In a world when screens dominate our lives and the appeal of physical printed material hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or just adding an individual touch to the space, Income Tax Deduction For Hearing Aids have become a valuable resource. In this article, we'll dive to the depths of "Income Tax Deduction For Hearing Aids," exploring what they are, how they are, and the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Deduction For Hearing Aids Below

Income Tax Deduction For Hearing Aids

Income Tax Deduction For Hearing Aids -

Key Takeaways You may be able to claim a medical expense deduction for costs related to your hearing loss or deafness including the cost of hearing aids batteries maintenance and repairs If you re deaf or have hearing loss you may be able to deduct the cost of special aids you need to work effectively

So the short answer is yes hearing aids qualify for a tax deduction However the answer in your specific situation will depend on a few factors Did your out of pocket medical care expense exceed 7 5 of your adjusted gross income Did you pay for your hearing aids through a health savings account HSA Do you qualify for the

Printables for free include a vast assortment of printable, downloadable items that are available online at no cost. These resources come in various types, such as worksheets templates, coloring pages and much more. The benefit of Income Tax Deduction For Hearing Aids is in their variety and accessibility.

More of Income Tax Deduction For Hearing Aids

Pascrell Opening Statement At Hearing To Restore SALT Deduction YouTube

Pascrell Opening Statement At Hearing To Restore SALT Deduction YouTube

Are hearing aids tax deductible Yes Those with large uninsured medical and dental expenses during the year such as hearing aids which can cost up to 6 000 and are not often covered by insurance may benefit from itemizing

Did you know that hearing aids may be tax deductible For individuals with hearing loss this can provide a significant financial benefit The Internal Revenue Service IRS recognizes the importance of hearing health and allows eligible taxpayers to claim hearing aids as a medical expense deduction

Income Tax Deduction For Hearing Aids have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: We can customize printed materials to meet your requirements whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Free educational printables are designed to appeal to students from all ages, making them a valuable device for teachers and parents.

-

The convenience of Instant access to various designs and templates helps save time and effort.

Where to Find more Income Tax Deduction For Hearing Aids

CareCredit Rewards MasterCard Login 2022 Www carecredit In 2022

CareCredit Rewards MasterCard Login 2022 Www carecredit In 2022

Depending on your situation you may be able to pay for hearing aids using a Health Savings Account HSA or a Flexible Spending Arrangement FSA With both the HSA and FSA there is no deduction threshold All the cash contributed to the HSA or FSA reduces your taxable income i e is considered pre tax dollars

The good news is that if you have an income and pay income tax you can claim a tax offset for any out of pocket costs on your hearing aids They come under the category of medical expenses Tax offsets are means tested for people on a

In the event that we've stirred your curiosity about Income Tax Deduction For Hearing Aids We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in Income Tax Deduction For Hearing Aids for different applications.

- Explore categories such as the home, decor, craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs are a vast selection of subjects, that range from DIY projects to planning a party.

Maximizing Income Tax Deduction For Hearing Aids

Here are some creative ways to make the most use of Income Tax Deduction For Hearing Aids:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Deduction For Hearing Aids are an abundance of practical and innovative resources which cater to a wide range of needs and passions. Their accessibility and versatility make they a beneficial addition to both personal and professional life. Explore the vast collection of Income Tax Deduction For Hearing Aids now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Deduction For Hearing Aids really completely free?

- Yes you can! You can download and print these files for free.

-

Can I utilize free printables to make commercial products?

- It's based on the rules of usage. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Do you have any copyright issues with Income Tax Deduction For Hearing Aids?

- Some printables could have limitations on use. Be sure to review these terms and conditions as set out by the creator.

-

How can I print Income Tax Deduction For Hearing Aids?

- You can print them at home with any printer or head to a print shop in your area for premium prints.

-

What software do I need to open printables for free?

- Most PDF-based printables are available with PDF formats, which can be opened using free software like Adobe Reader.

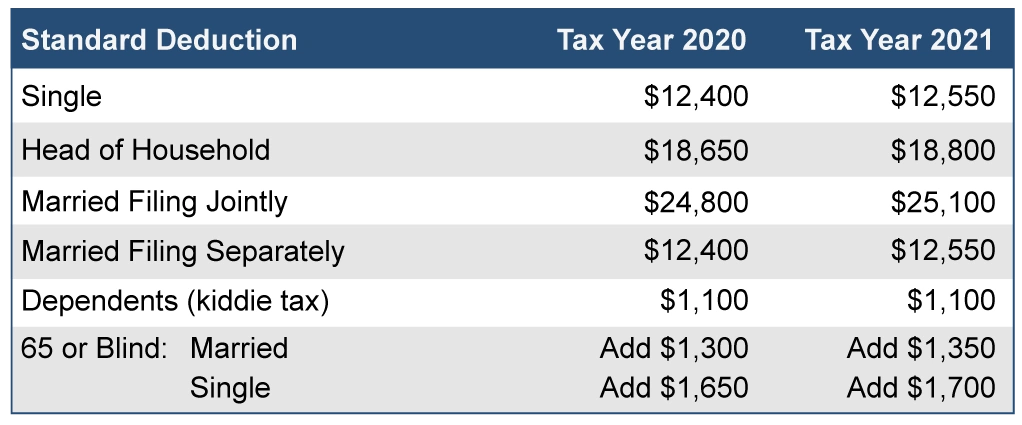

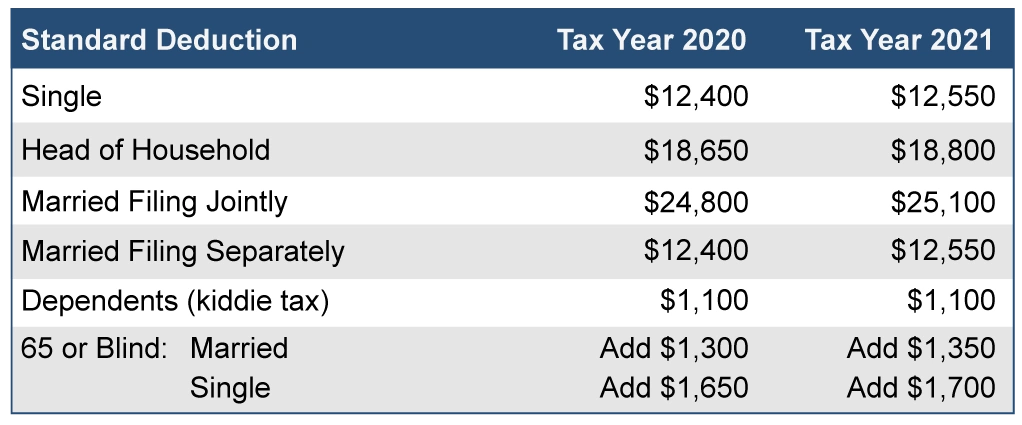

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Paying For Hearing Aids Tax Breaks From Uncle Sam With HSAs And FSAs

Check more sample of Income Tax Deduction For Hearing Aids below

How To Take A Tax Deduction On Your Hearing Aids With Sample Math

Are Hearing Aids Covered By Medicare Part B MedicareTalk

Tax Aid For Hearing Aids Maybe SDPB Radio

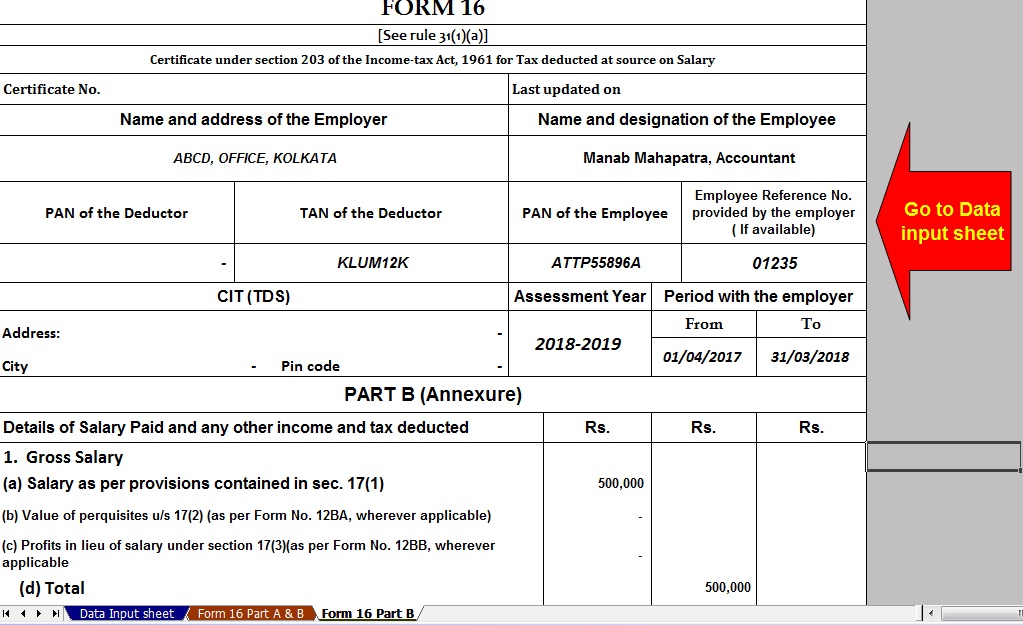

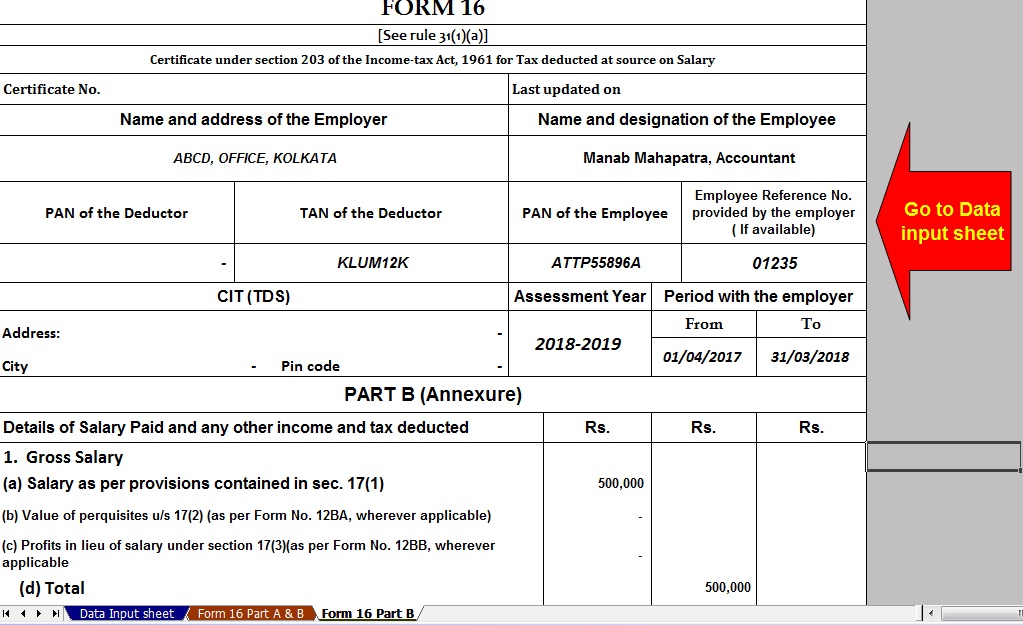

Income Tax Deduction For Medical Treatment With Automated TDS On

Printable Itemized Deductions Worksheet

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

https://www.soundly.com/blog/hearing-aid-tax-deductions

So the short answer is yes hearing aids qualify for a tax deduction However the answer in your specific situation will depend on a few factors Did your out of pocket medical care expense exceed 7 5 of your adjusted gross income Did you pay for your hearing aids through a health savings account HSA Do you qualify for the

https://community.ato.gov.au/s/question/a0J9s0000001JrJ

BlakeATO Community Support 9 Oct 2020 Hi JamilaGen Previously disability aids like hearing aids were able to be claimed under the net medical expenses tax offset This offset is no longer available as of 1 July 2019 and its phase out coincided with the phase in of NDIS

So the short answer is yes hearing aids qualify for a tax deduction However the answer in your specific situation will depend on a few factors Did your out of pocket medical care expense exceed 7 5 of your adjusted gross income Did you pay for your hearing aids through a health savings account HSA Do you qualify for the

BlakeATO Community Support 9 Oct 2020 Hi JamilaGen Previously disability aids like hearing aids were able to be claimed under the net medical expenses tax offset This offset is no longer available as of 1 July 2019 and its phase out coincided with the phase in of NDIS

Income Tax Deduction For Medical Treatment With Automated TDS On

Are Hearing Aids Covered By Medicare Part B MedicareTalk

Printable Itemized Deductions Worksheet

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

What Is The Standard Deduction For 2021

What Is The Standard Deduction For 2021

Notice Of Motion For Wage Deduction Exemption Hearing 171 292A Pdf