Today, when screens dominate our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. In the case of educational materials for creative projects, simply adding personal touches to your area, Income Tax Deduction In Nepal have become a valuable source. Here, we'll take a dive through the vast world of "Income Tax Deduction In Nepal," exploring the different types of printables, where they are, and how they can add value to various aspects of your daily life.

What Are Income Tax Deduction In Nepal?

Income Tax Deduction In Nepal include a broad selection of printable and downloadable materials available online at no cost. They are available in numerous designs, including worksheets templates, coloring pages, and many more. The attraction of printables that are free is in their variety and accessibility.

Income Tax Deduction In Nepal

Income Tax Deduction In Nepal

Income Tax Deduction In Nepal -

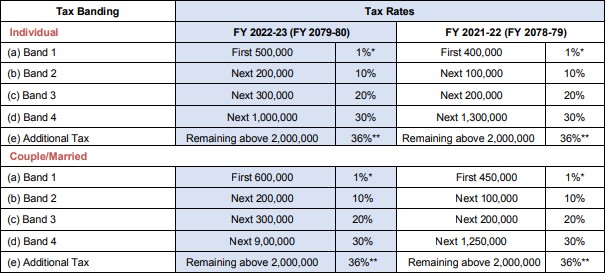

[desc-5]

[desc-1]

Section 80C Income Tax Deduction In Marathi Tax

Section 80C Income Tax Deduction In Marathi Tax

[desc-4]

[desc-6]

Income Tax Deduction U s 80U Tax Deduction For Disabled Individuals

Income Tax Deduction U s 80U Tax Deduction For Disabled Individuals

[desc-9]

[desc-7]

Top 6 Ideas To Protect Your Income From Heavy Taxes In Nepal Legally

How To Calculate Income Tax On Salary With Example

Higher Income Tax Deduction On NPS Likely For Private Sector Employees

Income Tax Deduction

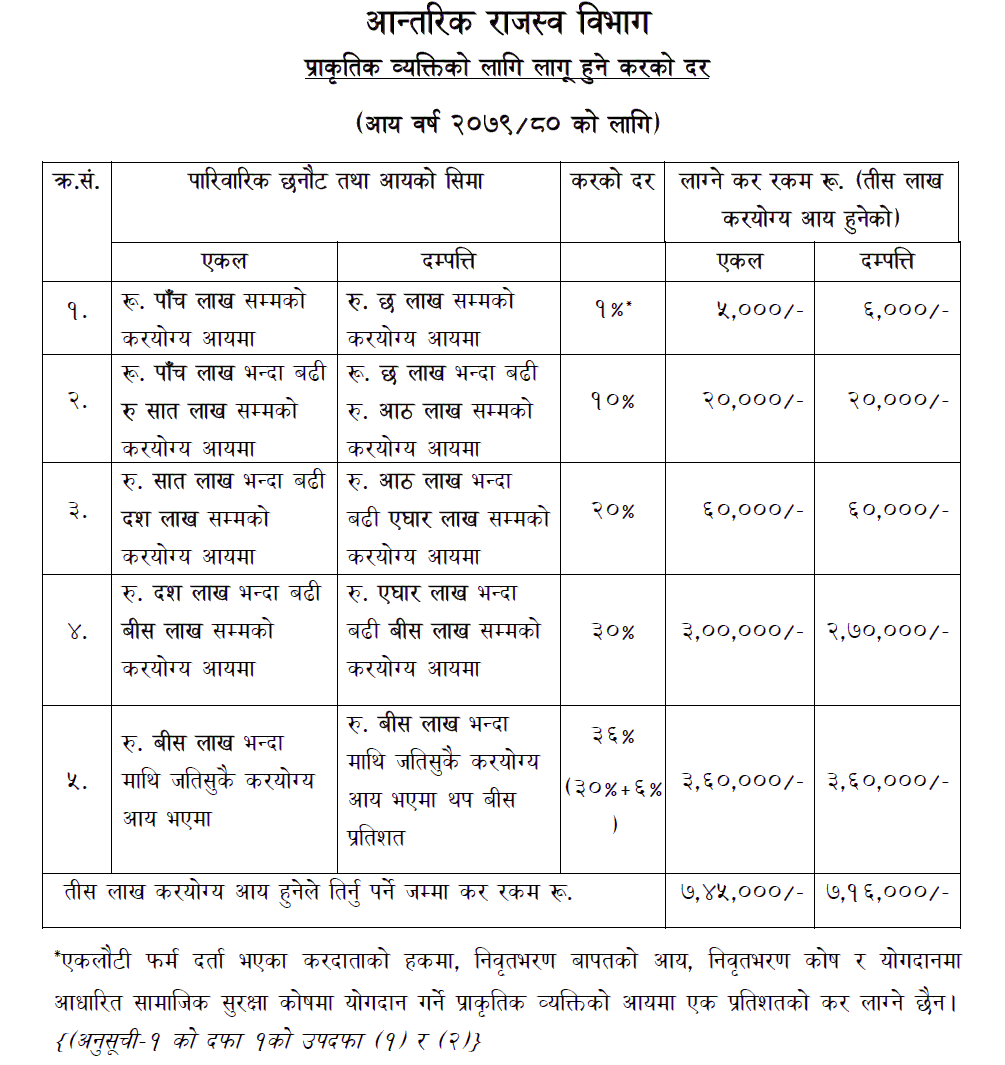

Income Tax Rate In Nepal For Fiscal Year 2079 80 For Natural Person

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Assessee Cannot Claim Double Deduction If Section 14A Of The Income Tax