In the age of digital, with screens dominating our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons and creative work, or simply adding an element of personalization to your space, Income Tax Deduction For Nps Tier 1 have become an invaluable resource. In this article, we'll dive into the sphere of "Income Tax Deduction For Nps Tier 1," exploring the different types of printables, where they are, and what they can do to improve different aspects of your life.

Get Latest Income Tax Deduction For Nps Tier 1 Below

Income Tax Deduction For Nps Tier 1

Income Tax Deduction For Nps Tier 1 -

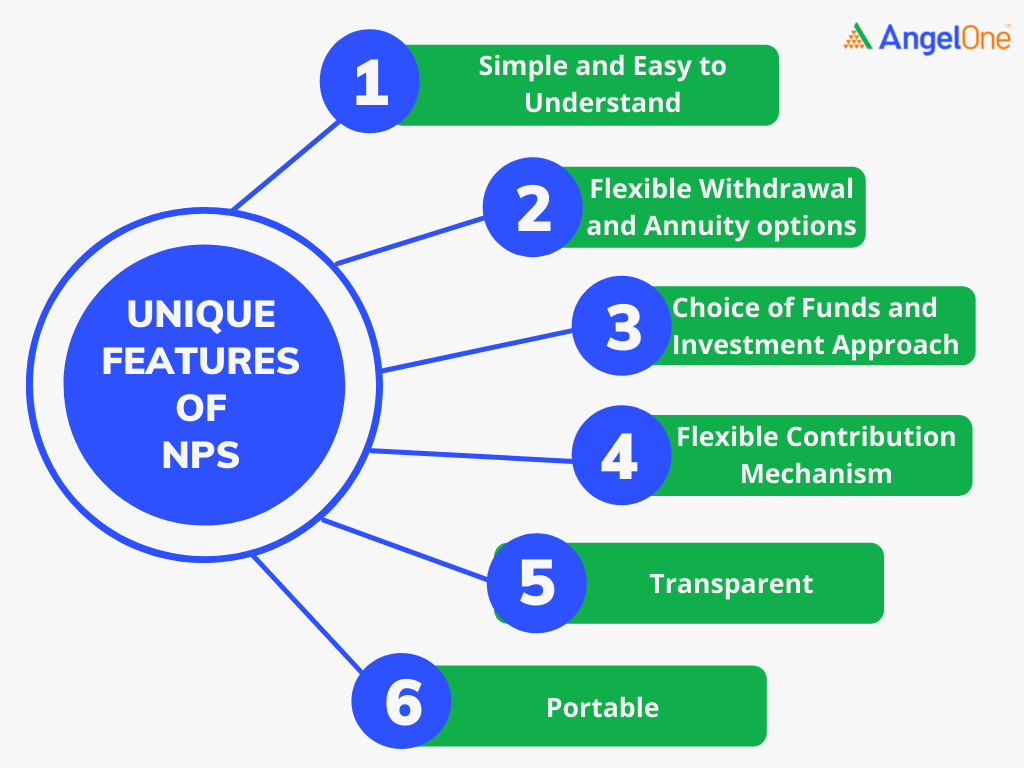

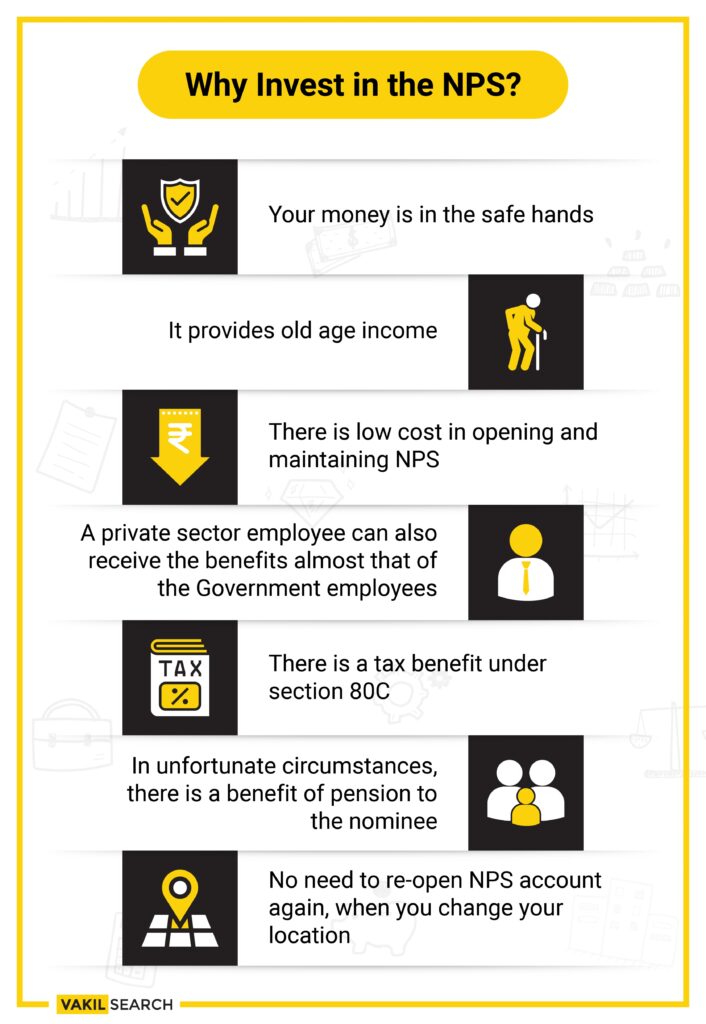

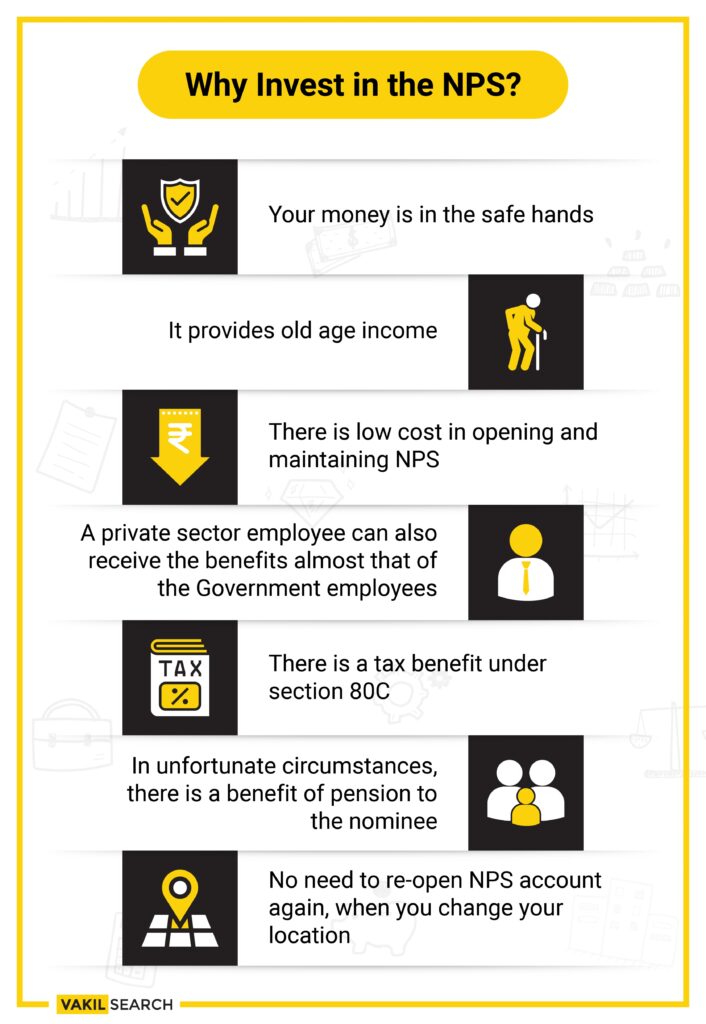

Verkko 16 syysk 2022 nbsp 0183 32 What are NPS Tier 1 and Tier 2 Tax Benefits The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any

Verkko 6 maalisk 2023 nbsp 0183 32 Under Section 80CCE all NPS Tier 1 subscribers can claim a deduction of up to Rs 1 5 lakhs The entire amount invested is tax free if you

Income Tax Deduction For Nps Tier 1 offer a wide range of downloadable, printable items that are available online at no cost. These resources come in various kinds, including worksheets templates, coloring pages, and much more. The benefit of Income Tax Deduction For Nps Tier 1 is their flexibility and accessibility.

More of Income Tax Deduction For Nps Tier 1

Nps Solutions

Nps Solutions

Verkko 30 maalisk 2023 nbsp 0183 32 Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to

Verkko However for salaried professionals the maximum deduction allowed under Section 80CCD 1 is 10 of the salary for that year On the other hand for non salaried

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations making your schedule, or even decorating your house.

-

Educational Value Printing educational materials for no cost offer a wide range of educational content for learners of all ages, making the perfect tool for parents and teachers.

-

Affordability: You have instant access various designs and templates can save you time and energy.

Where to Find more Income Tax Deduction For Nps Tier 1

NPS Tax Benefits How To Avail NPS Income Tax Benefits

NPS Tax Benefits How To Avail NPS Income Tax Benefits

Verkko 6 huhtik 2023 nbsp 0183 32 In accordance with Section 80C of the Income Tax Act NPS Tier 1 accounts are eligible for a deduction of up to 1 5 lakh from taxable income and an additional deduction of up to

Verkko An additional deduction for investment up to Rs 50 000 in NPS Tier I account is available exclusively to NPS subscribers under subsection 80CCD 1B This is over

In the event that we've stirred your curiosity about Income Tax Deduction For Nps Tier 1 Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Income Tax Deduction For Nps Tier 1 for all applications.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs are a vast variety of topics, starting from DIY projects to planning a party.

Maximizing Income Tax Deduction For Nps Tier 1

Here are some fresh ways how you could make the most use of Income Tax Deduction For Nps Tier 1:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home and in class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Deduction For Nps Tier 1 are an abundance with useful and creative ideas catering to different needs and passions. Their accessibility and versatility make them a wonderful addition to each day life. Explore the plethora of Income Tax Deduction For Nps Tier 1 today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Deduction For Nps Tier 1 truly for free?

- Yes they are! You can print and download the resources for free.

-

Can I use the free printouts for commercial usage?

- It's determined by the specific rules of usage. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues in Income Tax Deduction For Nps Tier 1?

- Some printables could have limitations on usage. Always read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer or go to the local print shop for superior prints.

-

What program will I need to access printables that are free?

- The majority of PDF documents are provided in PDF format, which is open with no cost software such as Adobe Reader.

National Pension Scheme NPS Scheme NPS Tier 1 And Tier 2 NPS Tax

Creating NPS Deduction Pay Head For Employees Payroll

Check more sample of Income Tax Deduction For Nps Tier 1 below

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

NPS Tier II Account Income Tax Benefits Certiom Consultants

Creating Employees NPS Deduction Pay Head

Nps Contribution By Employee Werohmedia

NPS Scheme Basics Features Rules And Top NPS Schemes

https://cleartax.in/s/nps-tier-1-vs-nps-tier-2

Verkko 6 maalisk 2023 nbsp 0183 32 Under Section 80CCE all NPS Tier 1 subscribers can claim a deduction of up to Rs 1 5 lakhs The entire amount invested is tax free if you

https://taxguru.in/income-tax/income-tax-be…

Verkko 1 syysk 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of

Verkko 6 maalisk 2023 nbsp 0183 32 Under Section 80CCE all NPS Tier 1 subscribers can claim a deduction of up to Rs 1 5 lakhs The entire amount invested is tax free if you

Verkko 1 syysk 2020 nbsp 0183 32 a The maximum tax deductions allowed is Rs 1 50 000 This limit is inclusive of section 80C limit b In case of salaried individual the maximum deduction cannot exceed 14 of salary of

Creating Employees NPS Deduction Pay Head

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Nps Contribution By Employee Werohmedia

NPS Scheme Basics Features Rules And Top NPS Schemes

Govt Notifies NPS Tier II Tax Deduction For Central Govt Employees Mint

How Should You Manage Your NPS Tier 1 Account Under The New Tax Regime

How Should You Manage Your NPS Tier 1 Account Under The New Tax Regime

NPS Gets You Extra 50 000 Income Tax Deduction How To Claim Mint