Today, where screens dominate our lives The appeal of tangible printed materials isn't diminishing. Be it for educational use, creative projects, or simply adding some personal flair to your area, Income Tax Deduction On Hra And Home Loan have become a valuable resource. For this piece, we'll dive deeper into "Income Tax Deduction On Hra And Home Loan," exploring the different types of printables, where you can find them, and ways they can help you improve many aspects of your life.

Get Latest Income Tax Deduction On Hra And Home Loan Below

Income Tax Deduction On Hra And Home Loan

Income Tax Deduction On Hra And Home Loan -

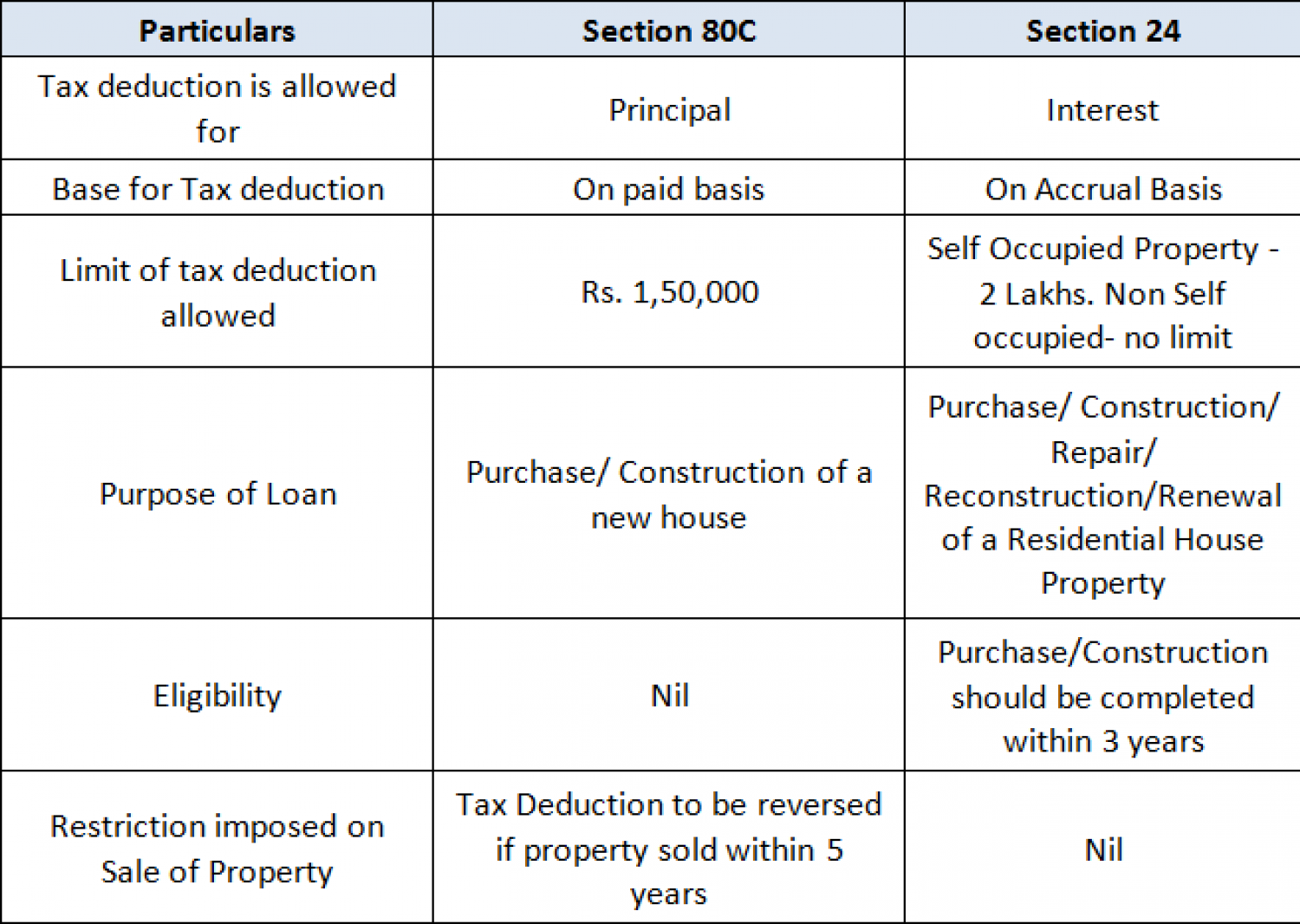

Tax deductions on HRA are claimed under Section 10 13A of the Income Tax Act Suggested read Home Loan Tax Benefits Eligibility for Claiming Both Benefits

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more

The Income Tax Deduction On Hra And Home Loan are a huge selection of printable and downloadable content that can be downloaded from the internet at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and many more. One of the advantages of Income Tax Deduction On Hra And Home Loan is in their variety and accessibility.

More of Income Tax Deduction On Hra And Home Loan

Can You Claim Both HRA And Home Loan For Tax Deduction Explained By V

Can You Claim Both HRA And Home Loan For Tax Deduction Explained By V

One can claim HRA exemption as well as the deduction for interest on a home loan if one owns a house but lives in a rented house Both these tax deductions are

The answer is yes If you are living on rent in your city of job and own house in another city then income tax benefit can be claimed on HRA as well as Home loan

The Income Tax Deduction On Hra And Home Loan have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor printing templates to your own specific requirements in designing invitations and schedules, or decorating your home.

-

Educational Impact: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a valuable device for teachers and parents.

-

The convenience of Quick access to numerous designs and templates is time-saving and saves effort.

Where to Find more Income Tax Deduction On Hra And Home Loan

How To Claim HRA In ITR Ay 2021 22 HRA And Home Loan ITR AY 2021 22

How To Claim HRA In ITR Ay 2021 22 HRA And Home Loan ITR AY 2021 22

HRA is a component received by salaried taxpayers to bear the rental payment iStock ITR filing The taxpayer can claim HRA exemption and home loan tax benefits

The answer is yes One can claim HRA exemption and interest deduction on a housing loan simultaneously if one satisfies all of the conditions for claiming so says Kapil Rana Founder

We hope we've stimulated your curiosity about Income Tax Deduction On Hra And Home Loan, let's explore where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Income Tax Deduction On Hra And Home Loan for different reasons.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Income Tax Deduction On Hra And Home Loan

Here are some unique ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Deduction On Hra And Home Loan are an abundance of fun and practical tools that cater to various needs and hobbies. Their access and versatility makes them an essential part of every aspect of your life, both professional and personal. Explore the vast world of Income Tax Deduction On Hra And Home Loan now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes they are! You can print and download the resources for free.

-

Can I utilize free printing templates for commercial purposes?

- It's dependent on the particular terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright concerns with Income Tax Deduction On Hra And Home Loan?

- Some printables may contain restrictions in their usage. Be sure to check these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home with a printer or visit a local print shop for top quality prints.

-

What software do I need to open Income Tax Deduction On Hra And Home Loan?

- The majority of printables are with PDF formats, which can be opened with free programs like Adobe Reader.

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

ITR Filing How To Claim Income Tax Deduction On House Rent Payment

Check more sample of Income Tax Deduction On Hra And Home Loan below

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

How To Claim Hra And Home Loan In Income Tax Return A Y 22 23 YouTube

How To Claim Both HRA And Home Loan Tax Benefits Together

HRA House Rent Allowances Can You Claim Both HRA And Home Loan For

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Can You Claim Both HRA And Home Loan Tax Benefits The Financial Express

https://www.vero.fi/en/individuals/tax-cards-and...

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more

https://fi.money/blog/posts/how-to-claim-hra-and...

The short answer is yes You can claim the tax benefits on HRA and home loan repayments subject to different conditions in different scenarios as follows Use your

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more

The short answer is yes You can claim the tax benefits on HRA and home loan repayments subject to different conditions in different scenarios as follows Use your

HRA House Rent Allowances Can You Claim Both HRA And Home Loan For

How To Claim Hra And Home Loan In Income Tax Return A Y 22 23 YouTube

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Can You Claim Both HRA And Home Loan Tax Benefits The Financial Express

Kisan Own Two Houses Here s How To Claim Tax Deduction On HRA And

ITR Filing Things To Consider When Applying For HRA And Home Loan

ITR Filing Things To Consider When Applying For HRA And Home Loan

CAN EMPLOYEES CLAIM HRA AND HOME LOAN DEDUCTION BOTH AT THE SAME TIME