In this age of technology, when screens dominate our lives, the charm of tangible printed items hasn't gone away. In the case of educational materials or creative projects, or simply to add personal touches to your area, Income Tax Deduction Parents Medical Expenses have become an invaluable source. Here, we'll take a dive to the depths of "Income Tax Deduction Parents Medical Expenses," exploring the different types of printables, where they are, and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Deduction Parents Medical Expenses Below

Income Tax Deduction Parents Medical Expenses

Income Tax Deduction Parents Medical Expenses -

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your

Your medical expense deduction is limited to the amount of medical expenses that exceeds 7 5 of your adjusted gross income You can include medical expenses you paid for

Printables for free cover a broad assortment of printable resources available online for download at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and more. The appealingness of Income Tax Deduction Parents Medical Expenses is their versatility and accessibility.

More of Income Tax Deduction Parents Medical Expenses

U Card Launches New Website U Card Twin Cities

U Card Launches New Website U Card Twin Cities

Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers and the

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Modifications: The Customization feature lets you tailor designs to suit your personal needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Education-related printables at no charge can be used by students of all ages, which makes them a vital tool for parents and teachers.

-

Accessibility: immediate access the vast array of design and templates saves time and effort.

Where to Find more Income Tax Deduction Parents Medical Expenses

Malaysia Personal Income Tax Relief 2022

Malaysia Personal Income Tax Relief 2022

You might be able to deduct qualified medical expenses that are more than 7 5 of your adjusted gross income Some states offer lower thresholds

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and

Now that we've piqued your interest in printables for free, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Income Tax Deduction Parents Medical Expenses for a variety purposes.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to planning a party.

Maximizing Income Tax Deduction Parents Medical Expenses

Here are some unique ways create the maximum value of Income Tax Deduction Parents Medical Expenses:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Deduction Parents Medical Expenses are an abundance of innovative and useful resources that meet a variety of needs and passions. Their accessibility and versatility make them a wonderful addition to each day life. Explore the endless world of Income Tax Deduction Parents Medical Expenses and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes they are! You can download and print these documents for free.

-

Does it allow me to use free printables in commercial projects?

- It's all dependent on the usage guidelines. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues in Income Tax Deduction Parents Medical Expenses?

- Certain printables might have limitations on use. Make sure to read these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home using your printer or visit a local print shop to purchase more high-quality prints.

-

What software do I require to open printables for free?

- Many printables are offered in PDF format, which is open with no cost software, such as Adobe Reader.

University Of Minnesota Twin Cities Launches Unlimited Public Transit

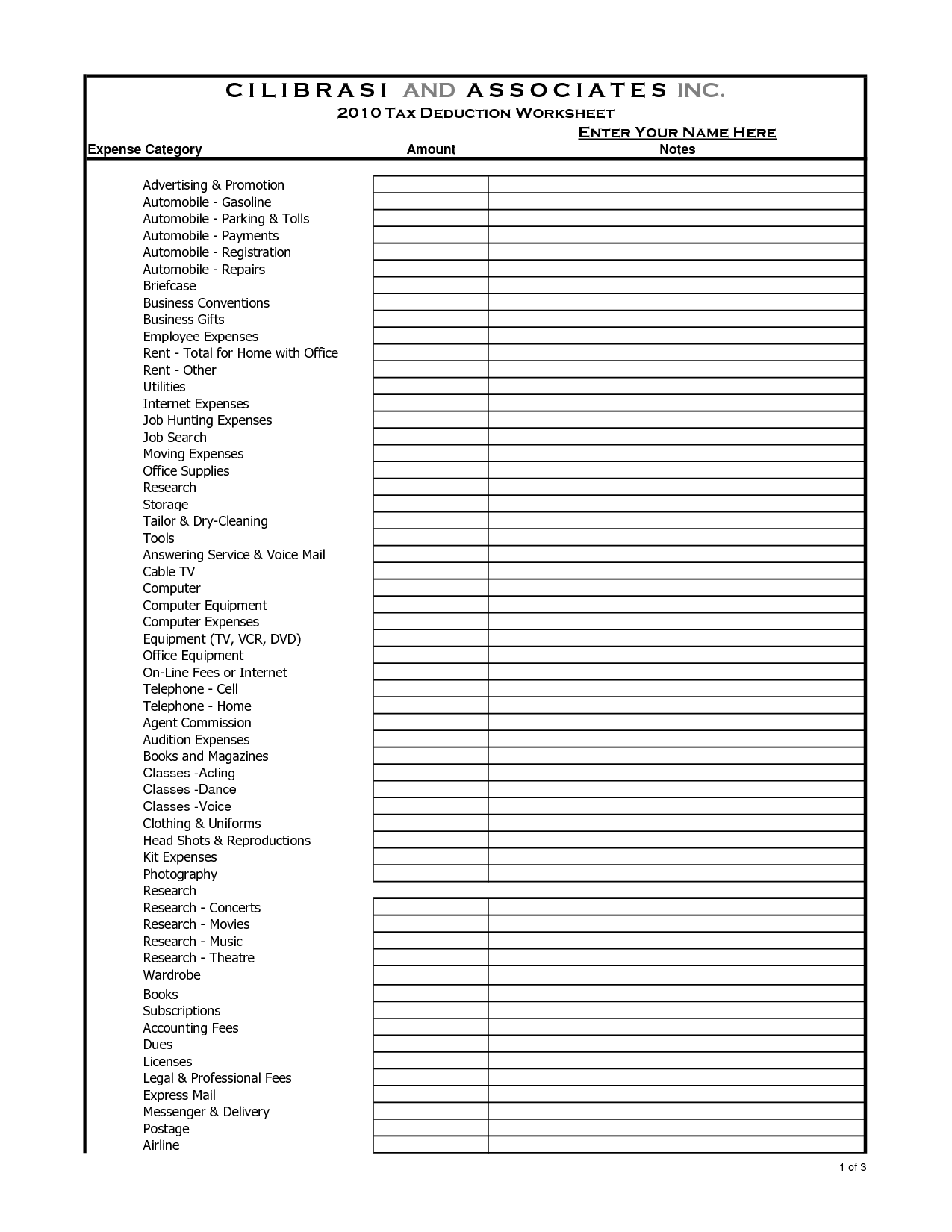

16 Tax Organizer Worksheet Worksheeto

Check more sample of Income Tax Deduction Parents Medical Expenses below

PPT PPTer

5 Itemized Tax Deduction Worksheet Worksheeto

Fundraiser By Cheri Donnell Mom s Cancer Treatment

Qualified Business Income Deduction And The Self Employed The CPA Journal

PPT PPTer

Preventive Check Up 80d Wkcn

https://www.irs.gov/faqs/irs-procedures/for-caregivers

Your medical expense deduction is limited to the amount of medical expenses that exceeds 7 5 of your adjusted gross income You can include medical expenses you paid for

https://www.agingcare.com/Articles/me…

To qualify for the deduction the total cost of your eligible unreimbursed medical expenses must exceed 7 5 percent of your adjusted gross income AGI For example if your AGI is 50 000 then the first 3 750 of

Your medical expense deduction is limited to the amount of medical expenses that exceeds 7 5 of your adjusted gross income You can include medical expenses you paid for

To qualify for the deduction the total cost of your eligible unreimbursed medical expenses must exceed 7 5 percent of your adjusted gross income AGI For example if your AGI is 50 000 then the first 3 750 of

Qualified Business Income Deduction And The Self Employed The CPA Journal

5 Itemized Tax Deduction Worksheet Worksheeto

PPT PPTer

Preventive Check Up 80d Wkcn

Printable Itemized Deductions Worksheet

PPT PPTer

PPT PPTer

10 2014 Itemized Deductions Worksheet Worksheeto