In the age of digital, with screens dominating our lives but the value of tangible printed materials isn't diminishing. No matter whether it's for educational uses for creative projects, simply adding personal touches to your space, Income Tax Deduction Investment Management Fees are a great source. We'll take a dive through the vast world of "Income Tax Deduction Investment Management Fees," exploring the benefits of them, where they are, and how they can enhance various aspects of your lives.

Get Latest Income Tax Deduction Investment Management Fees Below

Income Tax Deduction Investment Management Fees

Income Tax Deduction Investment Management Fees -

The short answer is no but you can still tap into tax benefits through the fees Prior to 2018 investors could treat advisory fees as an itemized deduction if the

While financial advisor fees are no longer deductible there are things you can do to keep your tax bill as low as possible For

Printables for free cover a broad array of printable materials available online at no cost. These resources come in various types, like worksheets, coloring pages, templates and more. The beauty of Income Tax Deduction Investment Management Fees is in their variety and accessibility.

More of Income Tax Deduction Investment Management Fees

Investment Management Fees Is It Worth It Assetmonk

Investment Management Fees Is It Worth It Assetmonk

It includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or other regulated investment companies such

The Tax Cuts and Jobs Act may have cut tax deductions for financial advisor fees but you can still find handy tax breaks

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Education-related printables at no charge are designed to appeal to students of all ages, which makes the perfect tool for parents and educators.

-

The convenience of Quick access to the vast array of design and templates will save you time and effort.

Where to Find more Income Tax Deduction Investment Management Fees

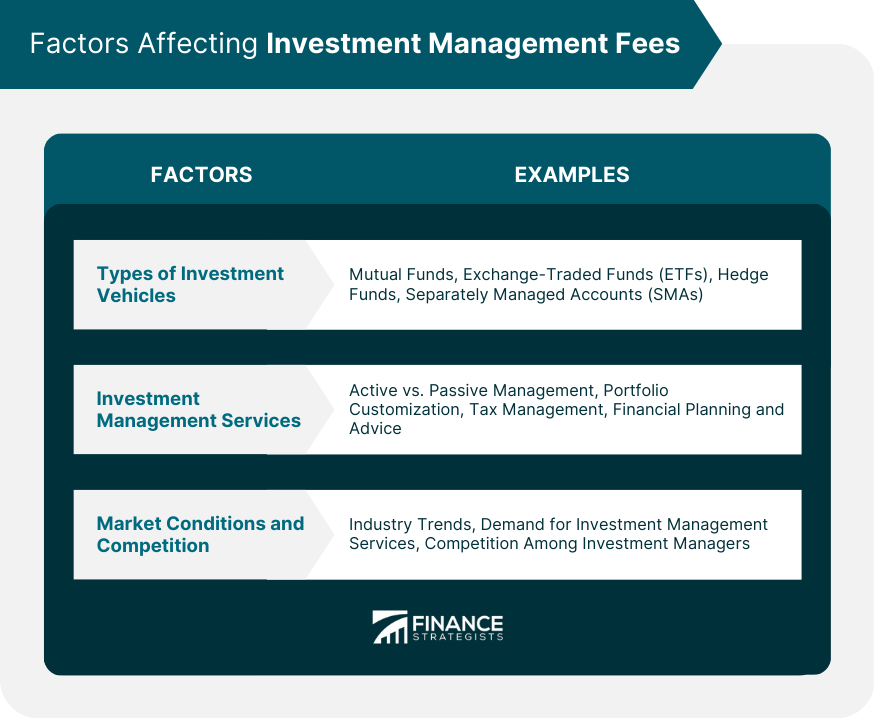

Investment Management Fees A Complete Guide

Investment Management Fees A Complete Guide

Investment management fees are a tax deductible expense They can be listed on Schedule A under the section Job Expenses and Certain Miscellaneous

Fees to manage or take care of your investments other than fees you paid for services in connection with your pooled registered pension plan PRPP registered retirement

Since we've got your interest in printables for free We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety in Income Tax Deduction Investment Management Fees for different objectives.

- Explore categories such as design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs are a vast spectrum of interests, ranging from DIY projects to party planning.

Maximizing Income Tax Deduction Investment Management Fees

Here are some new ways that you can make use of Income Tax Deduction Investment Management Fees:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Deduction Investment Management Fees are an abundance of innovative and useful resources designed to meet a range of needs and interests. Their accessibility and versatility make them a fantastic addition to each day life. Explore the plethora of Income Tax Deduction Investment Management Fees today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can download and print these documents for free.

-

Can I use free printables for commercial purposes?

- It's based on specific usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in Income Tax Deduction Investment Management Fees?

- Some printables may contain restrictions on usage. Be sure to check the terms and conditions set forth by the author.

-

How can I print printables for free?

- Print them at home with a printer or visit an in-store print shop to get more high-quality prints.

-

What software do I need to run Income Tax Deduction Investment Management Fees?

- Many printables are offered as PDF files, which can be opened with free software like Adobe Reader.

Investment Management Fees Meaning Types Considerations

Do You Qualify For A Tax Deduction On Your Investment Management Fees

Check more sample of Income Tax Deduction Investment Management Fees below

Pay Less Income Tax Traditional Roth IRA Tax Deduction Investment

Paying IRA Investment Management Fees Kiplinger

Section 54GA Exemption Of Capital Gain On Transfer Of Assets In

Investment Management Fees A Complete Guide

Investment Expenses What s Tax Deductible Charles Schwab

Investment Management Fees Some Tips Axis finance

https://smartasset.com/financial-advisor/…

While financial advisor fees are no longer deductible there are things you can do to keep your tax bill as low as possible For

https://www.schwab.com/learn/story/investment...

Prior to the Tax Cuts and Jobs Act of 2017 TCJA taxpayers were allowed to deduct expenses such as fees for investment advice IRA custodial fees and

While financial advisor fees are no longer deductible there are things you can do to keep your tax bill as low as possible For

Prior to the Tax Cuts and Jobs Act of 2017 TCJA taxpayers were allowed to deduct expenses such as fees for investment advice IRA custodial fees and

Investment Management Fees A Complete Guide

Paying IRA Investment Management Fees Kiplinger

Investment Expenses What s Tax Deductible Charles Schwab

Investment Management Fees Some Tips Axis finance

Investment Management Fees Definition Types What It Pays For

Why Paying Investment Management Fees Is A Losing Game YouTube

Why Paying Investment Management Fees Is A Losing Game YouTube

Uncovering Secrets About Investment Fees DBS Treasures