Today, where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. In the case of educational materials such as creative projects or simply to add a personal touch to your home, printables for free have proven to be a valuable resource. For this piece, we'll take a dive deep into the realm of "Income Tax Deduction For House Rent Paid," exploring their purpose, where to find them, and what they can do to improve different aspects of your life.

Get Latest Income Tax Deduction For House Rent Paid Below

Income Tax Deduction For House Rent Paid

Income Tax Deduction For House Rent Paid -

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

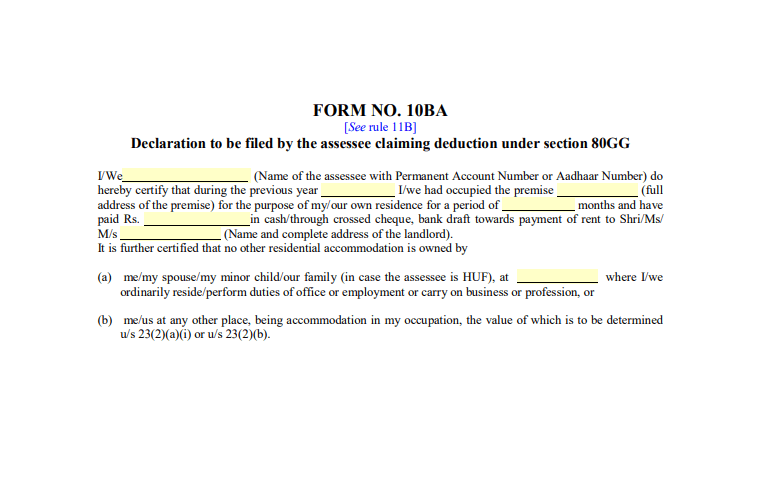

It is a declaration that has to be filed by an individual who wants to claim a deduction under section 80GG for rent paid on rental property while filing their income tax returns

Income Tax Deduction For House Rent Paid cover a large collection of printable materials online, at no cost. They are available in a variety of types, like worksheets, templates, coloring pages, and much more. The appealingness of Income Tax Deduction For House Rent Paid is their versatility and accessibility.

More of Income Tax Deduction For House Rent Paid

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Rental income from residential and other property You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises to 34 for amounts

Individuals owning a residential property that generates rental income or is self occupied are eligible to claim deductions under Section 24 Types of deductions Standard deduction A flat 30 deduction is allowed on the gross annual value of the property regardless of any actual expenses incurred

Income Tax Deduction For House Rent Paid have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization This allows you to modify print-ready templates to your specific requirements, whether it's designing invitations to organize your schedule or decorating your home.

-

Educational Use: Printables for education that are free can be used by students of all ages, which makes them an essential aid for parents as well as educators.

-

The convenience of Quick access to numerous designs and templates helps save time and effort.

Where to Find more Income Tax Deduction For House Rent Paid

Tax Deduction On House Rent U S 80GG Without HRA For Employees

Tax Deduction On House Rent U S 80GG Without HRA For Employees

HRA Salary Components Salary Income Last updated on November 24th 2023 With the increase in urbanisation more people are moving to cities for better career opportunities As these people move to cities demand for housing facilities increases causing a spike in rental prices Such rent expenses are so huge that it burns a hole in

House Rent Allowance or HRA is a component of salary provided by employers to employees to meet their rental expenses HRA can be claimed as a tax deduction under the Income Tax Act The amount of HRA received depends on factors such as the employee s salary the actual rent paid and the city of residence

In the event that we've stirred your curiosity about Income Tax Deduction For House Rent Paid We'll take a look around to see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of applications.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free including flashcards, learning tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs are a vast selection of subjects, that range from DIY projects to party planning.

Maximizing Income Tax Deduction For House Rent Paid

Here are some ways how you could make the most of Income Tax Deduction For House Rent Paid:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Deduction For House Rent Paid are an abundance of fun and practical tools catering to different needs and preferences. Their accessibility and versatility make them a valuable addition to both personal and professional life. Explore the vast array of Income Tax Deduction For House Rent Paid now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can download and print these materials for free.

-

Can I download free templates for commercial use?

- It's dependent on the particular rules of usage. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions on their use. Make sure to read the terms and conditions set forth by the creator.

-

How do I print Income Tax Deduction For House Rent Paid?

- You can print them at home with either a printer or go to a local print shop to purchase better quality prints.

-

What software do I require to open Income Tax Deduction For House Rent Paid?

- Most PDF-based printables are available with PDF formats, which can be opened using free software like Adobe Reader.

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

5 Itemized Tax Deduction Worksheet Worksheeto

Check more sample of Income Tax Deduction For House Rent Paid below

Income Tax Deduction For Rent Paid Section 80GG IndiaFilings

Rent Receipt For Income Tax Deductions Under HRA

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Deduction For House Rent Paid U s 80GG For The Financial Year 2021 22

80GG Deduction On House Rent Paid With Automated Income Tax

Income Tax Deduction For House Rent TOP CHARTERED ACCOUNTANT IN

https:// cleartax.in /s/claim-deduction-under-section-80gg-for-rent-paid

It is a declaration that has to be filed by an individual who wants to claim a deduction under section 80GG for rent paid on rental property while filing their income tax returns

https:// taxguru.in /income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

It is a declaration that has to be filed by an individual who wants to claim a deduction under section 80GG for rent paid on rental property while filing their income tax returns

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Deduction For House Rent Paid U s 80GG For The Financial Year 2021 22

Rent Receipt For Income Tax Deductions Under HRA

80GG Deduction On House Rent Paid With Automated Income Tax

Income Tax Deduction For House Rent TOP CHARTERED ACCOUNTANT IN

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Income Tax

Income Tax

Section 80GG Deduction Income Tax IndiaFilings