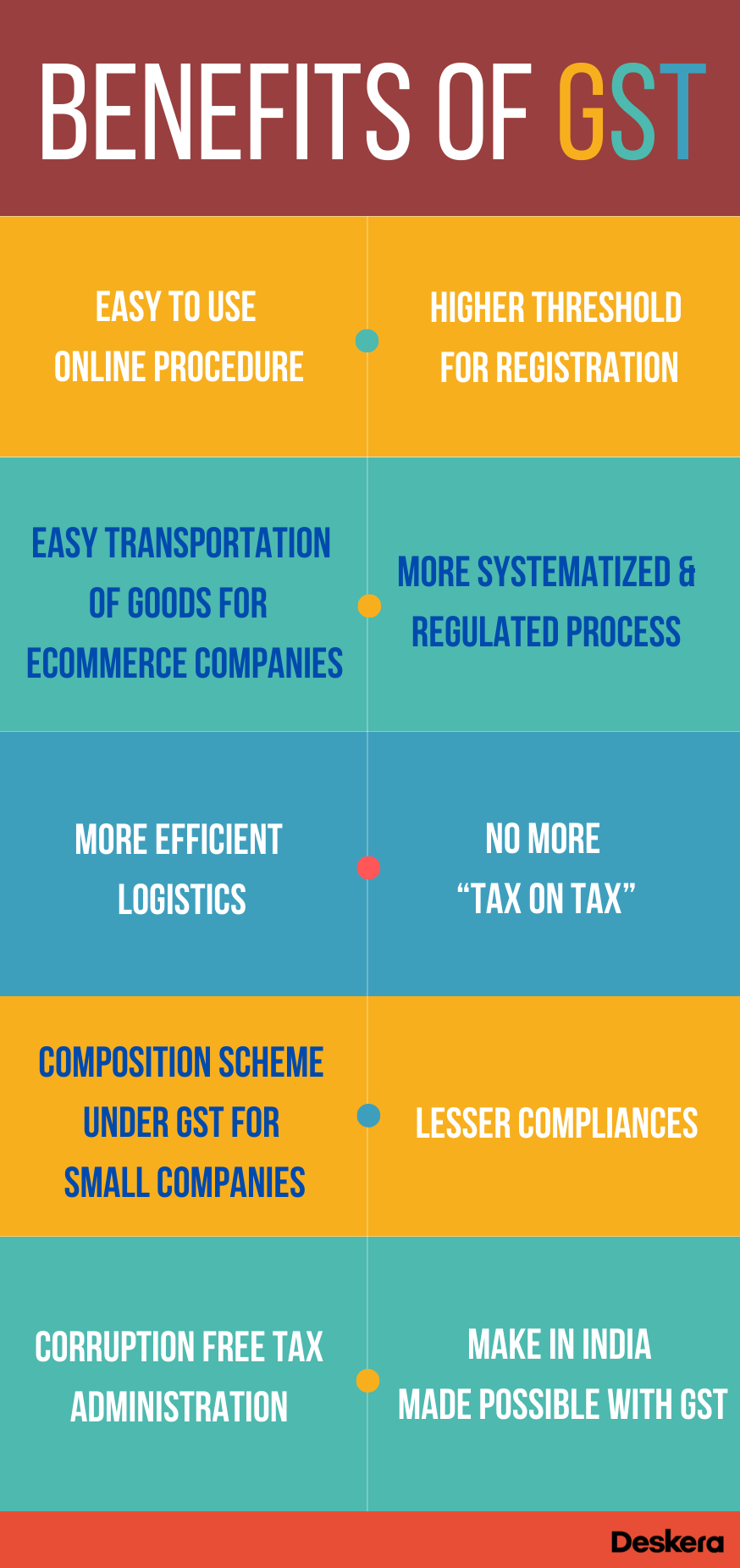

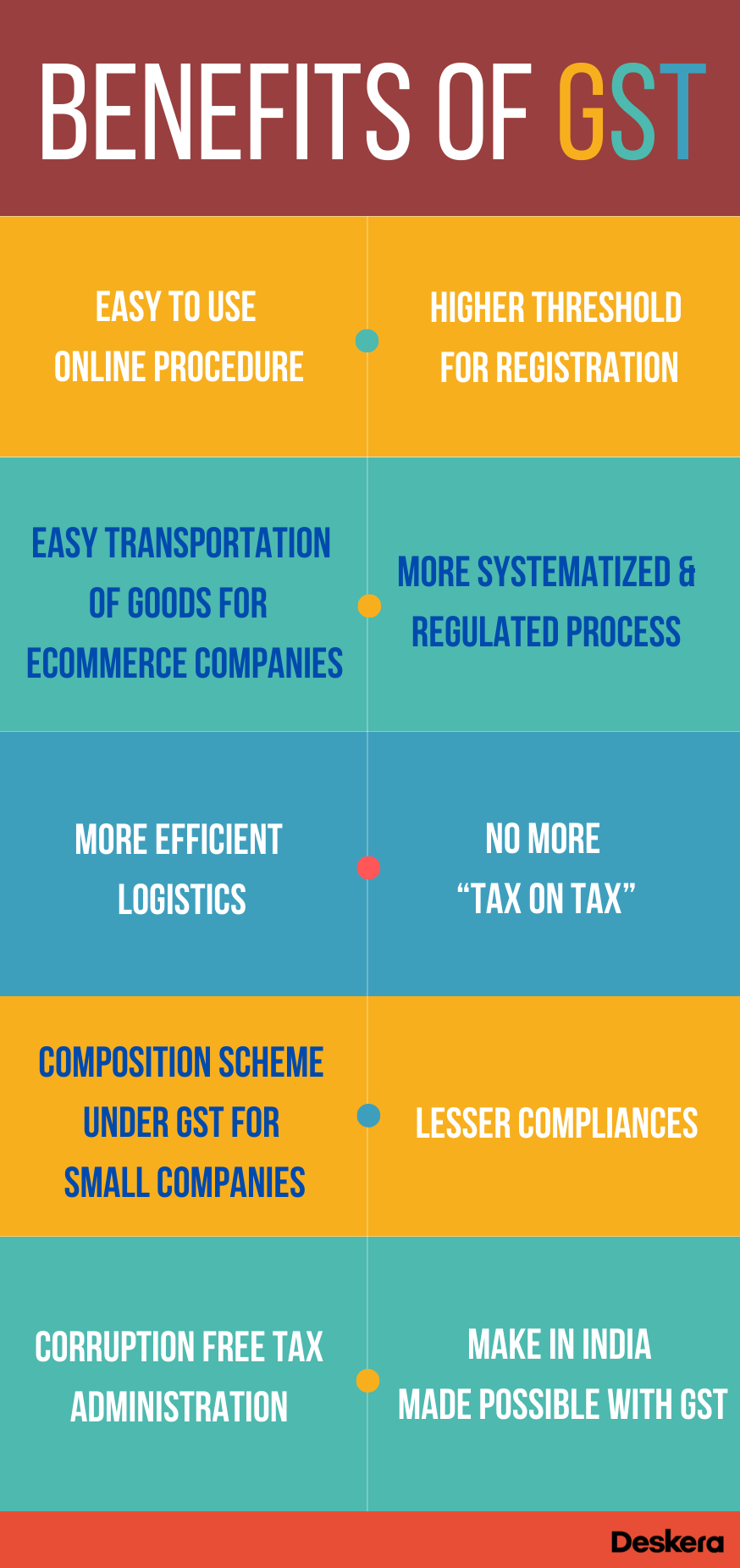

Benefits Of GST In India

How To Save Tax Under Section 80E 80EE 80TTA how To Get Income Tax

https://cleartax.in/s/income-tax-allowances-and-deductions

A Total HRA received from your employer b Rent paid less than 10 of basic salary DA c 40 of salary Basic salary DA for non metros and 50 of salary Basic salary DA for metros Read more about how to claim HRA exemption Standard Deduction For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime

https://economictimes.indiatimes.com/wealth/tax/5...

Income tax Act offers five different types of tax benefit to the individuals Some of these include allowances tax exemptions rebate tec Getty Images Common allowances include DA house rent LTA education medical transport etc 1 Exemption One need not pay any tax on such income

A Total HRA received from your employer b Rent paid less than 10 of basic salary DA c 40 of salary Basic salary DA for non metros and 50 of salary Basic salary DA for metros Read more about how to claim HRA exemption Standard Deduction For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime

Income tax Act offers five different types of tax benefit to the individuals Some of these include allowances tax exemptions rebate tec Getty Images Common allowances include DA house rent LTA education medical transport etc 1 Exemption One need not pay any tax on such income

NPS Tax Benefits How To Avail NPS Income Tax Benefits

Know All About Term Insurance Tax Benefits In India Techcrams

Benefits Of GST In India

How To Save Tax Under Section 80E 80EE 80TTA how To Get Income Tax

Electric Vehicle Tax Benefits In India Passionate In Marketing

EV Tax Benefits In India Everything You Need To Know Before Buying An

EV Tax Benefits In India Everything You Need To Know Before Buying An

Claiming Tax Benefits In India A Step by Step Guide To Lowering Your