In the digital age, when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. For educational purposes such as creative projects or just adding an individual touch to your home, printables for free are now a useful source. For this piece, we'll take a dive to the depths of "Income Tax Deduction For Cancer Patients," exploring their purpose, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Income Tax Deduction For Cancer Patients Below

Income Tax Deduction For Cancer Patients

Income Tax Deduction For Cancer Patients -

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their income tax return This has been discussed below Details of deduction allowed under section 80DDB

Income Tax Deduction For Cancer Patients cover a large selection of printable and downloadable resources available online for download at no cost. These resources come in many types, like worksheets, templates, coloring pages, and more. The appeal of printables for free is in their versatility and accessibility.

More of Income Tax Deduction For Cancer Patients

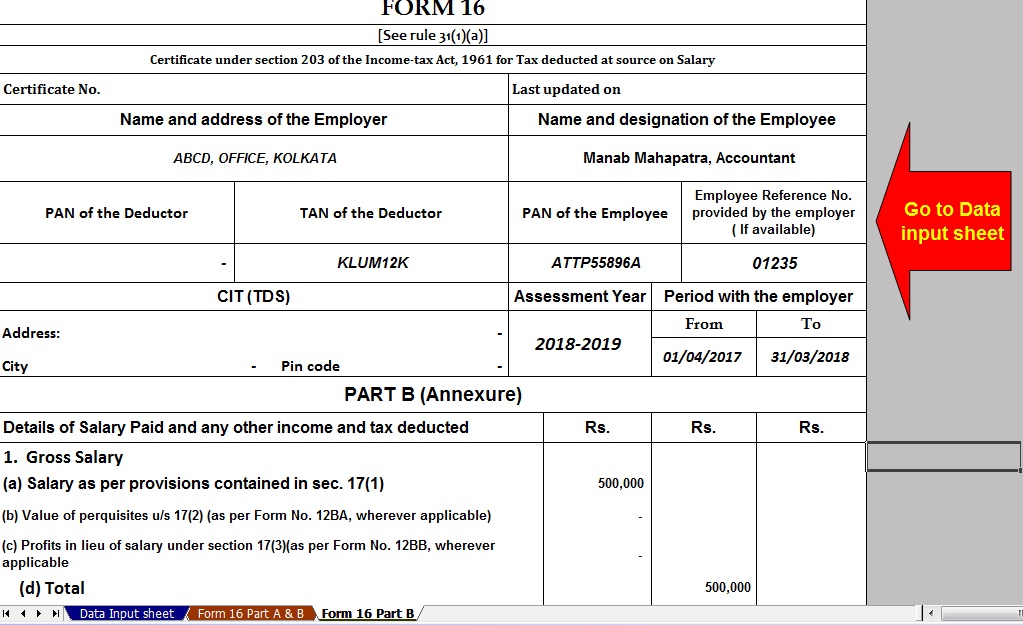

Income Tax Deduction For Medical Treatment With Automated TDS On

Income Tax Deduction For Medical Treatment With Automated TDS On

You may be eligible for tax breaks if diagnosed with cancer Find out these benefits and how they could help you pay fewer taxes as you manage cancer treatment In this article we discuss various U S based resources and regulations

The cost involved in the travel during cancer treatment medical procedures might be tax deductible There is a comprehensive list of costs which would qualify for a tax deduction and this list would include health insurance premiums which are not paid in

The Income Tax Deduction For Cancer Patients have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Personalization They can make print-ready templates to your specific requirements in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value These Income Tax Deduction For Cancer Patients offer a wide range of educational content for learners of all ages, making the perfect tool for teachers and parents.

-

It's easy: Quick access to the vast array of design and templates will save you time and effort.

Where to Find more Income Tax Deduction For Cancer Patients

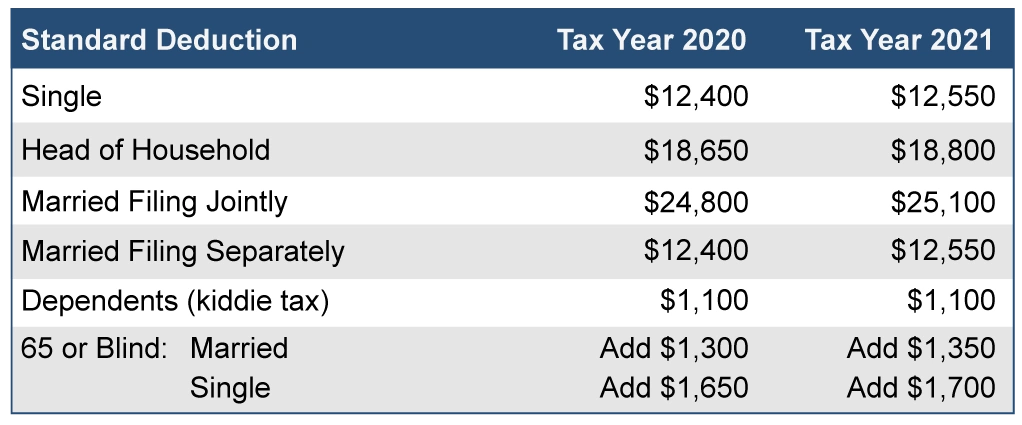

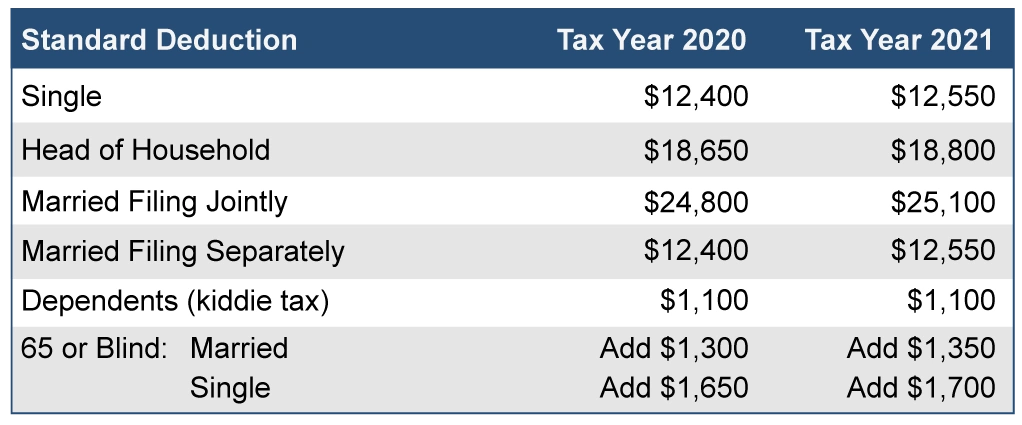

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Section 80DDB of the Income Tax Act of 1961 allows tax deductions to taxpayers on the treatment of certain specified diseases According to Section 80DDB these taxpayers are individuals and Hindu Undivided Families HUFs

Under Section 80DDB of the Income Tax Act 1961 an individual can claim tax deduction for medical treatment of certain specified ailments availed for self or a dependent The dependent can be spouse parent or sibling

After we've peaked your curiosity about Income Tax Deduction For Cancer Patients and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Income Tax Deduction For Cancer Patients to suit a variety of uses.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast variety of topics, that includes DIY projects to party planning.

Maximizing Income Tax Deduction For Cancer Patients

Here are some inventive ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Deduction For Cancer Patients are a treasure trove of practical and innovative resources that cater to various needs and desires. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the vast array that is Income Tax Deduction For Cancer Patients today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial uses?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may contain restrictions in their usage. Make sure you read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home with any printer or head to a print shop in your area for higher quality prints.

-

What software do I need to run printables at no cost?

- A majority of printed materials are in the format PDF. This is open with no cost software such as Adobe Reader.

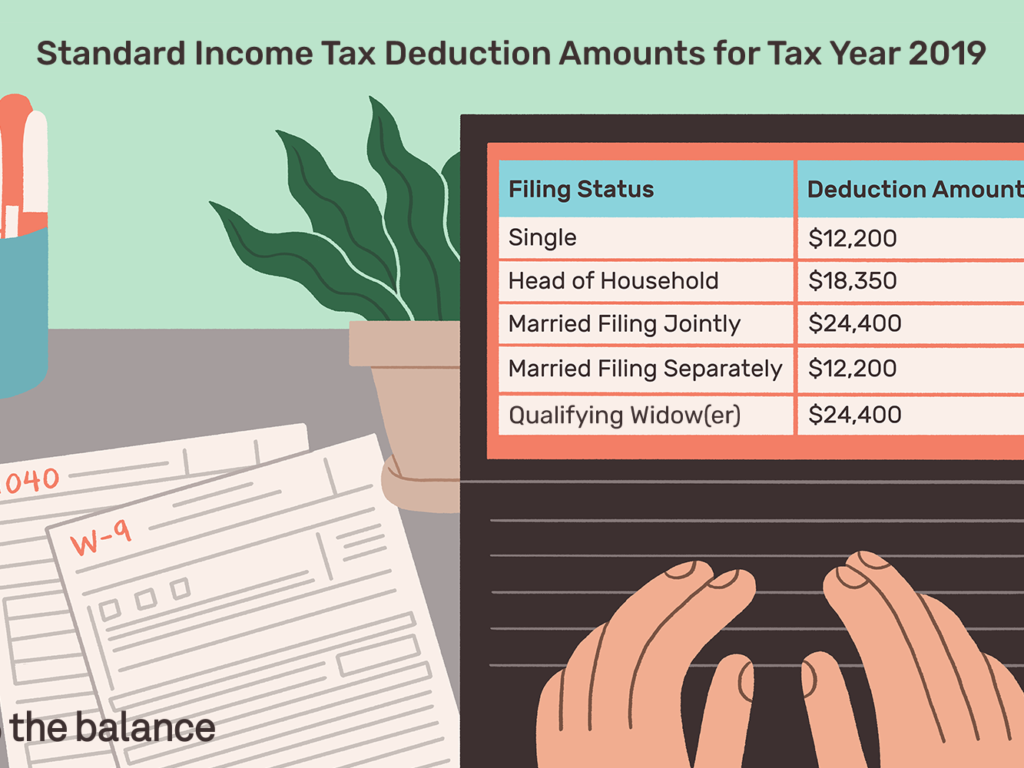

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

Printable Itemized Deductions Worksheet

Check more sample of Income Tax Deduction For Cancer Patients below

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Epf Contribution Table For Age Above 60 2019 Frank Lyman

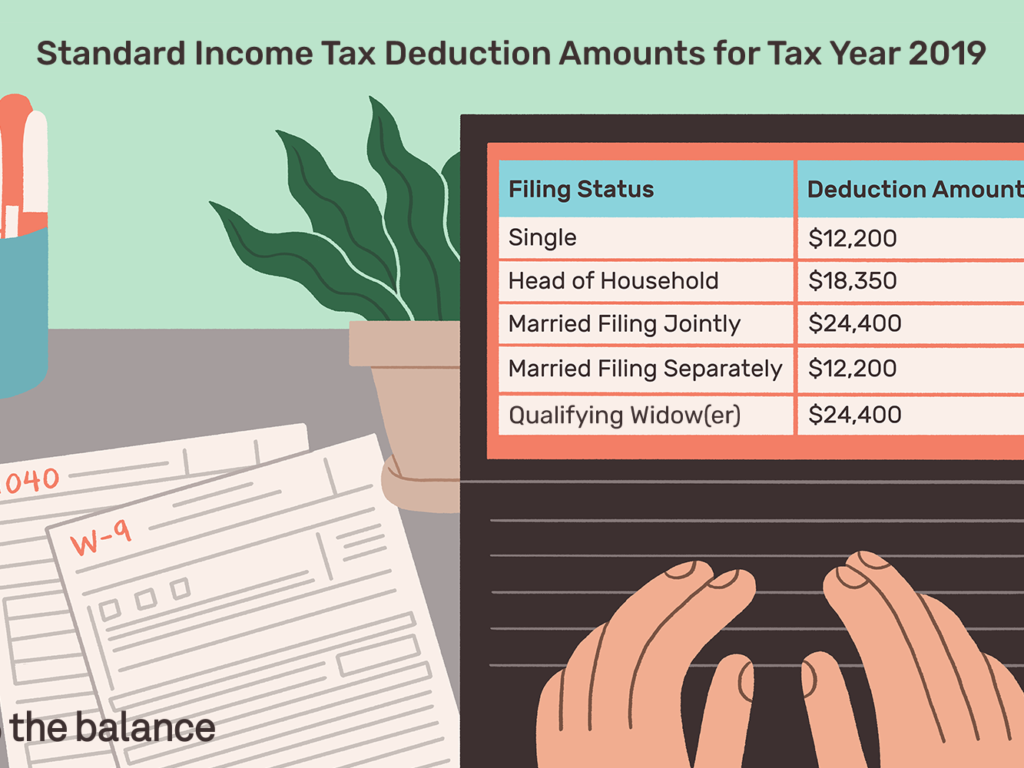

What Is The Standard Deduction For 2021

Standard Income Tax Deduction For 2020 Standard Deduction 2021

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their income tax return This has been discussed below Details of deduction allowed under section 80DDB

https://taxguru.in/income-tax/deduction-section-80...

Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or ailment prescribed by the Board see rule 11DD for prescribed disease or ailment

Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their income tax return This has been discussed below Details of deduction allowed under section 80DDB

Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or ailment prescribed by the Board see rule 11DD for prescribed disease or ailment

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

What Is The Standard Deduction For 2021

Standard Income Tax Deduction For 2020 Standard Deduction 2021

The Tax Deductions For Dementia Patients In The United States Excel

Tax Deductions For Cancer Patients

Tax Deductions For Cancer Patients

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News