In a world with screens dominating our lives The appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses or creative projects, or simply to add a personal touch to your home, printables for free are now a vital resource. This article will take a dive in the world of "Income Tax Deduction For College Fees," exploring what they are, where to locate them, and how they can enrich various aspects of your life.

Get Latest Income Tax Deduction For College Fees Below

Income Tax Deduction For College Fees

Income Tax Deduction For College Fees -

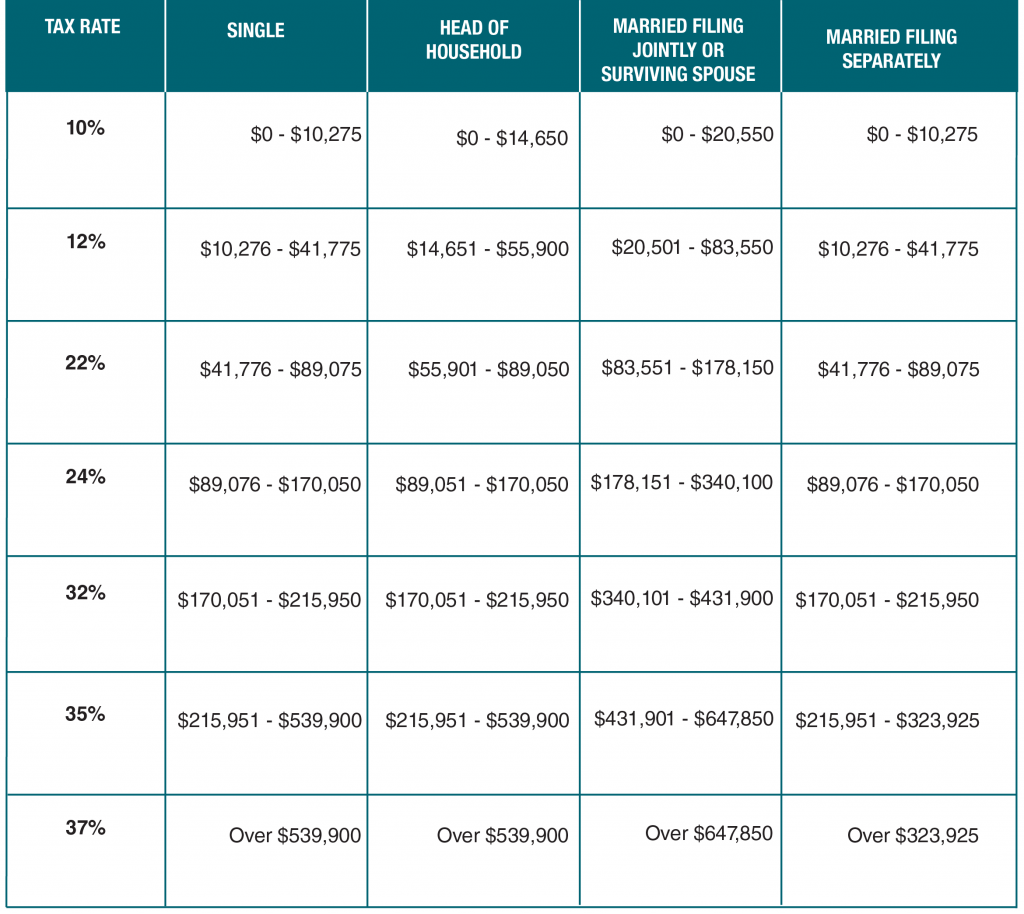

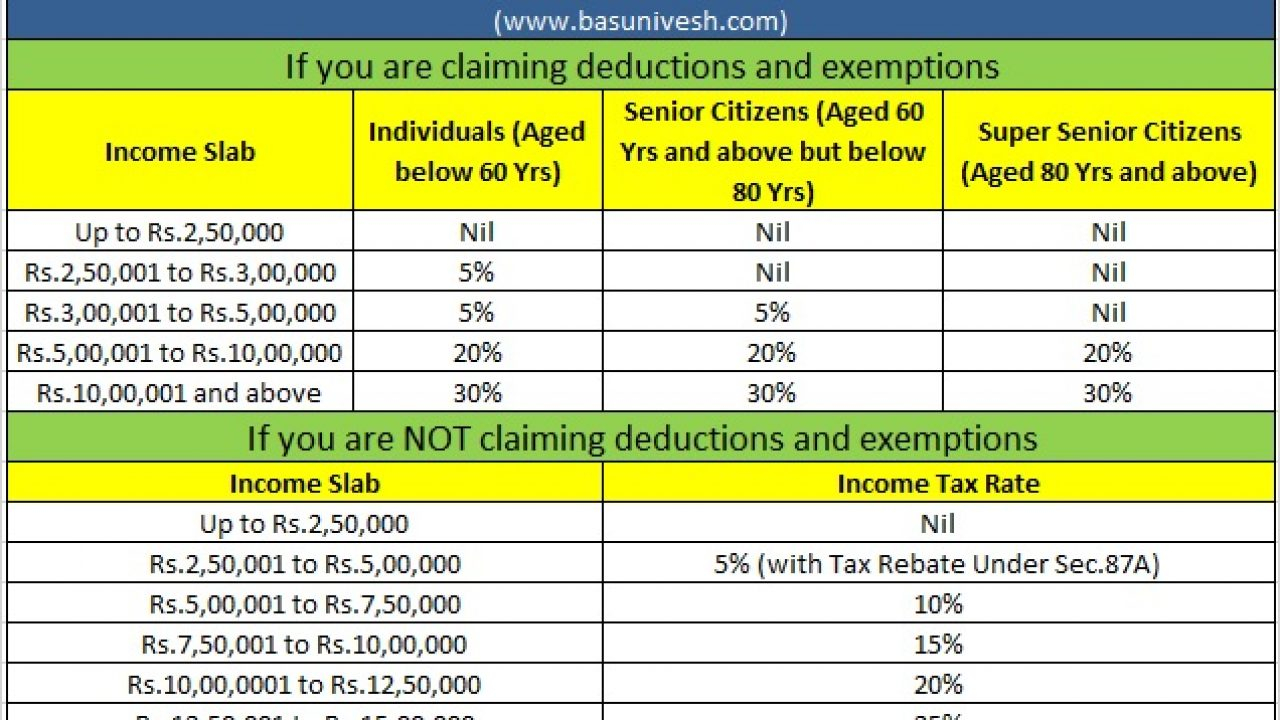

A parent can claim a deduction on the actual amount paid as tuition fees to a university college school or any other educational institution Other components of fees like development fees and transport fees are not eligible for deduction under Section 80C

OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents TABLE OF CONTENTS When can I take this deduction Which expenses qualify What if I receive grants or

Income Tax Deduction For College Fees include a broad assortment of printable materials available online at no cost. They come in many designs, including worksheets coloring pages, templates and many more. One of the advantages of Income Tax Deduction For College Fees is in their variety and accessibility.

More of Income Tax Deduction For College Fees

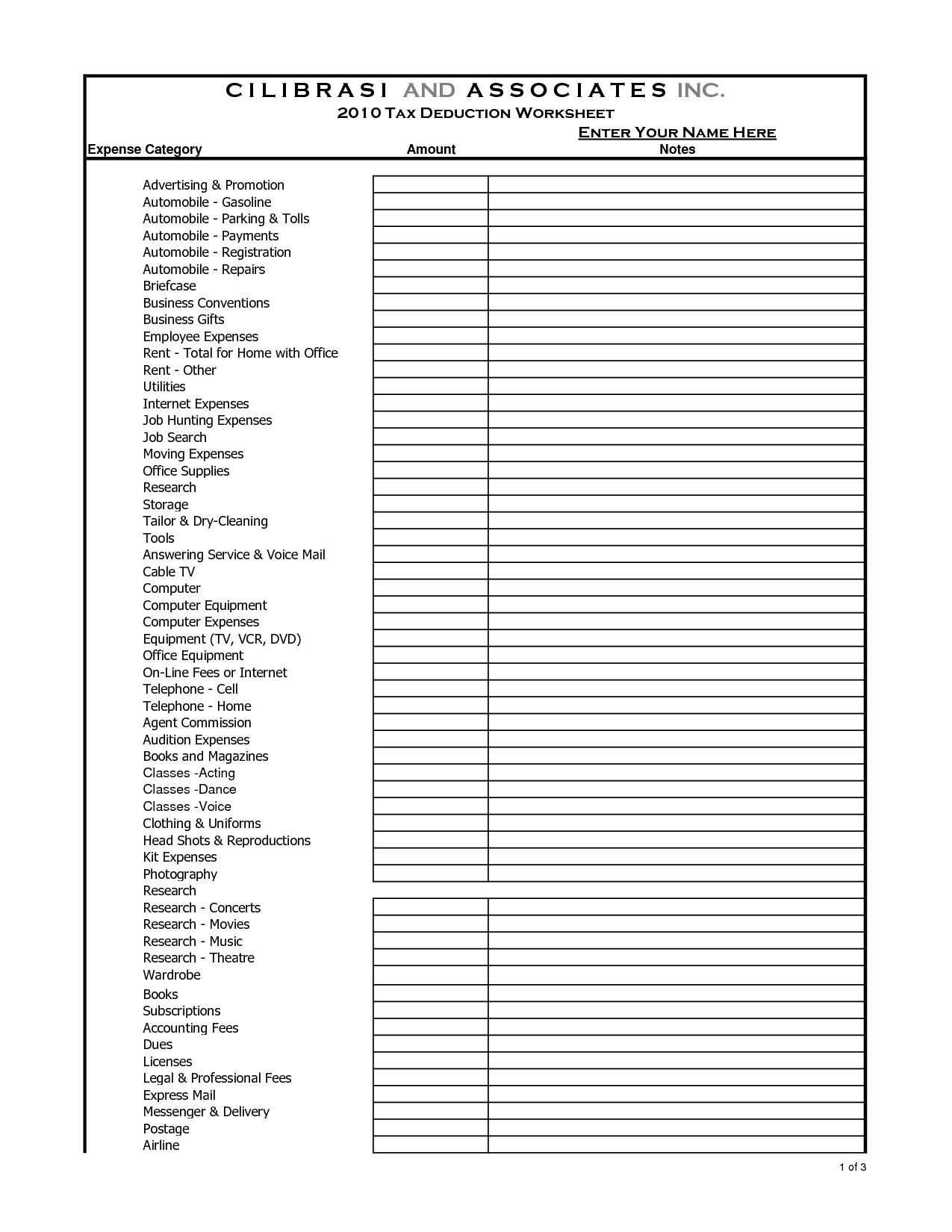

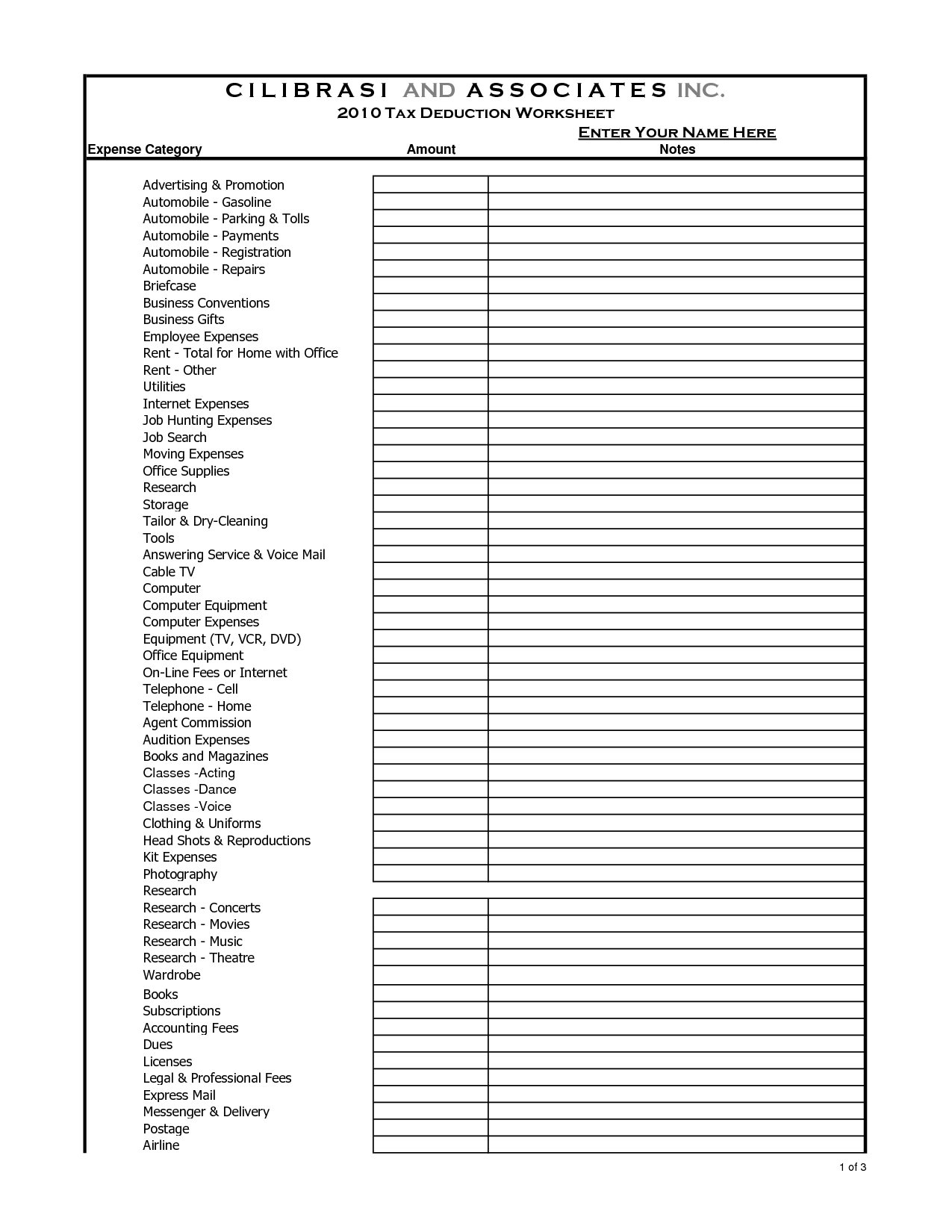

10 Home Based Business Tax Worksheet Worksheeto

10 Home Based Business Tax Worksheet Worksheeto

You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at an approved college

Whether it s community college a trade school a four year university or an advanced degree higher education is expensive The good news is tax credits can help offset these costs

Income Tax Deduction For College Fees have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: You can tailor print-ready templates to your specific requirements for invitations, whether that's creating them as well as organizing your calendar, or even decorating your home.

-

Educational value: Free educational printables offer a wide range of educational content for learners from all ages, making these printables a powerful device for teachers and parents.

-

The convenience of instant access many designs and templates will save you time and effort.

Where to Find more Income Tax Deduction For College Fees

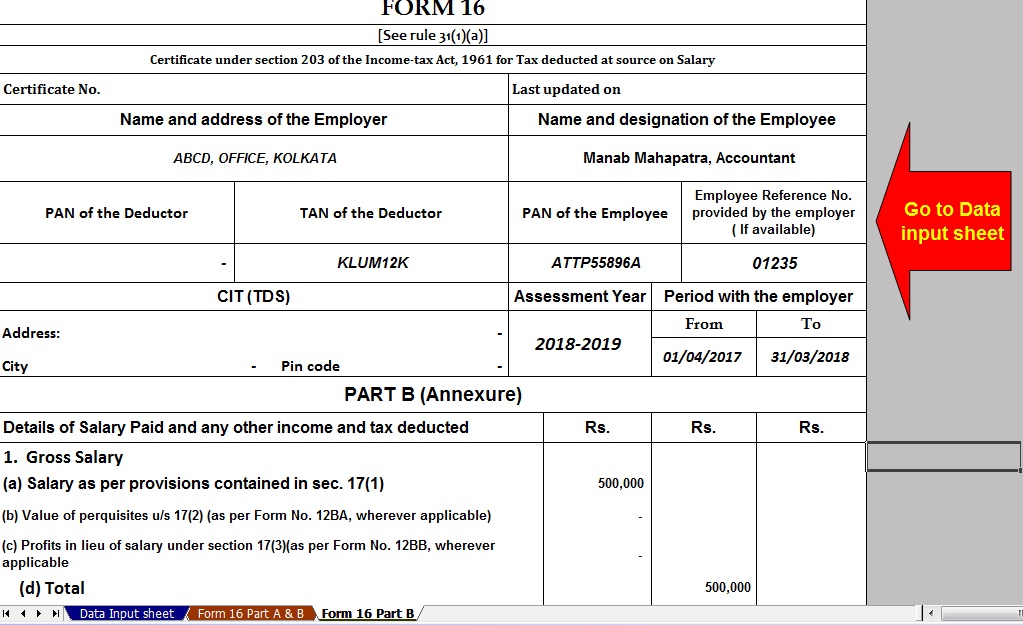

Income Tax Deduction For Medical Treatment With Automated TDS On

Income Tax Deduction For Medical Treatment With Automated TDS On

Some college tuition and fees are deductible on your 2022 tax return The American Opportunity and the Lifetime Learning tax credits provide deductions but you can only use one at a time

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit

Now that we've ignited your curiosity about Income Tax Deduction For College Fees Let's find out where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Income Tax Deduction For College Fees for various objectives.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs are a vast range of topics, that includes DIY projects to planning a party.

Maximizing Income Tax Deduction For College Fees

Here are some creative ways of making the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Income Tax Deduction For College Fees are an abundance with useful and creative ideas that satisfy a wide range of requirements and interests. Their access and versatility makes these printables a useful addition to each day life. Explore the world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download these documents for free.

-

Can I utilize free printables for commercial purposes?

- It depends on the specific rules of usage. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright concerns with Income Tax Deduction For College Fees?

- Certain printables may be subject to restrictions regarding usage. Be sure to review the terms and condition of use as provided by the designer.

-

How can I print Income Tax Deduction For College Fees?

- You can print them at home with any printer or head to an in-store print shop to get higher quality prints.

-

What software do I need in order to open printables that are free?

- A majority of printed materials are in the format of PDF, which is open with no cost software, such as Adobe Reader.

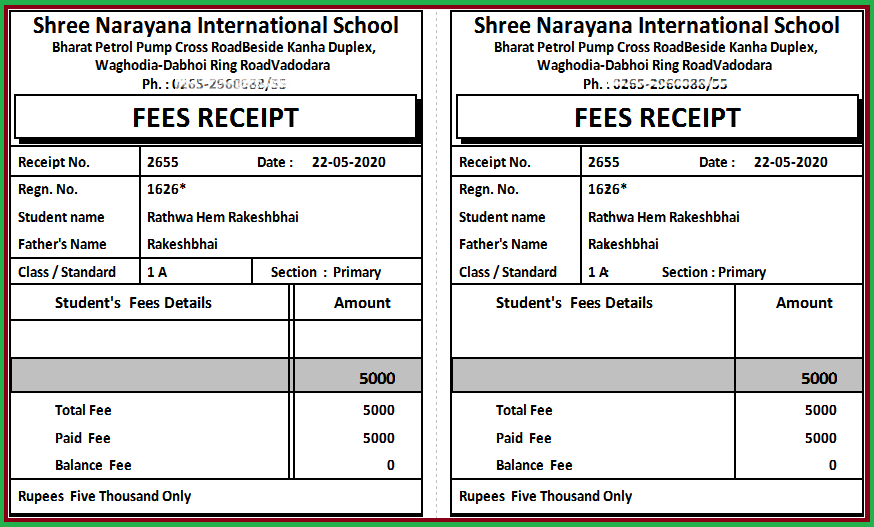

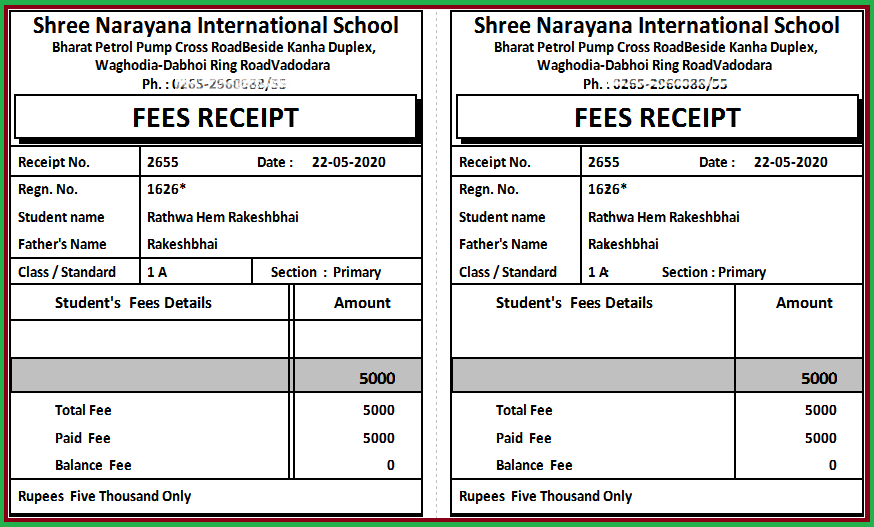

Printable Free Professional Fee Receipt Templates At

Tax Deduction Of Secretarial Fees And Tax Filing Fees

Check more sample of Income Tax Deduction For College Fees below

Tax Deductions You Can Deduct What Napkin Finance

Can I Claim Student Loan Interest Deduction College Raptor

Tax Deduction For Secretarial And Tax Filing Fee

Form 1040 U S Individual Tax Return Definition

/GettyImages-184939771-10a77dd8e8b34ac7aaff499dfe09a657.jpg)

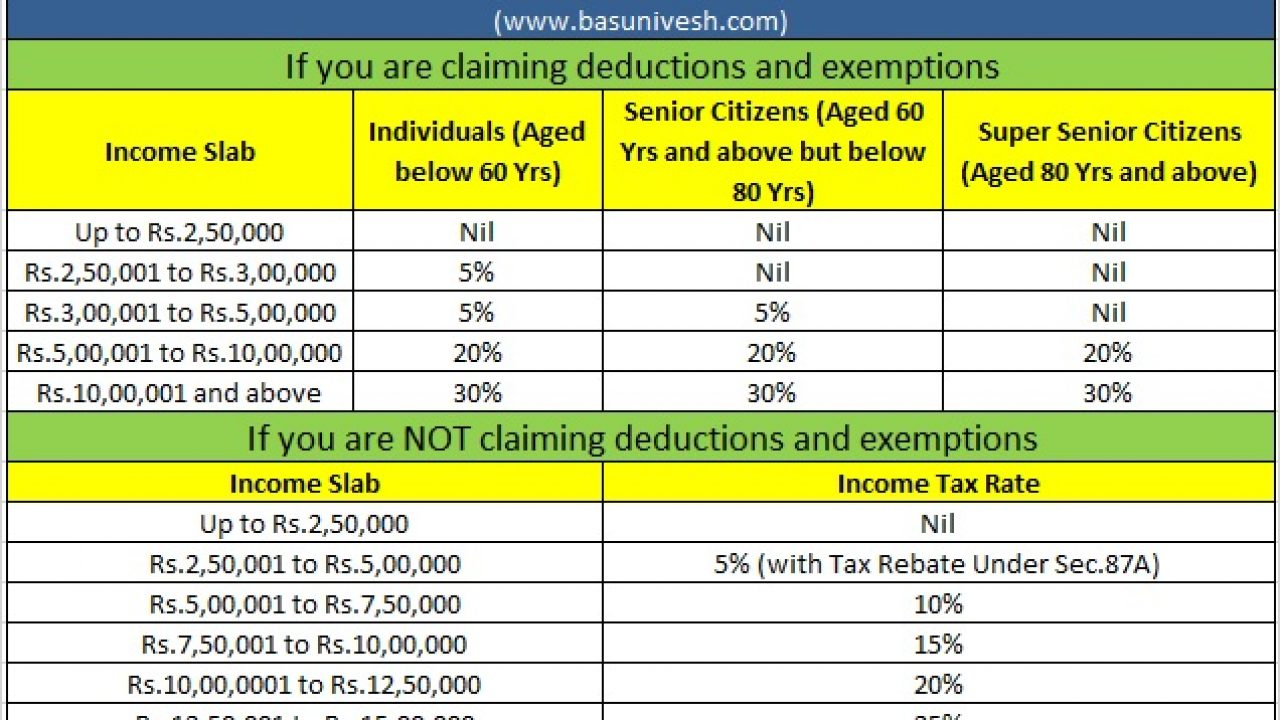

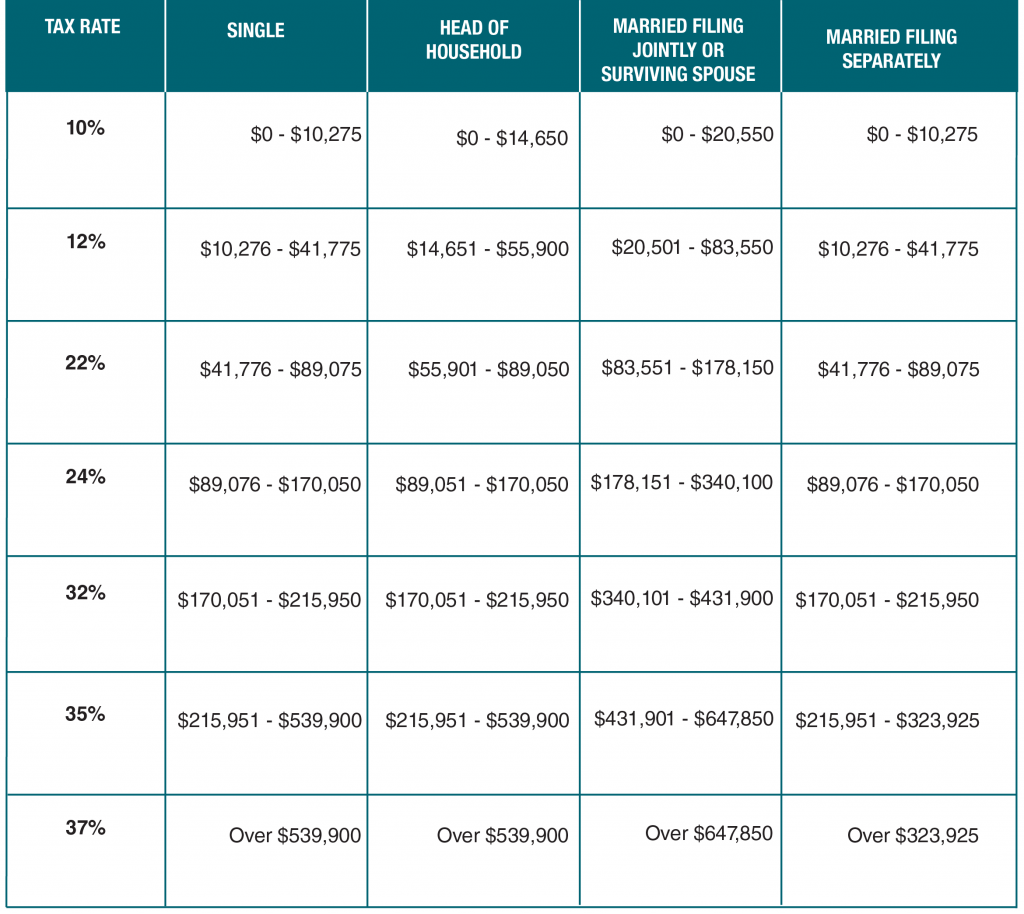

2022 Tax Tables Married Filing Jointly Printable Form Templates And

Request Letter For Tax Certificate For Income Tax SemiOffice Com

https://turbotax.intuit.com/tax-tips/college-and...

OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents TABLE OF CONTENTS When can I take this deduction Which expenses qualify What if I receive grants or

https://www.irs.gov/credits-deductions/individuals/...

You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year Eligible expenses also include student activity fees you are required to pay to enroll or attend the school

OVERVIEW The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents TABLE OF CONTENTS When can I take this deduction Which expenses qualify What if I receive grants or

You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year Eligible expenses also include student activity fees you are required to pay to enroll or attend the school

/GettyImages-184939771-10a77dd8e8b34ac7aaff499dfe09a657.jpg)

Form 1040 U S Individual Tax Return Definition

Can I Claim Student Loan Interest Deduction College Raptor

2022 Tax Tables Married Filing Jointly Printable Form Templates And

Request Letter For Tax Certificate For Income Tax SemiOffice Com

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Fee Slip Format For School Toparhitecti ro

Fee Slip Format For School Toparhitecti ro

Deduction For Expenses In Relation To The Cost Of Personal Protective