In the age of digital, in which screens are the norm however, the attraction of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons such as creative projects or simply to add an extra personal touch to your space, Income Tax Deduction U S 80ddb are now a useful resource. With this guide, you'll take a dive through the vast world of "Income Tax Deduction U S 80ddb," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Income Tax Deduction U S 80ddb Below

Income Tax Deduction U S 80ddb

Income Tax Deduction U S 80ddb -

Section 80DDB of the Income Tax Act Section 80DDB provides a deduction for medical treatment of specified diseases This deduction can only be claimed if an individual or HUF has incurred expenses towards the maintenance and care of self or dependent family members

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

Income Tax Deduction U S 80ddb cover a large collection of printable items that are available online at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages and more. The great thing about Income Tax Deduction U S 80ddb lies in their versatility and accessibility.

More of Income Tax Deduction U S 80ddb

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Deduction under Section 80DD of the income tax act is allowed to Resident Individuals or HUFs for a dependent who is differently abled and is wholly dependent on the individual or HUF for support maintenance

Under the Section 80DDB an individual can claim for deduction up to Rs 40 000 If an individual on behalf of whom such medical expenditure is incurred is a senior citizen then one can claim

Income Tax Deduction U S 80ddb have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: They can make printing templates to your own specific requirements whether you're designing invitations planning your schedule or even decorating your home.

-

Educational Use: Education-related printables at no charge are designed to appeal to students from all ages, making them a valuable instrument for parents and teachers.

-

Easy to use: Quick access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Income Tax Deduction U S 80ddb

Know About Health Insurance Tax Benefits Under Section 80D

Know About Health Insurance Tax Benefits Under Section 80D

Section 80DDB of the Income Tax Act 1961 has gained its popularity in recent years You can claim a tax deduction against the expenses made for the medical treatment of self and dependents suffering from specified diseases

Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while computing the taxable income of the assessee

After we've peaked your curiosity about Income Tax Deduction U S 80ddb Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Income Tax Deduction U S 80ddb suitable for many objectives.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a wide range of topics, everything from DIY projects to party planning.

Maximizing Income Tax Deduction U S 80ddb

Here are some fresh ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Deduction U S 80ddb are a treasure trove of practical and innovative resources which cater to a wide range of needs and pursuits. Their access and versatility makes them a valuable addition to the professional and personal lives of both. Explore the vast collection that is Income Tax Deduction U S 80ddb today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I download free printables in commercial projects?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with Income Tax Deduction U S 80ddb?

- Some printables may contain restrictions in use. Make sure to read the terms and regulations provided by the designer.

-

How do I print Income Tax Deduction U S 80ddb?

- You can print them at home using a printer or visit a local print shop for top quality prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided in the PDF format, and can be opened with free programs like Adobe Reader.

Deduction U s 80DDB Medical Treatment Income Tax Act Tax Knowledges

Claim Deduction Under Section 80DD Learn By Quicko

Check more sample of Income Tax Deduction U S 80ddb below

All About Section 80DDB Deduction For Treatment Of Specified Disease

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Preventive Check Up 80d Wkcn

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://tax2win.in/guide/section-80ddb

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

https://www.taxbuddy.com/blog/80ddb-deduction

Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been revised from time to time to adjust for an escalation in health care costs

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure

Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been revised from time to time to adjust for an escalation in health care costs

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

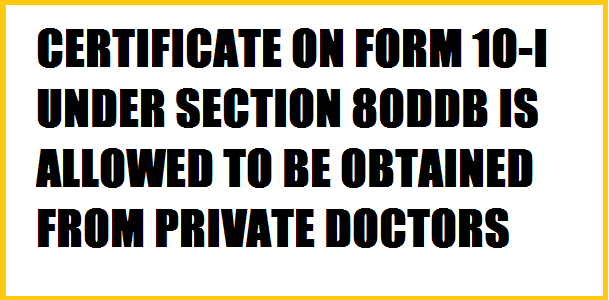

Deduction U s 80DDB Form 10 I May Be Issued By Non govt Specialists

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

All You Need To Know About Section 80DDB YouTube