In this age of technology, where screens have become the dominant feature of our lives however, the attraction of tangible, printed materials hasn't diminished. If it's to aid in education as well as creative projects or just adding a personal touch to your area, Income Tax Deduction On Home Loan Interest 80eea are now a vital resource. For this piece, we'll take a dive in the world of "Income Tax Deduction On Home Loan Interest 80eea," exploring their purpose, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Income Tax Deduction On Home Loan Interest 80eea Below

Income Tax Deduction On Home Loan Interest 80eea

Income Tax Deduction On Home Loan Interest 80eea -

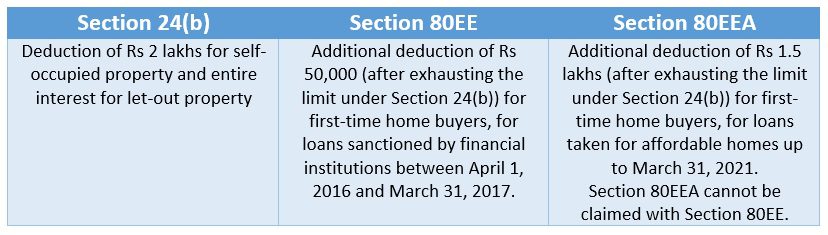

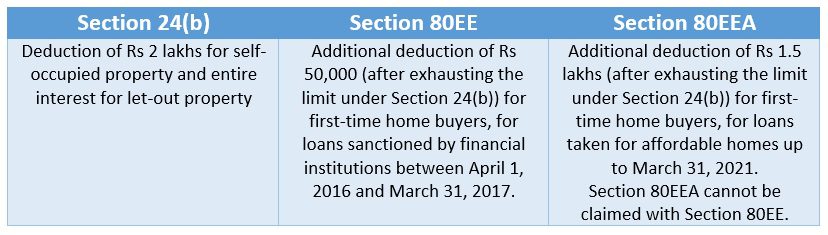

What is Home Loan Interest Deduction u s 80EE Section 80EE of the Income Tax Act introduced in the Financial Year 2013 14 offers an

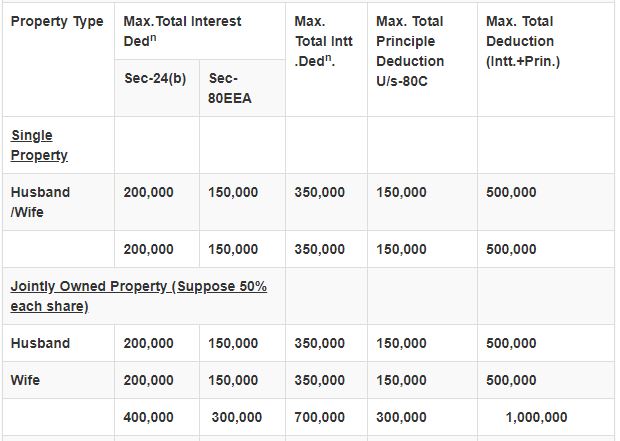

Under this section individual who have taken loan from a financial institution for purchase or construction of residential house property can claim deduction of Rs 1 50 000 along with

Income Tax Deduction On Home Loan Interest 80eea provide a diverse array of printable materials online, at no cost. These resources come in various designs, including worksheets templates, coloring pages, and many more. The appealingness of Income Tax Deduction On Home Loan Interest 80eea is their versatility and accessibility.

More of Income Tax Deduction On Home Loan Interest 80eea

Income Tax Deduction Of Rs 5 Lakh On Home Loan Interest 2022 Budget

Income Tax Deduction Of Rs 5 Lakh On Home Loan Interest 2022 Budget

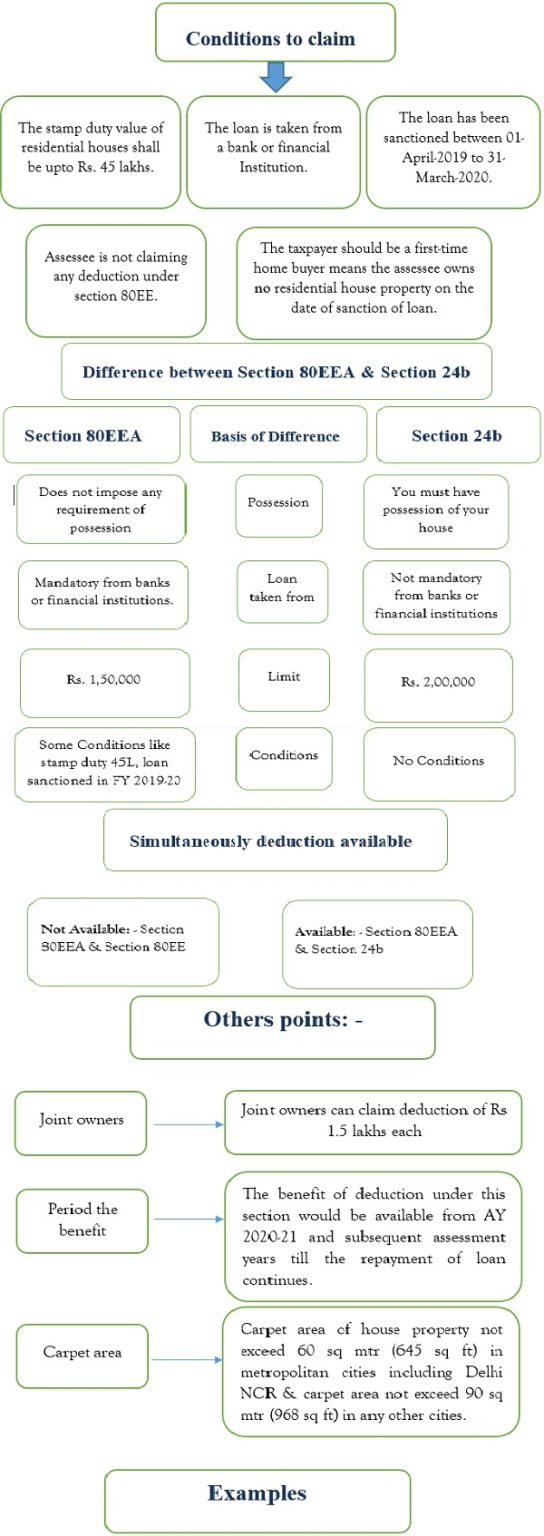

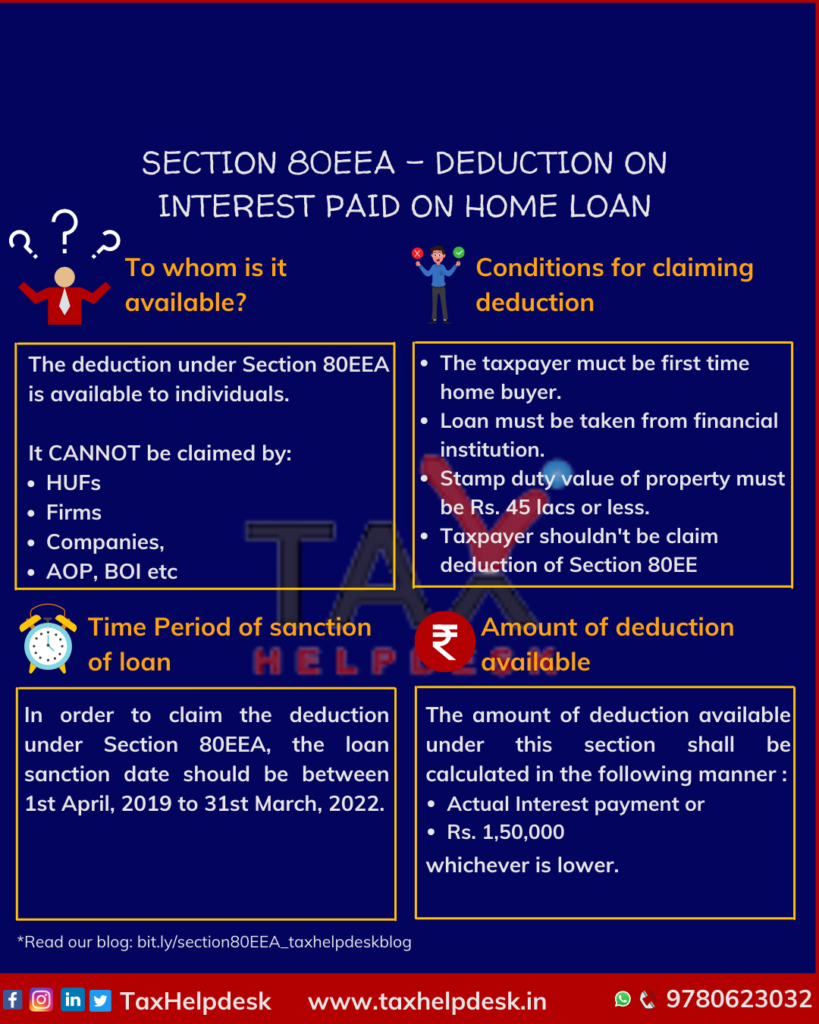

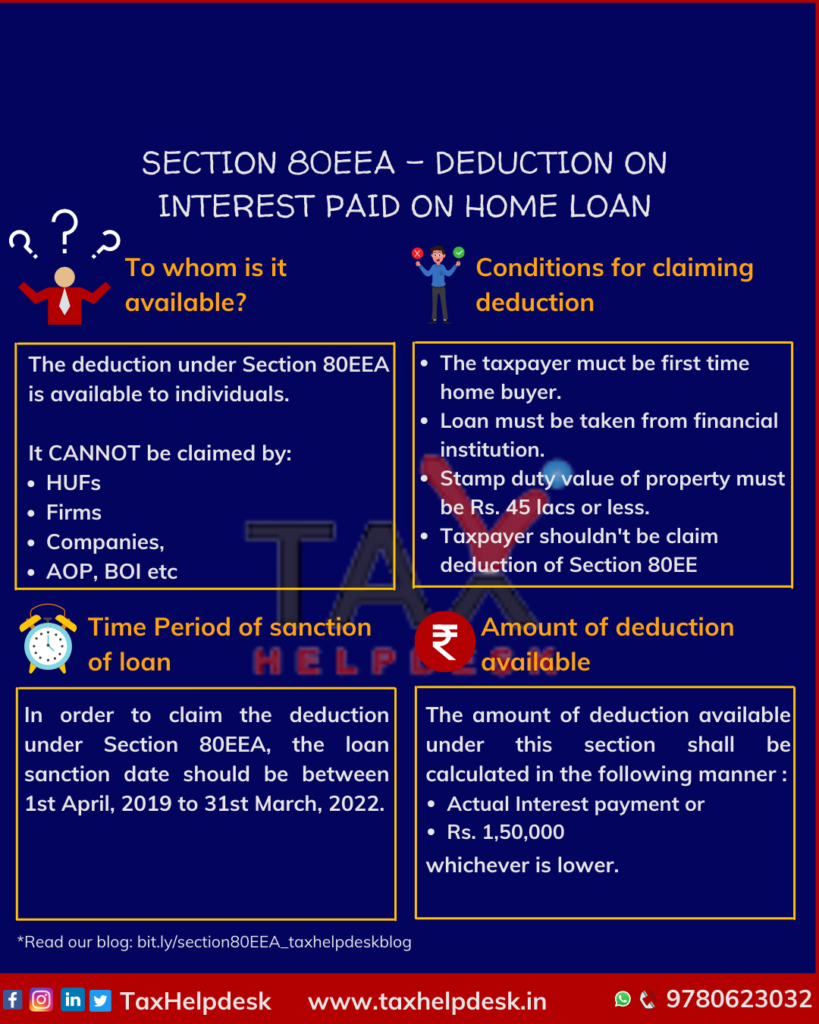

FAQs What is 80EEA in income tax Section 80EEA provides extended tax deductions of up to Rs 1 50 000 for first time homebuyers in India An individual is

This announcement brought the introduction of section 80EEA which allows a tax benefit of additional deduction on home loan interest from FY 2019

Income Tax Deduction On Home Loan Interest 80eea have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize designs to suit your personal needs whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Education-related printables at no charge can be used by students from all ages, making the perfect instrument for parents and teachers.

-

Convenience: Quick access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Income Tax Deduction On Home Loan Interest 80eea

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get

Section 80EEA Deduction for interest on home loan Is there any benefit for a loan obtained towards buying a new house Read Section 80EEA in this article

If we've already piqued your interest in Income Tax Deduction On Home Loan Interest 80eea We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of uses.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast range of topics, that range from DIY projects to party planning.

Maximizing Income Tax Deduction On Home Loan Interest 80eea

Here are some fresh ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Deduction On Home Loan Interest 80eea are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and interests. Their accessibility and flexibility make them an invaluable addition to the professional and personal lives of both. Explore the wide world of Income Tax Deduction On Home Loan Interest 80eea now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can print and download these items for free.

-

Can I use free printouts for commercial usage?

- It's based on the terms of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may come with restrictions on usage. Be sure to read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in the local print shop for top quality prints.

-

What software will I need to access printables free of charge?

- Most PDF-based printables are available in PDF format. These can be opened using free programs like Adobe Reader.

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Under construction House How To Claim Tax Deduction On Home Loan

Check more sample of Income Tax Deduction On Home Loan Interest 80eea below

Section 80EEA Deduction Of Housing Loan Interest Home Loan Interest

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

Section 80EEA All You Need To Know About Deduction For Interest Paid

Section 80EE Of Income Tax Act Deduction On Home Loan

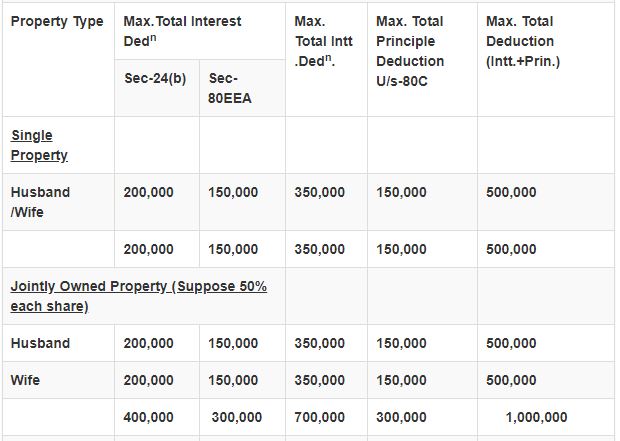

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://taxguru.in/income-tax/section-80…

Under this section individual who have taken loan from a financial institution for purchase or construction of residential house property can claim deduction of Rs 1 50 000 along with

https://tax2win.in/guide/section-80eea-d…

Section 80EEA of the Income Tax Act 1961 provides an additional deduction on home loan interest for first

Under this section individual who have taken loan from a financial institution for purchase or construction of residential house property can claim deduction of Rs 1 50 000 along with

Section 80EEA of the Income Tax Act 1961 provides an additional deduction on home loan interest for first

Section 80EE Of Income Tax Act Deduction On Home Loan

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

Stamp Duty Exemption 2019 Warren Churchill

Stamp Duty Exemption 2019 Warren Churchill

Section 80EE Income Tax Deduction On Home Loan Interest