In the digital age, in which screens are the norm yet the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an individual touch to the space, Income Tax Deduction For Home Health Care are a great source. For this piece, we'll take a dive into the world "Income Tax Deduction For Home Health Care," exploring the different types of printables, where to find them, and how they can add value to various aspects of your lives.

Get Latest Income Tax Deduction For Home Health Care Below

Income Tax Deduction For Home Health Care

Income Tax Deduction For Home Health Care -

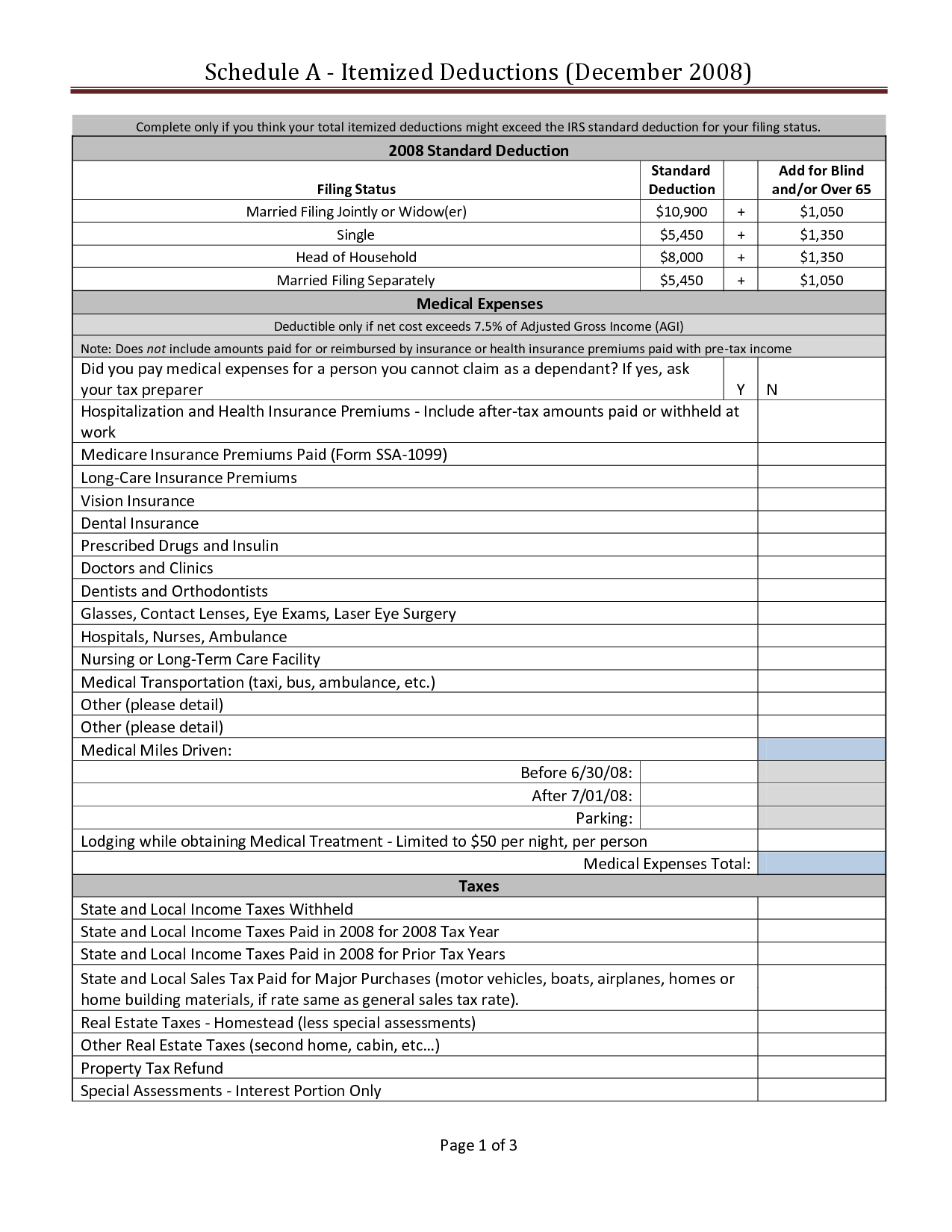

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you itemize deductions The

Income Tax Deduction For Home Health Care include a broad selection of printable and downloadable materials that are accessible online for free cost. These resources come in various styles, from worksheets to templates, coloring pages and many more. The appeal of printables for free is in their versatility and accessibility.

More of Income Tax Deduction For Home Health Care

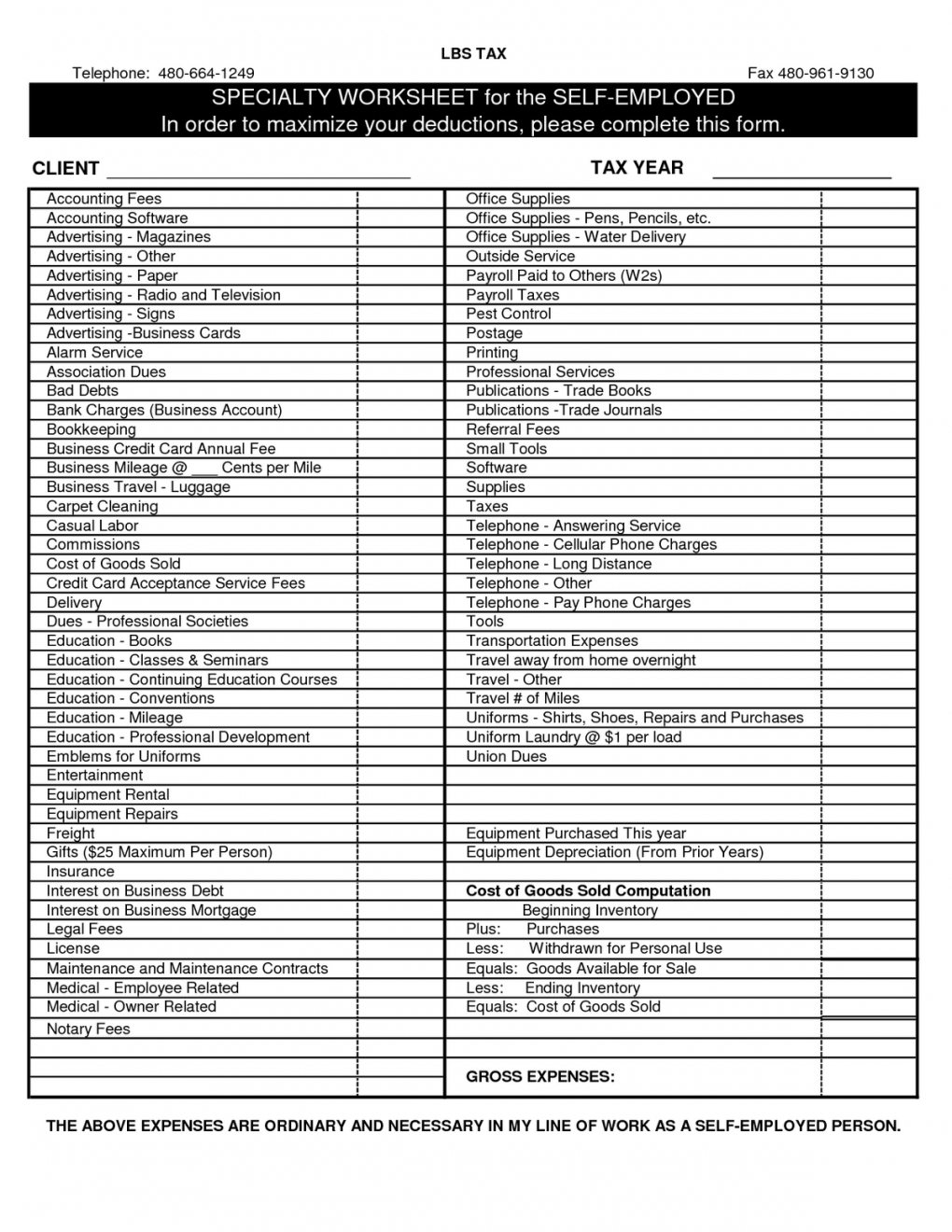

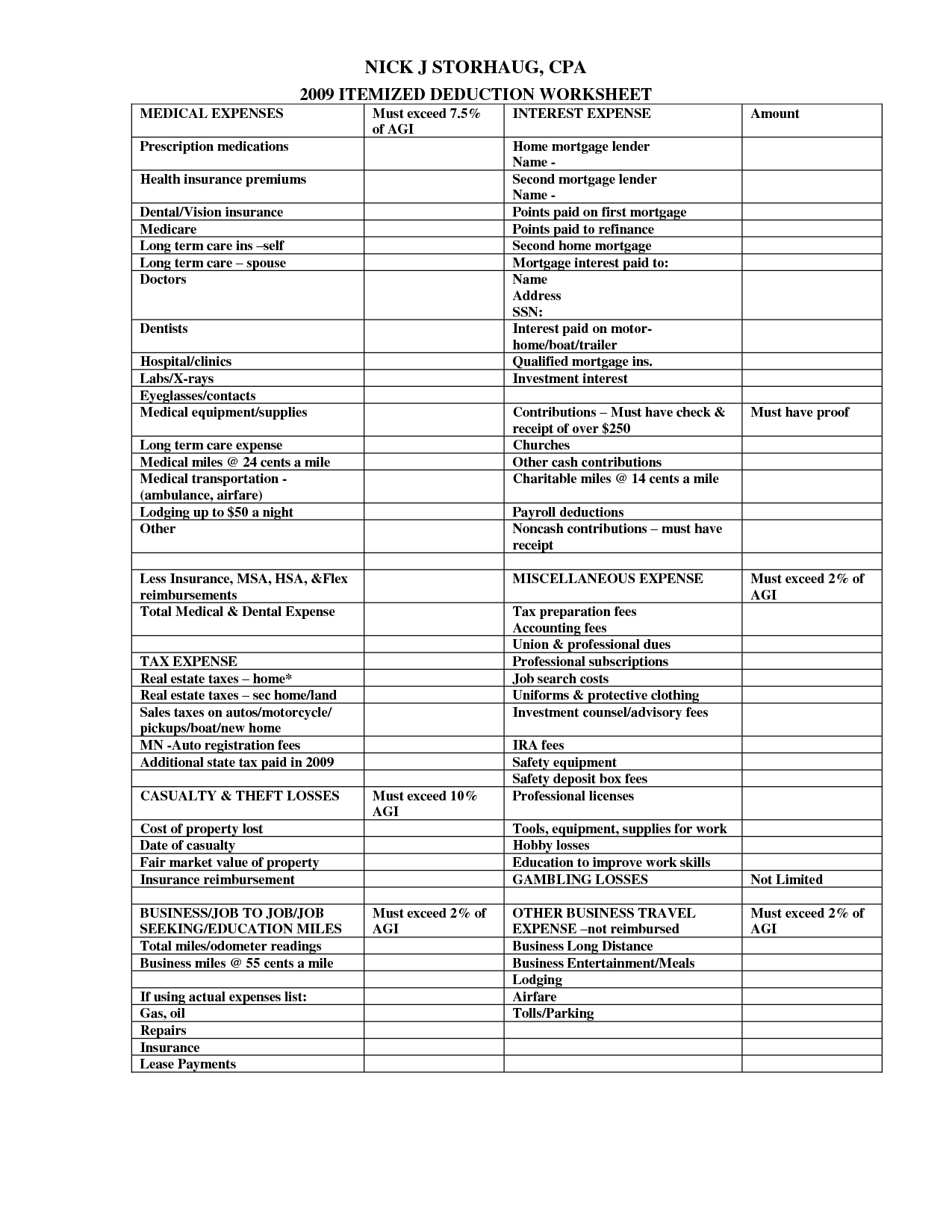

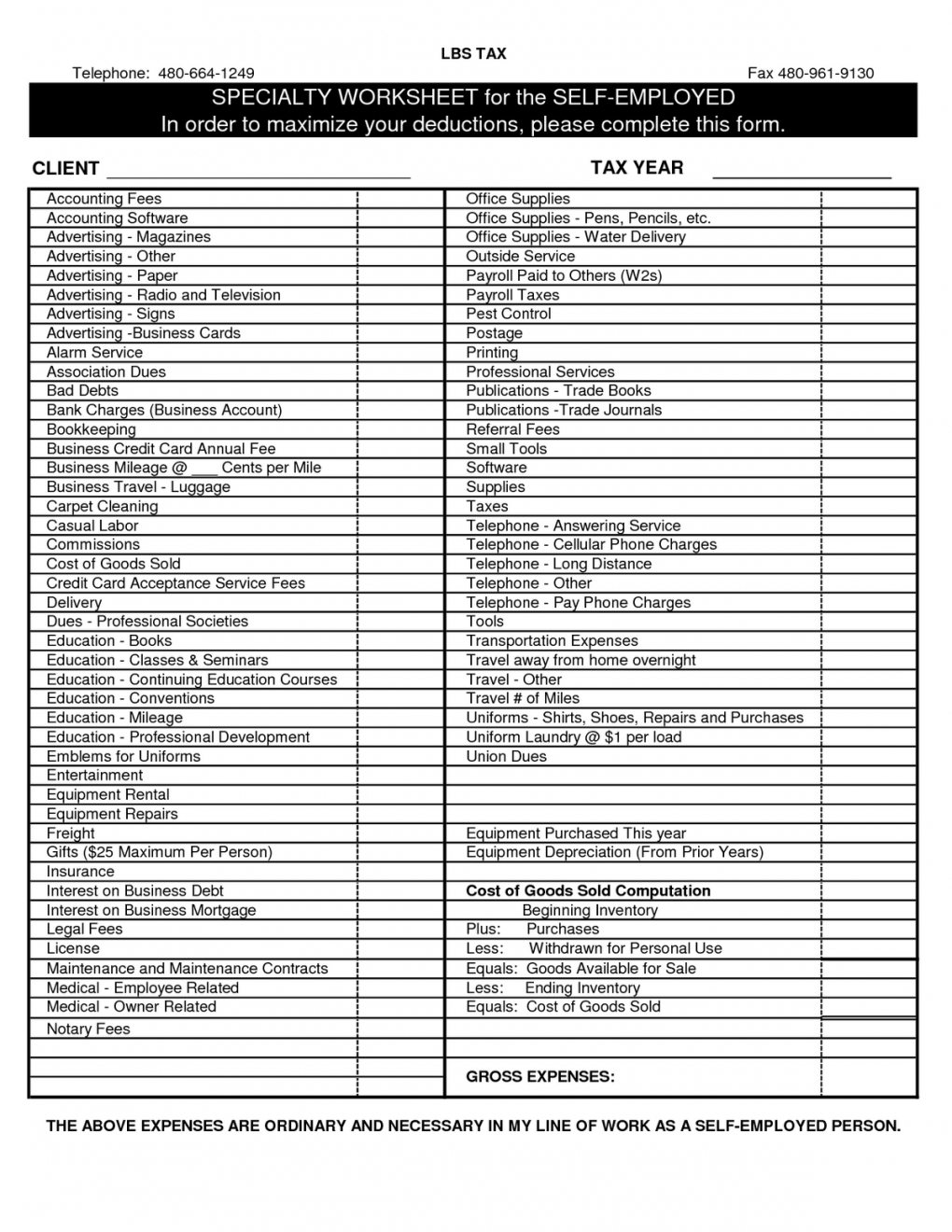

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

According to IRS Publication 502 in general only medical services performed by a home care worker can be deducted Some examples of qualifying services include giving medication wound care and help with the management of diseases and long term conditions

The short answer is yes but there are some criteria you need to meet You must be unmarried or unmarried on the last day of the year You claim your parent as a dependent You paid more than half of the cost of keeping up a home for your parent more than half of the tax year

Income Tax Deduction For Home Health Care have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: There is the possibility of tailoring print-ready templates to your specific requirements such as designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value Printables for education that are free can be used by students from all ages, making these printables a powerful device for teachers and parents.

-

Accessibility: You have instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Income Tax Deduction For Home Health Care

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

Is in home care tax deductible The cost of certain nonmedical home care services may be deductible if a doctor determines they are medically necessary and includes them in a prescribed plan of care Home care typically consists of help with activities of daily living ADLs

Topic no 502 Medical and dental expenses If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your

Since we've got your interest in printables for free We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection and Income Tax Deduction For Home Health Care for a variety motives.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing including flashcards, learning tools.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast range of interests, starting from DIY projects to party planning.

Maximizing Income Tax Deduction For Home Health Care

Here are some fresh ways that you can make use of Income Tax Deduction For Home Health Care:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Income Tax Deduction For Home Health Care are a treasure trove of creative and practical resources which cater to a wide range of needs and interests. Their accessibility and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the world of Income Tax Deduction For Home Health Care today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial uses?

- It's based on specific terms of use. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright rights issues with Income Tax Deduction For Home Health Care?

- Some printables may have restrictions on their use. Always read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit an area print shop for premium prints.

-

What software do I need to run printables at no cost?

- Most printables come in the PDF format, and is open with no cost software, such as Adobe Reader.

Home Daycare Tax Worksheet Personal Budget Spreadsheet Budgeting

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Check more sample of Income Tax Deduction For Home Health Care below

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Section 80EE Income Tax Deduction For Interest On Home Loan

Printable Itemized Deductions Worksheet

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Farm Income And Expense Spreadsheet Download Pertaining To Farm Expense

Income Tax 80c Deduction Fy 2021 22 TAX

https://www.cpapracticeadvisor.com/2022/11/09/home...

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you itemize deductions The

https://www.irs.gov/faqs/itemized-deductions...

Yes in certain instances nursing home expenses are deductible medical expenses If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense

Background Currently you can deduct unreimbursed medical expenses in excess of 7 5 of your adjusted gross income AGI down from 10 of AGI if you itemize deductions The

Yes in certain instances nursing home expenses are deductible medical expenses If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EE Income Tax Deduction For Interest On Home Loan

Farm Income And Expense Spreadsheet Download Pertaining To Farm Expense

Income Tax 80c Deduction Fy 2021 22 TAX

Section 80EE The Ultimate Guide To Income Tax Deduction For Home Loan

When Can You Claim A Tax Deduction For Health Insurance

When Can You Claim A Tax Deduction For Health Insurance

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense