In a world in which screens are the norm it's no wonder that the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses as well as creative projects or simply adding an element of personalization to your space, Income Tax Benefits Under Section 80ccc have become an invaluable resource. In this article, we'll dive through the vast world of "Income Tax Benefits Under Section 80ccc," exploring what they are, how to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Income Tax Benefits Under Section 80ccc Below

Income Tax Benefits Under Section 80ccc

Income Tax Benefits Under Section 80ccc -

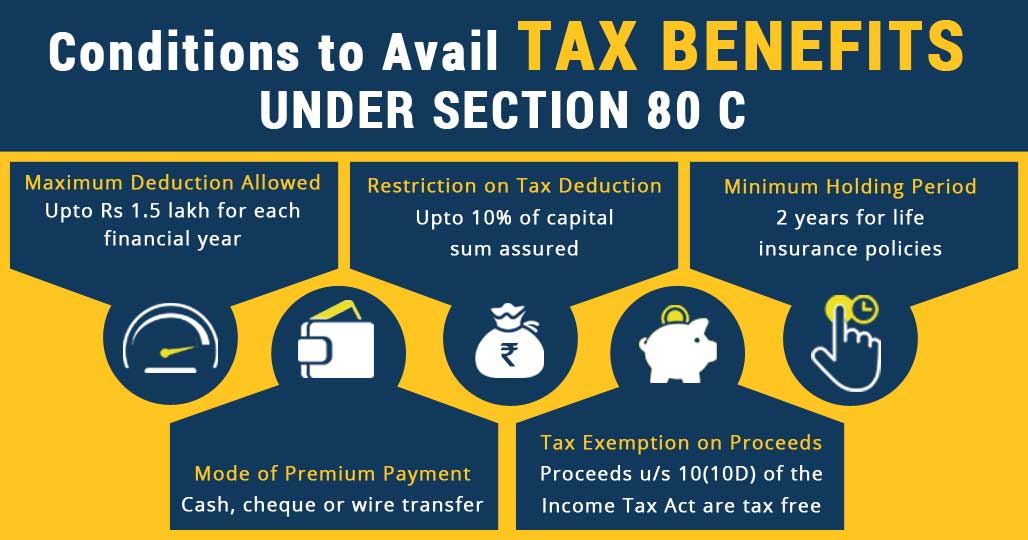

Section 10 23AAB specifies the pension funds that are eligible for investment to claim the benefit under Section 80CCC The interest and other benefits

Under Section 80CCC of the Income Tax Act 1961 a taxpayer can claim tax deductions against the monetary contributions

The Income Tax Benefits Under Section 80ccc are a huge assortment of printable resources available online for download at no cost. These resources come in various types, such as worksheets templates, coloring pages and much more. One of the advantages of Income Tax Benefits Under Section 80ccc lies in their versatility as well as accessibility.

More of Income Tax Benefits Under Section 80ccc

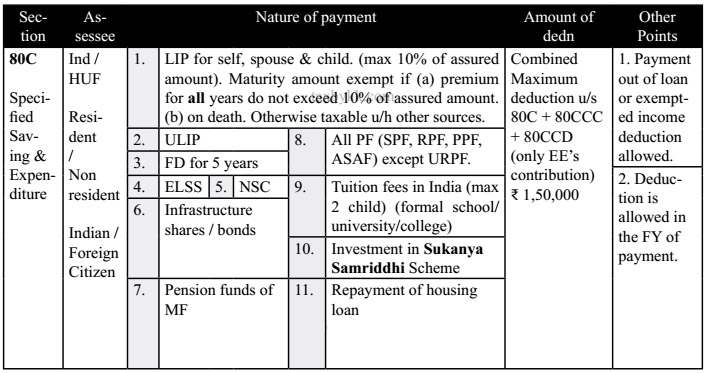

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deduction From Gross Total Income Section 80C To 80U Graphical Table

An individual can claim tax benefits for certain pension funds under Section 80CCC of the Income Tax Act Learn about its features eligibility claim limits on Groww

Under Section 80CCC of Income Tax Act 1961 an individual can claim tax deduction for contributions made to certain pension funds The tax benefit is only for payments in the

Income Tax Benefits Under Section 80ccc have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Modifications: There is the possibility of tailoring print-ready templates to your specific requirements in designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages, which makes them a valuable aid for parents as well as educators.

-

Convenience: Access to a variety of designs and templates reduces time and effort.

Where to Find more Income Tax Benefits Under Section 80ccc

HDFC Credila Education Loan For Foreign Education RONE GLOBAL

HDFC Credila Education Loan For Foreign Education RONE GLOBAL

With effect from assessment year 2015 16 amended sub section 1 has clarified that a non government employee can claim deduction under section 80CCD even if his date of joining is prior to

Section 80CCC of the Income Tax Act provides tax deductions when you invest in certain types of pension funds Read the article to understand why it is important features eligibility criteria for

Now that we've piqued your curiosity about Income Tax Benefits Under Section 80ccc Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Income Tax Benefits Under Section 80ccc for a variety objectives.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- The blogs covered cover a wide range of interests, starting from DIY projects to party planning.

Maximizing Income Tax Benefits Under Section 80ccc

Here are some unique ways for you to get the best use of Income Tax Benefits Under Section 80ccc:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Benefits Under Section 80ccc are an abundance of useful and creative resources that cater to various needs and desires. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the vast collection of Income Tax Benefits Under Section 80ccc now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes they are! You can download and print the resources for free.

-

Do I have the right to use free printables in commercial projects?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright concerns when using Income Tax Benefits Under Section 80ccc?

- Some printables may contain restrictions regarding usage. Make sure you read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- Print them at home with printing equipment or visit an in-store print shop to get more high-quality prints.

-

What software will I need to access printables that are free?

- Many printables are offered in PDF format. They can be opened with free software, such as Adobe Reader.

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

Section 80CCC Deductions Under Section 80CCC Of Income Tax Act

Check more sample of Income Tax Benefits Under Section 80ccc below

Section 80C Deduction Under Section 80C In India Paisabazaar

![]()

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax

Anything To Everything Income Tax Guide For Individuals Including

Income Tax Section 80C 80CCC Latest Update 2023

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

Deduction Under Section 80C 80CCC 80CCD 80D For AY 2019 20

https://tax2win.in/guide/section-80ccc

Under Section 80CCC of the Income Tax Act 1961 a taxpayer can claim tax deductions against the monetary contributions

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY

Under Section 80CCC of the Income Tax Act 1961 a taxpayer can claim tax deductions against the monetary contributions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY

Income Tax Section 80C 80CCC Latest Update 2023

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

Deduction Under Section 80C 80CCC 80CCD 80D For AY 2019 20

Life Insurance Policy And Tax Benefits ComparePolicy

Section 80CCC Deduction Of Income Tax IndiaFilings

Section 80CCC Deduction Of Income Tax IndiaFilings

lec 2 Income Tax Deductions Under Section 80CCC YouTube